Are you facing the daunting prospect of filing for bankruptcy? It can feel overwhelming, but understanding the process is the first step toward financial recovery. This letter template serves as a practical guide to help you inform relevant parties about your bankruptcy filing in a clear and professional manner. Curious about how to navigate this challenging time? Read on to discover essential tips and insights!

Company Name and Contact Information

Bankruptcy filing notifications often contain critical details regarding the entity involved. A company, such as Acme Corp, located at 123 Business Lane, Suite 456, Springfield, IL, must include accurate contact information. The notification should specify the bankruptcy chapter under which the filing is taking place, for example, Chapter 11, indicating a reorganization process, or Chapter 7, leading to liquidation. Important dates, such as the filing date (October 15, 2023), and relevant case numbers must be included to ensure proper identification within the legal system. Additionally, notifications may outline the company's outstanding debts, total assets, and the anticipated timeline for creditor meetings, emphasizing cooperation with the U.S. Bankruptcy Court in ensuring a fair and transparent process.

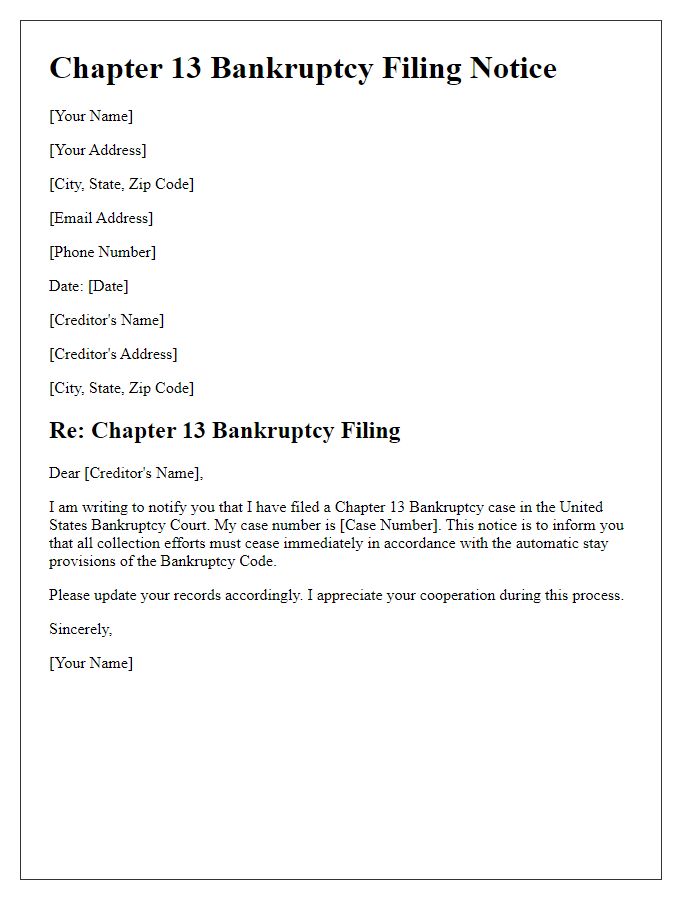

Bankruptcy Case Number

Bankruptcy filings can impact financial status significantly, requiring clear communication about the associated Case Number. The Bankruptcy Case Number, a unique identifier assigned by the court, relates directly to the specific proceedings under the United States Bankruptcy Code. This number aids in tracking case progress and associated documents, such as Notice of Bankruptcy Filing. Timely notification of bankruptcy filing affects creditors, debtors, and stakeholders involved. In the event of a Chapter 7 or Chapter 13 filing, understanding the implications of the Case Number is imperative, as it governs the discharge of debts and liquidation of assets. Accurate documentation and prompt response to bankruptcy notifications are critical to ensure all parties are informed of the legal standing and procedural updates.

Court Details and Jurisdiction

Filing for bankruptcy involves submitting a notification to the relevant court, such as the United States Bankruptcy Court or the local district court depending on jurisdiction. The jurisdiction usually includes federal court systems, with specific divisions based on geographical location, such as Northern District of California or Southern District of New York. Important details include the case number (assigned upon filing), the name of the judge overseeing the case, and scheduled court hearings related to the bankruptcy process. Additionally, it is crucial to include contact information for the trustee assigned to the case and any required notices for creditors, which may vary by state laws. Comprehensive knowledge of the specific court rules and procedures is essential to ensure compliance and proper notification to all parties involved.

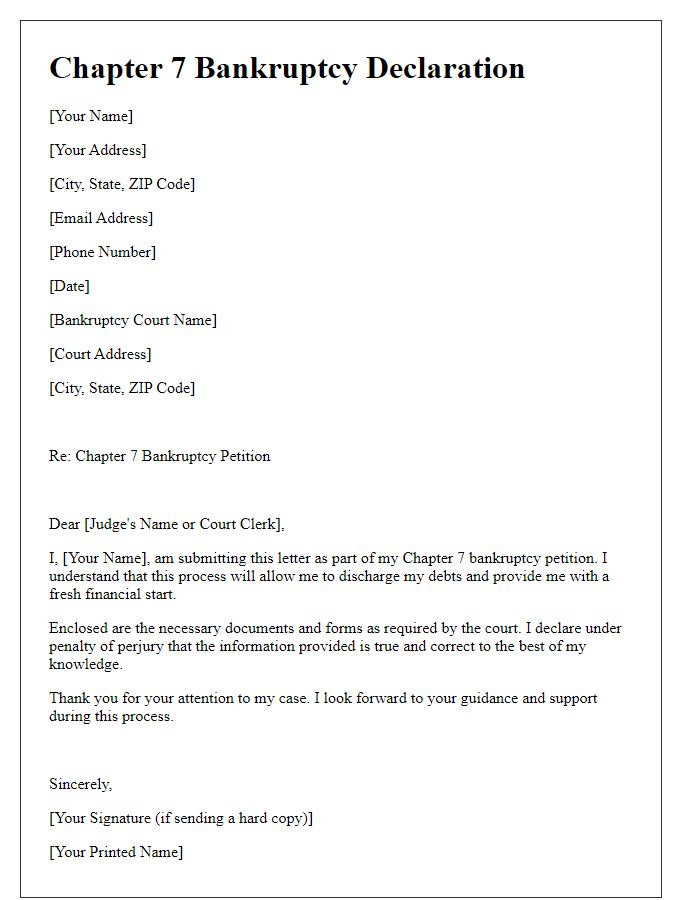

Statement of Bankruptcy Filing

The statement of bankruptcy filing is an official document that informs creditors and involved parties of a person's or organization's legal declaration of insolvency. This process typically includes Chapter 7 (liquidation) or Chapter 13 (reorganization) bankruptcy under the United States Bankruptcy Code, designed to provide relief to individuals or businesses struggling with overwhelming debt. Upon filing, a bankruptcy case number assigned by the court, such as in the Southern District of New York, allows for the identification and tracking of the case throughout the legal proceedings. Notifications often include details such as the date of filing, relevant deadlines for creditors to submit claims, and information regarding the appointed trustee who will manage the assets and debts involved. This formal communication serves to prevent further collection actions by creditors, offering a structured path toward financial recovery.

Implications and Next Steps

Bankruptcy filings can significantly impact individuals and businesses, leading to various legal and financial implications. Notification of a bankruptcy filing, particularly under Chapter 7 or Chapter 11 in the United States, results in an automatic stay that halts creditor actions, safeguarding assets from immediate collection efforts. Essential next steps involve engaging with a bankruptcy attorney to navigate the complexities of the filing process, understanding the implications for credit ratings (which may drop significantly, sometimes by 200 points or more), and preparing for mandatory financial counseling sessions. Additionally, debtors must be aware of the limitations imposed during bankruptcy, including restrictions on incurring new debt and difficulties in securing loans for several years post-filing. Proper documentation of assets and liabilities becomes crucial, ensuring transparency in the proceedings and aiding the court in asset distribution or reorganization plans.

Comments