Are you tired of the confusion surrounding rent payment methods? Whether you prefer traditional checks, online transfers, or automated payments, navigating these options can sometimes feel overwhelming. Understanding the pros and cons of each method is essential in making the best choice for your rental situation. Dive into our article to discover the most effective ways to streamline your rent payments and take the stress out of this monthly chore!

Clear Payment Instructions

Rent payments for residential properties typically utilize various methods, including bank transfers, online payment portals, and checks. For instance, a direct bank transfer may require tenants to utilize their bank's online services, entering specific account details such as routing numbers and the landlord's account number. Online payment portals, such as Rentec Direct or Cozy, often facilitate convenient transactions, where tenants log in securely to submit their payments, choose recurring payment options, and track their payment history. Additionally, mailing checks to a designated address ensures that tangible payments are processed, although this method may involve longer processing times. Clear communication of each payment method's instructions minimizes confusion and ensures timely rent submission each month.

Accepted Payment Methods

Accepted payment methods for monthly rent include bank transfers, which allow for secure transactions directly from tenant accounts to landlord accounts. Online payment platforms, such as PayPal and Venmo, facilitate easy electronic transactions, providing instant confirmation and tracking. Credit and debit cards, often linked to these platforms, enable tenants to manage their payments conveniently. Check payments remain a traditional option, requiring tenants to mail physical checks or deliver them in person to property management offices. Automatic withdrawals, arranged through bank settings, can ensure timely payments each month without manual action.

Payment Deadline and Frequency

Monthly rental payments typically occur on the first day of each month, as outlined in the lease agreement. Tenants must ensure that payments are received by the property management office located at 123 Main Street, Springfield, by 5 PM to avoid late fees. Acceptable payment methods include bank transfers, checks, or online payment platforms such as PayPal or Venmo. Failure to remit the rent by the specified deadline may result in a late fee of $50, added to the following month's rent statement. Tenants should maintain records of all transactions to ensure timely processing and dispute resolution.

Contact Information for Inquiries

Inquiries regarding rent payment methods can be directed to the property management office located at 123 Elm Street, Springfield, Illinois. The office hours are Monday through Friday, 9 AM to 5 PM CST. For immediate assistance, tenants can contact (555) 123-4567, or email support@springfieldrentals.com. Various payment options are available, including online portals, checks, and direct bank transfers, ensuring convenience for all residents.

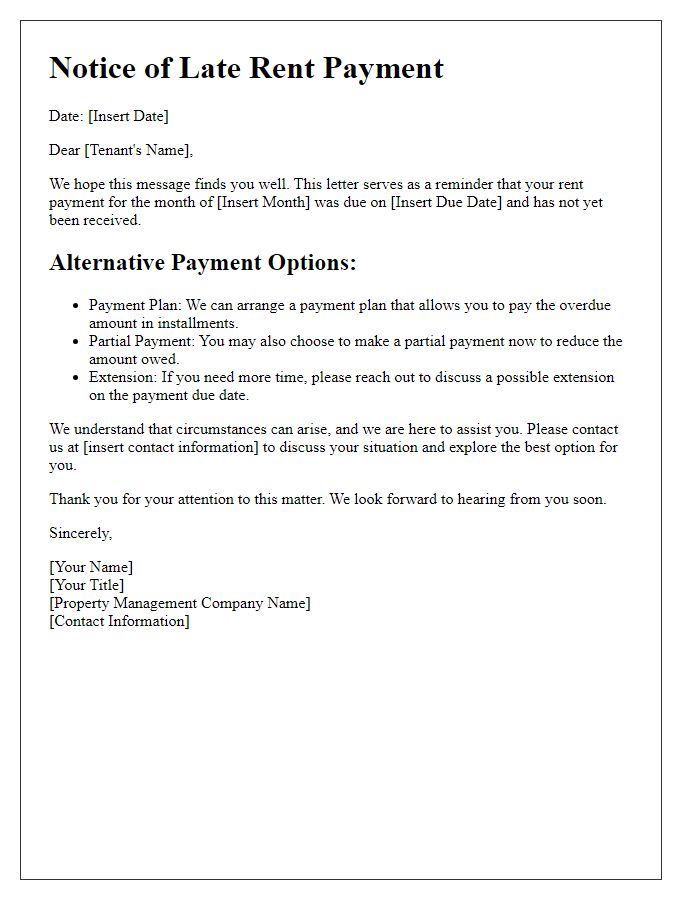

Consequences for Late Payments

Timely rent payment is crucial for maintaining a positive relationship between tenants and landlords. Late payments can result in various consequences including late fees, which commonly range from 5% to 10% of the total rent, depending on local laws and lease agreements. Additionally, repeated late payments can lead to eviction notices in states like California, where the legal process can be initiated after three consistent late payments. Landlords may also report persistent late payers to credit bureaus, negatively impacting tenants' credit scores and future rental applications. It is important for tenants to understand the policies outlined in their lease agreement and communicate promptly with landlords to avoid such repercussions.

Comments