Hey there! If you've recently been affected by flooding, navigating the ins and outs of liability can feel overwhelming. It's crucial to understand your rights and responsibilities, especially when it comes to addressing damage costs. Whether you're a property owner or a tenant, the details matterâand that's why we're here to help you untangle the complex world of flood damage liability. So, let's dive deeper into this essential topic together!

Clear identification of parties involved

In the aftermath of significant flood events, particularly those that affect residential areas like New Orleans or Houston, it is crucial to clearly identify all parties involved in flood damage liability. Homeowners, represented by their insurance companies such as Allstate or State Farm, must be aware of their responsibilities outlined in policy agreements. Local authorities, such as municipal governments in affected regions, are also key players, as they may contribute to flood management through infrastructure maintenance or emergency response. Furthermore, construction companies responsible for building or modifying properties may be liable if negligence contributed to inadequate flood defenses. Environmental agencies may also play a role, especially if improper land use contributed to flooding. Documentation establishing the flow of responsibility among these entities can aid in legal processes, ensuring that claims for repairs or compensation are addressed efficiently.

Precise description of flood event and damage

The catastrophic flood event on September 15, 2023, resulted from unprecedented rainfall, exceeding 10 inches within 24 hours, overwhelming local drainage systems in Springfield, Illinois. This natural disaster caused extensive damage to residential and commercial properties, with water levels reaching three feet in basements, warping hardwood floors, and saturating drywall, leading to significant structural concerns. Affected areas experienced power outages, disrupting electricity and rendering appliances unusable. Additionally, personal belongings, including furniture and electronics, sustained irreparable damage due to prolonged exposure to floodwaters. The local emergency response teams recorded over 500 damage claims, showcasing the widespread impact of this devastating flood.

Reference to insurance policies or agreements

Flood damage can cause significant financial loss for property owners, especially in areas prone to heavy rainfall or rising water levels, such as New Orleans or Houston. Homeowners insurance policies, often covering various natural disasters, may have specific clauses for flood-related incidents. The National Flood Insurance Program (NFIP) provides separate flood insurance policies to safeguard against such damages, typically offering coverage limits of up to $250,000 for homes and $100,000 for personal property. When filing a claim, property owners need to reference their policy number and document the extent of damage through photographs and repair estimates, ensuring compliance with policy requirements. Additionally, local jurisdictions may have regulations regarding liability for flood-related damages, influencing insurance claims and responsibilities.

Explicit liability claims and responsibilities

Flood damage liability often involves specific claims and responsibilities outlined in legal agreements and insurance policies. Property owners must understand that flooding events, such as those occurring during heavy rainfall or hurricanes, can lead to substantial damage to residential or commercial buildings. According to the National Flood Insurance Program (NFIP), individuals may seek compensation for structural losses and personal property damage, often necessitating documented evidence of the incident date, extent of damage, and repairs needed. Responsibility can also depend on negligence factors, with homeowners expected to maintain proper landscaping and drainage systems to mitigate flood risks. When a third party, such as municipal entities, is involved, liability claims may address improper water management practices, leading to a determination of fault in the event of catastrophic flooding. Legal frameworks typically require a thorough examination of local ordinances and contractual obligations to assess liability accurately. Documentation including photos, invoices for repair costs, and expert assessments will support claims, ensuring compliance with legal stipulations during the resolution process.

Contact details for further communication and resolution

Flood damage liability claims often require clear communication regarding responsibility and financial restitution. Entities such as insurance companies or property management firms may seek contact information for effective coordination. Key details include the name of the insurance adjuster, claim number, direct phone line (often a seven-digit number), and email address (usually in a format of first.last@company.com). Additionally, it is beneficial to provide the physical address for written correspondence and a designated office hours schedule (typically weekdays from 9 AM to 5 PM). Timely and thorough communication can greatly expedite the resolution process related to flood damage.

Letter Template For Flood Damage Liability Samples

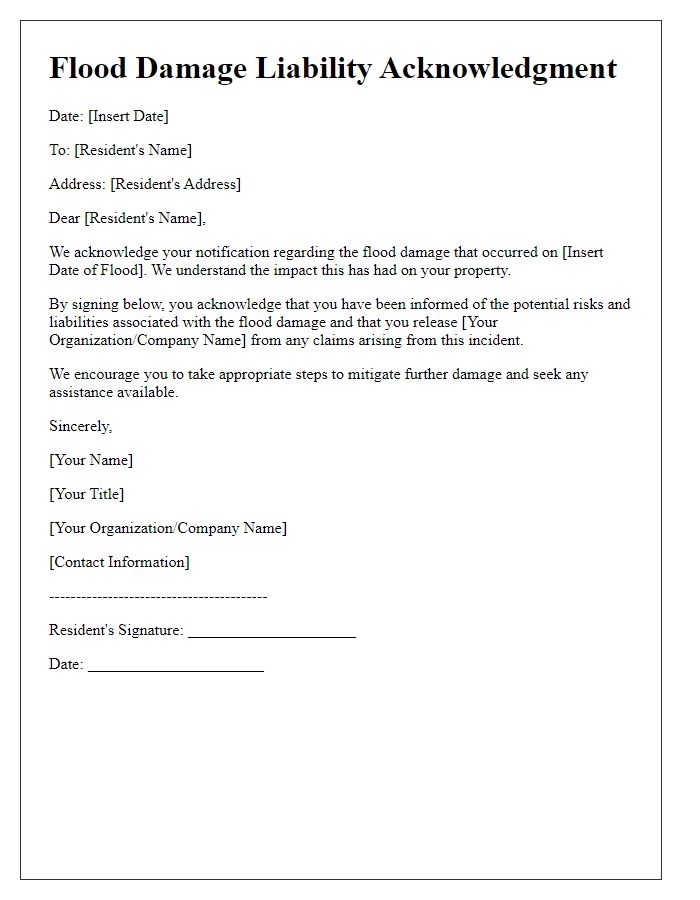

Letter template of flood damage liability acknowledgment for affected residents.

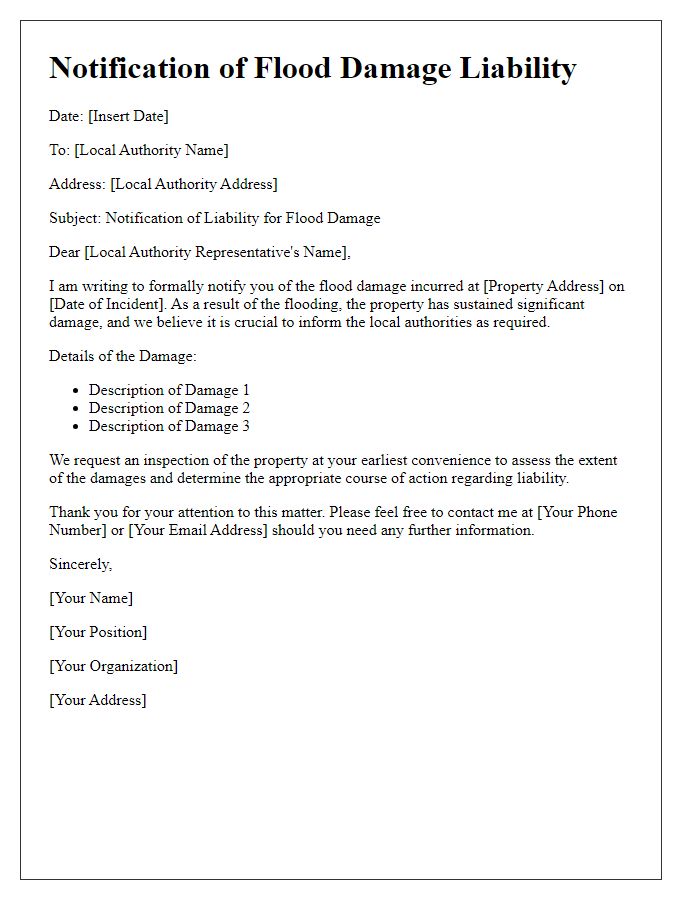

Letter template of flood damage liability notification to local authorities.

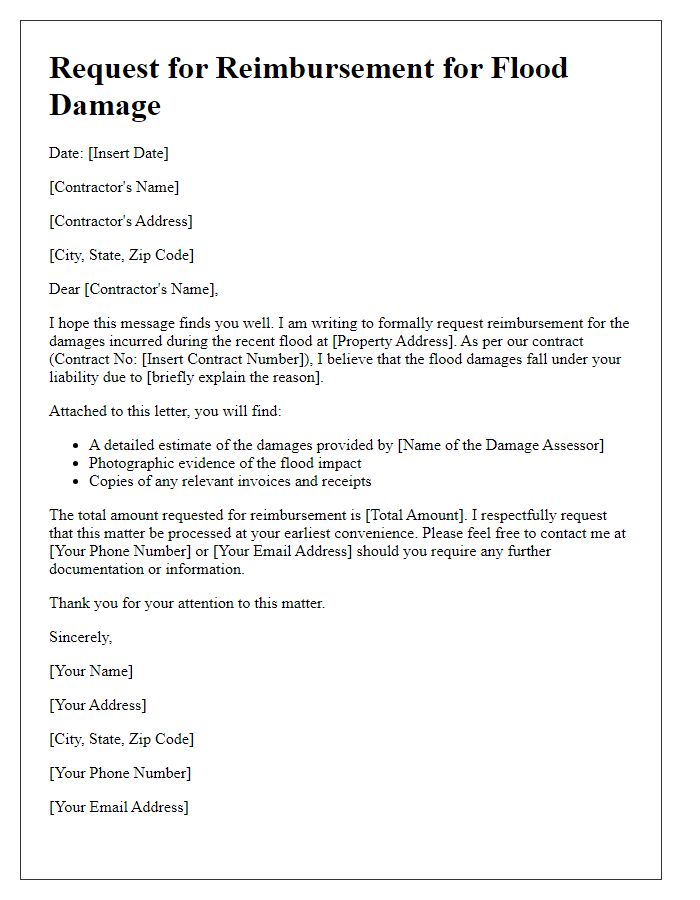

Letter template of flood damage liability reimbursement request to contractors.

Comments