Dissolving a business can be a complex process, especially when it comes to understanding the tax implications involved. It's not just about closing the doors; there are several financial responsibilities and strategies that need to be addressed to avoid future headaches. From settling up with creditors to filing final tax returns, there's much to consider to ensure a smooth exit. Curious about what steps you should take to navigate this landscape effectively? Let's dive deeper into the essential considerations for business dissolution and its tax ramifications.

Business Name and EIN

Navigating the business dissolution process can present significant tax implications for entities such as LLCs or corporations. The IRS assigns an Employer Identification Number (EIN) to identify the business for tax purposes. Upon dissolution, outstanding assets must be handled, including liquidating any remaining inventory or property, which may incur capital gains taxes. Business owners must also consider prorating any remaining income or losses for the taxable year. Depending on the structure of the business, there may be additional liabilities, such as final employment taxes for wages paid to employees. Consulting relevant tax documents such as Form 8832 (entity classification) or Form 1040 (individual income tax) can ensure compliance and mitigate unexpected tax burdens during dissolution.

Effective Date of Dissolution

The effective date of dissolution significantly impacts tax implications for businesses, including LLCs, corporations, and partnerships. In the United States, once a business declares an effective date, it marks the conclusion of its operations for tax purposes, affecting the filing requirements for the final tax returns. Various state laws, such as California's Corporations Code Section 1900, specify that taxation ends when the dissolution is filed with the state. Additionally, the Internal Revenue Service requires entities to finalize any outstanding tax liabilities, ensuring that all income and expenses incurred up to the dissolution date are reported accurately. Claiming deductions for business losses can be complex, necessitating the completion of all final payroll taxes and employee benefits, which vary by state and federal regulations. Furthermore, partnerships and multi-member LLCs may face additional considerations, such as distributing assets and potential capital gains taxes. Understanding these aspects is crucial for ensuring compliance and minimizing tax liabilities during the dissolution process.

Tax Clearance and Compliance

Business dissolution can trigger significant tax implications, necessitating meticulous attention to tax clearance and compliance to avoid penalties. A business entity, once dissolved, such as an LLC or corporation, must ensure all outstanding taxes are filed in accordance with state regulations, often including final income tax returns for the year. Jurisdictional compliance, particularly in locations like California (known for rigorous business laws) or New York, may require obtaining a tax clearance certificate to confirm that no tax liabilities are pending. Entities should also consider seeking assistance from tax professionals to navigate the complexities surrounding employment taxes, sales taxes, and any applicable local levies, safeguarding owners from potential audits or fines with the IRS. Completing dissolution paperwork like Form 990 or Schedule K-1 accurately will further substantiate compliance during the winding-up process.

Final Tax Return Filing Requirements

When a business entity dissolves, it triggers specific final tax return filing requirements that must be met for compliance with the Internal Revenue Service (IRS) regulations. The business, whether a corporation, partnership, or sole proprietorship, must file a final tax return for the year of dissolution, indicating on the return that it is the final one. For corporations, Form 1120 or 1120S must be completed, while partnerships use Form 1065. Sole proprietors must file Schedule C with their Form 1040. All income generated prior to dissolution must be reported, and any remaining assets distributed to owners can result in tax implications under capital gains tax regulations. State-specific requirements, often varying by jurisdiction, should also be reviewed to ensure compliance with local tax authorities, as penalties for non-compliance can be significant. It's advisable to consult a tax professional to navigate complex tax landscapes and ensure all obligations are met effectively.

Distribution of Assets and Liabilities

Dissolving a business involves the distribution of assets and liabilities, impacting tax implications significantly. For corporations, assets such as real estate, inventory, and equipment must be evaluated to determine their fair market value. The Internal Revenue Service requires reporting of capital gains or losses when these assets are transferred to shareholders during liquidation. Liabilities, including outstanding debts and obligations, must be settled before any distribution of remaining assets. Partnerships face similar considerations, as the allocation of remaining assets and liabilities must conform to the partnership agreement and can trigger tax consequences for individual partners. State laws and regulations may also influence the dissolution process, necessitating careful attention to legal requirements and obligations to ensure compliance.

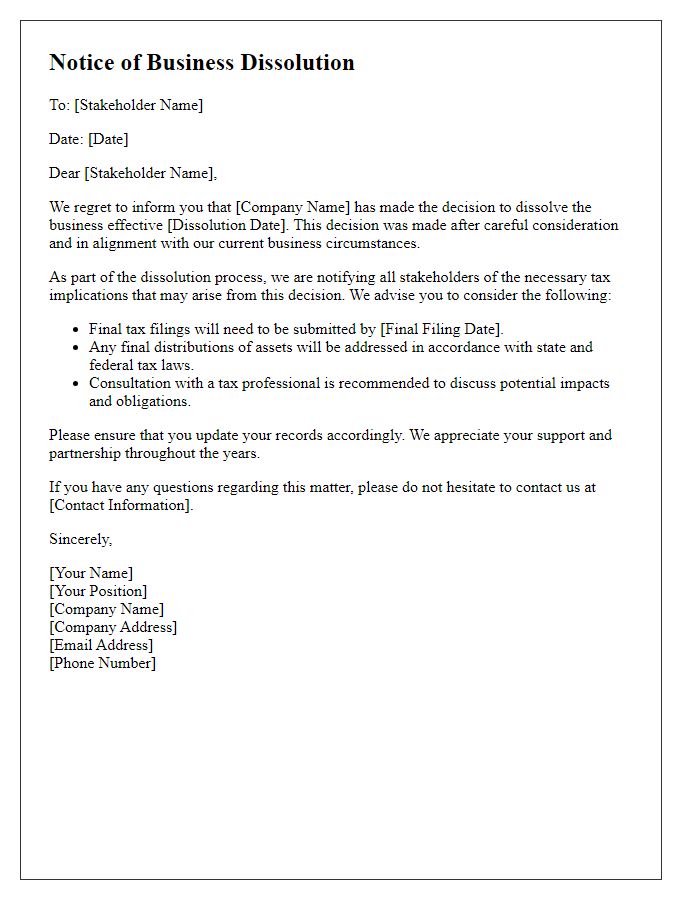

Letter Template For Business Dissolution Tax Implications Samples

Letter template of business dissolution tax obligations for sole proprietorships.

Letter template of business dissolution tax considerations for partnerships.

Letter template of business dissolution tax reporting requirements for corporations.

Letter template of business dissolution tax implications on asset distribution.

Letter template of business dissolution tax effects on retained earnings.

Letter template of business dissolution tax responsibilities for partners.

Letter template of business dissolution tax strategies for minimizing liability.

Letter template of business dissolution tax adjustments for final returns.

Comments