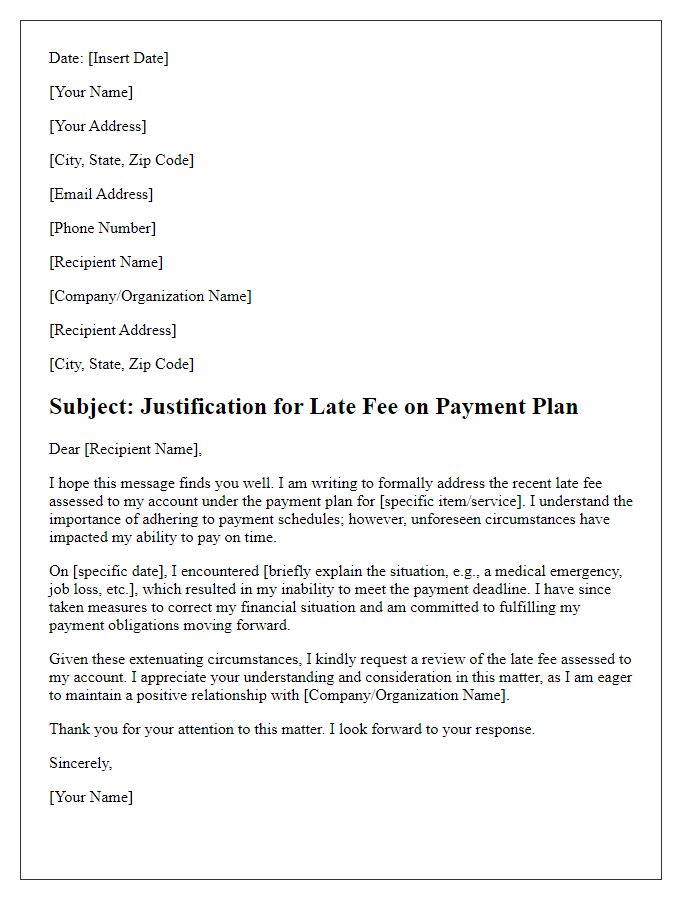

Are you facing a late fee and looking for a way to explain your situation? Writing a letter to justify your late payment can be a straightforward task if you know how to approach it. In this article, we'll guide you through the essential elements of an effective letter, helping you articulate your reasons clearly and concisely. So, grab a cup of coffee and join us as we explore how to communicate your circumstances in the best possible light!

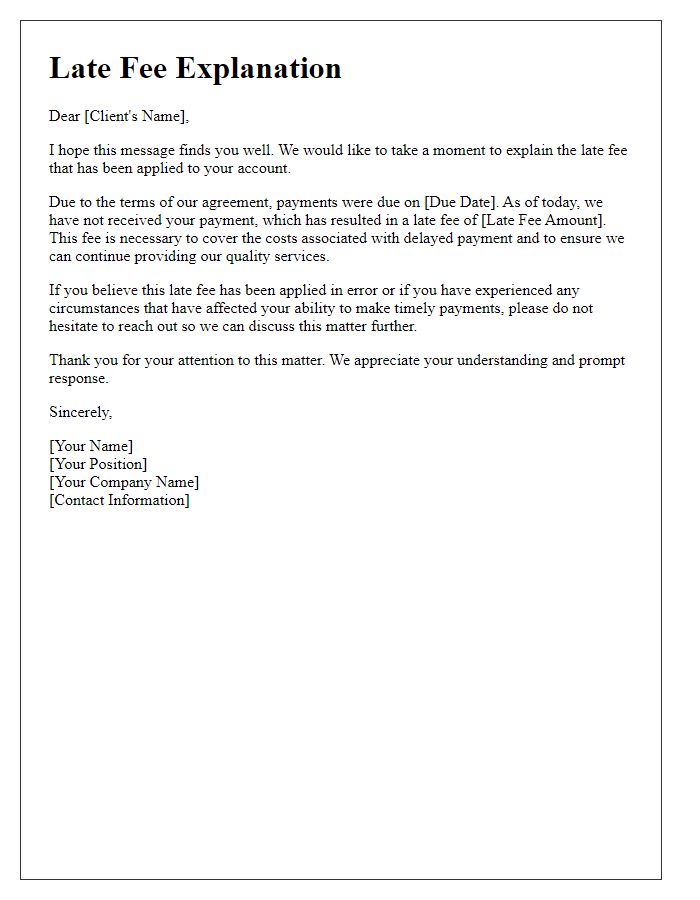

Contextual Introduction

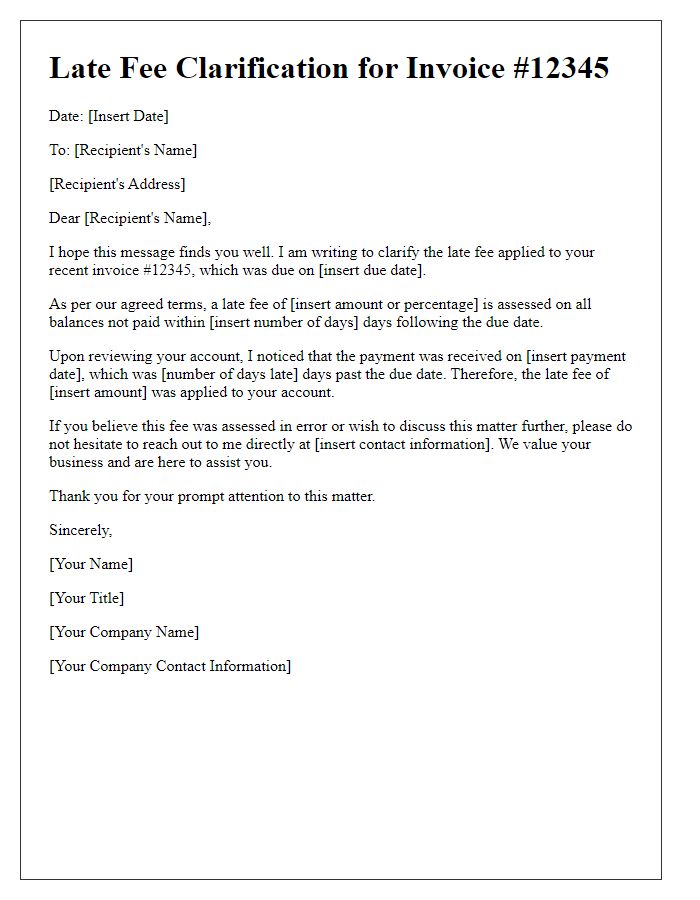

Late payment fees can significantly impact businesses' cash flow and financial stability. For example, many companies impose a late fee of $25 after a grace period of 30 days, which can accumulate quickly if multiple invoices are not settled promptly. This fee not only serves as a deterrent for late payments but also compensates for the administrative costs associated with managing overdue accounts. Businesses, particularly small enterprises, rely on timely payments to maintain operations and meet payroll, which underscores the importance of clear communication regarding payment timelines. In industries such as utilities and retail, consistent late payments can hinder service delivery and growth, emphasizing the need for clients to adhere to agreed-upon payment schedules.

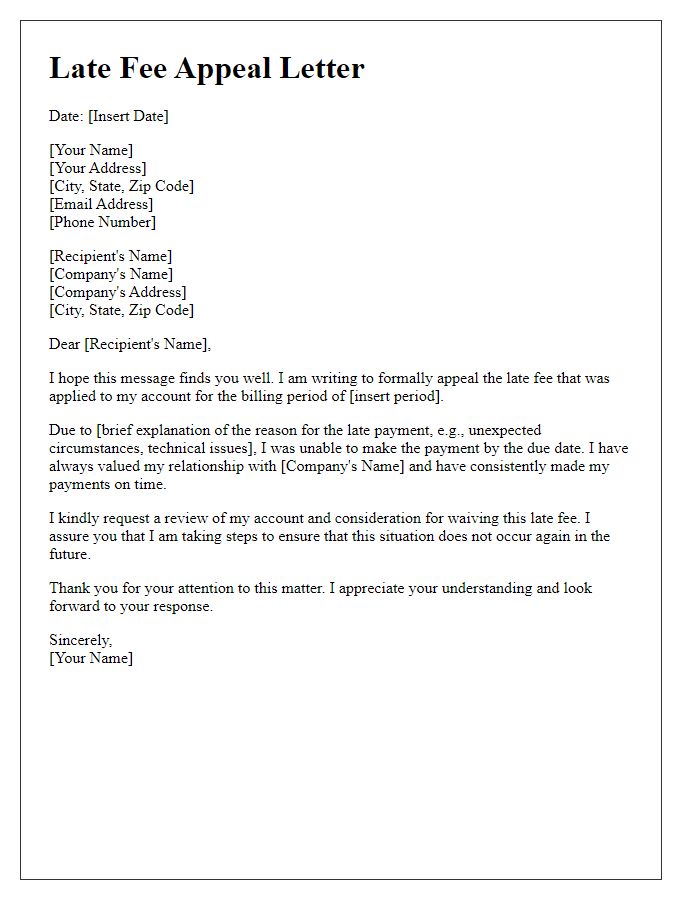

Reason for Delay

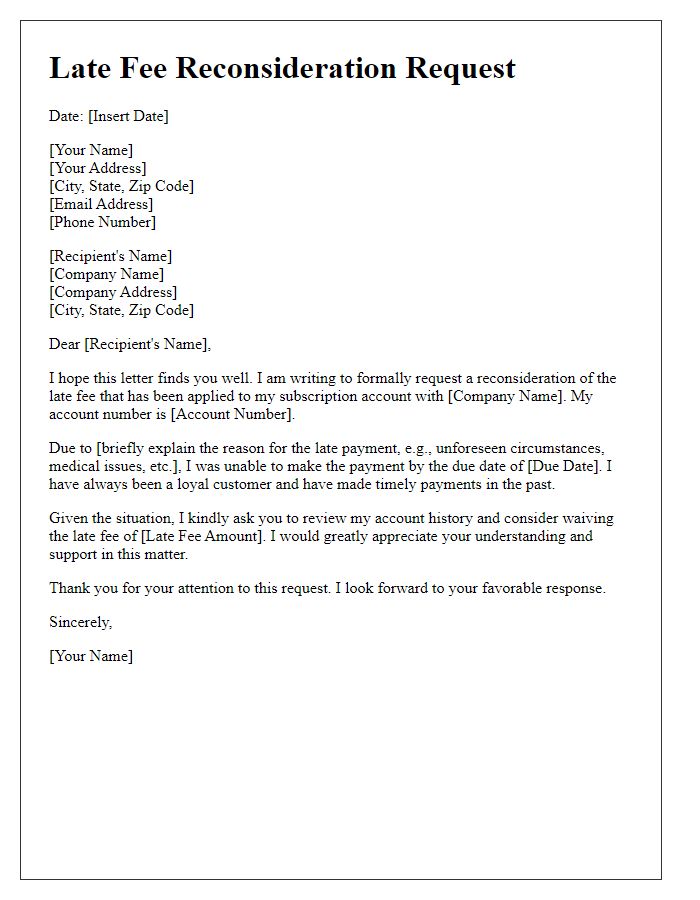

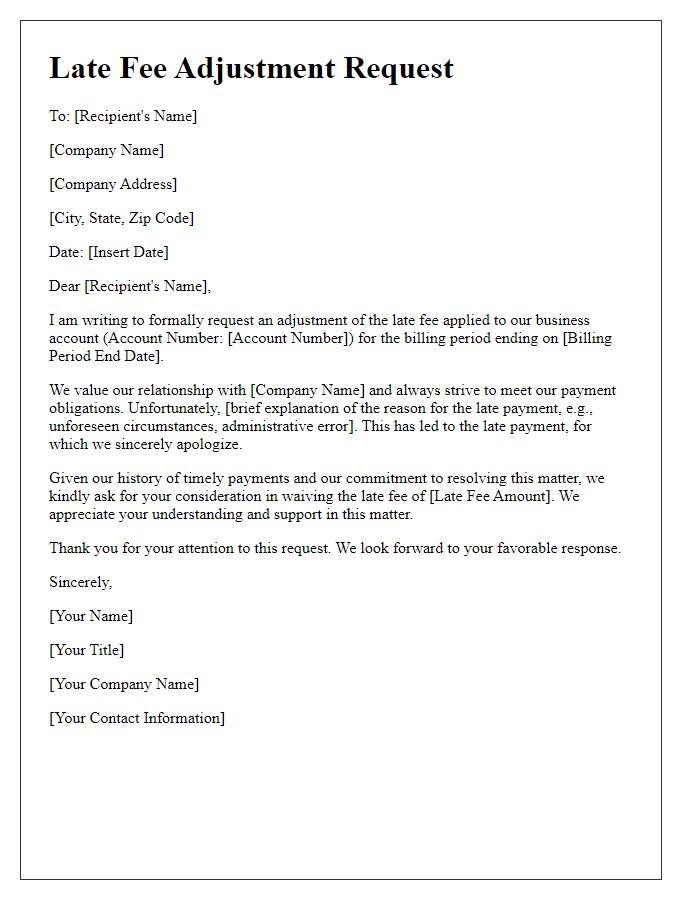

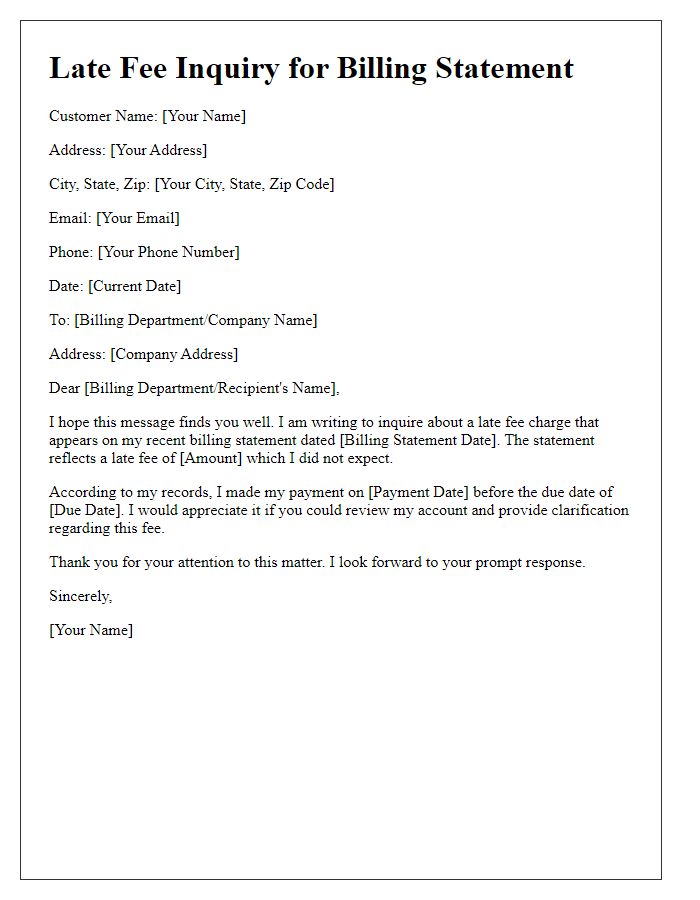

Delays in payment often stem from unforeseen circumstances such as unexpected medical expenses or job loss. Economic downturns can cause financial strain, making timely payments difficult. Additionally, technical issues with banking institutions, such as system outages or transaction failures, can also contribute to payment delays. Communication failures, like not receiving billing statements due to address changes, may further complicate the situation. Clearing up these misunderstandings is crucial to maintaining positive relationships with service providers.

Assurance of Payment

Late payment fees may stem from missed deadlines, often causing financial strain. Various institutions, such as credit card companies or rental agencies, impose fees ranging from $25 to $100 after specified grace periods, typically 5 to 15 days past the due date. This penalty incentivizes timely payments, ensuring smooth account management. Failure to pay on time can also impact credit scores, sometimes resulting in decreases of 30 to 100 points. Documenting communication with a payment agreement can help demonstrate intent to resolve issues, possibly mitigating late fees or improving terms with creditors.

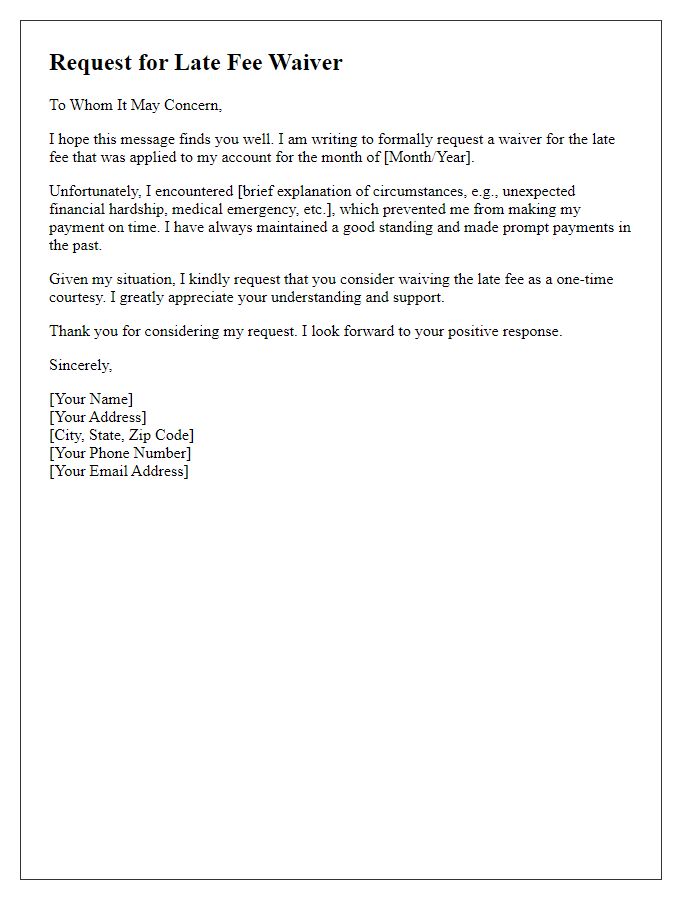

Request for Waiver or Reduction

Late fees can impose significant financial burdens on individuals or businesses facing unexpected circumstances, such as medical emergencies or natural disasters. These fees, often ranging from 5% to 15% of the outstanding amount, can accumulate quickly, leading to a substantial increase in the total balance owed. In many cases, financial institutions or service providers impose these late fees to encourage timely payments; however, a compassionate approach can foster goodwill and loyalty among customers. For example, the fee for a missed payment on a student loan typically starts at $30, while utility companies may charge late fees of around $10 to $50. Requesting a waiver or reduction of these late fees due to extenuating circumstances, such as job loss or unforeseen medical expenses, can offer much-needed relief and assist in maintaining financial stability.

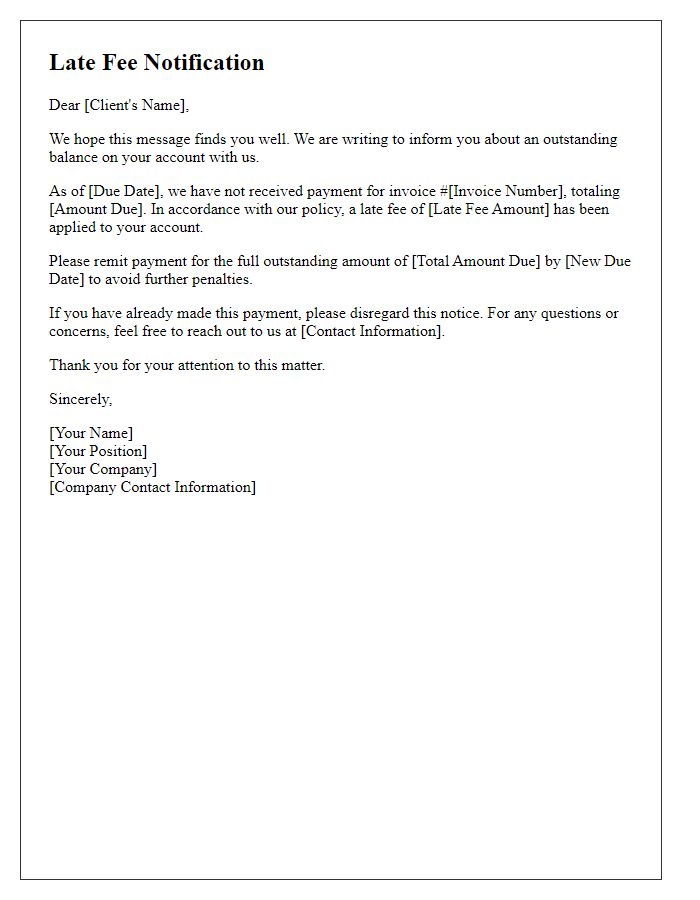

Polite Conclusion and Contact Information

A late fee can arise from various circumstances impacting timely payments, such as unexpected financial hardships, illnesses, or administrative errors. It is crucial to communicate clearly regarding any such issues to seek a potential waiver or adjustment. Providing context to the situation helps in understanding the reasons behind the delayed payment. Individuals may contact the billing department or customer service representatives directly via email or phone to discuss the reconsideration of late fees related to their accounts. Always ensure to include account details (such as account number) to facilitate efficient processing of inquiries.

Comments