Are you feeling the stress of unpaid invoices piling up and wondering how to address the issue without ruffling any feathers? You're not alone; many businesses experience the awkwardness of reminding clients about overdue payments. The good news is that crafting a polite, professional follow-up letter can help maintain relationships while also ensuring you receive what's owed. Dive into our article for effective templates and tips to tackle those unpaid invoices with confidence!

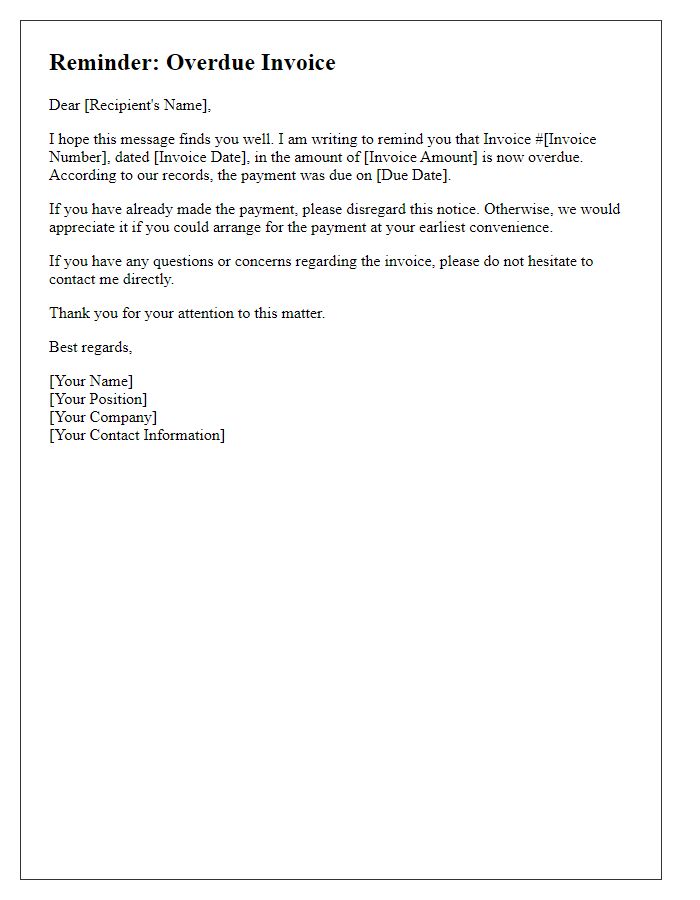

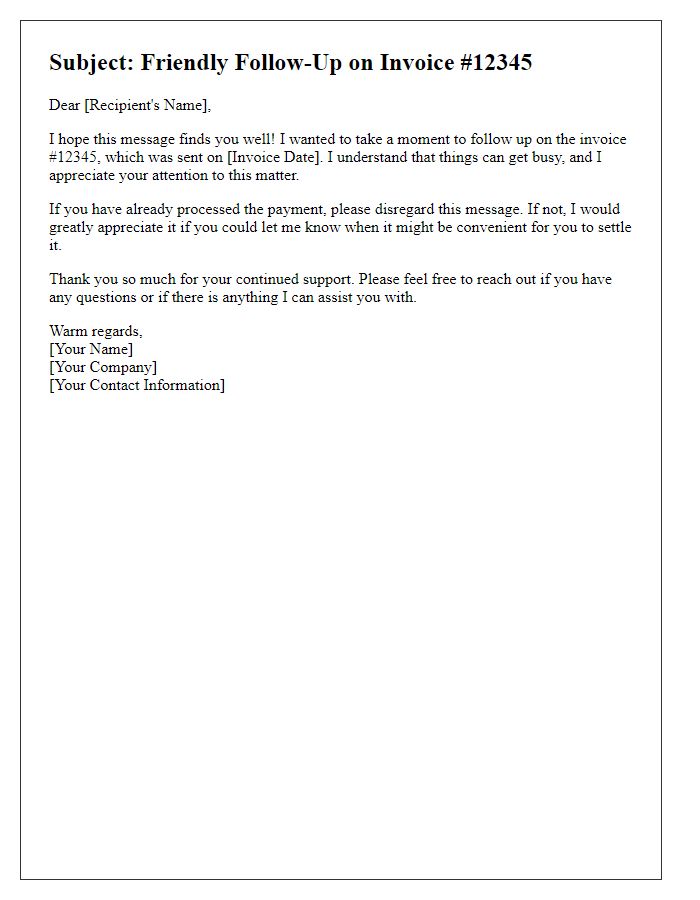

Clear subject line

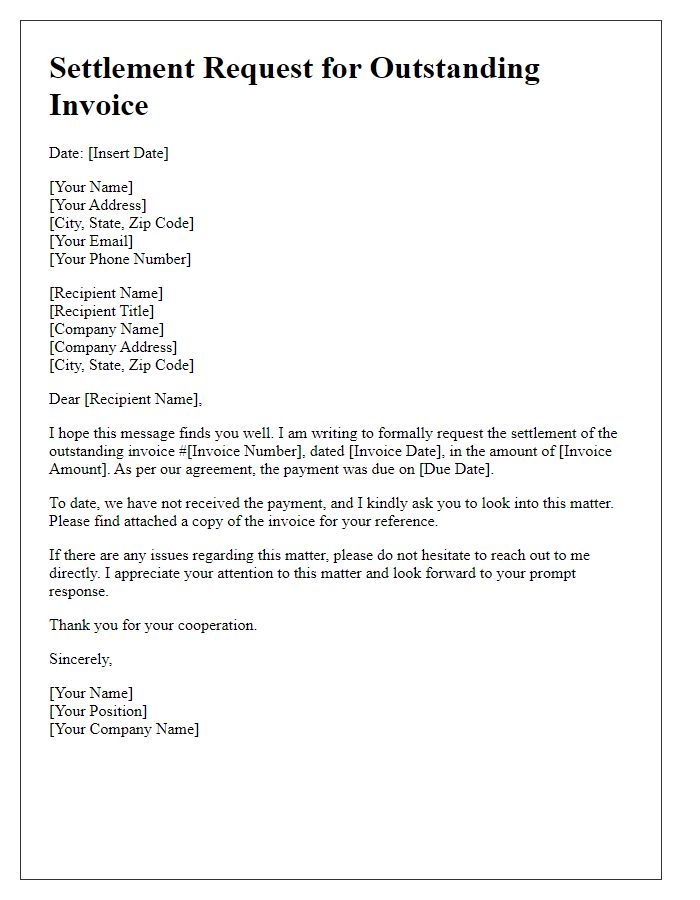

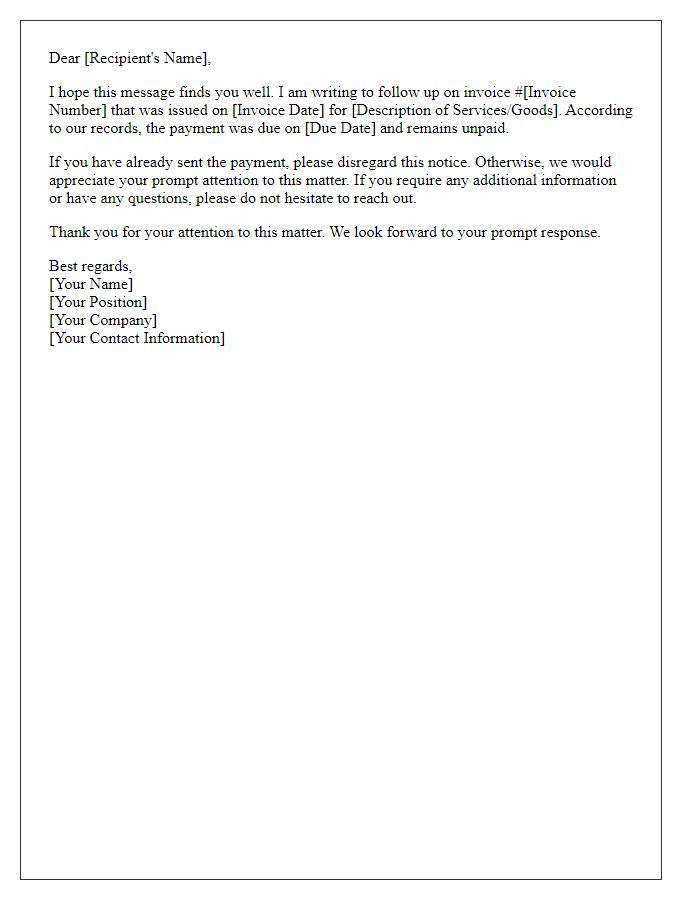

Businesses experience cash flow challenges when unpaid invoices go unresolved. Timely follow-up is crucial; reminders can be sent electronically or through traditional mail. Typically, invoices are due within 30 days of issuance, but delays can occur for various reasons, including oversight or financial difficulties on the client's part. Maintaining clear communication enhances relationships while ensuring prompt payments. Best practices suggest specifying invoice details, such as invoice number, date, and outstanding amount, to avoid confusion and streamline the resolution process. Employing polite yet firm language also encourages prompt attention to outstanding balances.

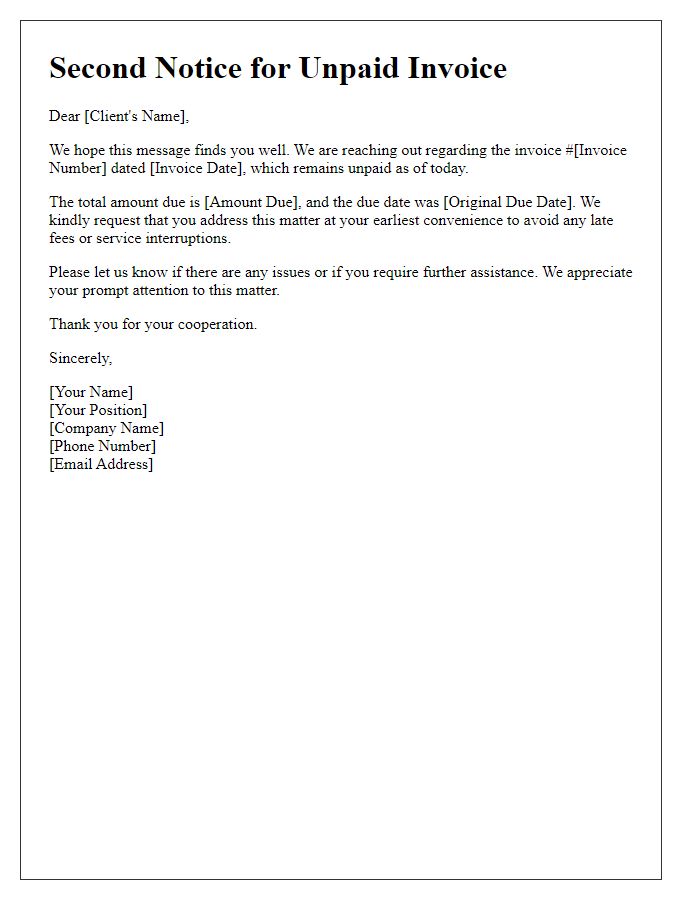

Concise opening statement

Unpaid invoices can disrupt cash flow for businesses, making timely follow-up essential. A concise and clear opening statement in a follow-up email highlights the importance of resolving the issue promptly. Businesses often have a specified payment window, usually 30, 60, or 90 days from the invoice date. For example, if an invoice dated July 15 remains unpaid past the 30-day mark, a follow-up may reference this specific timeframe. Emphasizing the invoice amount, service provided, and payment terms fosters transparency. Utilizing a professional tone while expressing the urgency for settlement contributes to maintaining a positive client relationship.

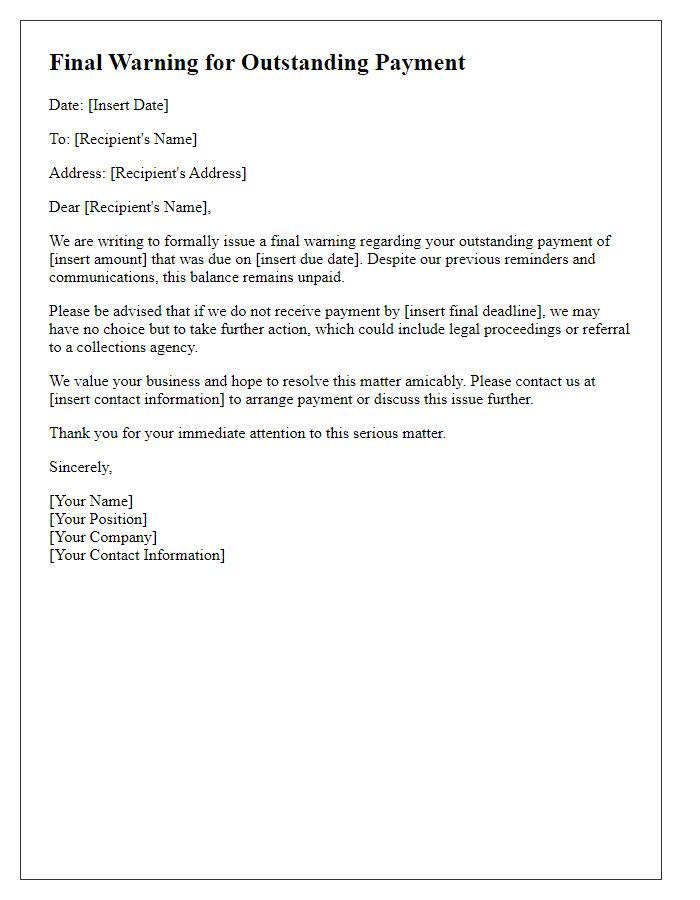

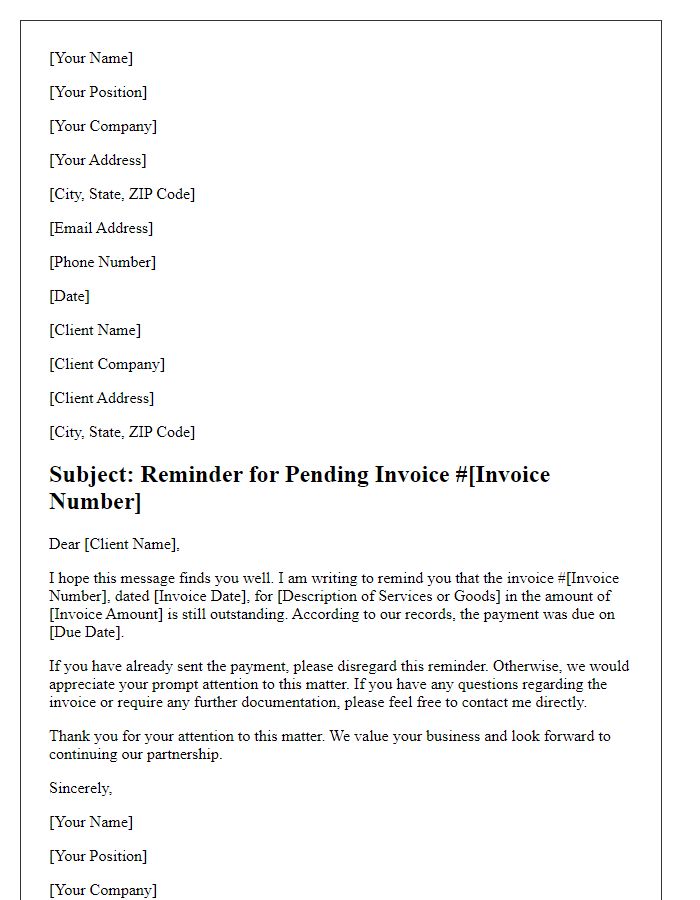

Invoice details

Unpaid invoices can disrupt cash flow for businesses, particularly small enterprises, leading to financial strain. Specific invoice details, such as an outstanding amount of $1,200, dated July 15, 2023, may require follow-up to ensure timely payment. The invoice number #12345 references services rendered, including a consulting project located in New York City. Payment terms typically specify a net 30 days policy, meaning payment due by August 14, 2023. Communication with the client may include reminders about any late fees or interest that could accrue according to the terms of service. Tracking overdue invoices helps maintain healthy business relationships while safeguarding financial stability.

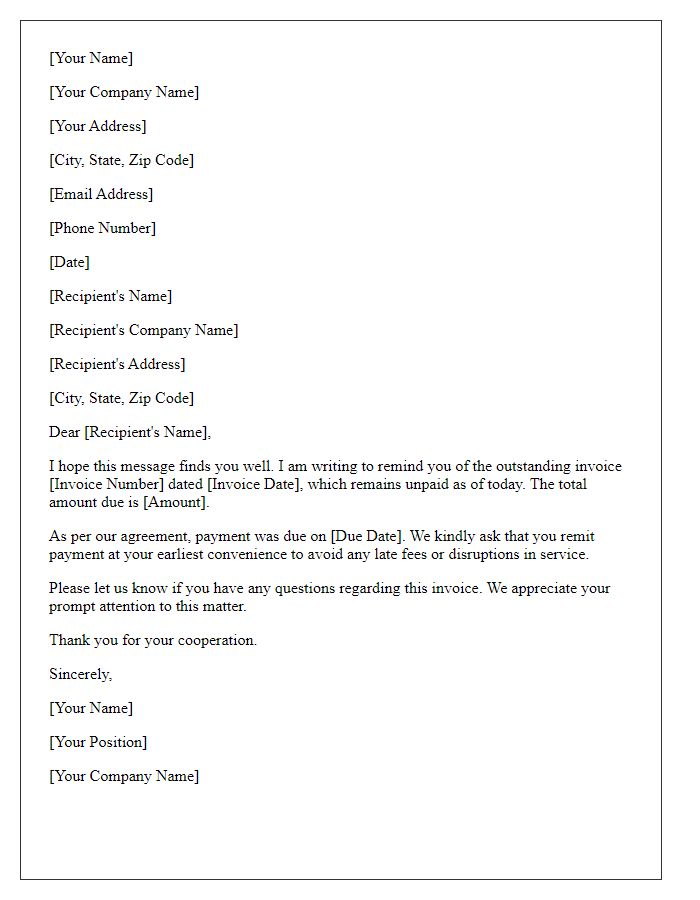

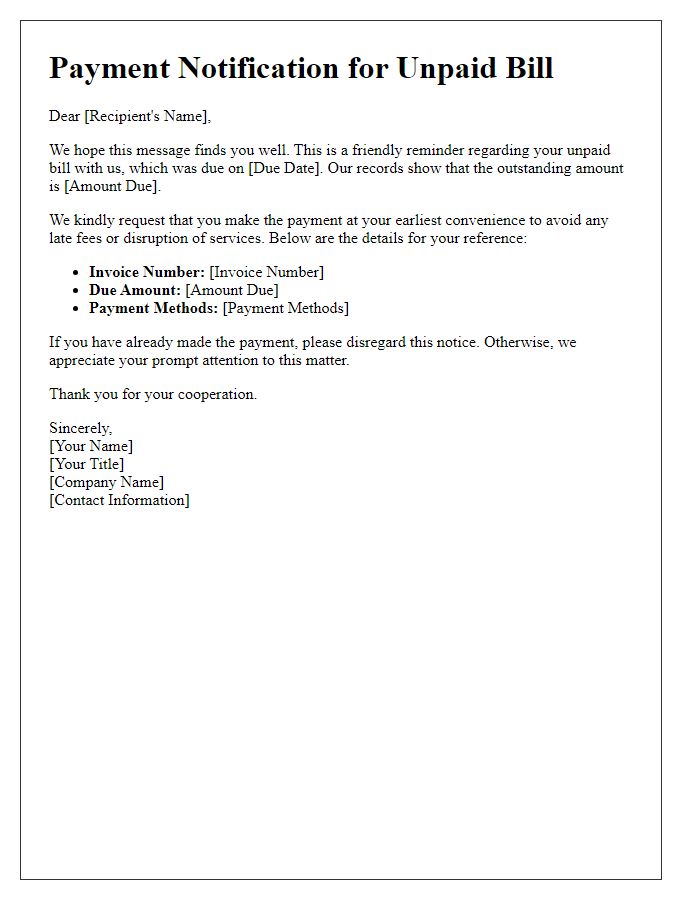

Payment methods

Unpaid invoices can significantly impact cash flow for businesses, particularly for small enterprises and freelancers. To address overdue payments, various payment methods are typically offered, including credit cards, PayPal, wire transfers, checks, and even cryptocurrencies in some cases. Each payment option presents different processing times; for instance, credit card transactions may take a few business days to clear, while PayPal transfers are often instantaneous. Encouraging prompt payment can involve highlighting any potential late fees associated with overdue invoices, which can be a deterrent for late payers. It's essential to maintain professionalism and transparency in communication, ensuring that clients are aware of payment deadlines and the consequences of missing them.

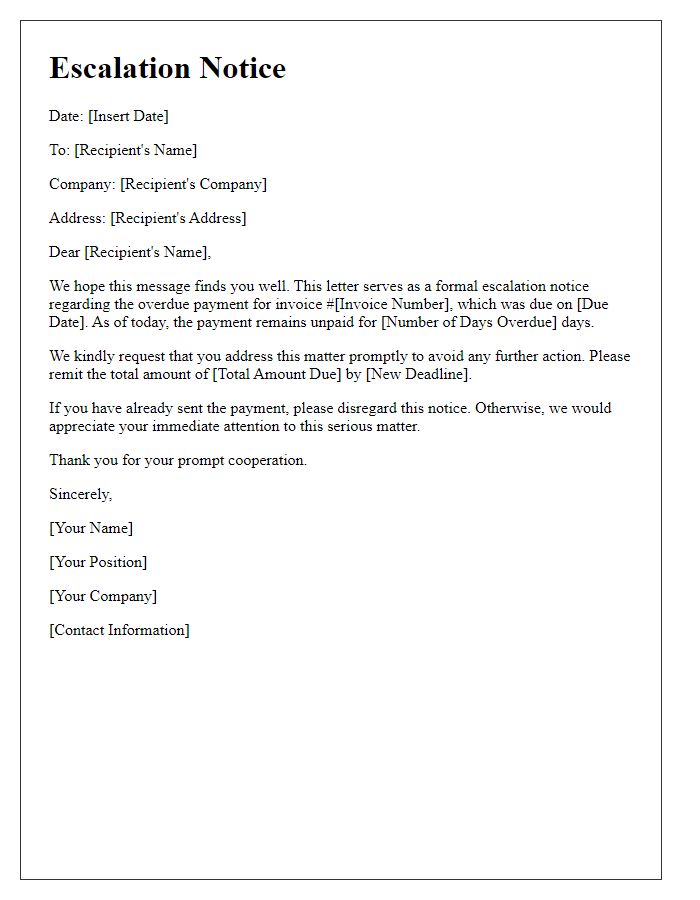

Follow-up contact information

Unpaid invoices can disrupt cash flow for businesses, causing concern among owners. Following up with clients requires maintaining professional contact information, such as email addresses and phone numbers, to ensure effective communication. Delays beyond the specified payment terms, usually 30 or 60 days, can lead to further complications. Persistence is crucial, with reminders sent on a weekly basis, highlighting the invoice number, due date, and total amount owed. Tracking payment history in accounting software also aids in organizing follow-ups. Understanding client payment cycles, such as monthly or quarterly, allows for tailored follow-up strategies, fostering better relationships and timely payments.

Comments