Are you navigating the sometimes tricky waters of financial discussions with clients? A well-crafted payment plan proposal letter can make all the difference, turning potential hurdles into smooth sailing. By clearly outlining the terms and demonstrating your commitment to finding a mutually beneficial solution, you can foster trust and maintain strong client relationships. Ready to learn how to craft the perfect proposal letter? Keep reading for some helpful tips!

Personalization and Client Details

Creating a personalized client payment plan proposal requires careful consideration of the specific details relevant to the client and their circumstances. Identifying critical components can enhance the proposal's clarity and effectiveness. Start by noting the client's name (John Smith), their business (Smith Consulting), and the total outstanding balance (USD 10,000). Outline the proposed payment structure, detailing the number of installments (5 monthly payments), the amount of each installment (USD 2,000), and the due dates (beginning the first of next month). Include a brief rationale for the payment plan, noting economic challenges like fluctuating market conditions that may affect cash flow. Emphasize the flexibility built into the proposal, detailing provisions for adjusting due dates or installment amounts if necessary. Reinforce the benefits of maintaining a positive working relationship, ensuring prompt payments will secure ongoing collaboration and support. Conclude with clarity on the next steps, such as signing the agreement by the end of the month to commence the payment plan.

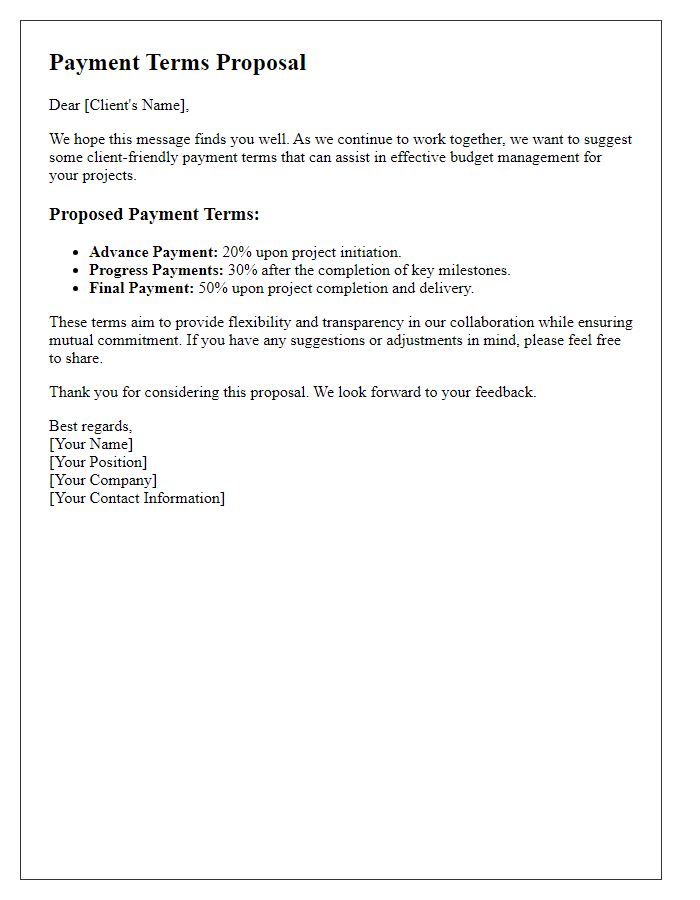

Clear Payment Terms and Schedule

Creating a clear payment plan proposal is critical for maintaining professional relationships and ensuring mutual understanding. A well-structured proposal includes defined payment terms and an organized schedule. Specify the total amount owed, breaking it down into manageable installments according to a timeline that accommodates both parties. For instance, an initial deposit of 20% upon acceptance, followed by monthly payments of 10% over 6 months. Include due dates for each payment, like the 1st of every month, while outlining accepted payment methods such as bank transfer or credit card. Provide clarification on any late fees or penalties to promote adherence to the schedule. Transparency about the agreement fosters trust, simplifying future collaborations.

Payment Methods and Options

A comprehensive payment plan proposal can significantly ease the financial commitment for clients, providing them with various payment methods and options tailored to their needs. For instance, offering credit card payments allows for immediate processing and can include major brands such as Visa and MasterCard. Incorporation of digital payment platforms like PayPal or Stripe enables quick transactions and enhances user convenience. Additionally, introducing installment plans permits clients to break down larger sums into manageable monthly payments, facilitating budget adherence. Furthermore, accepting alternative payment methods such as bank transfers or checks ensures accessibility for clients who prefer traditional methods. Clear communication regarding due dates, penalties for late payments, and potential discounts for early settlement can help maintain transparency in financial dealings. Overall, a flexible and client-centered payment plan proposal not only strengthens business relationships but also enhances customer satisfaction.

Benefits and Incentives for Timely Payments

A structured client payment plan proposal can showcase numerous benefits and incentives that encourage timely payment adherence. First, clients who consistently meet payment deadlines often enjoy a 5% discount on total invoices, fostering a culture of reliability. Additionally, loyalty programs can grant exclusive access to premium services or priority project scheduling, enhancing overall satisfaction and retention. Access to financial resources, such as flexible payment options, can alleviate cash flow concerns, allowing clients to manage budgets effectively while maintaining timely payments. Early payment rebates serve as a financial incentive by rewarding clients with a percentage back when settling invoices before the due date. Clear communication channels, such as dedicated account managers, facilitate discussions on concerns, ensuring a transparent relationship that bolsters trust and encourages on-time payments.

Contact Information for Queries and Support

The client payment plan proposal outlines the financial arrangements for services rendered, specifying monthly payment options and total amounts due. Clients seeking guidance or clarification can reach out directly to the finance department, located at the headquarters in New York City, or through email at support@company.com. For urgent inquiries, a dedicated phone line is available at (555) 123-4567, operating from 9 AM to 5 PM Eastern Standard Time. Comprehensive resources, including FAQs and payment processing details, can be accessed on the official website, ensuring clients receive prompt and effective support.

Letter Template For Client Payment Plan Proposal Samples

Letter template of installment payment plan offer for longstanding clients.

Letter template of customized payment schedule suggestion for valued customers.

Letter template of deferred payment agreement proposal for clients facing financial strain.

Letter template of sequential payment option proposal for service agreements.

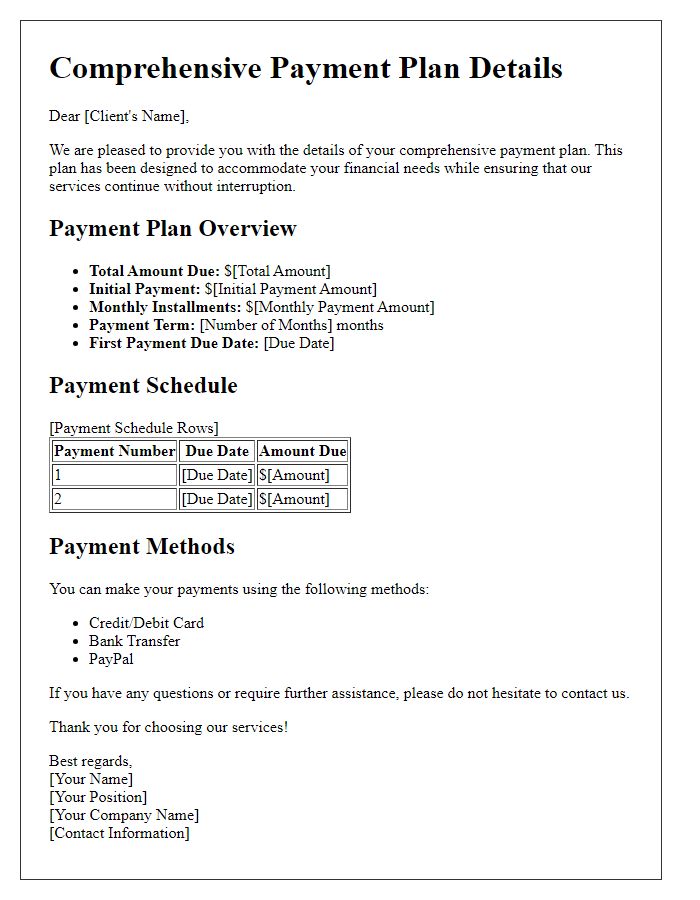

Letter template of comprehensive payment plan details for regular clients.

Letter template of alternative payment strategy proposal for seasonal clients.

Comments