Are you ready to navigate the often complex world of UCC financing statements? Whether you're a seasoned entrepreneur or just starting your business journey, understanding how to properly file these documents is crucial for securing your financing. In this article, we'll break down the essential steps and tips to ensure your UCC filings are on point and legally sound. So, grab a cup of coffee and dive in with us to learn more about this important aspect of business financing!

Accurate Debtor and Secured Party information

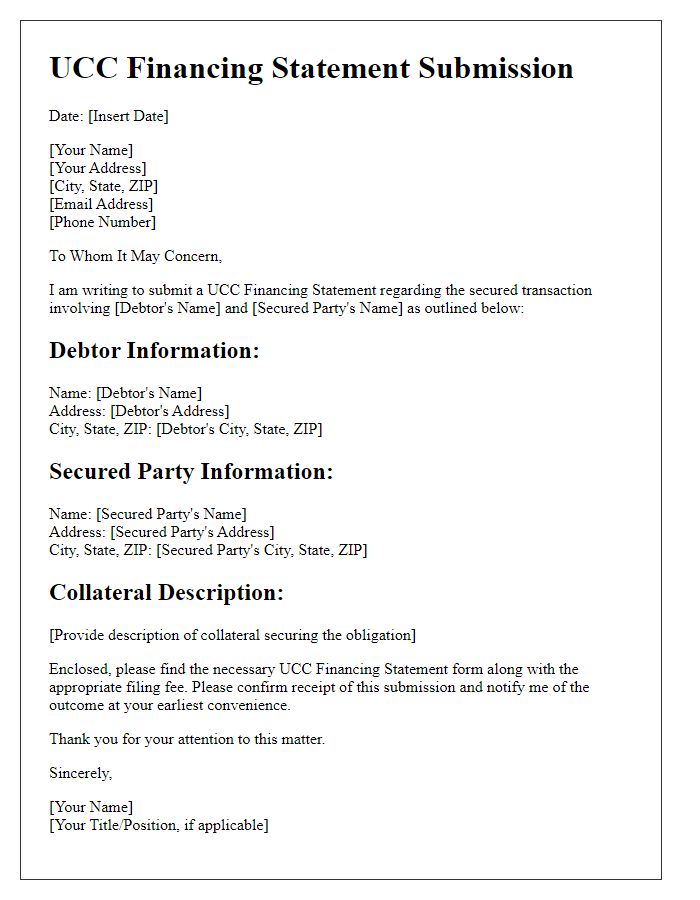

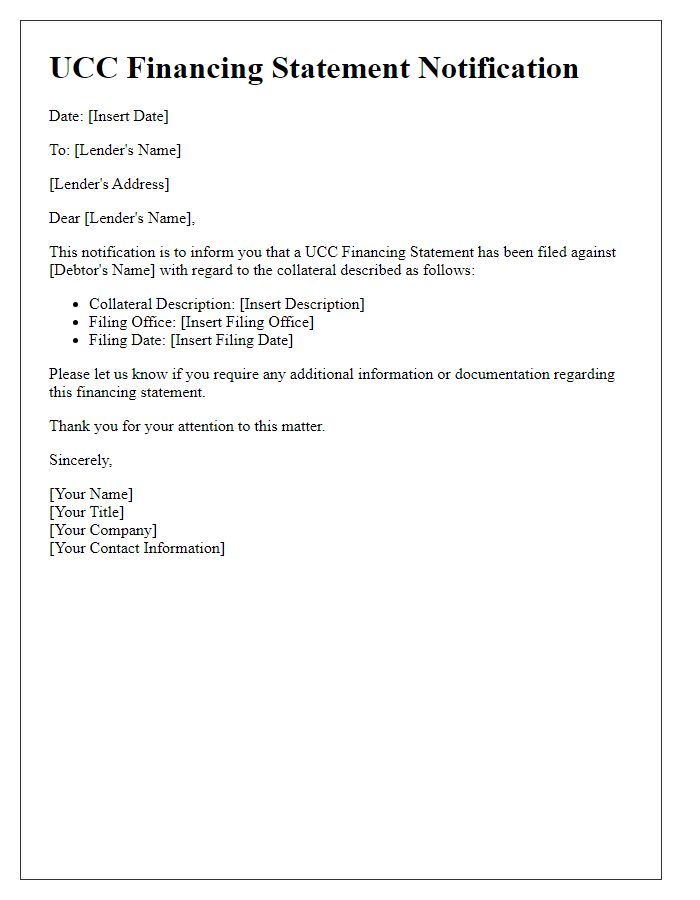

Accurate debtor information is crucial when filing a UCC (Uniform Commercial Code) financing statement, as it ensures proper identification of the parties involved. The debtor's name must align with the name registered in official state records, including corporate entities or individuals, to avoid rejection. Similarly, the secured party must provide precise details, including a name and address, reflecting their legal status, whether they are a business or individual. Filing typically occurs at the local secretary of state's office, with provisions varying by state, highlighting the importance of adhering to local regulations. Errors, such as misspelled names or incorrect addresses, can lead to complications in enforcing security interests, making meticulous accuracy essential in this legal documentation process.

Clear description of collateral

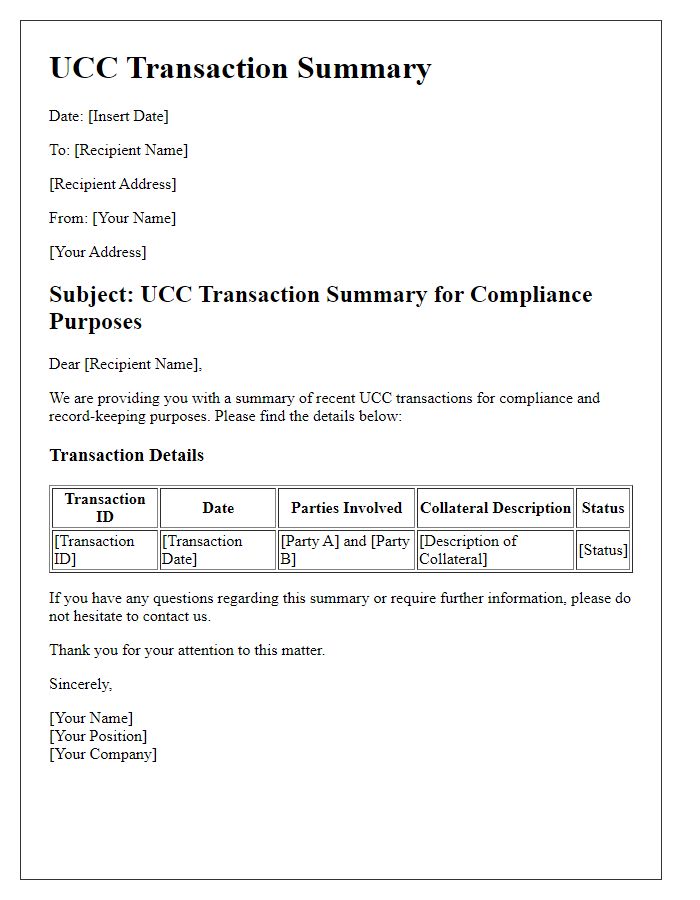

A UCC financing statement filing requires a clear description of collateral, which is the asset or property that secures a loan. Common types of collateral include equipment (machinery, tools valued over $5,000), inventory (goods held for sale by businesses), accounts receivable (money owed by customers), and real estate (land or buildings). Specific details about the collateral, such as VIN numbers for vehicles or serial numbers for machinery, enhance identification. For example, "All inventory located at 123 Main Street, Anytown, USA, including electronics and household goods valued at over $50,000." This specificity ensures clarity and legal protection for the lender in case of default.

Proper UCC form completion

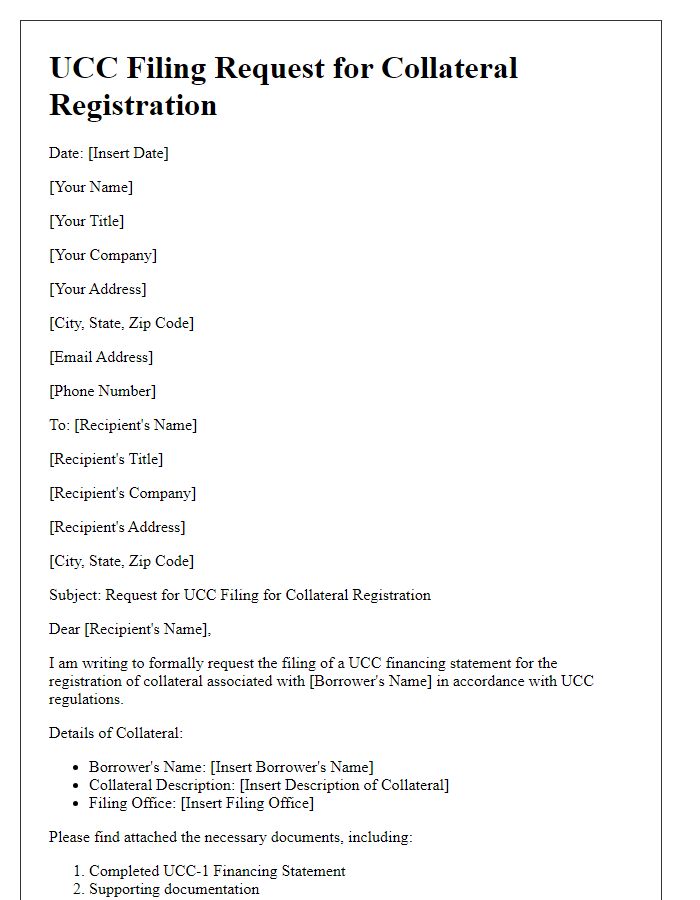

Filing a UCC financing statement requires meticulous attention to detail to ensure compliance with state regulations, notably the Official UCC Form 1. Essential components include the debtor's legal name, which must align with documentation such as a driver's license or business registration certificate to avoid rejection. The secured party's information, identified accurately, should reflect the entity holding the security interest or financing lien. The collateral description needs to be precise, whether specifying personal property, inventory, or equipment, in accordance with Article 9 of the Uniform Commercial Code. Notably, filing fees vary among states--ranging approximately between $20 and $200--and submission can occur through in-person filings at the local Secretary of State's office, or electronically, depending on jurisdiction. Understanding these nuances is crucial for protecting interests effectively.

Filing jurisdiction considerations

Filing a UCC (Uniform Commercial Code) financing statement involves several jurisdictional considerations to ensure compliance and effectiveness. The primary jurisdiction for filing typically corresponds to the location of the debtor, particularly in the case of registered entities, which are generally governed by the state of incorporation. For individuals, the filing should occur in the state of the debtor's principal residence. Additionally, secured parties must be aware of specific state rules regarding the duration of the financing statement's effectiveness, which may necessitate periodic renewals every five years. Some jurisdictions also impose particular fees and require submission of additional documentation, such as proof of identification or previous liens, affecting the filing process. Accurate identification of the collateral, including its specific type and any pertinent serial numbers or descriptions, is crucial to avoid complications in enforcement. Understanding these jurisdictional nuances is essential for secured parties seeking to protect their interests in the event of debtor default.

Compliance with state-specific requirements

Filing a UCC financing statement requires compliance with specific state regulations to ensure valid and enforceable security interests. Each state, such as California or Texas, has unique requirements regarding the required information, form formats, and filing procedures. Key elements typically include the debtor's name and address, secured party's name and address, and a description of the collateral, which must be specific enough to identify the assets, like inventory or equipment. Some states mandate the use of an approved UCC form, while others may allow for electronic filings through designated online portals. Moreover, states may have deadlines for filing to establish priority among creditors, emphasizing the importance of timely submissions for businesses seeking financing. Accurate adherence to these state-specific rules is crucial to avoid rejection or legal challenges.

Letter Template For Ucc Financing Statement Filing Samples

Letter template of UCC financing statement submission for secured transactions

Comments