Navigating the complexities of government contract compliance can be daunting, but it doesn't have to be. Understanding the essential regulations and requirements is crucial for ensuring your organization meets all obligations and avoids costly penalties. By establishing clear protocols and maintaining open lines of communication, you can streamline the compliance process and foster a transparent working relationship with government entities. If you're interested in learning more about how to effectively manage your government's contracting obligations, keep reading!

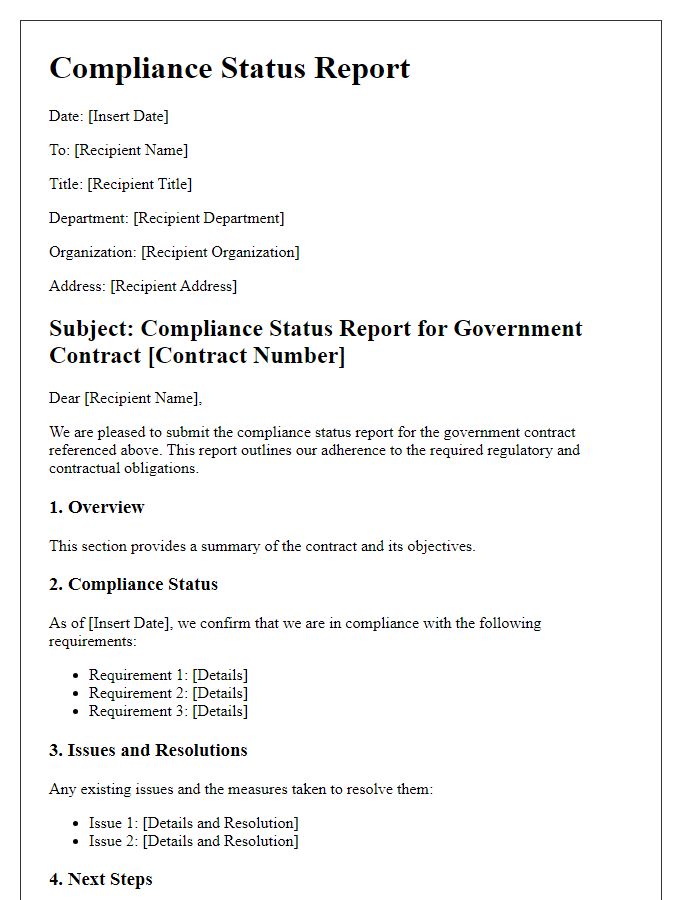

Clear Compliance Requirements

Clear compliance requirements are essential for government contracts, ensuring adherence to regulations such as the Federal Acquisition Regulation (FAR) in the United States. These requirements outline specific standards for quality assurance, reporting procedures, and audits that contractors must follow. For example, the Davis-Bacon Act mandates prevailing wage rates for laborers on federally funded construction projects, impacting budget allocations and contractor responsibilities. Additionally, the Office of Management and Budget (OMB) Circular A-133 emphasizes the importance of financial audits for non-profit and governmental entities, ensuring transparency and accountability in expenditure of federal funds. Following these compliance standards not only fosters trust between contractors and government entities but also enhances the overall integrity of public sector procurement processes.

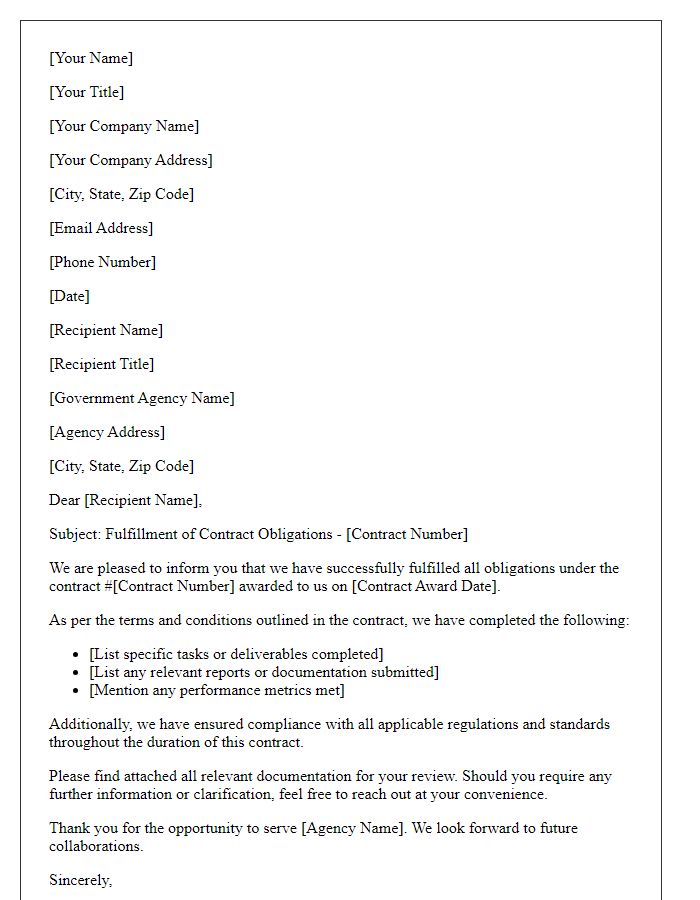

Specific Deliverable Timeframes

Specific deliverable timeframes are crucial for the successful execution of government contracts, defining key milestones that ensure timely project completion. Government agencies, such as the Department of Defense or the Environmental Protection Agency, often require deliverables to be submitted within precise timeframes to maintain accountability and oversight. For instance, deliverable milestones may include project initiation reports due within 30 days of contract award, interim progress updates submitted bi-weekly, and a final project completion report expected within six months. Adherence to these specified timeframes helps mitigate risks of non-compliance, encourages systematic progress tracking, and fosters effective communication between contractors and government representatives, ultimately ensuring project objectives are met in a timely manner.

Contact Information for Compliance Queries

For inquiries regarding compliance with government contracts, please contact the Compliance Department at 123 Compliance Ave, Springfield, IL 62701. For telephone assistance, reach us at (555) 123-4567. Email inquiries can be sent to compliance@governmentcontracts.com. Our office hours are Monday through Friday, 9 AM to 5 PM CST. Regulatory compliance is essential for the successful execution of government contracts, ensuring adherence to federal guidelines, maintaining ethical standards, and fulfilling contractual obligations. Timely communication with the Compliance Department is crucial for addressing any concerns and ensuring alignment with the terms set forth by governing agencies.

Penalties for Non-Compliance

Penalties for non-compliance with government contracts can have serious financial and legal consequences. The Federal Acquisition Regulation (FAR) outlines various penalties, including liquidated damages, which can range from thousands to millions of dollars depending on the contract value and degree of violation. Disqualifications from future bids may also occur, impacting a contractor's ability to participate in upcoming federal projects. Additionally, agency-specific regulations, for instance, those set by the Department of Defense, may impose stricter penalties such as suspension or debarment from federal contracts for up to three years. The Small Business Administration also may rescind 8(a) Program eligibility for non-compliance, severely limiting opportunities for small businesses. Audit findings from entities like the Government Accountability Office (GAO) can lead to payment withholdings and increased scrutiny for non-compliant contractors.

Signature and Authorization Sections

Government contract compliance requires precise and clear documentation, especially in signature and authorization sections. Signatures must be provided by authorized representatives of the bidding organization, often including company executives such as the Chief Executive Officer (CEO) or Chief Financial Officer (CFO), who hold legal authority. Full legal names and titles should accompany signatures, ensuring accountability and clarity. Additionally, the date must be provided to establish the timeline of acceptance. In many contracts, specific sections delineate the scope of authority, detailing any limitations or exemptions regarding signatory power. Compliance also mandates the inclusion of witness signatures in some cases, to validate the contract's legitimacy. Including notary public acknowledgments may be necessary, particularly for contracts exceeding certain monetary thresholds, enhancing legal enforceability.

Comments