Navigating the complexities of probate estate administration can feel overwhelming, but it doesn't have to be. Understanding the steps involved, from filing the will to distributing assets, is crucial for ensuring a smooth process. Whether you're an executor or an heir, knowing your rights and responsibilities can make all the difference. So, if you're looking for guidance on managing a probate estate effectively, keep reading to learn more!

Clear language and structure

Probate estate administration involves the legal process of managing a deceased person's estate (the total assets and liabilities) following their passing. Executors, designated through a will (a legal document outlining a person's wishes regarding their assets), are responsible for this process. The initial step includes filing the will with a local probate court (specific court designated to handle estate matters) in the jurisdiction where the deceased resided. Moreover, an inventory of assets, including real estate (land and buildings) and personal property (all movable items), must be compiled and appraised to determine their value. Creditors have a specified period to file claims against the estate for outstanding debts. After settling debts, the executor distributes the remaining assets to beneficiaries (those designated in the will to receive the inheritance), adhering to the terms outlined in the will. Final accounting documents, representing the financial transactions that occurred during administration, must also be submitted to the probate court for approval, ensuring a transparent process.

Legal references and obligations

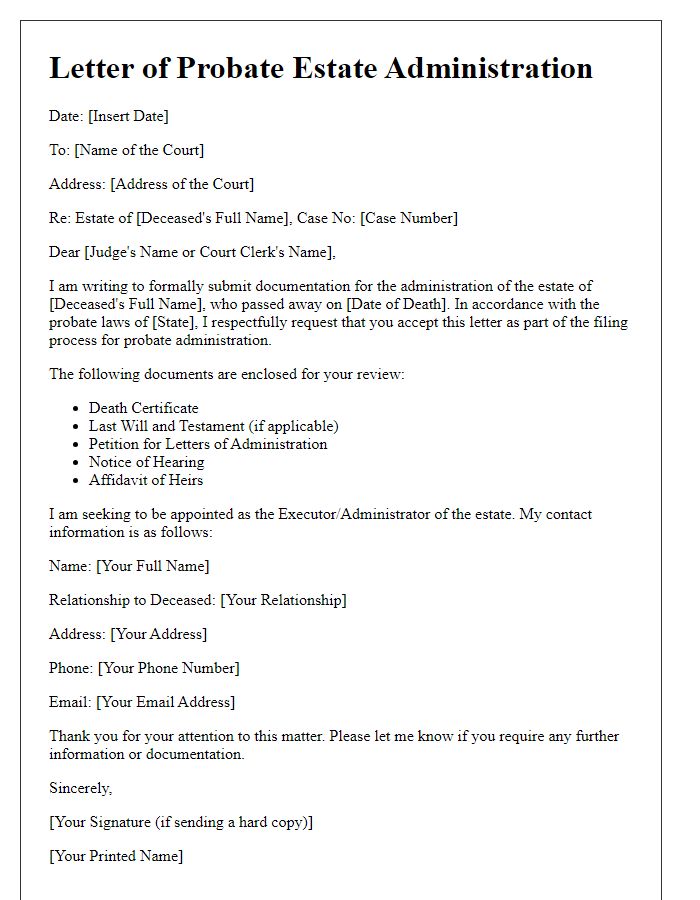

Probate estate administration involves a legal process to manage a deceased individual's estate, guided by state-specific laws and court orders. In the United States, each state has its own probate code, detailing the necessary procedures for validating a will, addressing creditor claims, and distributing assets to heirs, often requiring documentation like Form 706 for estate tax, if applicable. The appointed executor or personal representative must adhere to fiduciary duties, ensuring fair and transparent management of the estate, including filing for notices to beneficiaries and inventorying assets within specified timeframes, typically within 90 days of appointment. Legal precedents, such as the Uniform Probate Code introduced in 1969, assist in resolving disputes related to will contests and trust management while mandating accountability through probate court oversight. Compliance with tax obligations under the Internal Revenue Service regulations remains crucial, as estates reaching certain asset thresholds require federal tax filings, ensuring proper settlement of debts and accurate distribution according to the decedent's wishes legally established in the probate proceedings.

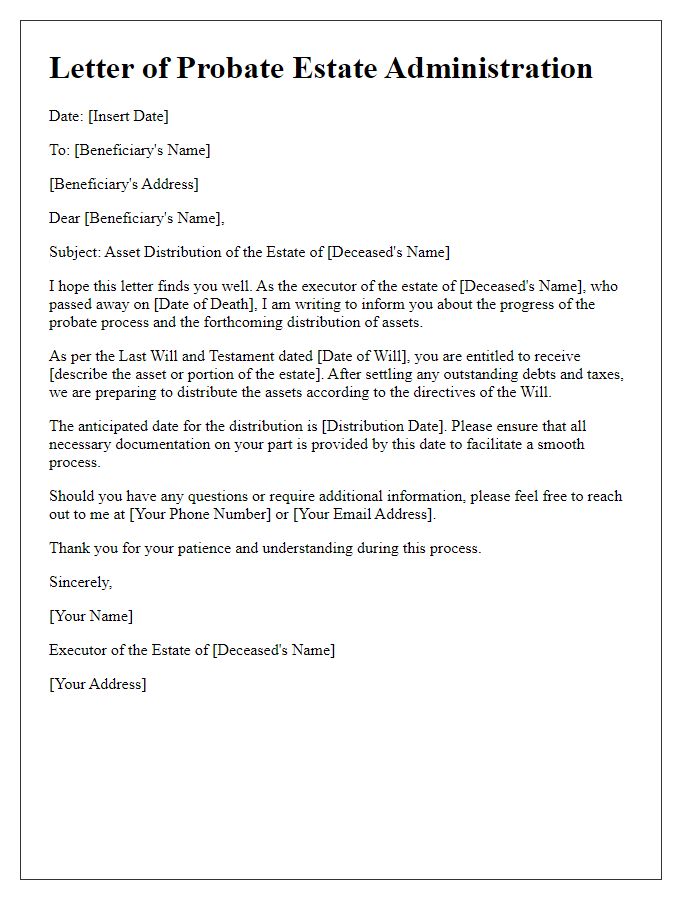

Beneficiary information and contact

Beneficiaries in probate estate administration must provide accurate information for efficient processing. Each beneficiary, including individuals and organizations, should include full legal names, birth dates, and social security numbers for identification. Contact details such as mailing addresses and phone numbers enable seamless communication regarding estate matters. Important documents like wills, death certificates, and trust agreements (if applicable) should accompany the information. The estate executor must ensure compliance with state-specific probate laws, which may require formal notices or hearing dates, often set within the jurisdiction of the local probate court, such as those in Los Angeles County or Manhattan, to uphold transparency and facilitate the distribution of assets.

Asset inventory and valuation

The asset inventory and valuation process within probate estate administration is a critical step in managing the estate, ensuring all assets are accounted for, and determining their fair market value. Assets can include real estate properties, bank accounts, investment portfolios, and personal belongings, such as heirlooms or collectibles. Estate executors (individuals appointed to administer the estate) must compile a comprehensive list, detailing each asset's location, condition, and estimated value, often relying on professional appraisers for real estate (properties like family homes in California or vacation retreats), art, and collectibles. Accurate valuation is essential, influencing tax liabilities (e.g., estate taxes that can reach up to 40% in some jurisdictions) and ultimately determining the equitable distribution among heirs. Clear documentation of all assets is crucial for transparency, aiding in any disputes that may arise, and ensuring that the probate court can efficiently assess the estate's overall worth.

Timeline and deadlines for actions

Probate estate administration involves a series of critical actions governed by specific timelines and deadlines to ensure compliance with legal requirements. The initial step typically requires the filing of the deceased's will and petition for probate within 30 days of death in jurisdictions like California. Notifications to heirs and beneficiaries must be sent within 60 days, while creditor claims need to be addressed, usually allowing a period of 4 months. Inventorying estate assets, including real property or stocks, should be completed within 6 months to provide an accurate overview of the estate's value. Additionally, the final accounting of the estate, detailing all transactions, typically occurs within one year post-death. Closing the estate, often requiring court approval, final distributions, and the filing of a final tax return, may ideally target completion within 18 months to 2 years, depending on complexity and claims. Each step adheres strictly to local laws and regulations, ensuring a streamlined process in the probate court system.

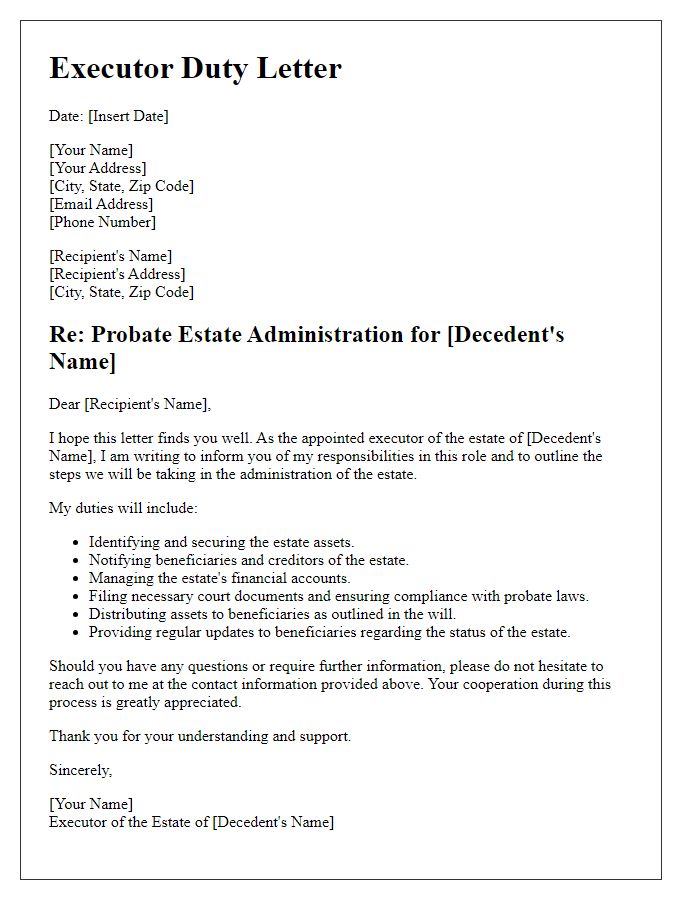

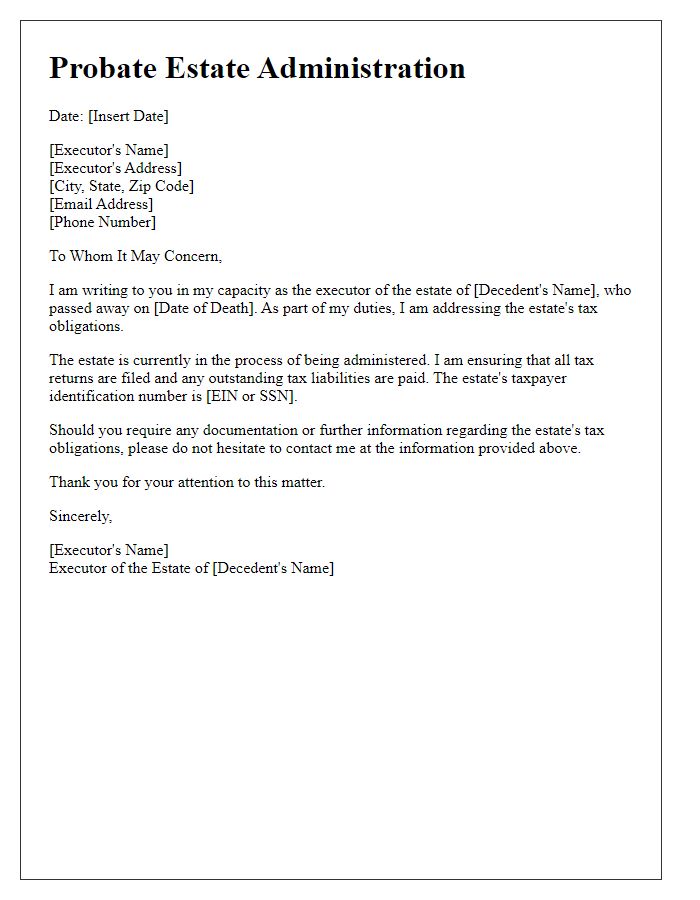

Letter Template For Probate Estate Administration Samples

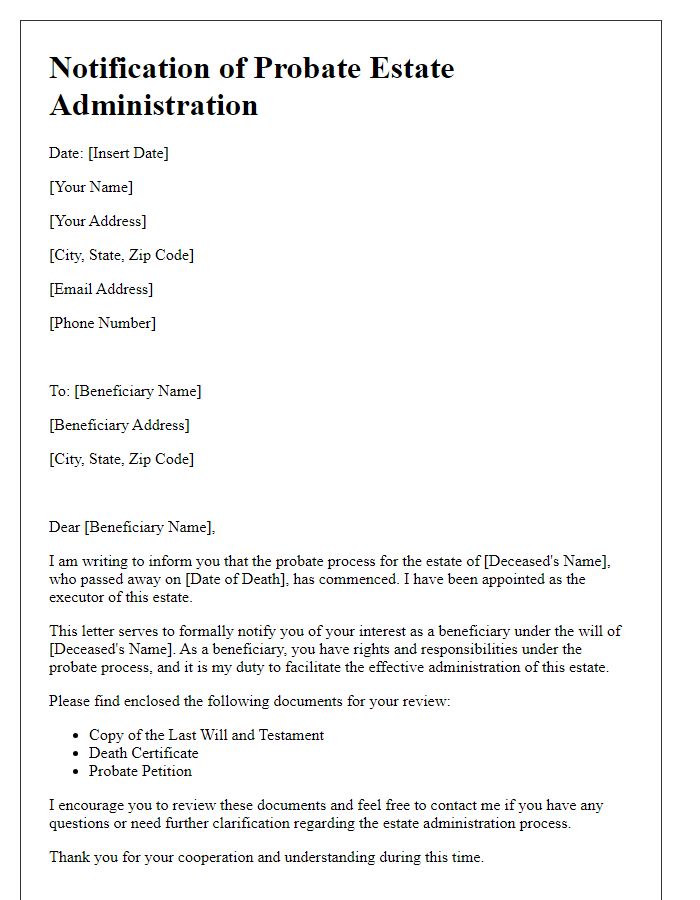

Letter template of probate estate administration for beneficiaries notification

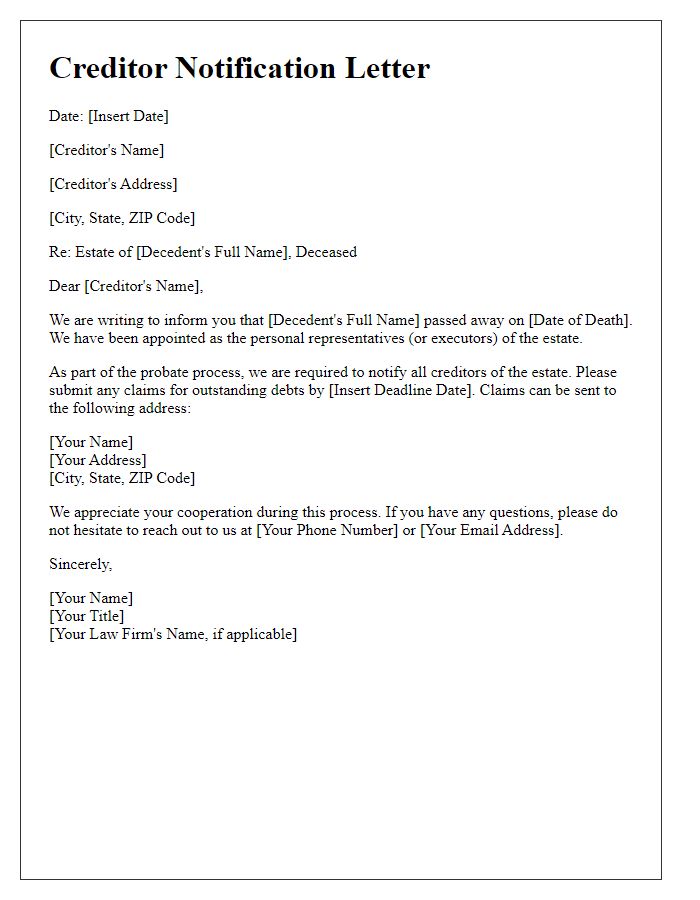

Letter template of probate estate administration for creditor notifications

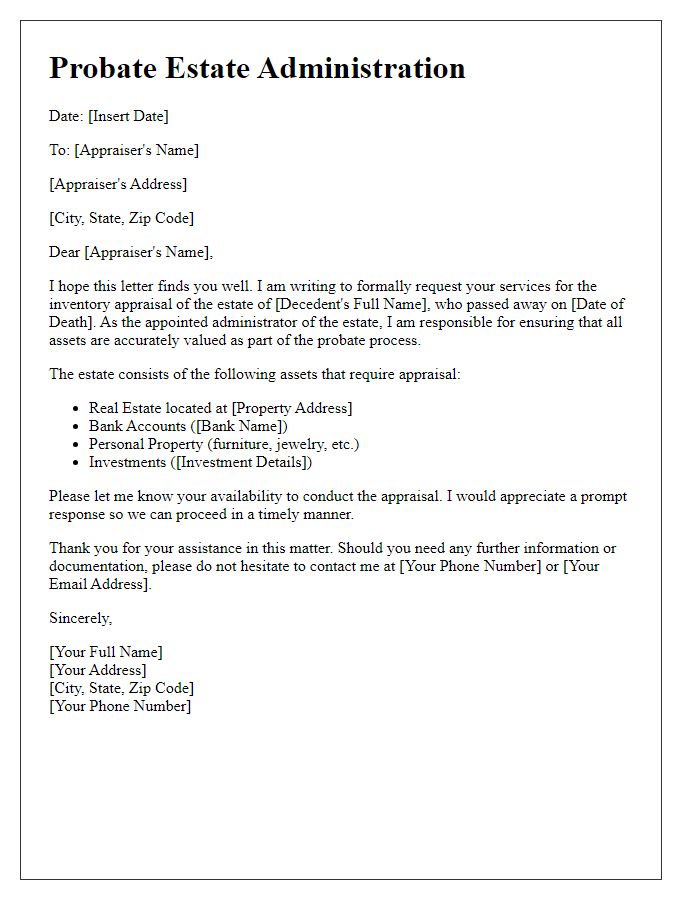

Letter template of probate estate administration for inventory appraisal

Comments