Are you feeling overwhelmed by your tax liabilities and unsure of your next steps? Crafting a well-structured settlement proposal can be the key to easing that financial burden. In this article, we'll guide you through the essential elements to include in your letter, ensuring you effectively communicate your situation to the tax authorities. So, let's dive in and discover how you can take control of your tax challenges!

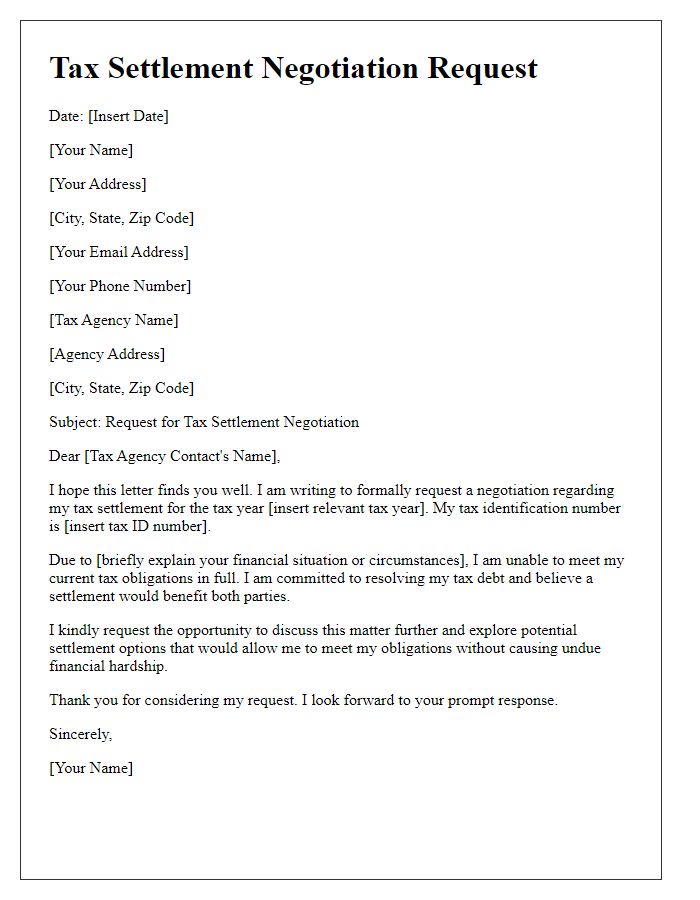

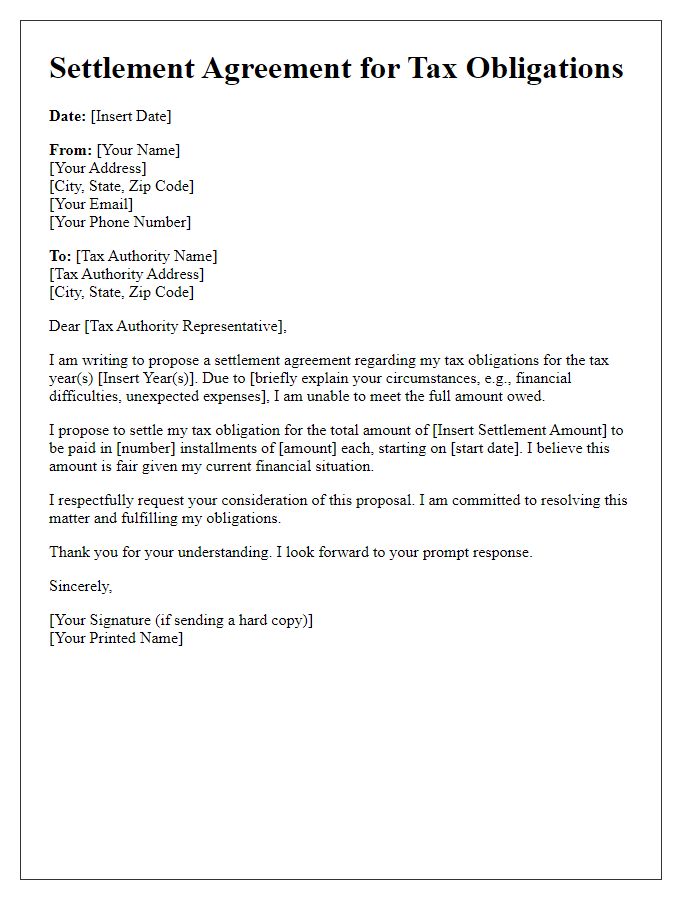

Formal Letterhead and Contact Information

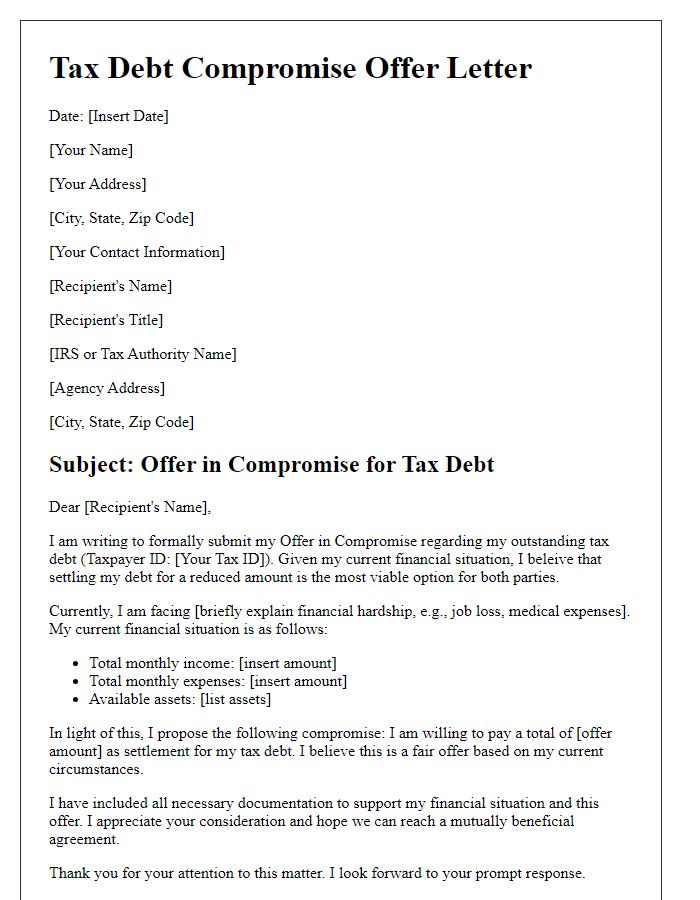

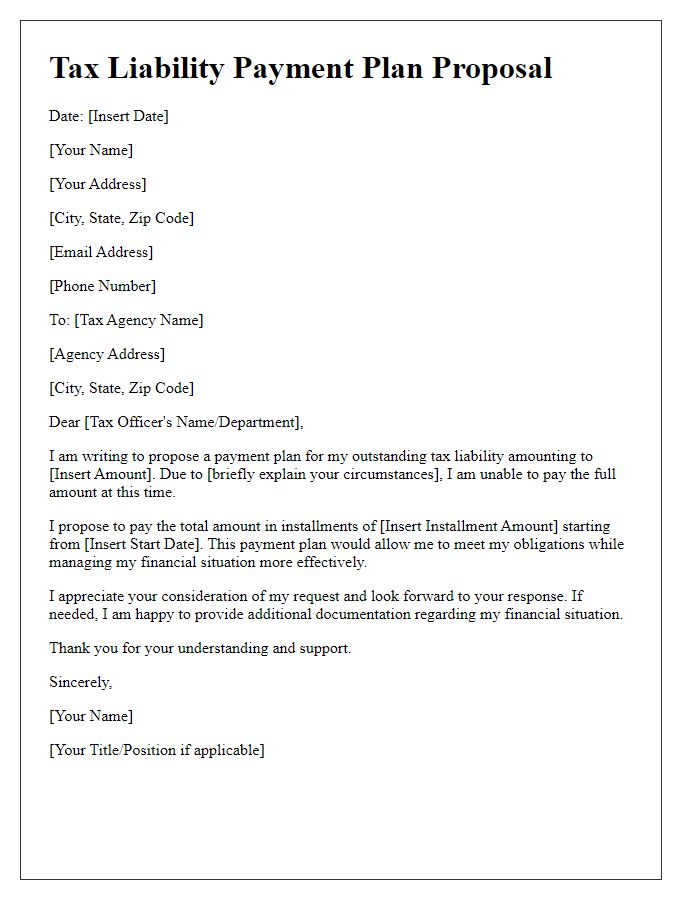

The tax liability settlement proposal involves formal communication regarding outstanding payments owed to the Internal Revenue Service (IRS) or state tax authorities. Detailed financial documents (income statements, assets, liabilities), specific amounts owed (including interest and penalties) must be clearly outlined. Proposed settlement terms, such as reduced payment options, installment agreements, or Offer in Compromise (OIC) must be specified. The proposal should include a comprehensive explanation of financial difficulties (job loss, medical expenses) affecting payment capability, along with any supporting evidence. Compliance with deadlines, adherence to tax settlement regulations, and potential negotiating strategies (including good faith efforts) are essential to increase the likelihood of acceptance.

Detailed Explanation of Tax Liability

Tax liability refers to the total amount of tax owed by an individual or entity to a taxing authority, such as the Internal Revenue Service (IRS) in the United States. This obligation typically arises from various income sources, including wages, business revenue, and investment gains, calculated based on prevailing tax rates and laws. Accurate determination of tax liability involves a comprehensive review of taxable income, applicable deductions, and credits available under sections of the tax code, such as Section 167 for depreciation and Section 501 for charitable organizations. An outstanding tax liability can lead to penalties, interest charges, and potential legal actions if left unresolved. Tax settlement proposals often include documentation detailing income, expenses, and other financial data to support reduced liability requests, with negotiation based on current financial circumstances and relief programs, such as Offer in Compromise, allowing for tax reduction based on financial hardship.

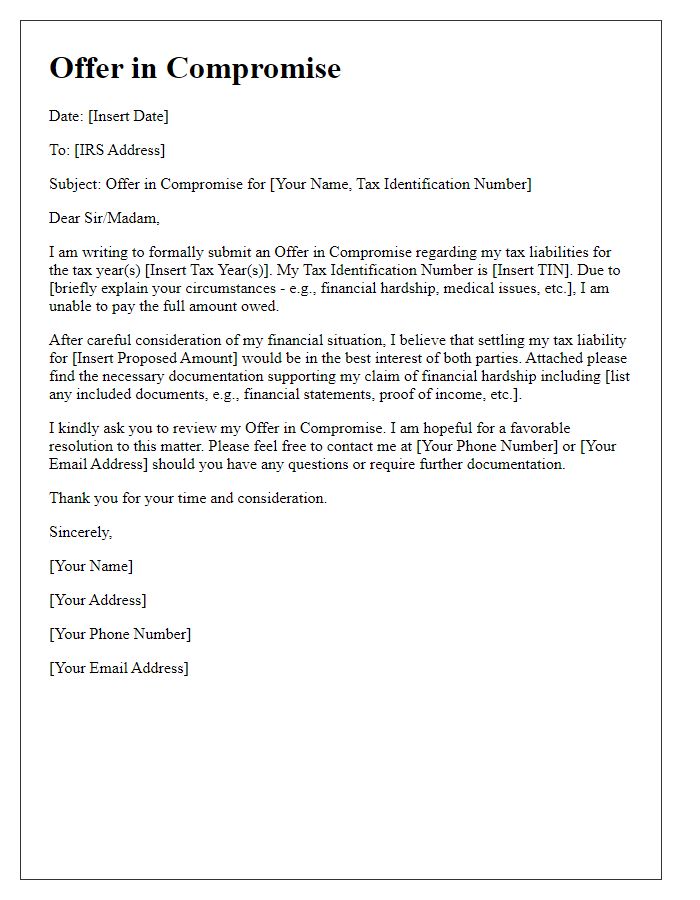

Proposed Settlement Terms and Rationale

Proposing a tax liability settlement involves addressing specific terms and providing a rationale for the proposed agreement. An effective settlement proposal should clearly delineate the amount owed, such as $10,000 in federal tax payments, and the proposed reduced amount, perhaps $5,000, which reflects the taxpayer's current financial condition. Detail the rationale behind this proposal, including considerations such as total income, monthly expenses amounting to $2,500, and the taxpayer's present inability to pay the full amount without extreme hardship. Highlight relevant events that led to this situation, such as job loss or unexpected medical expenses, that have significantly impacted the taxpayer's financial stability. It may also be valuable to reference related policies, such as IRS guidelines for offer in compromise, which allow taxpayers to settle for less than the full tax debt if they can demonstrate an inability to pay. Incorporate any supporting documentation that justifies the settlement request, including income statements, expense reports, and letters from financial advisors if available. This comprehensive approach helps establish credibility and presents a compelling case for the proposed settlement terms.

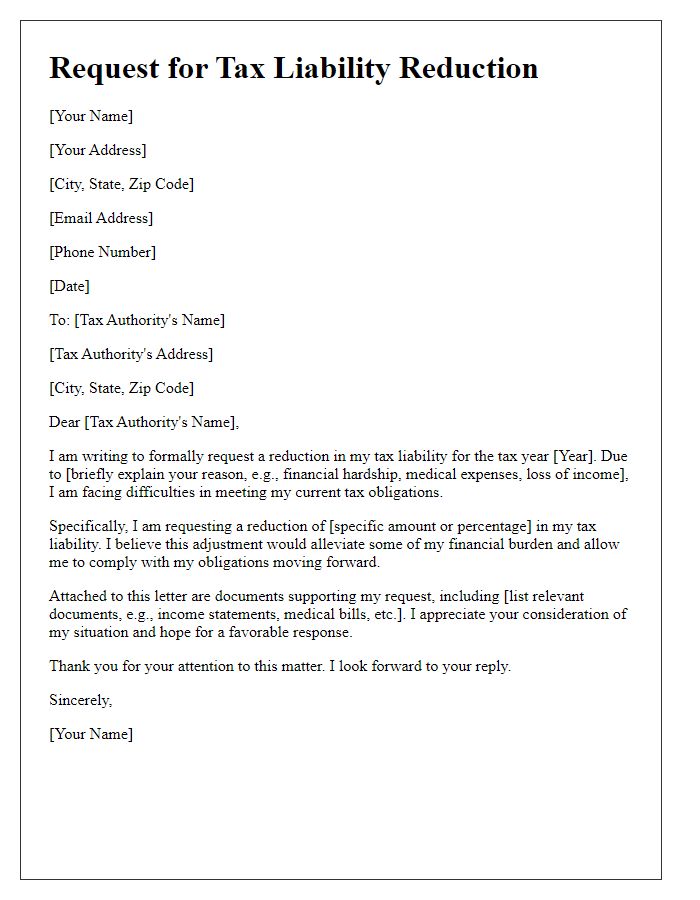

Financial Documentation and Supporting Evidence

Gathering comprehensive financial documentation is essential for proposing a tax liability settlement. This entails preparing detailed records such as income statements, including W-2 and 1099 forms from previous tax years, which highlight all sources of earned income. Additionally, compiling expense reports, showcasing legitimate business expenses, can support claims for deductions. Bank statements detailing cash flow over the past year will provide transparency about financial health. Supporting evidence, such as proof of assets like property deeds, vehicle registration documents, and investment account statements, reinforces the proposal. Furthermore, any correspondence with the Internal Revenue Service (IRS), including notices and previous settlement offers, should also be included to provide a complete context of the situation. Ensuring accuracy in all documentation helps in negotiating a feasible settlement amount with tax authorities.

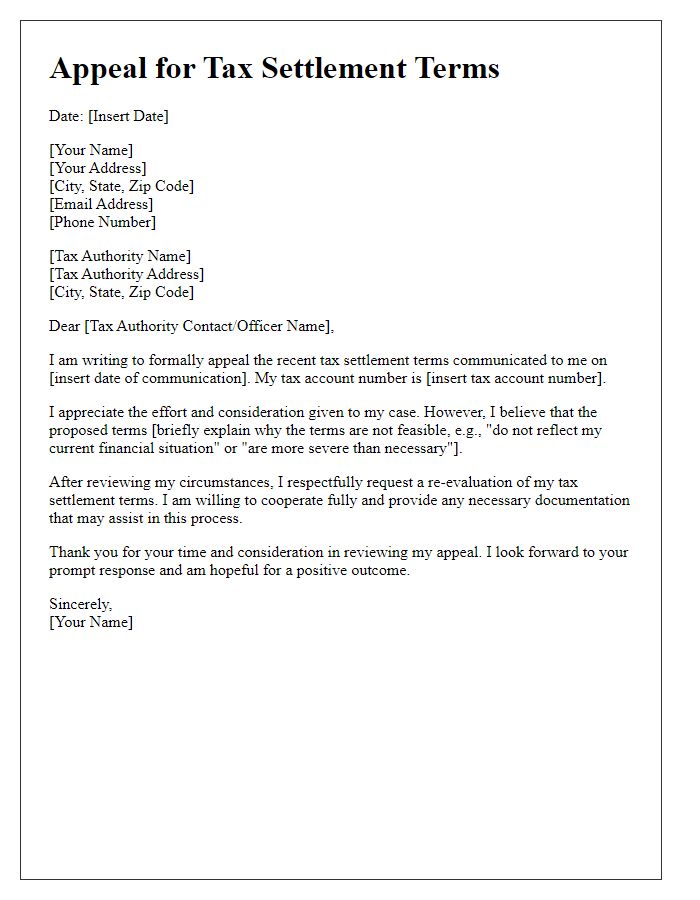

Request for Consideration and Follow-up Plan

Tax liability settlements often involve detailed proposals outlining payment plans and requests for consideration. A settlement might include a specific amount owed, such as $5,000, due to unreported income from a previous fiscal year, like 2022. The proposal should refer to IRS regulations governing installment agreements, detailing a structured payment plan over a period, such as 24 months. It is crucial to highlight significant personal or financial hardships, like medical expenses exceeding $10,000 during 2022, that justify the request for a reduced payment. A follow-up plan may include specific timelines for correspondence, including a request for a response by the end of the month, such as November 30, 2023, ensuring all documents are submitted promptly to avoid penalties.

Comments