In today's fast-paced corporate world, maintaining compliance is essential for ensuring smooth operations and building trust with stakeholders. A well-structured compliance confirmation letter not only serves as a formal acknowledgment of adherence to regulatory standards but also reinforces a company's commitment to ethical practices. By outlining specific compliance measures and accountability, such a letter can significantly enhance transparency within an organization. Ready to explore tips and templates for crafting the perfect corporate compliance confirmation letter? Let's dive in!

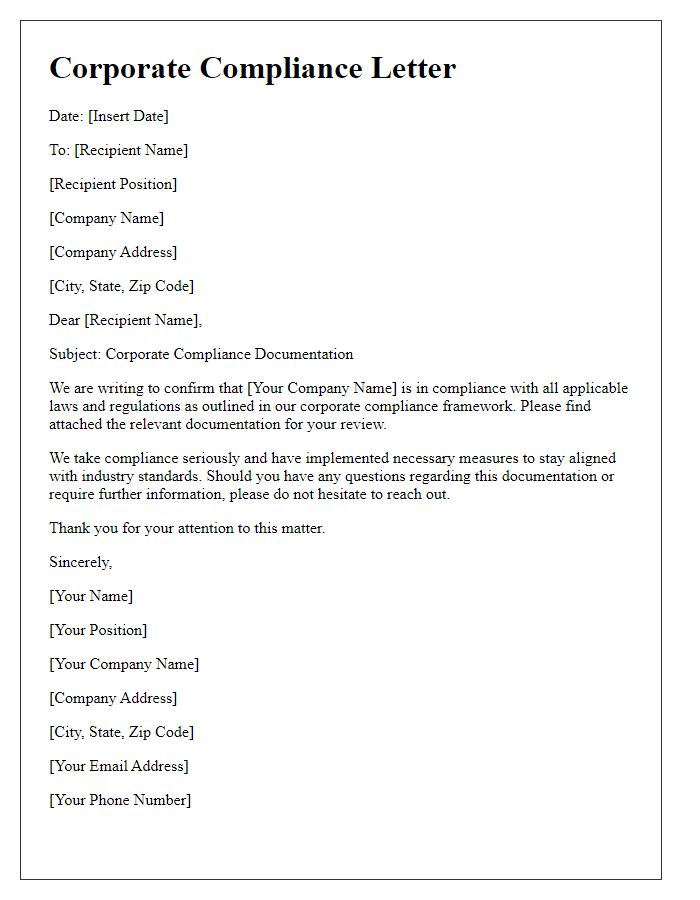

Professional tone and formal language

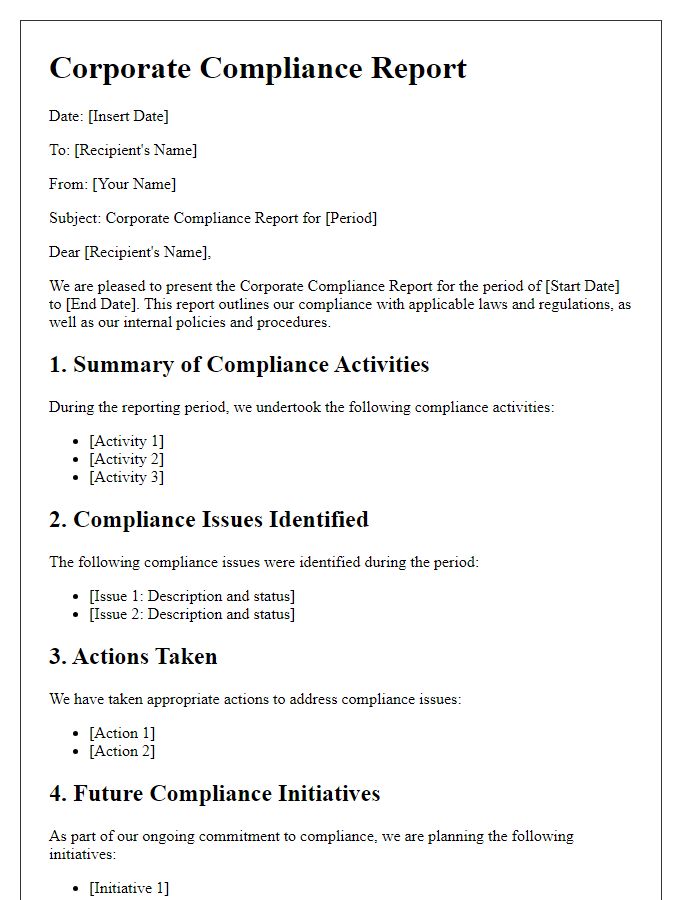

Corporate compliance confirmation involves verifying adherence to regulations and policies within an organization. Companies must regularly conduct audits to ensure compliance with legal standards, including the Sarbanes-Oxley Act or the General Data Protection Regulation (GDPR). In sectors like finance and healthcare, maintaining compliance is critical to avoid legal penalties and maintain trust with stakeholders. Regular training sessions for employees on compliance policies are essential, alongside detailed documentation of compliance efforts. Auditors may assess internal controls and review documentation to verify compliance status. Effective communication of compliance statuses to stakeholders ensures transparency and accountability, fostering a culture of integrity and ethical behavior.

Clear statement of compliance policy adherence

Corporate compliance confirmation requires a clear understanding of adherence to established policies and legal regulations. The compliance policy outlines guidelines and procedures reflecting the company's commitment to ethical standards and legal obligations. Regular audits (conducted annually, for example) assess conformity with various laws, including the Sarbanes-Oxley Act and the Foreign Corrupt Practices Act, ensuring the organization operates within legal frameworks. Mandatory training sessions for employees emphasize knowledge of compliance expectations, fostering a culture of integrity. Non-compliance can lead to severe implications, including financial penalties and damage to reputation, underlining the importance of continuous monitoring and reporting mechanisms to reinforce adherence to the compliance policy in operations.

Specific references to applicable regulations and guidelines

Corporate compliance confirmation encompasses a thorough adherence to regulations and guidelines applicable to various sectors. For instance, the Sarbanes-Oxley Act (SOX), established in 2002, mandates financial transparency and fraud prevention for publicly traded companies in the United States. Guidelines from the International Organization for Standardization (ISO), such as ISO 37001, focus on anti-bribery management systems, ensuring organizations implement effective measures against corruption. The General Data Protection Regulation (GDPR), enforced in 2018 across the European Union, emphasizes data protection and privacy, requiring businesses to ensure the lawful processing of personal data. Additionally, the Health Insurance Portability and Accountability Act (HIPAA) safeguards sensitive patient health information in the healthcare sector, necessitating compliance through strict data handling protocols. Regular audits and training programs facilitate ongoing adherence to these regulations, ensuring companies maintain their legal and ethical obligations within their operational frameworks.

Contact information for compliance queries

Corporate compliance confirmation ensures adherence to regulations, policies, and ethical standards within an organization. For any compliance queries, stakeholders may reach out to the designated Compliance Officer, often located within the Compliance Department (a division ensuring law and policy adherence) of the corporation. The office can typically be contacted via email at compliance@companyname.com or by phone at (123) 456-7890. Mailing address may include the corporate headquarters at 123 Corporate Lane, Business City, ST 12345. Availability for inquiries is generally from 9 AM to 5 PM, Monday through Friday (local time). Regular training sessions are conducted to ensure all employees are aware of compliance protocols and the importance of maintaining ethical standards.

Signature line for authorized representative approval

Corporate compliance confirmations play a vital role in ensuring adherence to regulatory requirements and internal policies. An authorized representative's signature line serves as a crucial endorsement, verifying that the compliance measures undertaken align with industry standards and legal frameworks, such as the Sarbanes-Oxley Act or ISO 9001 certification. This signature signifies accountability and commitment to transparent business practices, reinforcing the organization's integrity. The placement of this signature line should follow any relevant compliance documentation and precede an affirmation statement, ensuring clarity in the endorsement process. Incorporating additional details, such as the representative's name, title, and date, further enhances the validity of the confirmation.

Comments