Filing for bankruptcy can feel overwhelming, but understanding the process is the first step toward financial recovery. Whether you're considering it for personal or business reasons, knowing how to notify your creditors and other parties is crucial. By following the right steps and using the appropriate templates, you can streamline your communication and ease some of the burdens. Let's dive in and explore effective letter templates that can help you navigate this challenging time with confidence!

Company Information

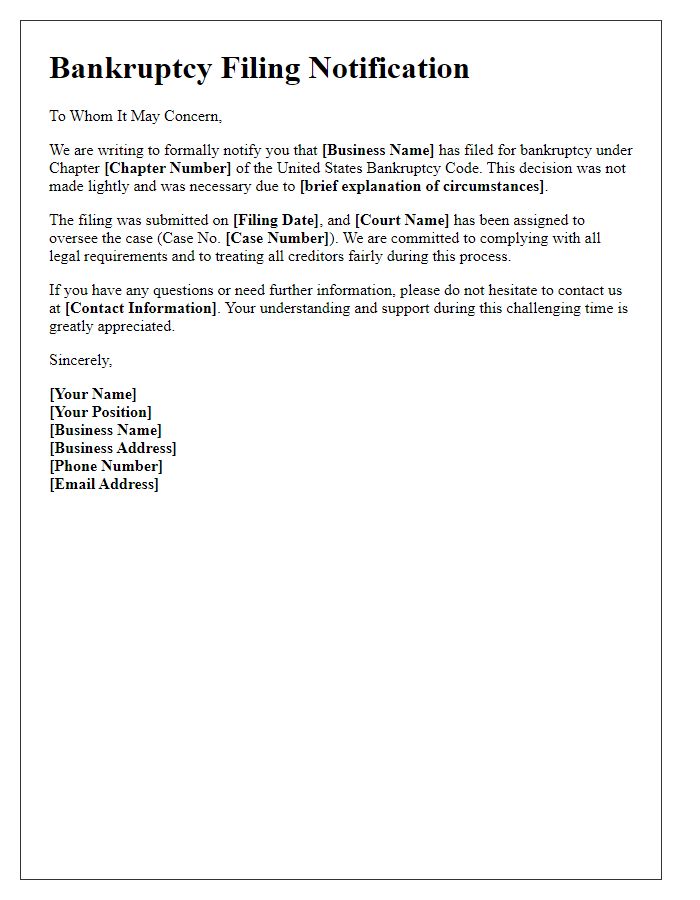

In the notification of bankruptcy filings, company information plays a crucial role in ensuring transparency and maintaining trust among stakeholders, including creditors and employees. The company's name, registered address (typically including street, city, state, and zip code), and federal Employer Identification Number (EIN) are essential identifiers. Additionally, including the date of establishment and the primary business activity, such as retail or manufacturing, provides context to the bankruptcy situation. Clear contact information, including the phone number and email address of the legal representative handling the case, is vital for facilitating inquiries. Furthermore, disclosing essential financial data, like total assets and liabilities, helps creditors understand the company's financial position, contributing to a smoother bankruptcy process.

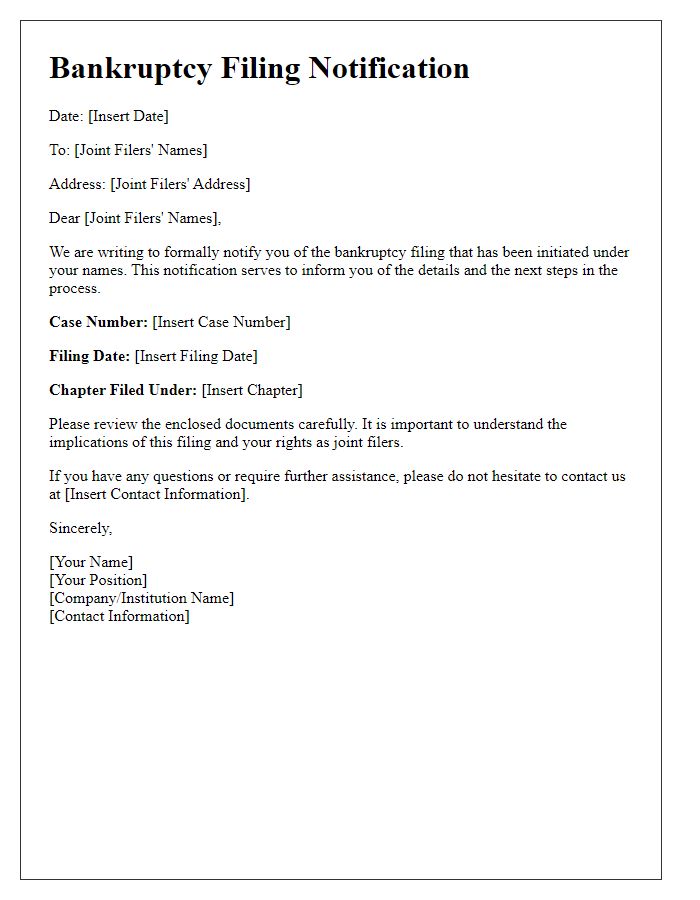

Case Details

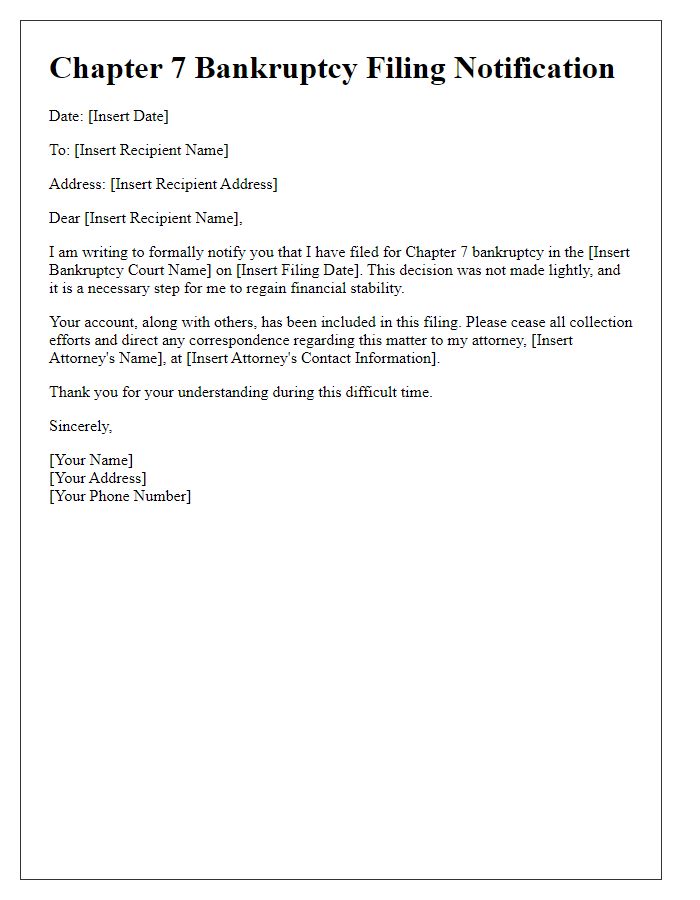

Bankruptcy filings involve complex legal processes designed to assist individuals or businesses facing financial distress. Notification case details include unique identifiers, such as case number (e.g., 20-12345), filing date (e.g., October 5, 2023), and jurisdiction (e.g., U.S. Bankruptcy Court for the Southern District of New York). Additionally, entities involved in the case may include the debtor's name (e.g., John Doe), attorney information (e.g., Jane Smith, Esq.), and any creditors listed in the documentation. It is essential to indicate the type of bankruptcy filed, like Chapter 7 or Chapter 13, as this affects the proceedings and potential outcomes. Furthermore, deadlines for objections or creditor claims must be highlighted, ensuring clear communication about the timeline of the case.

Creditor List

When preparing a creditor list for bankruptcy filing notifications, it is essential to include comprehensive details about each creditor. The list should feature the full legal names of the creditors, such as banks, credit card companies, or loan servicers, along with their corresponding addresses for accurate correspondence, including street addresses, cities, states, and zip codes. Each entry must also specify the balances owed, whether tax obligations, secured debts like mortgages, or unsecured debts like personal loans, and any relevant account numbers associated with those debts. Accurate documentation aids in the overall bankruptcy process, ensuring transparency and compliance with legal requirements as outlined under U.S. Bankruptcy Code, particularly Chapter 7 or Chapter 13 proceedings.

Payment Plan Proposal

A payment plan proposal for bankruptcy filings provides a structured outline for individuals or businesses seeking relief under laws like Chapter 7 or Chapter 13 of the United States Bankruptcy Code. This document details the debtor's financial situation, including total debt amount (often exceeding thousands of dollars), income sources, monthly expenses, and assets, such as property or vehicles. The proposal typically includes a prioritized repayment strategy over a specific time frame, commonly between three to five years, explaining how creditors will be paid back, with considerations for securing debts (like mortgages) versus unsecured debts (such as credit card bills). Additionally, it may offer information about any mandatory credit counseling received from certified agencies to adhere to federal bankruptcy requirements, reinforcing the feasibility of the plan.

Legal Representation Contacts

Bankruptcy filings often require detailed notifications that specify legal representation. Legal professionals, such as attorneys specializing in bankruptcy law, provide guidance and representation in court. Typical contact information includes names, phone numbers, email addresses, and physical office locations, which may vary by state, such as New York or California, where distinct bankruptcy regulations apply. Filing deadlines, such as the 341 Meeting of Creditors, must also be highlighted, emphasizing the importance of prompt communication with the designated legal representatives. Accurate legal representation contacts ensure compliance with court requirements and facilitate smooth proceedings during a bankrupt entity's financial restructuring process.

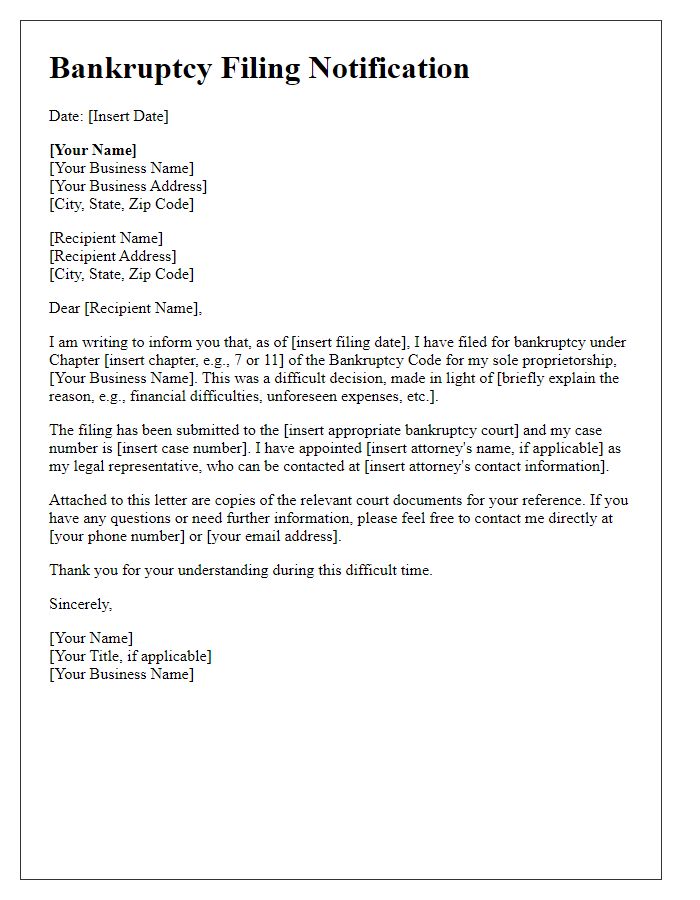

Letter Template For Bankruptcy Filing Notifications Samples

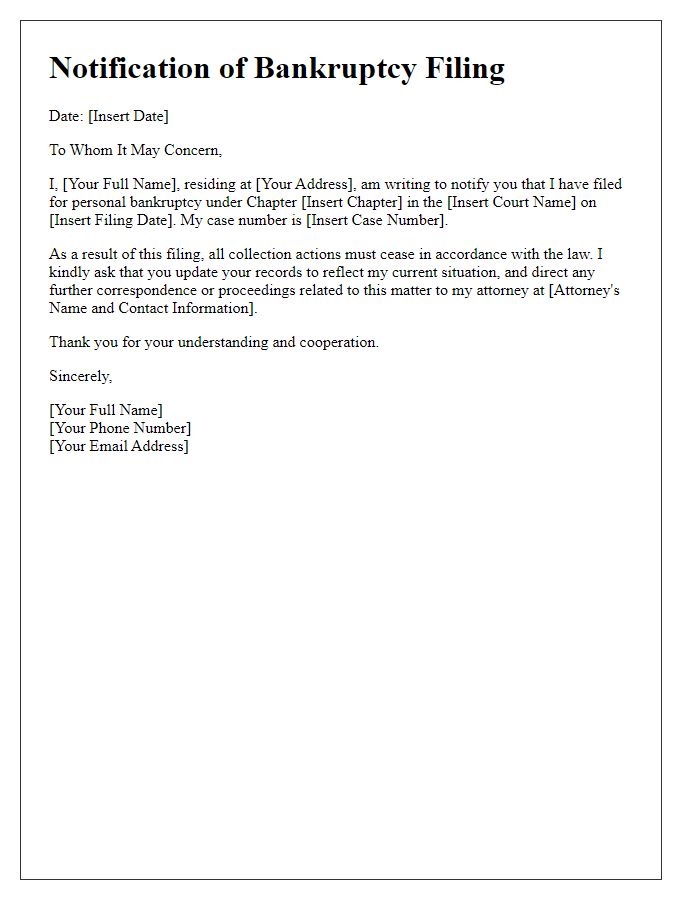

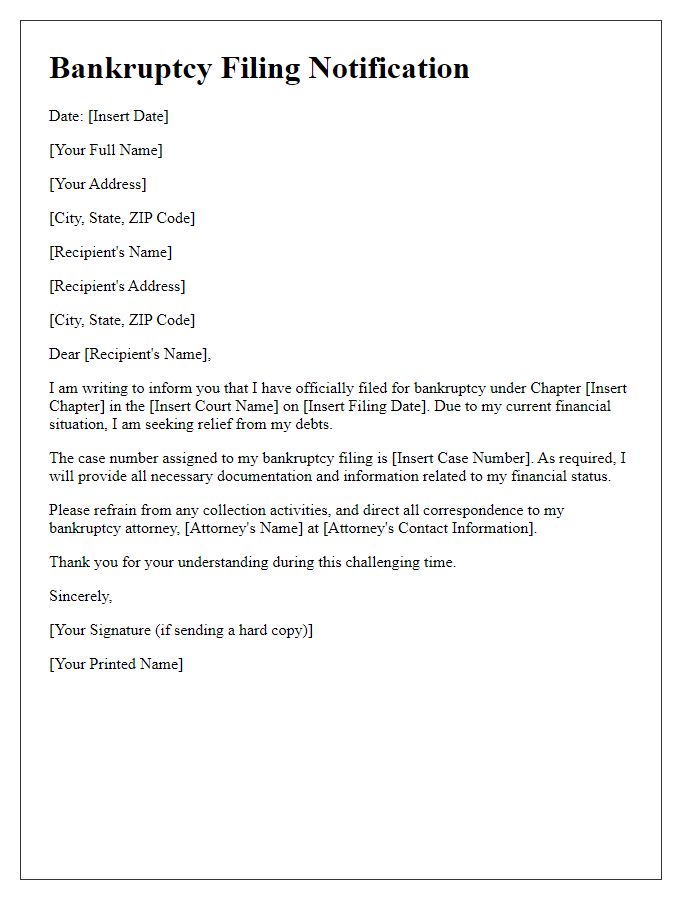

Letter template of personal bankruptcy filing notification to creditors.

Comments