Navigating the world of invoices can sometimes be a bit tricky, especially when adjustments need to be made. It's not uncommon for errors or changes to arise, and knowing how to effectively communicate those modifications is essential for maintaining a positive relationship with clients. In this article, we'll explore some useful tips on crafting a professional yet friendly invoice adjustment notification. So, let's dive in and ensure your communication is clear and effective!

Header: Company Name, Logo, and Contact Information

Company Name, a leading provider of [specific services or products], is known for its commitment to customer satisfaction. The professional logo prominently displays the company's brand identity, while contact information, including email and phone number, allows clients to reach out directly for inquiries. This structured header promotes clear communication regarding invoice adjustments, ensuring clients promptly receive updates. The inclusion of key elements enhances recognition and maintains relationship integrity. Addressing clients efficiently demonstrates a respect for their time and fosters ongoing trust.

Recipient's Name and Address

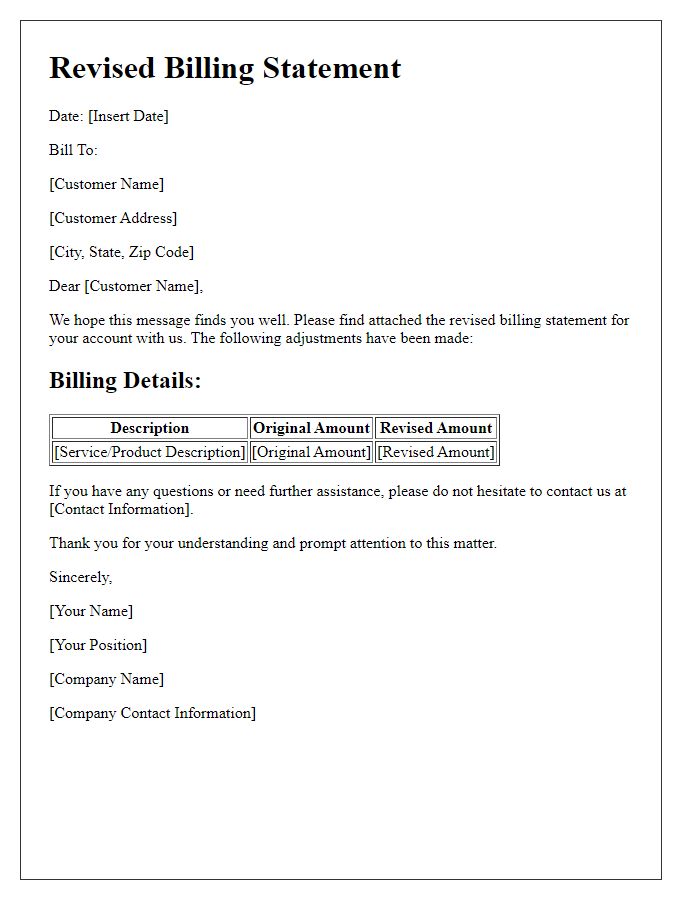

Invoice adjustments can arise due to discrepancies in billing, such as incorrect quantities or pricing errors. Affected parties, including clients or customers, may receive formal notifications outlining these changes. Essential information in these invoices includes the recipient's name, reflecting the entity responsible for the account, as well as a complete address, which ensures proper delivery and record-keeping. Adjustments may also detail the original invoice number for reference, the date of the original transaction, and an explanation of the discrepancies. This transparency supports effective communication and fosters trust, especially in professional relationships. The revised total may be highlighted for clarity, preventing potential confusion or disputes regarding financial responsibilities.

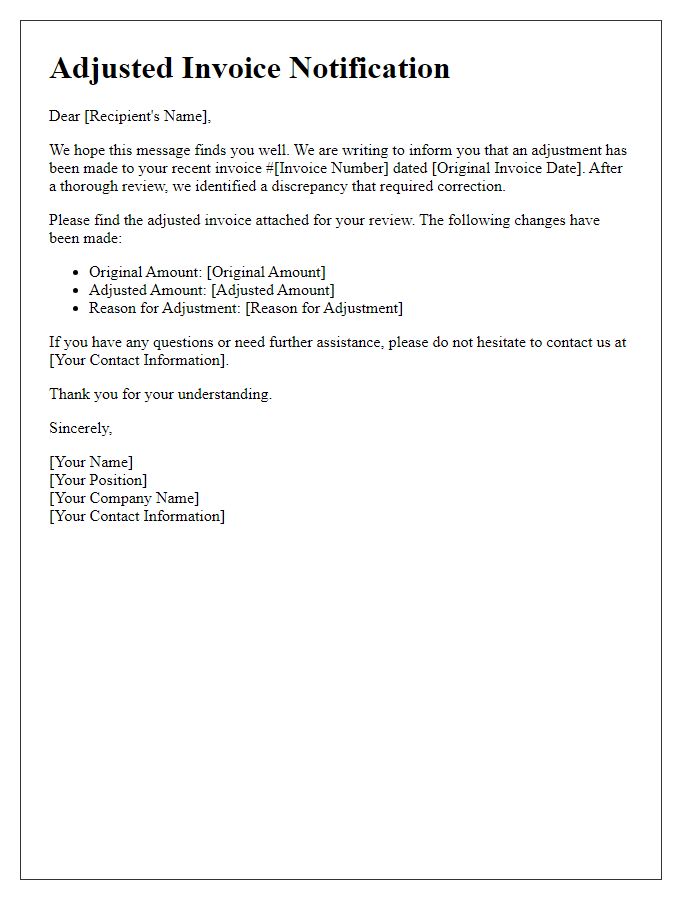

Subject Line: Clear and Concise

An invoice adjustment notification is essential for maintaining transparent communication with clients regarding billing changes. An effective subject line conveys clarity and specificity, such as "Invoice Adjustment Notification - Invoice #12345." This subject line directly references the specific invoice in question, ensuring recipients can quickly associate it with their records. Additionally, including the date or type of adjustment (e.g., "Correction" or "Updated Total") in the subject can further clarify the purpose of the notification, fostering trust and clarity in the financial transaction process.

Salutation: Personalized Greeting

Notification of invoice adjustment is essential to maintain transparency in financial transactions. An invoice, often issued by a service provider or vendor, outlines the costs for products or services rendered. Accurate calculation of totals, including taxes and discounts, ensures both parties agree on outstanding amounts. A clear summary detailing changes can prevent misunderstandings. Key details include the original invoice number, adjustment description, adjusted total, and due date. Accurate record-keeping in accounting software, such as QuickBooks or FreshBooks, supports smooth financial operations and enhances client trust.

Explanation: Reason for Adjustment

Invoice adjustments serve as critical notifications within financial transactions, ensuring accuracy in billing processes. Common reasons for these adjustments can include product returns, pricing errors, or changes in service delivery timelines. For instance, a customer may return a product, resulting in a refund that impacts the total invoice amount. Pricing errors could arise from incorrect data entry, which necessitates recalculating the total to reflect the correct charges, especially in line with agreements stated in contracts or service level agreements. Changes in service delivery timelines might involve an adjustment due to extended project timelines, requiring reevaluation of the initial cost estimates. These adjustments are essential for maintaining transparency and trust in business relationships, particularly for companies operating within sectors such as retail, construction, or professional services.

Comments