Are you considering establishing a charitable trust but don't know where to start? Creating a trust can be a fulfilling way to make a lasting impact in your community and support causes you care about. It's important to understand the key elements involved, from defining your mission to choosing the right trustees. To dive deeper into the process and learn some valuable tips, we invite you to read more!

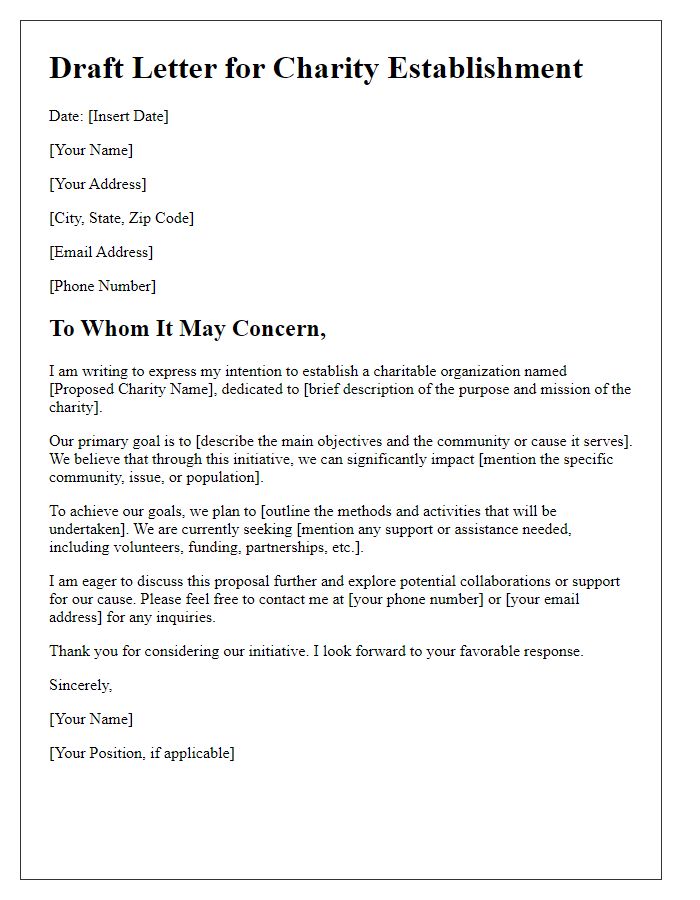

Mission Statement

The establishment of a charitable trust aims to promote educational opportunities for underprivileged children in urban areas, specifically in cities such as Detroit and Chicago, where access to quality education is severely limited. The mission statement emphasizes providing scholarships, mentorship programs, and after-school tutoring to enhance academic performance and support personal growth. By collaborating with local schools and community organizations, the trust seeks to create a sustainable impact, fostering an environment where every child has the resources and support necessary to achieve their full potential. This initiative targets at least 1,000 children annually, aiming for significant improvements in literacy and overall educational outcomes within five years.

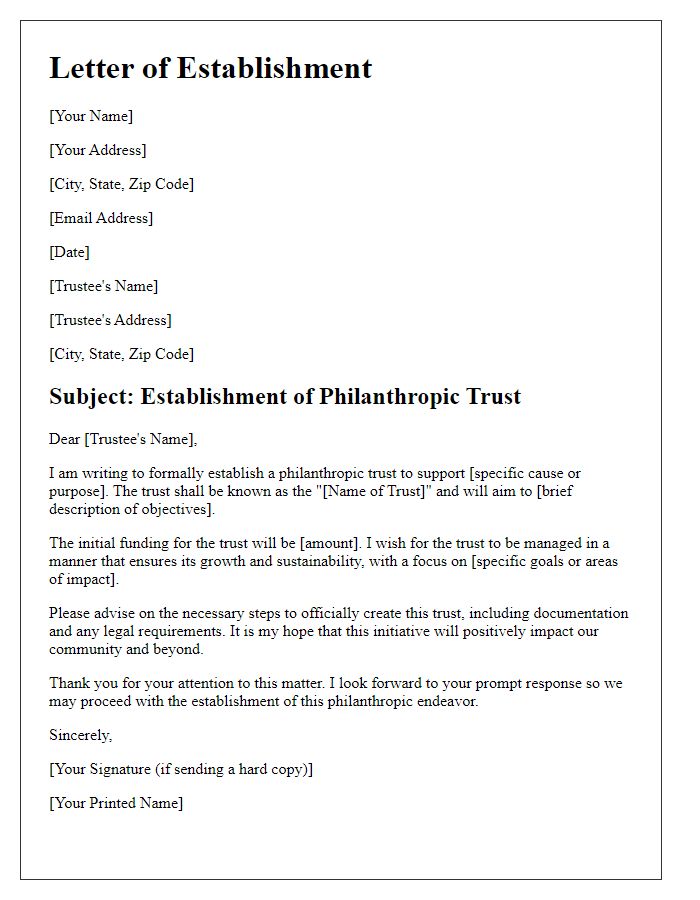

Governance Structure

A well-defined governance structure is essential for the effective operation of a charitable trust, such as the Springfield Community Trust. This structure typically includes a Board of Trustees, composed of individuals with diverse expertise in areas such as finance, law, and community service, ensuring well-rounded decision-making. Each trustee's term lasts for three years, allowing for regular turnover and fresh perspectives while maintaining continuity. The trust operates under the guidance of bylaws that outline responsibilities, eligibility criteria, and procedures for meetings--ensuring transparency. Compliance with regulations set forth by the Charity Commission, based in the United Kingdom, is mandatory, fostering public trust. Additionally, the establishment of an Advisory Committee comprises community leaders who provide insights and recommendations, enhancing community engagement in the trust's activities. Financial accountability is overseen through an independent auditor, ensuring proper use of donations for programs aimed at poverty alleviation, education, and healthcare initiatives.

Funding Sources

Establishing a charitable trust involves identifying diverse funding sources to sustain its mission effectively. Various avenues for funding include individual donations, corporate sponsorships, and government grants. Individual donations can range from small contributions to larger philanthropic gifts that significantly impact operations. Corporate sponsorships often involve partnerships with local businesses, which can provide financial support in exchange for brand visibility and community engagement. Government grants, available through state or federal programs, can also offer substantial funding for specific initiatives aligned with public benefit objectives. Additionally, fundraising events, such as galas or online crowdfunding campaigns, serve as effective methods for raising awareness and generating funds while building a community of support around the trust's mission and projects.

Legal Compliance and Registration

Establishing a charitable trust involves understanding legal compliance and registration processes essential for its operational legitimacy. In the United States, various state laws govern the formation of charitable trusts, with the Internal Revenue Service (IRS) requiring recognition as a 501(c)(3) organization to ensure tax-exempt status. Detailed documentation, including a declaration of trust and the trust's governing instrument, must be prepared, outlining the trust's purpose, beneficiaries, and management structure. States like California and New York have specific registration forms, such as the Form CT-1 or the Charitable Registration Form, requiring submission to relevant state tax boards. Additionally, federal compliance mandates adherence to regulations set forth by the IRS, including annual Form 990 filings detailing the trust's financial activities. Proper legal advice is vital to navigate these complexities, ensuring alignment with both state regulations and federal expectations, thereby fostering transparency and trust with donors and beneficiaries alike.

Community Engagement and Partnerships

Establishing a charitable trust focuses on fostering community engagement and building strong partnerships. A well-structured charitable trust can address local needs, enhancing the well-being of community members. The trust should prioritize establishing collaborations with organizations such as local non-profits, schools, and businesses, aiming to engage in various projects like educational programs, health initiatives, and environmental sustainability efforts. For instance, partnering with organizations like the United Way or local food banks can provide essential services to underserved populations. Creating advisory boards comprising community leaders can further enrich the trust's impact. Regular events, workshops, and forums should be organized to encourage active participation from residents, ensuring their voices shape the trust's initiatives. Over time, measurable outcomes such as increased volunteerism or improved access to community resources can showcase the effectiveness of these efforts, strengthening support and encouraging ongoing partnerships.

Comments