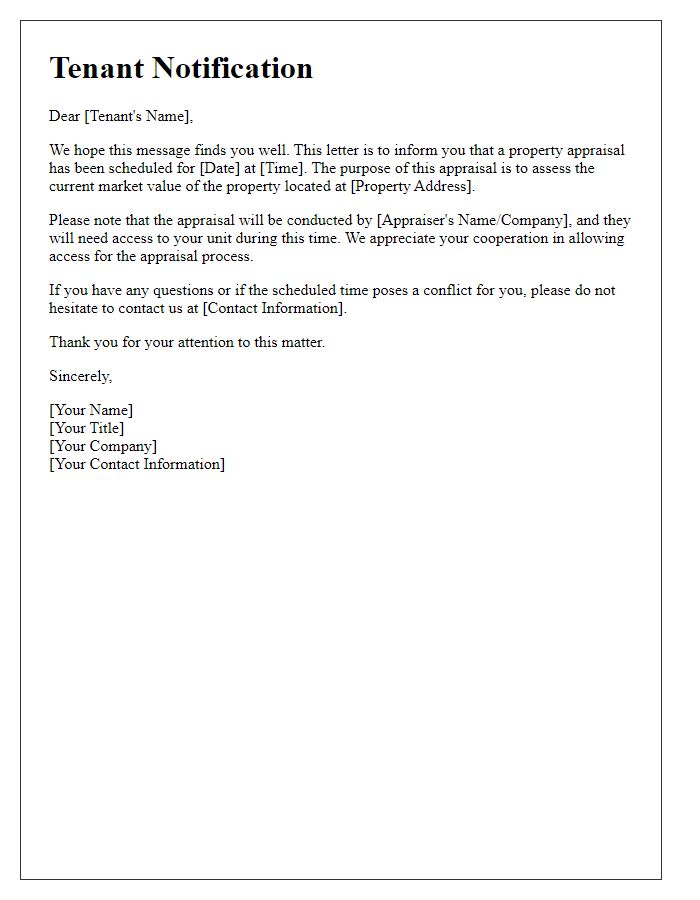

Are you a landlord looking to assess the value of your property? It can be a daunting task, but understanding the worth of your investment is crucial for making informed decisions. In this article, we'll walk you through a straightforward letter template designed for tenant property appraisal, ensuring efficient communication and clarity. So, if you're ready to dive deeper into optimizing your property management process, let's explore the details together!

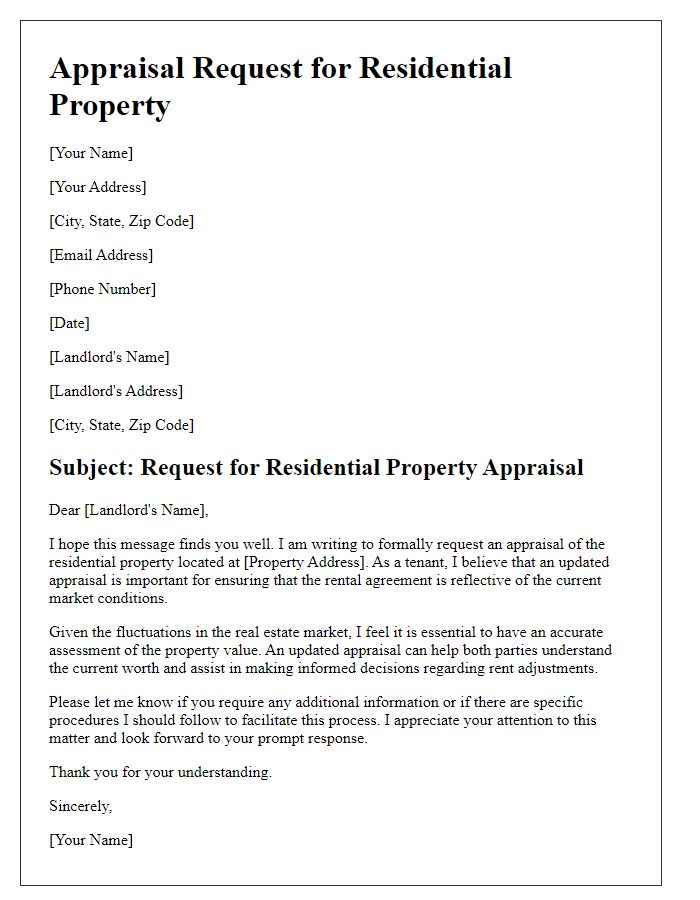

Contact Information

A thorough property appraisal for tenants includes essential contact information, ensuring effective communication. Important elements include the tenant's full name, which establishes identity, and the current address of the leased property, linked to real estate location dynamics. Phone numbers (home and cell) allow for immediate updates or inquiries regarding appraisal specifics. Email addresses provide a formal channel for sharing documents, reports, or scheduling appointments. Additionally, including the rental agency or landlord's contact details ensures clarity in communication throughout the appraisal process. This structured information promotes transparency between tenants and property management, facilitating a smoother appraisal experience.

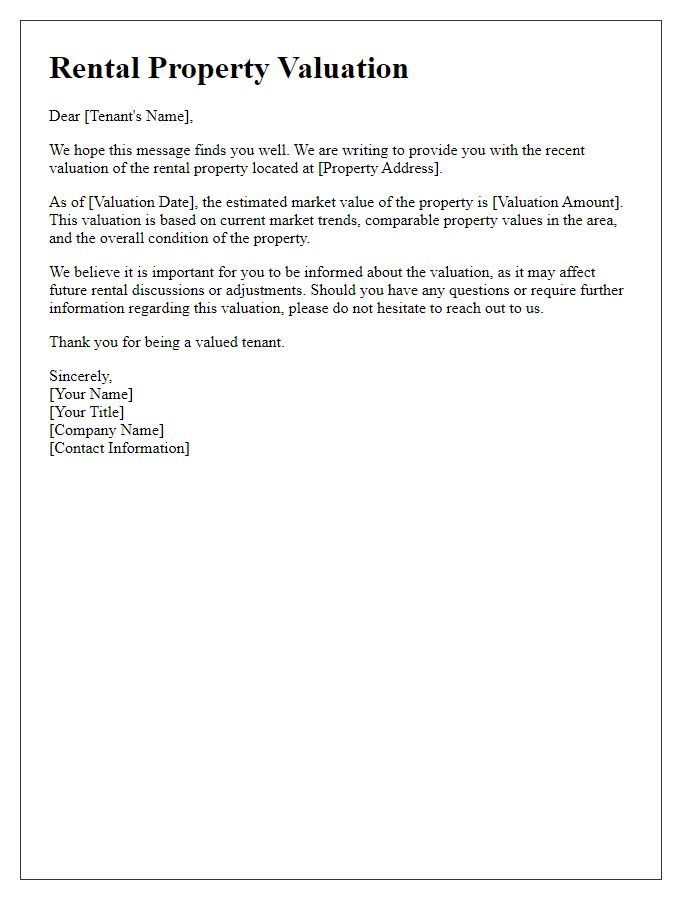

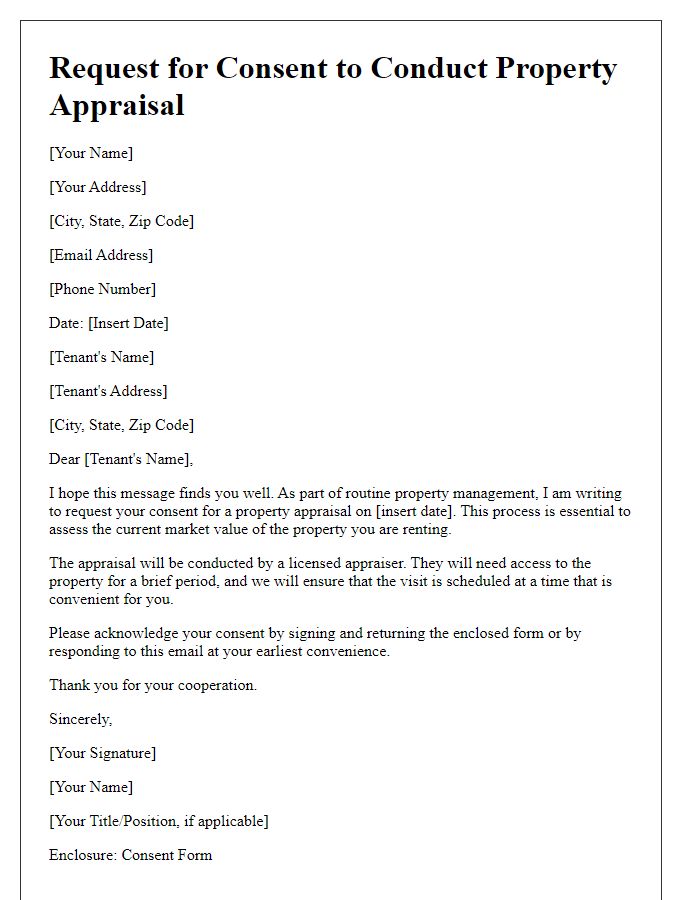

Property Details

A tenant property appraisal involves assessing various aspects of a rental property, such as location, condition, and amenities. The property, located at 123 Maple Street in Springfield, features a two-bedroom layout (approximately 950 square feet) and includes key amenities like in-unit laundry facilities and a modern kitchen equipped with stainless steel appliances. The surrounding neighborhood, characterized by tree-lined streets and proximity to local parks such as Riverside Park, boasts a walk score of 85, indicating excellent accessibility to public transportation and essential services. Recent renovations (completed in 2023) have enhanced the living space, with upgrades to the flooring, bathroom fixtures, and energy-efficient windows, contributing to its overall appeal and market value. Market trends indicate a competitive rental market in Springfield, with similar properties renting for between $1,200 and $1,500 monthly.

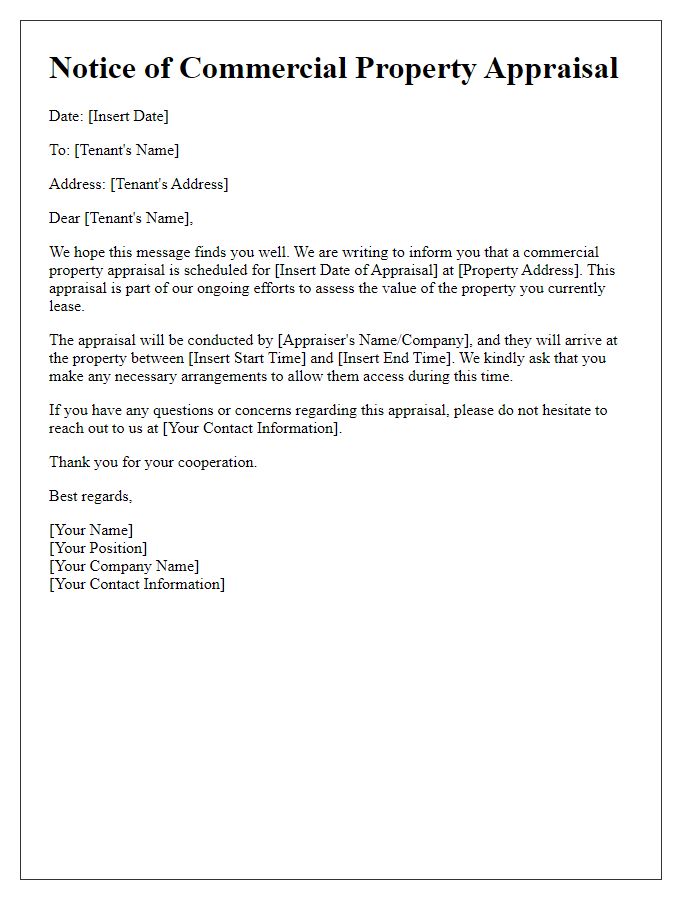

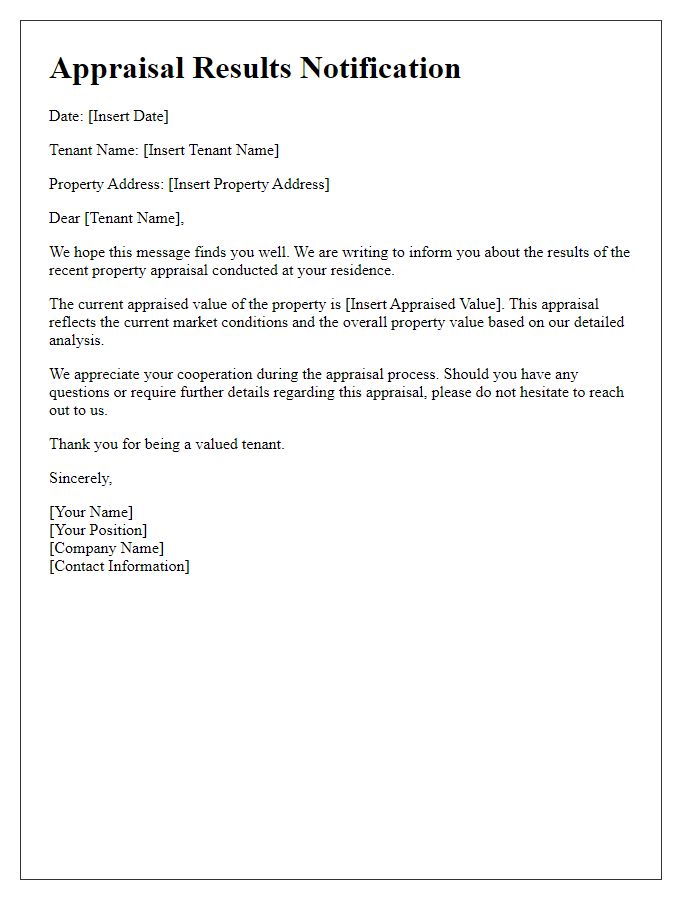

Appraisal Purpose

Property appraisals provide an essential assessment of the market value of residential real estate, utilizing comparable sales data, property features, and current market conditions. Often conducted by certified appraisers, these evaluations help determine rental pricing, assess property taxes, and facilitate mortgage applications for potential buyers. During the appraisal process, factors such as the property's location--like urban centers or suburban neighborhoods--square footage, age, condition, and surrounding amenities are meticulously analyzed. Detailed reports generated can impact negotiations and investment decisions. Ensuring accurate appraisals has become increasingly important in volatile housing markets, where property values fluctuate due to economic changes, demographic shifts, or local development projects.

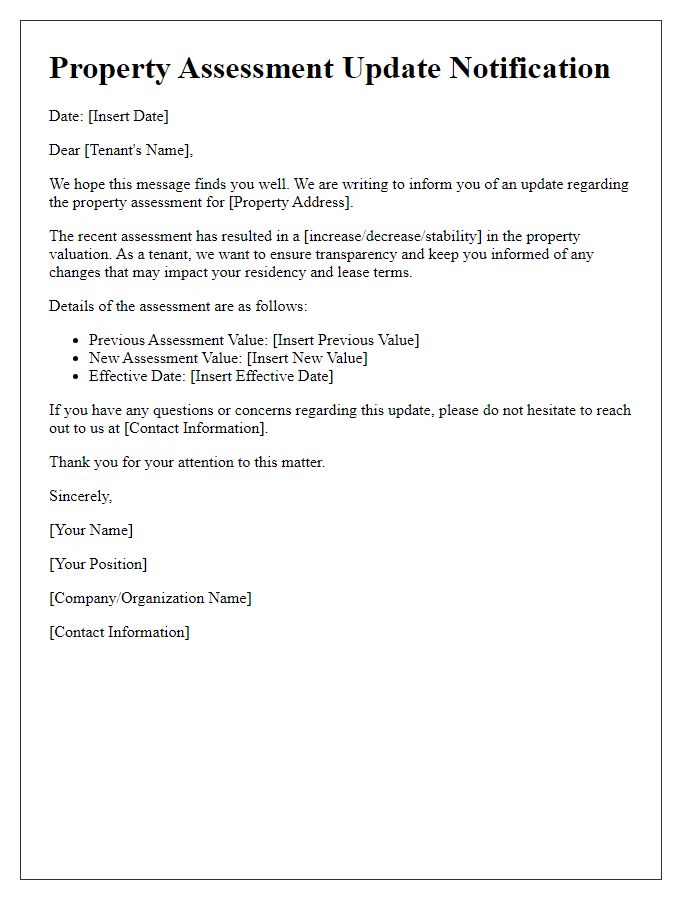

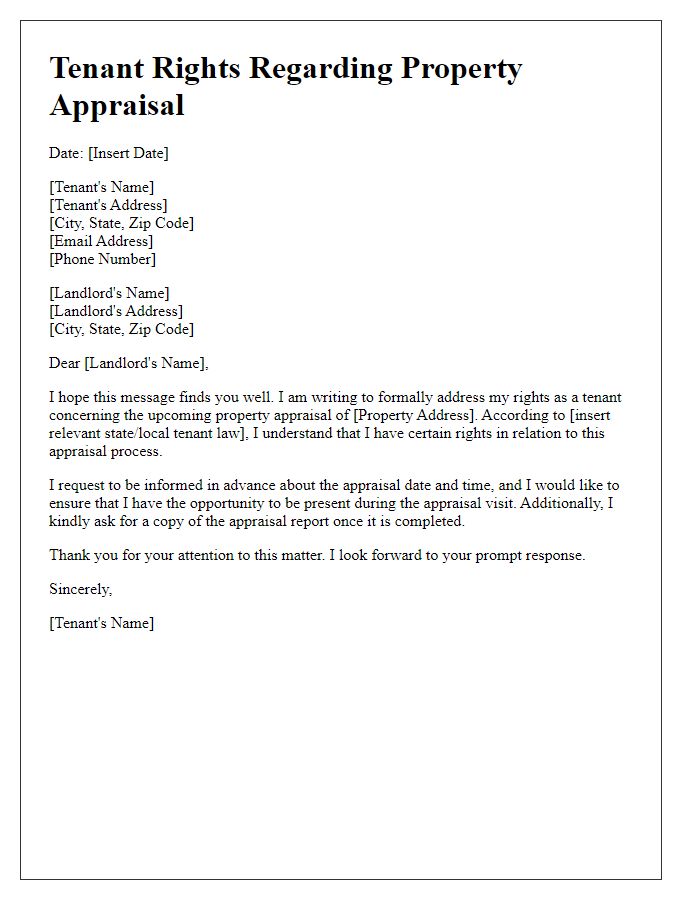

Terms and Conditions

A property appraisal, as required by landlords and tenants, involves a comprehensive evaluation of rental properties to determine their market value based on various factors. Key aspects of the appraisal process include property location, condition, rental history, and comparative market analysis of similar properties in the region. Appraisers often utilize recent sales data and rental rates to enhance the accuracy of their assessments. Being aware of the local real estate market, including fluctuations and zoning regulations, greatly influences appraisal outcomes. It is crucial for both parties to agree on the terms and conditions regarding the appraisal, including access to the property, duration of the appraisal process, and notification procedures. These details ensure transparency and cooperation throughout the valuation process, ultimately protecting the interests of both tenants and landlords.

Signature and Date

Property appraisal involves evaluating the worth of rental units. A comprehensive assessment considers factors like location (urban neighborhoods, suburban areas), property condition (age, structural integrity), and market trends (average rental prices in the area). An appraisal report may include comparable properties, square footage, and amenities (like swimming pools, fitness centers) that contribute to rental value. It's essential for tenants to understand the implications of property appraisals on rent and their rights regarding lease agreements. The final documentation requires a signature and date from the appraiser to validate the assessment.

Comments