Are you finding it challenging to manage invoice payments? You're not alone; many businesses face similar hurdles when it comes to cash flow. That's why a well-structured payment plan can be a game-changer in ensuring timely payments while fostering positive relationships with your clients. Join us as we explore the essential elements of an effective invoice payment plan proposal that can make the process smoother for everyone involved!

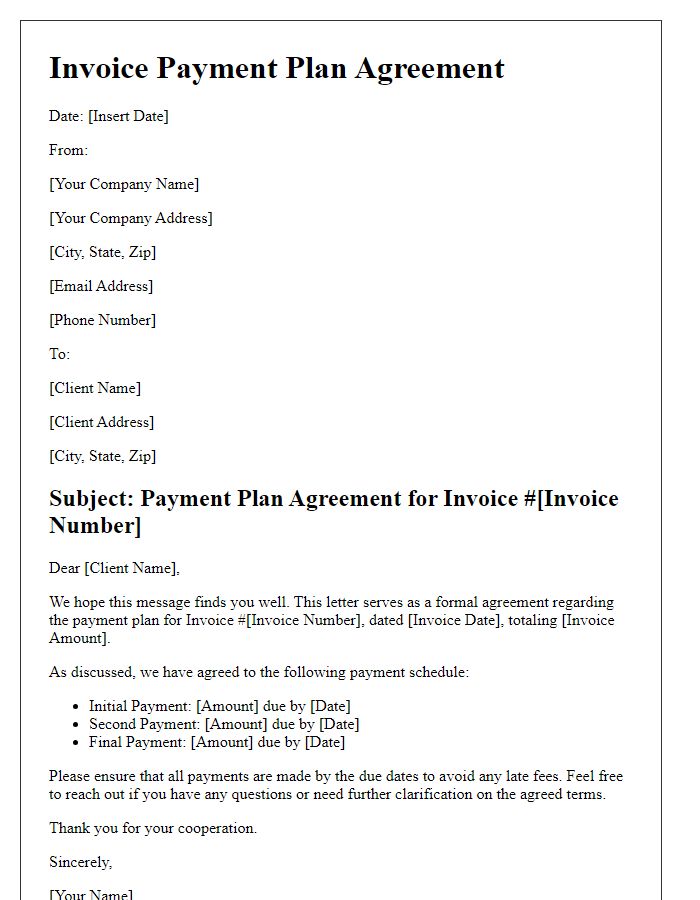

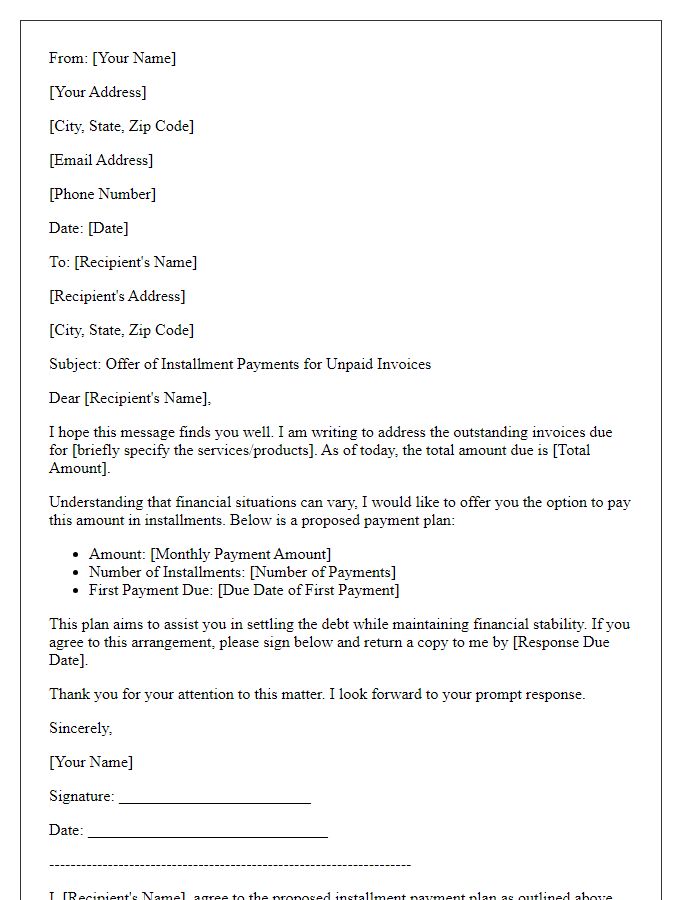

Clear contact information

A well-structured invoice payment plan proposal includes detailed contact information, essential for effective communication between parties. Include business name (for instance, "XYZ Enterprises"), address (such as "123 Business Road, Springfield, IL 62704"), email address (e.g., "contact@xyzenterprises.com"), and phone number (like "(555) 123-4567") for client inquiries. Additionally, provide a contact person's name (for example, "Jane Doe, Accounts Manager") to streamline interaction. A clear layout fosters trust and facilitates swift responses to payment-related questions, contributing to a smoother transaction process.

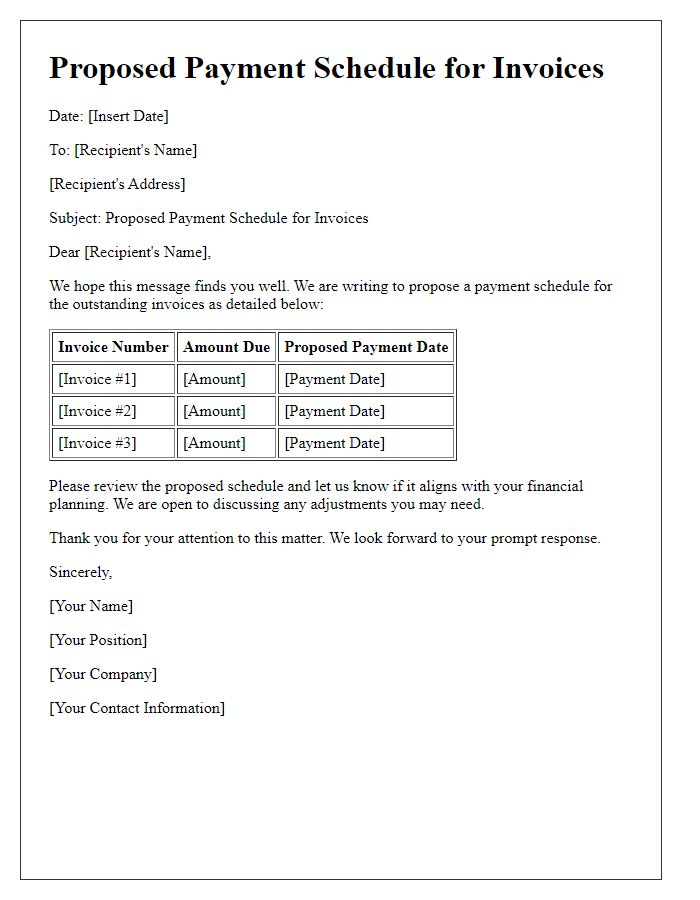

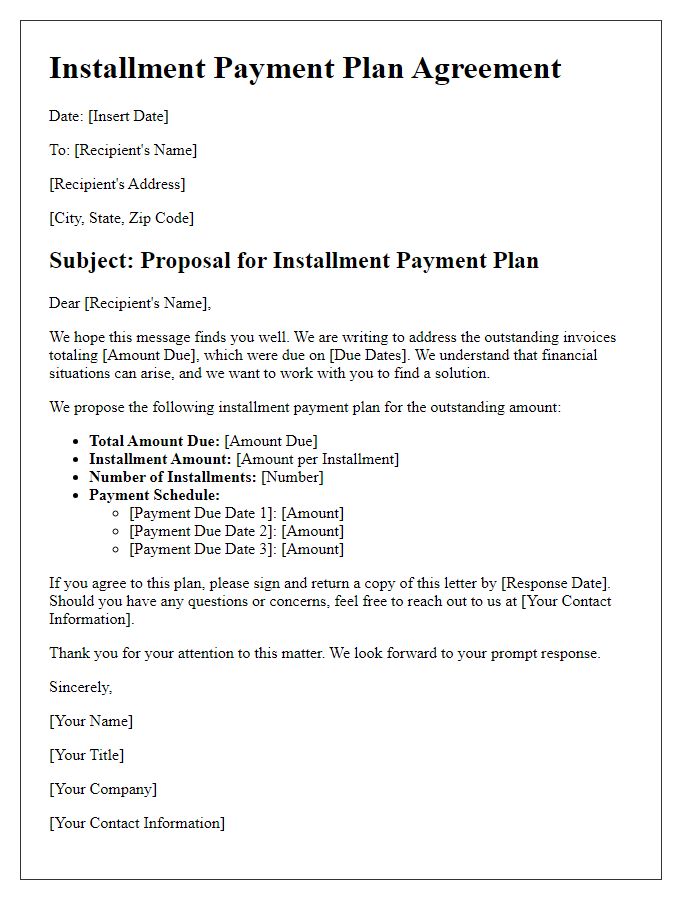

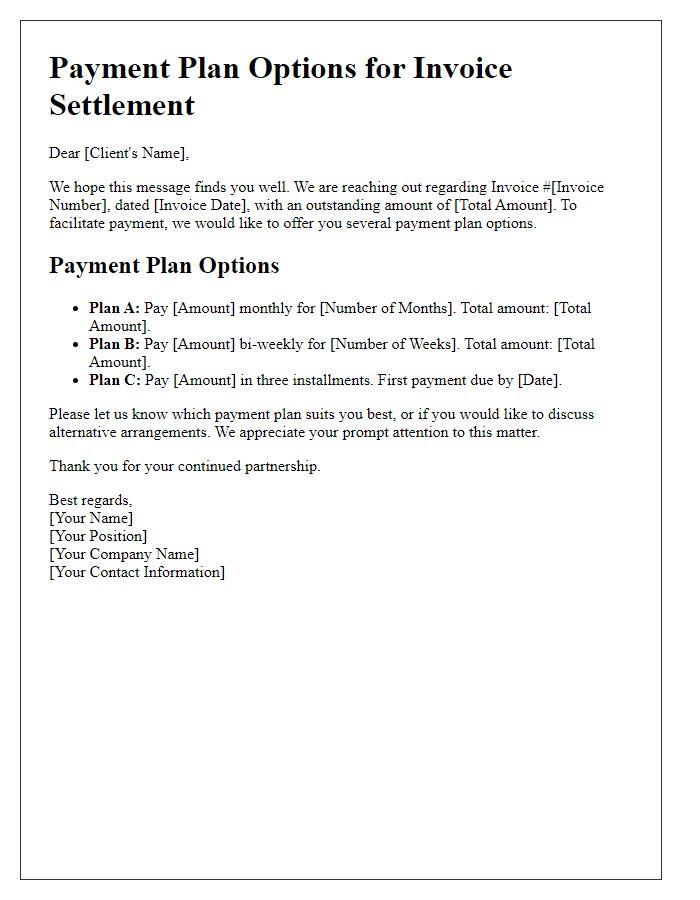

Detailed payment plan terms

A detailed payment plan proposal for invoice payments typically includes specific financial terms, timelines, and conditions. A structured repayment schedule might outline monthly payment amounts, due dates, and total balance on an invoice issued by a service provider, such as a graphic design agency, amounting to $5,000 for branding services. The proposal could allocate the total into five installments of $1,000 each, with the first payment due within 30 days of the invoice date, followed by subsequent payments due on the same calendar day in the following months. Additionally, late payment terms might state a 5% late fee on any overdue amount after a grace period of 10 days. The proposal would emphasize the opportunity for early payment discounts, potentially offering a 2% discount on the total invoice amount if full payment is made within two weeks. Clear communication regarding acceptable payment methods, such as bank transfers or credit card payments, would foster transparency in the agreement.

Consequences of missed payments

Missed payments can lead to various financial repercussions for both the creditor and the debtor. Late fees, typically ranging from $25 to $50 depending on the agreement, may apply to overdue amounts. Accumulated interest charges, which can increase the outstanding balance significantly, are often stipulated in the payment agreement. Furthermore, a detrimental impact on credit scores can occur, potentially resulting in a drop of 100 points or more, affecting future borrowing capabilities. Legal actions may also arise, such as collections efforts, which can involve additional costs and negative implications for the debtor's financial reputation. Ultimately, these consequences can create a cycle of debt, making it increasingly difficult to fulfill financial obligations.

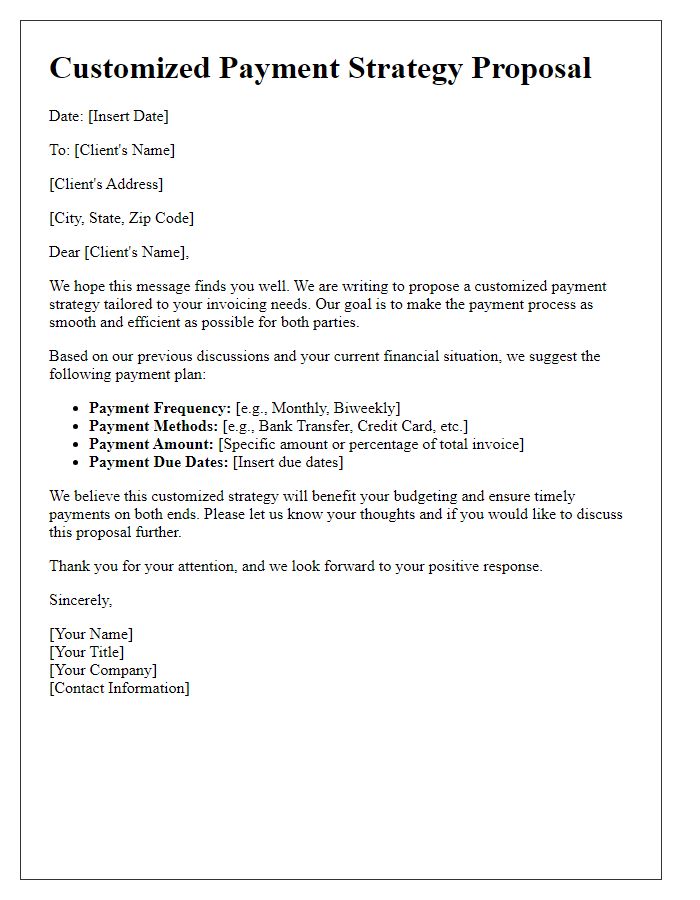

Personalized and professional tone

Creating a payment plan proposal for an invoice involves clear communication of terms and expectations. An ideal invoice payment plan outlines the payment schedule, amounts, and deadlines. A personalized approach might include addressing the client's specific needs or circumstances to foster goodwill and understanding. Professionalism ensures clarity and establishes trust, crucial for maintaining positive client relationships. For instance, if a consulting firm provided services amounting to $5,000, a payment plan could propose splitting the total into five monthly payments of $1,000, with the first due on a specific date, such as November 15, 2023. Each payment could specify preferred methods (bank transfer, credit card) for ease. Ultimately, a carefully crafted payment plan proposal fosters transparency, enhances client satisfaction, and promotes long-term professional relationships while effectively managing financial obligations.

Clear call-to-action

A structured invoice payment plan proposal outlines specific terms for settling an outstanding balance, ensuring clear communication with clients. The proposal typically includes key elements such as total amount due (for instance, $5,000 for services rendered), proposed payment installments (for example, $1,000 due monthly), due dates for each payment (such as the first of every month), and any applicable interest rates or late fees (usually around 1.5% after a grace period). Clearly defining expectations fosters a professional relationship and increases the likelihood of timely payments. A strong call-to-action encourages clients to review the plan by a specified date, sign the agreement, or reach out for any clarifications, making the process seamless and transparent.

Comments