Are you tired of the hassle of writing checks for your rent each month? Setting up electronic rent payment is not only convenient, but it also ensures that your payment is always on time, giving you peace of mind. With just a few simple steps, you can streamline your monthly obligations and save yourself valuable time. Dive into this article to discover everything you need to know about setting up your electronic rent payment today!

Account holder details.

Setting up an electronic rent payment ensures seamless transactions for monthly housing obligations. An account holder must provide personal identification details, including full name, address (including city, state, and zip code), and contact number, ensuring lease agreements are accurately linked to the payment method. The bank account details required typically include bank name, account number, and routing number, allowing automated withdrawals to be processed effectively. Additionally, specifying the rental amount due each month ensures correct deductions occur on the predetermined payment date, contributing to timely rent fulfillment without human error or delays. Providing an email address enhances communication regarding payment confirmations and any potential issues that might arise, ensuring transparency in the financial transaction process.

Bank account information.

Electronic rent payment setups require accurate bank account information for seamless transactions. Specific bank details, including the name of the bank (for example, Chase Bank or Wells Fargo), account number (typically a unique set of digits, such as 123456789), and routing number (often a nine-digit code used within the United States, like 021000021), must be precisely provided. Additionally, the type of account (checking, savings) should be noted for clarity. Rent amounts (specifically monthly payments, such as $1,200), due dates (e.g., the first of each month), and tenant identification (like lease agreement number) also play crucial roles in ensuring timely payment and proper record-keeping. Any special instructions about payment frequency, grace periods, or penalties for late payments should be included for comprehensive understanding.

Property address.

Establishing an electronic rent payment setup simplifies the transaction process for tenants residing at the property located at 123 Maple Street, Springfield. By implementing this digital solution, tenants can conveniently transfer their monthly rental fee of $1,500 on or before the first of each month directly to the property management's bank account. Utilizing platforms like PayPal or Venmo ensures secure transactions, reducing the reliance on physical checks that may delay processing. Tenants should provide their email address for confirmation notifications, enhancing transparency in payment history. This modern approach not only saves time but also ensures timely payments, fostering a positive landlord-tenant relationship.

Payment schedule and amount.

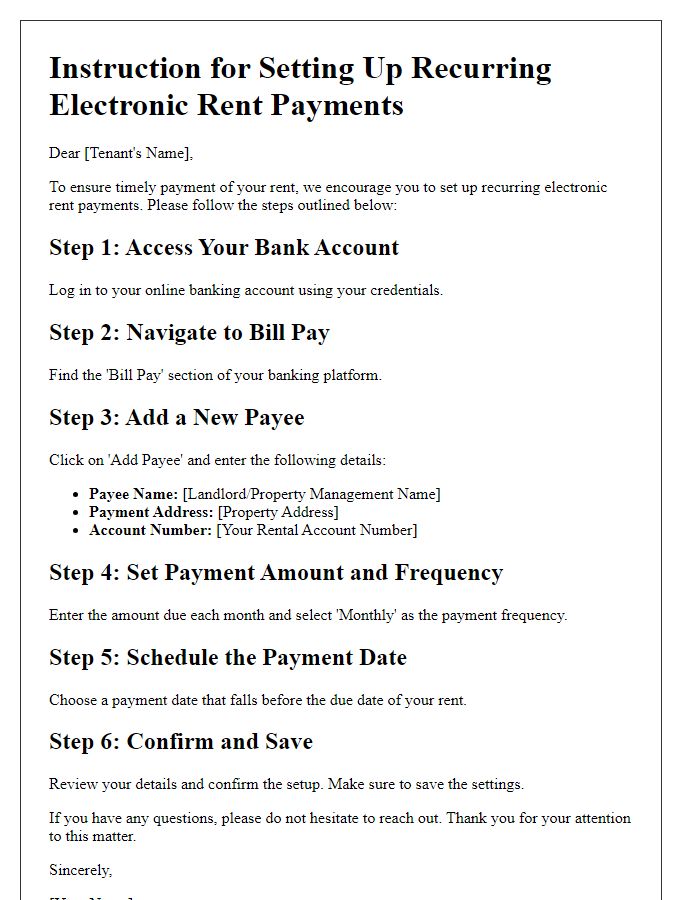

Setting up electronic rent payment involves a systematic schedule and specified payment amounts. For example, if the lease agreement states a monthly rent of $1,200, an automatic payment could be scheduled for the first of each month. This ensures timely payments and reduces the risk of late fees. Additionally, landlords often prefer using secure online platforms, such as PayPal or Venmo, to facilitate transactions, providing immediate electronic confirmation of payments. Clear communication regarding any potential increases in rent, such as a 3% increase discussed during lease renewals, should also be outlined to avoid future confusion.

Authorization signature.

Electronic rent payment setup facilitates convenient transactions for tenants and landlords, streamlining the payment process. This system typically requires authorization signatures from both parties, ensuring clear agreement on payment terms. Details needed include tenant identification information, such as the address of the rented property in Chicago, Illinois, along with the landlord's banking information for direct deposit purposes. The authorization process may also outline the payment schedule, specifying due dates each month, such as the first of every month. Compliance with local housing regulations or agreements can further safeguard interests and establish trust between tenants and landlords.

Letter Template For Electronic Rent Payment Setup Samples

Letter template of acknowledgment for successful electronic rent payment

Comments