Have you ever found yourself puzzled over an unexpected discrepancy in an invoice? You're not alone; these situations can arise in any business relationship, often leading to confusion and frustration. However, addressing these discrepancies promptly and effectively can help maintain healthy communication and foster trust with your clients or vendors. Want to know how to craft the perfect letter for explaining invoice discrepancies? Read on for our detailed guide!

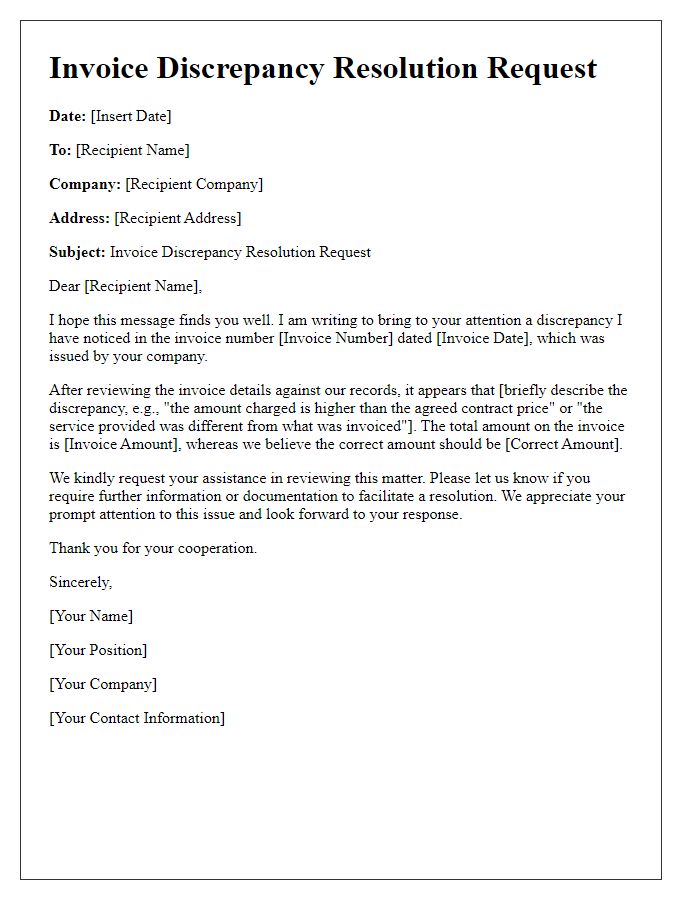

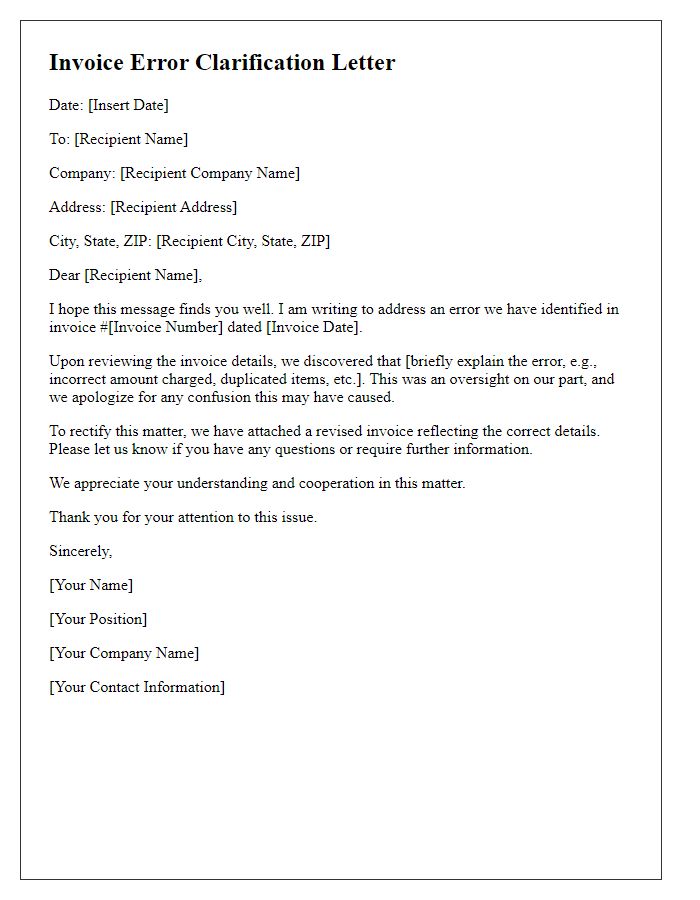

Clear Subject Line

In the realm of financial transactions, invoice discrepancies can arise from various factors, including incorrect billing information, quantity errors, or pricing inaccuracies. A common issue involves mismatched amounts between the invoice from the supplier and the records maintained by the purchasing department, often resulting in confusion. For instance, if an invoice from Company ABC dated October 5, 2023, displays a total of $1,200 for products delivered, while internal records indicate a shipment valued at $1,000, the discrepancy must be addressed swiftly. Miscommunication can also occur if promotional discounts were not applied correctly or if there were changes in order specifications without corresponding updates. Effective communication with the supplier, referencing specific invoice numbers, and providing clear documentation can help resolve these issues efficiently.

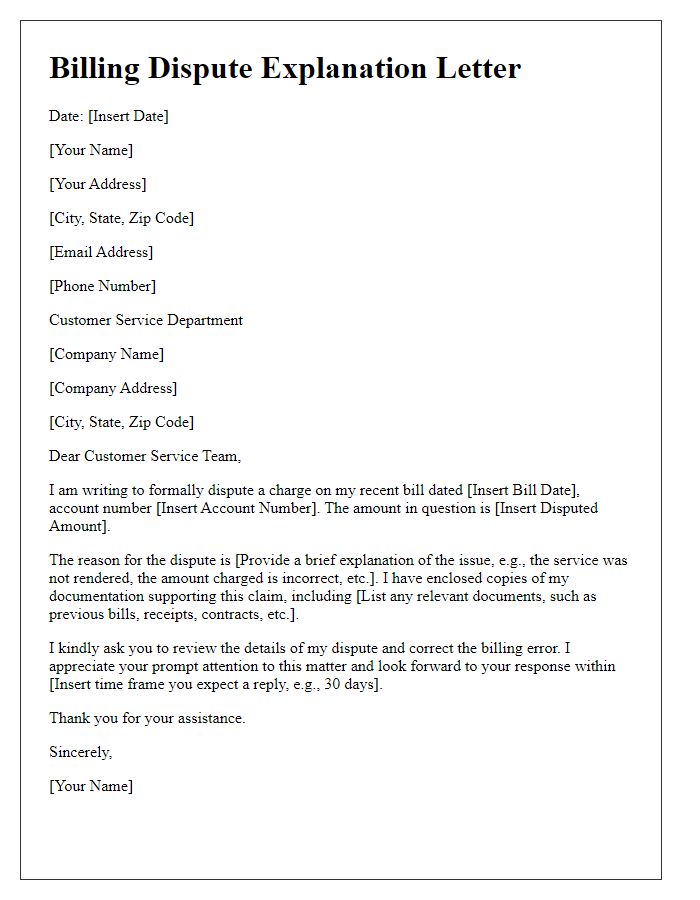

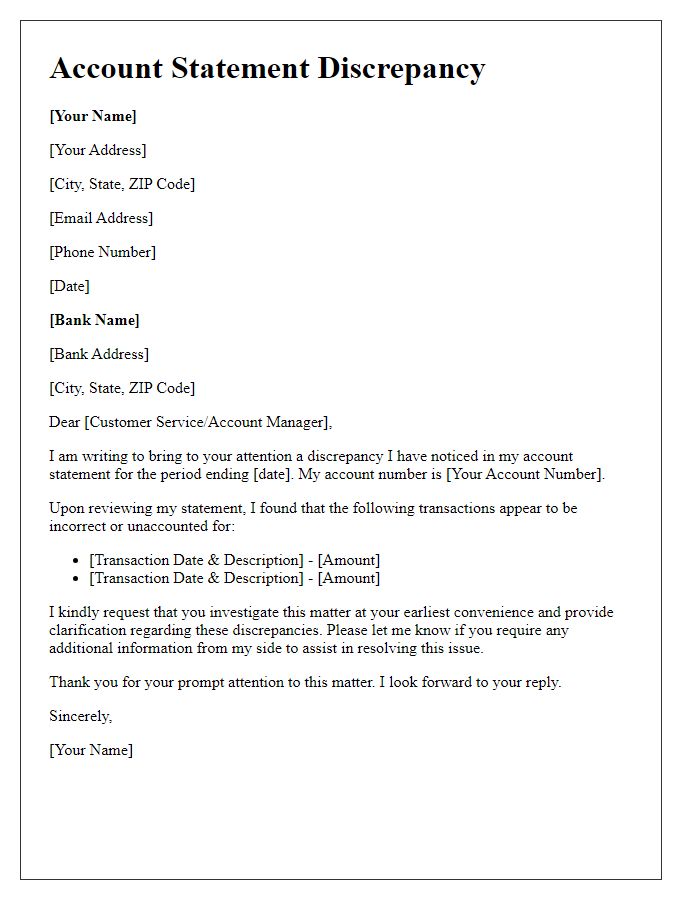

Contact Information

Invoice discrepancies can arise from various factors such as incorrect amounts, mismatched purchase orders, or service-related issues. Contact information, including the company's name, address, phone number, and email, should be clearly stated to facilitate effective communication regarding the discrepancy. For instance, a mobile number (e.g., +1-800-555-0199) and a professional email (e.g., support@company.com) allow for immediate inquiry resolution. Providing attention to specific personnel (like a billing manager) ensures that communications reach the right department, expediting the process of rectifying the error.

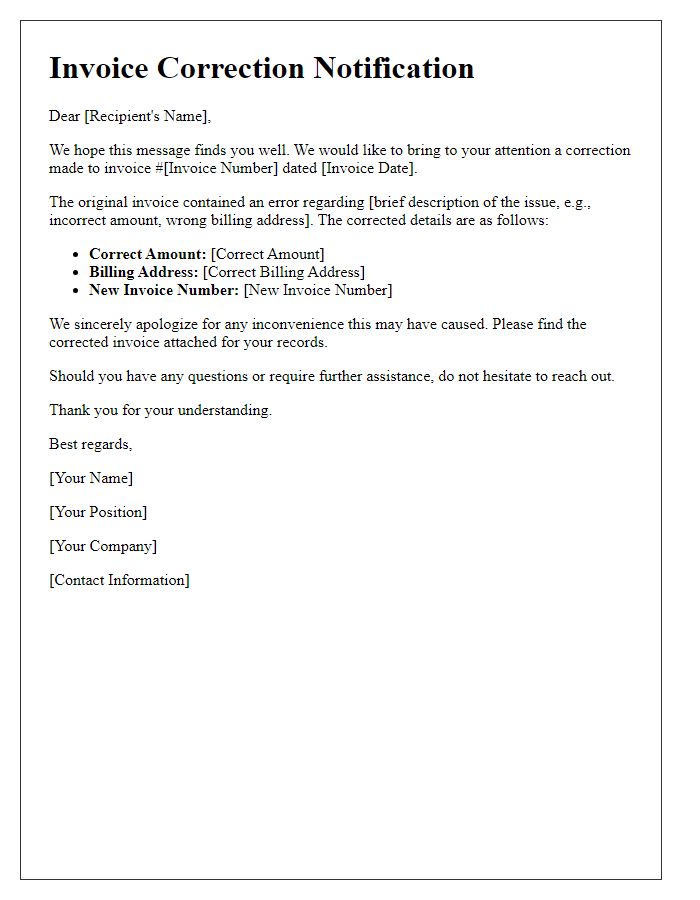

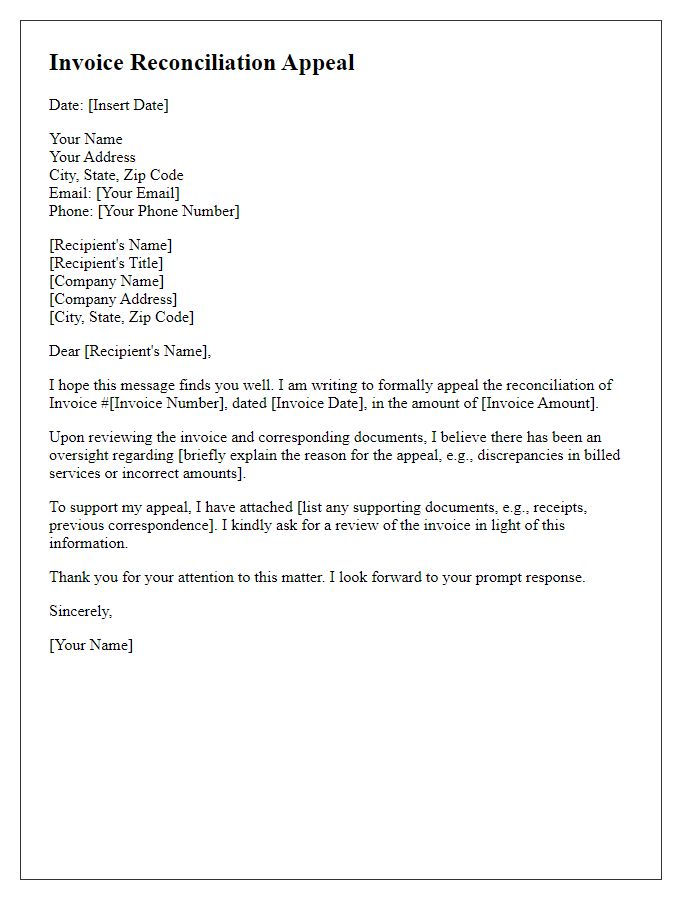

Invoice Details

Invoice discrepancies often arise from miscommunication regarding services rendered or billing amounts. For instance, an invoice dated October 15, 2023, may reflect a total of $1,200 for consulting services provided by a firm in New York City. However, upon review, a charge for an extra four hours of work may appear, despite prior agreements specifying a maximum of ten hours at a rate of $100 per hour. Potential discrepancies could also stem from additional fees previously discussed but not documented in a formal contract, complicating clarity. Timely addressing these issues is crucial to maintain goodwill and ensure accurate accounting practices in financial transactions.

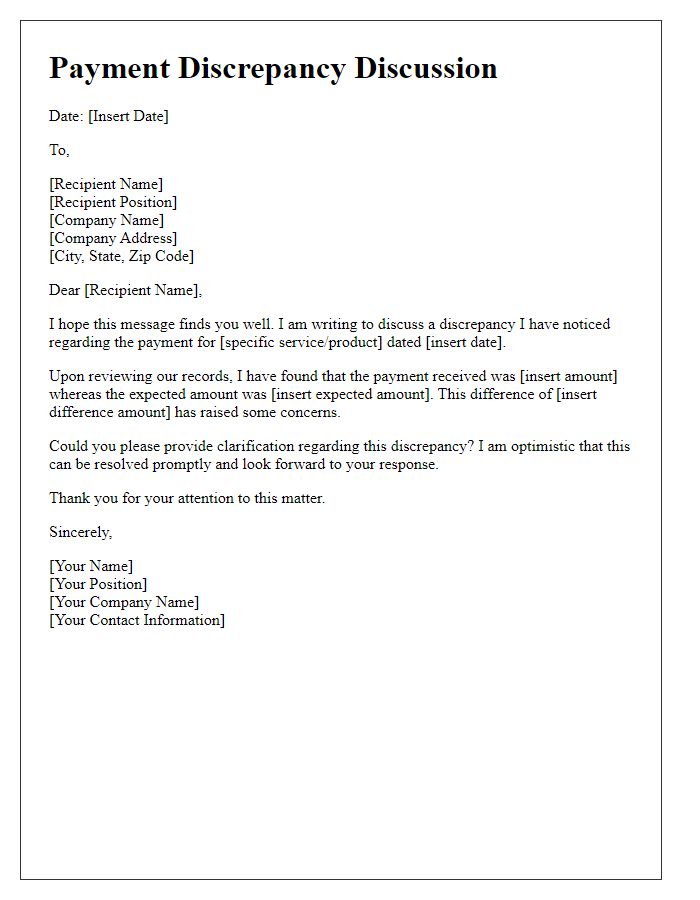

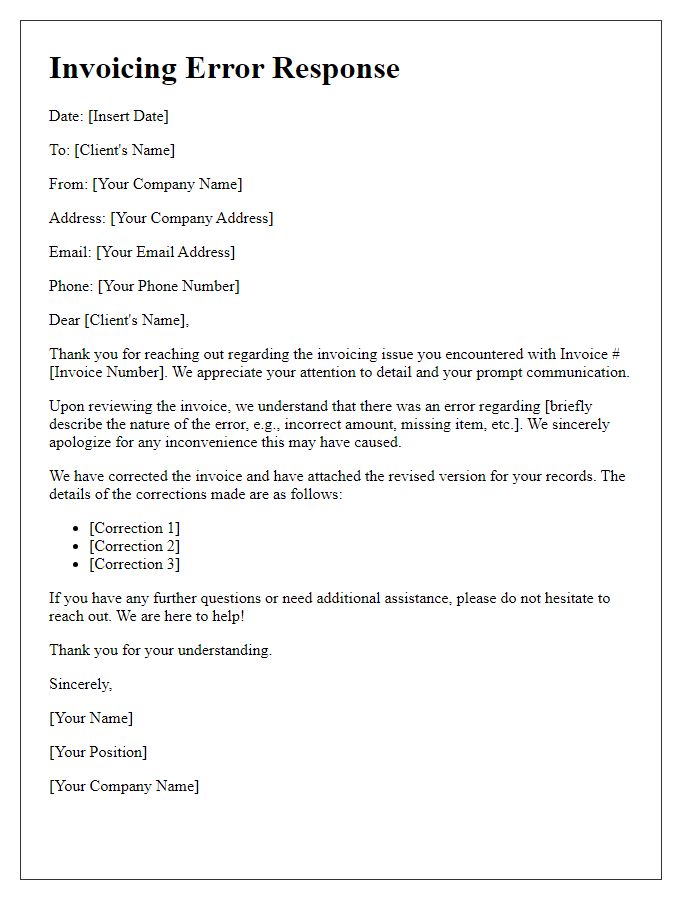

Explanation of Discrepancy

Invoice discrepancies can arise from various factors that affect billing accuracy. Common causes include incorrect item descriptions, prices not matching agreed terms, or quantities that differ from what was delivered. For instance, an invoice from ABC Supplies dated September 15, 2023, may list ten units of Item #12345 at $50 each, totaling $500, while the purchase order confirms a delivery of only eight units. Such inconsistencies often stem from data entry errors or misunderstandings between suppliers and customers. Promptly addressing these discrepancies ensures that both parties maintain accurate financial records and continue productive business relationships.

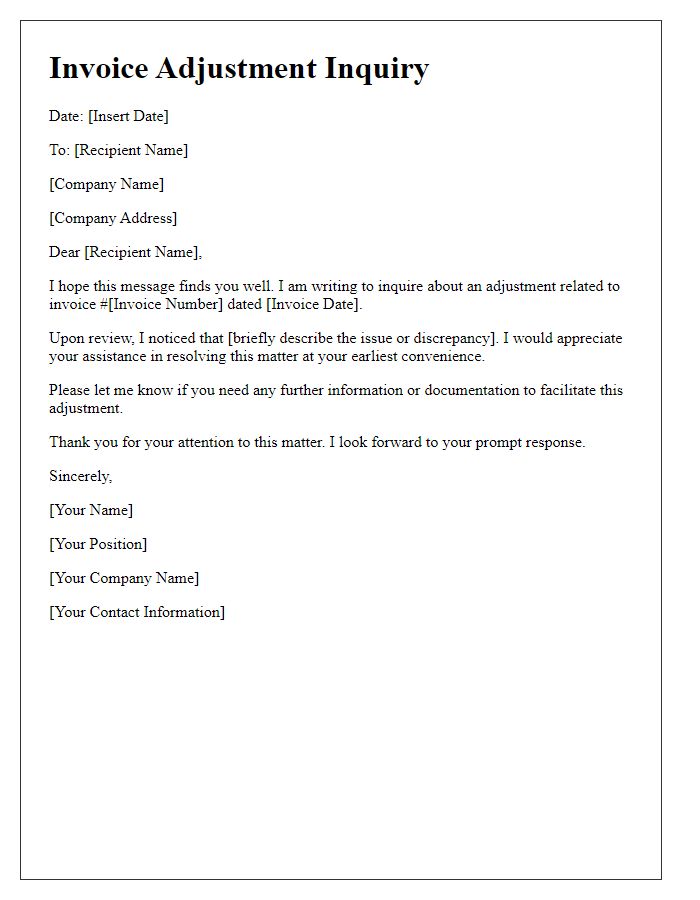

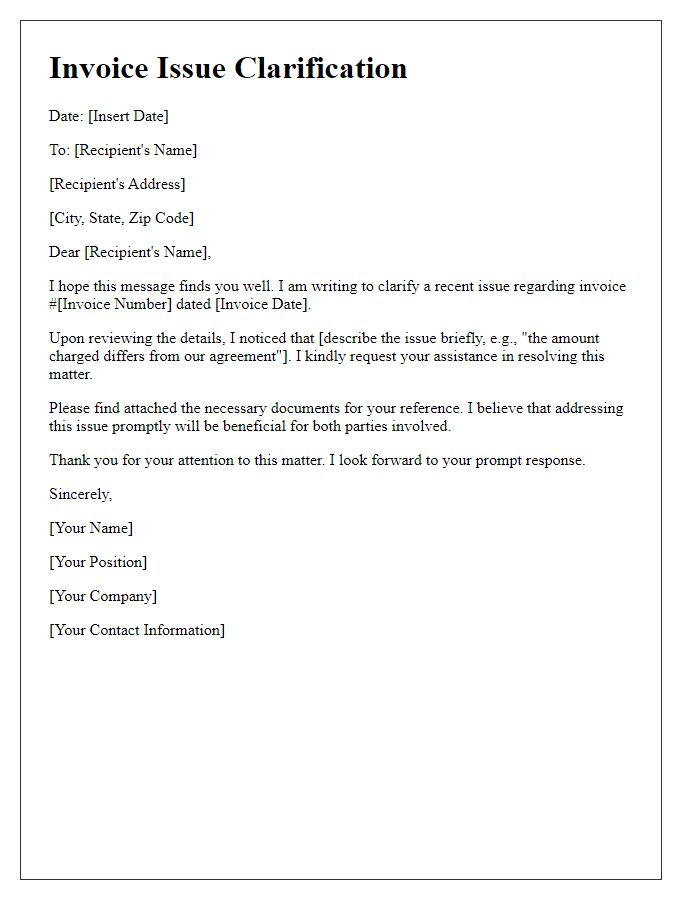

Resolution Steps

Invoice discrepancies can arise from various sources, such as incorrect billing amounts, missing line items, or misapplied tax rates. To resolve these issues, first, identify the specific discrepancy by comparing the invoice against purchase orders or contracts, focusing on details like individual item prices and quantities. Gather supporting documents, such as delivery receipts or service agreements, to substantiate your claim. Communicate with the vendor or service provider promptly, specifying the nature of the discrepancy and providing the gathered documentation for clarity. Suggest corrective action, whether it involves issuing a credit note, reissuing the invoice with accurate details, or adjusting payment terms. Follow up to ensure timely resolution, keeping records of all communications for future reference.

Comments