Crafting an effective cover letter for the finance industry can make all the difference in landing your dream job. It's your chance to showcase your unique skills and experiences, and to convey your genuine passion for finance. A well-structured letter will not only highlight your qualifications but also demonstrate your understanding of the industry's nuances. Ready to dive deeper into how to create a standout cover letter? Let's explore the essential elements together!

Targeted job position and company name

The finance industry often emphasizes precision and analytical skills. In a role such as Financial Analyst at Goldman Sachs, expertise in financial modeling and data analysis plays a crucial role in assessing market trends and advising clients. Candidates should highlight their proficiency with software tools like Excel and data analysis programs, showcasing their ability to manage large datasets. Providing insights into previous successes, such as cost reductions or revenue growth achieved through financial strategies, can further demonstrate capability. Additionally, familiarity with regulations and compliance standards, particularly those relevant to investment banking, adds significant value to an application.

Relevant financial industry experience

A robust financial analysis background shapes the ability to assess market trends and evaluate investment opportunities. Working at prestigious firms like Morgan Stanley and J.P. Morgan enabled the development of expertise in portfolio management, risk assessment, and financial forecasting. In previous roles, managing investment portfolios worth over $10 million demonstrated strong capabilities in optimizing returns while minimizing risks. Proficiency in financial modeling using Microsoft Excel and Bloomberg Terminal, combined with certifications such as CFA Level I, underlines a commitment to industry standards. Collaborating on multi-million dollar mergers and acquisitions at firms in Manhattan also honed negotiation skills and strategic thinking, crucial for success in high-stakes financial environments.

Specific skills and expertise (e.g., analysis, forecasting)

In the finance industry, robust analytical skills and precise forecasting abilities are crucial for assessing market trends and making informed investment decisions. Financial analysts utilize quantitative methods to evaluate financial data, interpreting key performance indicators (KPIs) such as return on investment (ROI) and earnings per share (EPS). Proficiency in complex modeling techniques enhances the ability to predict future financial performance, which is vital for strategic planning in firms like Goldman Sachs or JPMorgan Chase. Familiarity with advanced financial software, such as Bloomberg Terminal or Tableau, allows professionals to streamline data analysis and present insights effectively. Furthermore, expertise in risk management ensures that financial institutions identify and mitigate potential losses, contributing to overall organizational stability. Understanding regulatory environments, including compliance with the Sarbanes-Oxley Act, is essential for navigating the intricate landscape of finance.

Achievements and track record

Having consistently exceeded performance targets, professionals in the finance industry often showcase their achievements and track record to illustrate their expertise and reliability. A notable example includes a financial analyst who successfully generated a 15% increase in profitability for a mid-sized firm within just one fiscal year by implementing strategic cost-reduction measures. Furthermore, portfolio management specialists often highlight their ability to manage assets exceeding $100 million with an average annual return of 12%, outperforming market indices like the S&P 500 during that period. This quantifiable success not only emphasizes financial acumen but also demonstrates a commitment to maximizing client investments and driving substantial growth in competitive conditions.

Professional tone and formatting

In the finance industry, market fluctuations significantly influence investment strategies, particularly during economic downturns (such as the 2008 financial crisis). Analysts utilize quantitative methods to assess risks and returns associated with various asset classes, ensuring informed decision-making. Regulatory bodies like the Securities and Exchange Commission (SEC) enforce compliance and protect investors, creating a stable environment for market participants. Financial institutions, including commercial banks and investment firms, rely on robust forecasting models and financial instruments to navigate volatile market conditions. Effective communication skills are essential for conveying complex financial concepts to clients and stakeholders, fostering trust and transparency in all interactions.

Letter Template For Finance Industry Cover Letter Job Application Samples

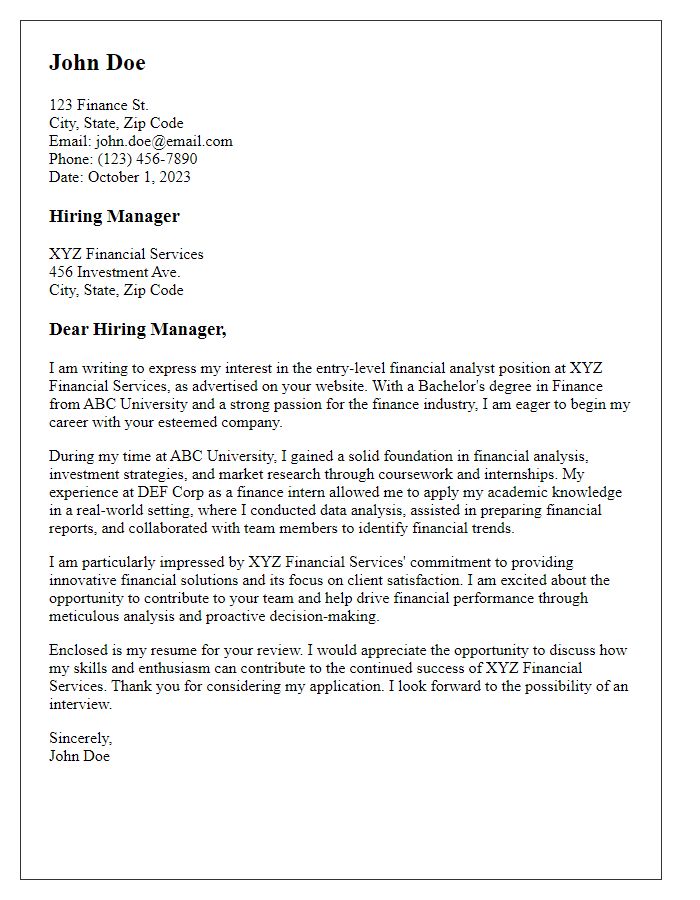

Letter template of finance industry cover letter for entry-level position.

Letter template of finance industry cover letter for experienced professional.

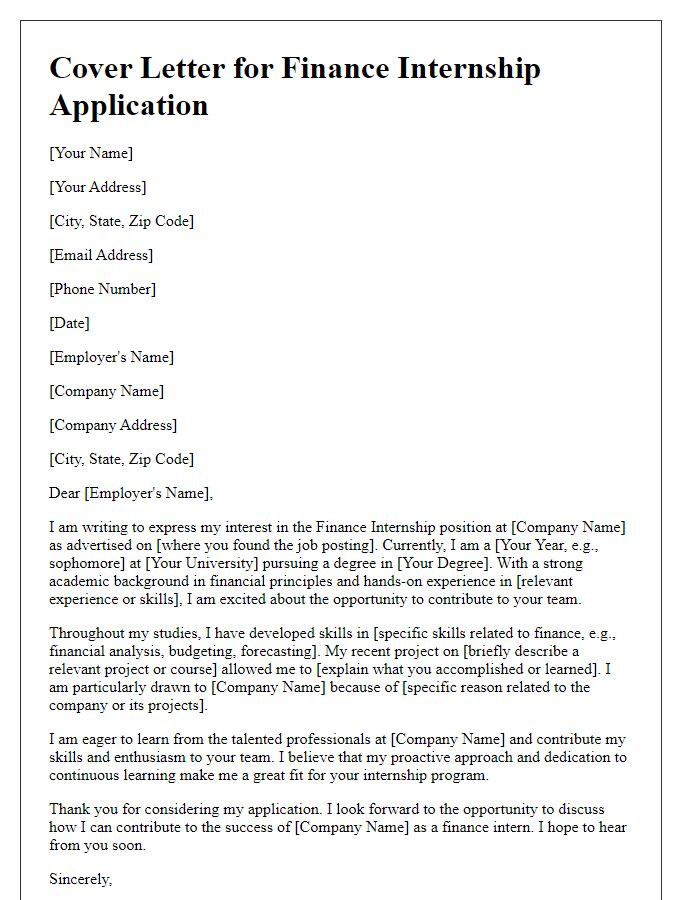

Letter template of finance industry cover letter for internship application.

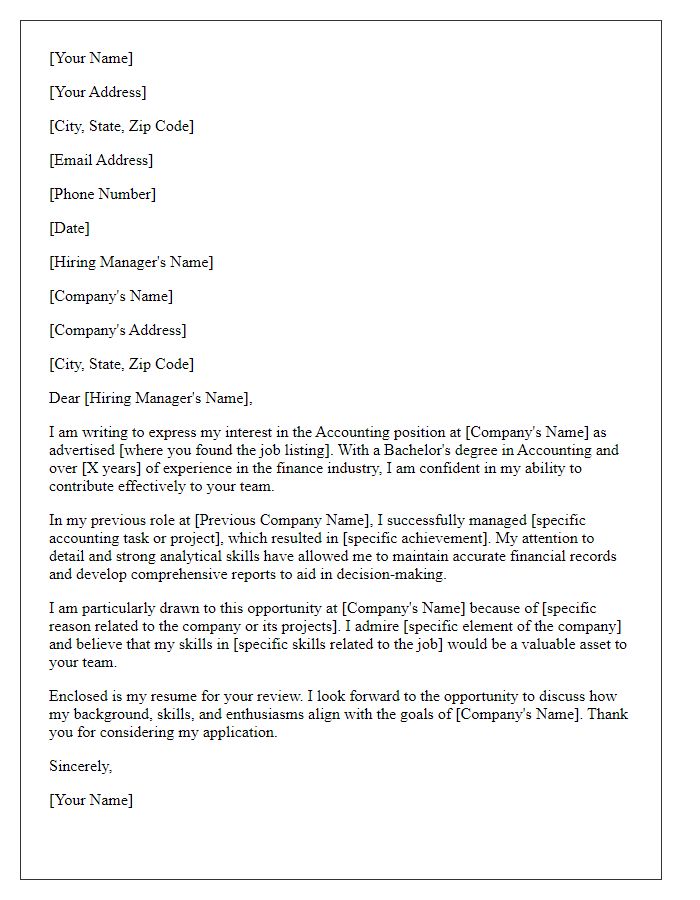

Letter template of finance industry cover letter for accounting position.

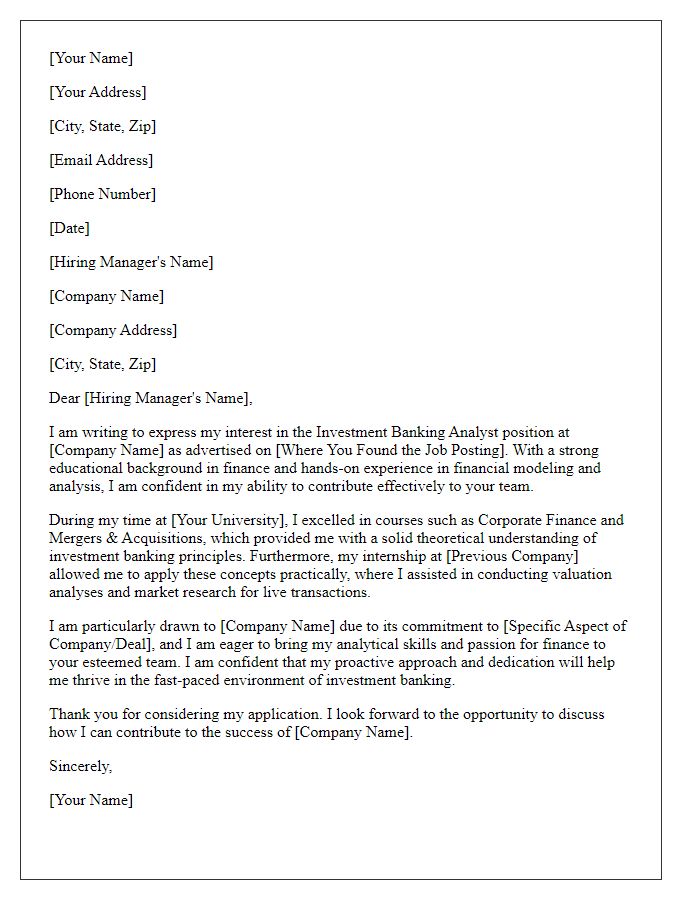

Letter template of finance industry cover letter for investment banking job.

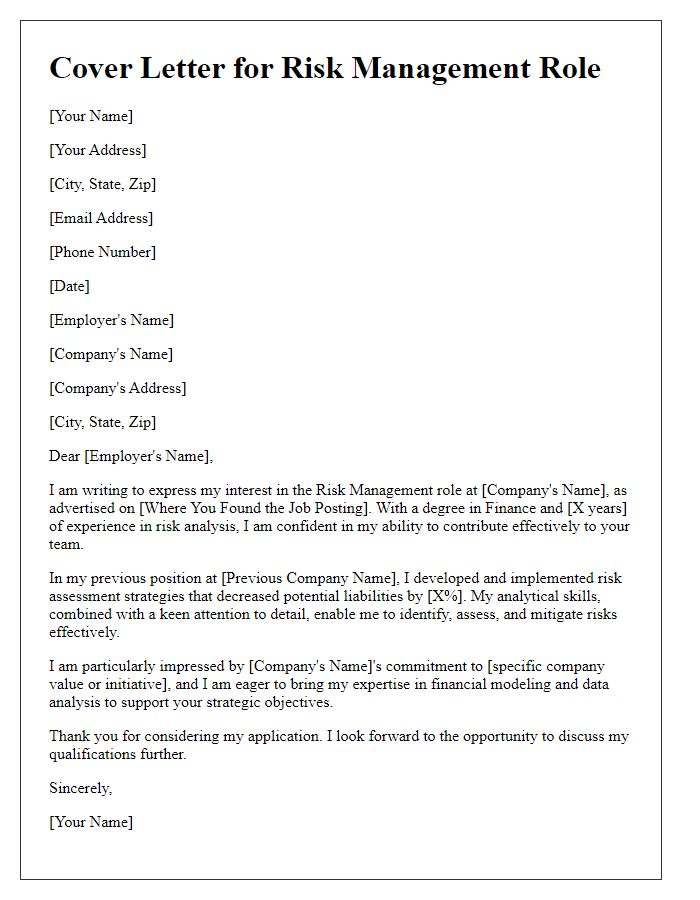

Letter template of finance industry cover letter for risk management role.

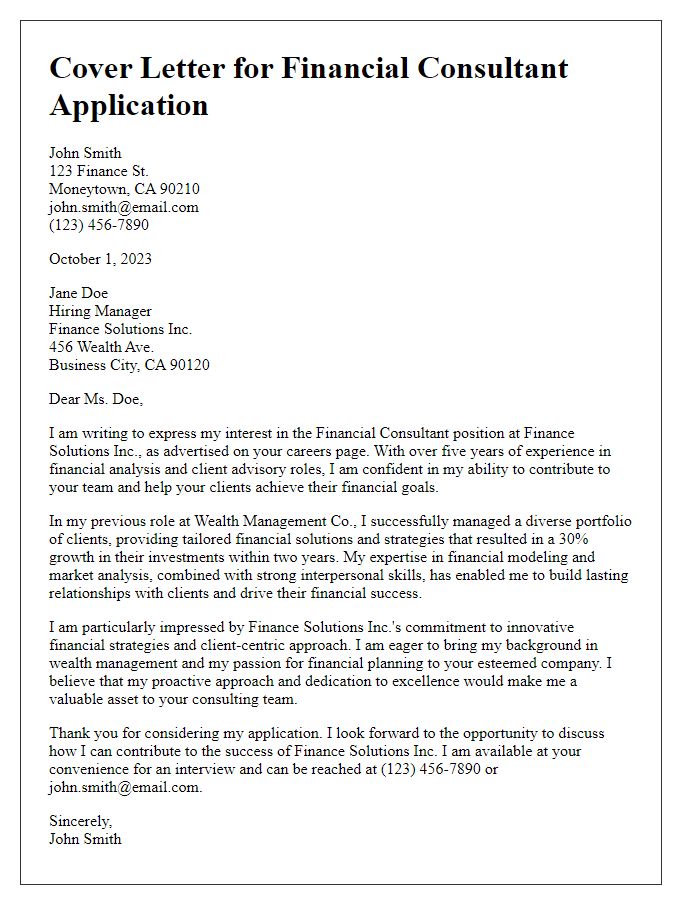

Letter template of finance industry cover letter for financial consultant application.

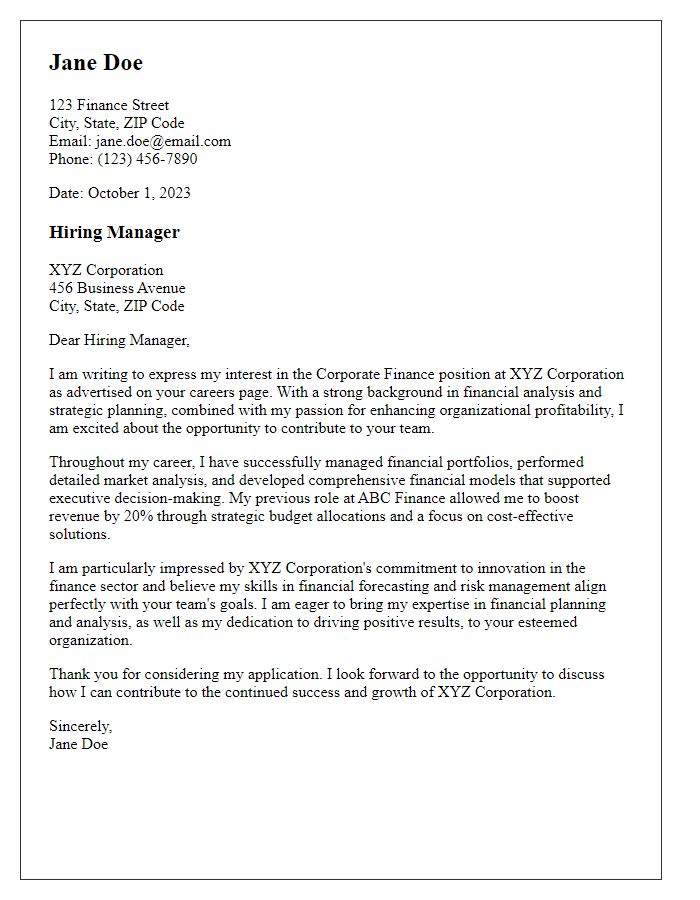

Letter template of finance industry cover letter for corporate finance position.

Comments