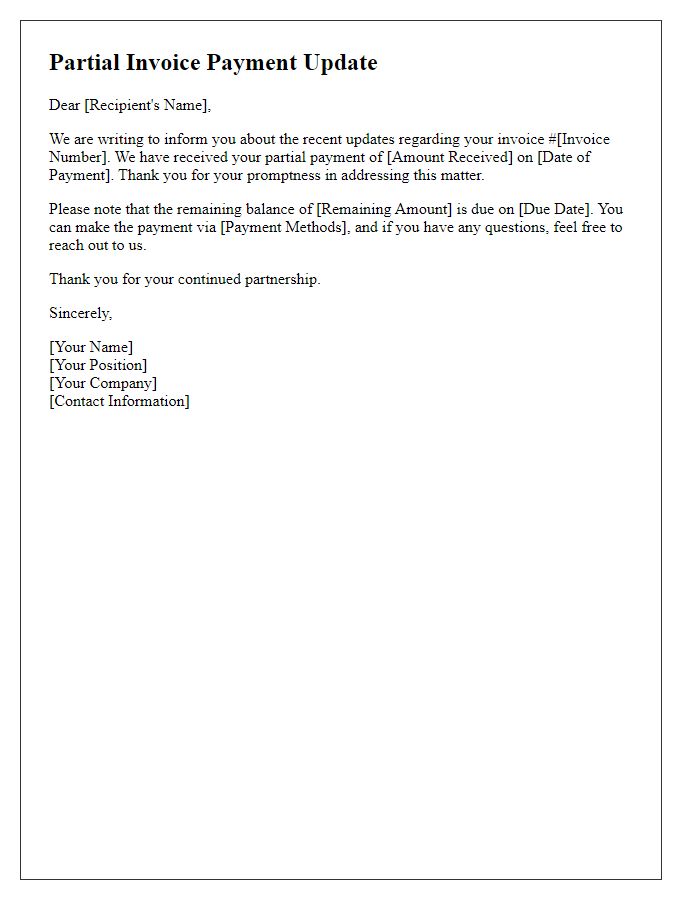

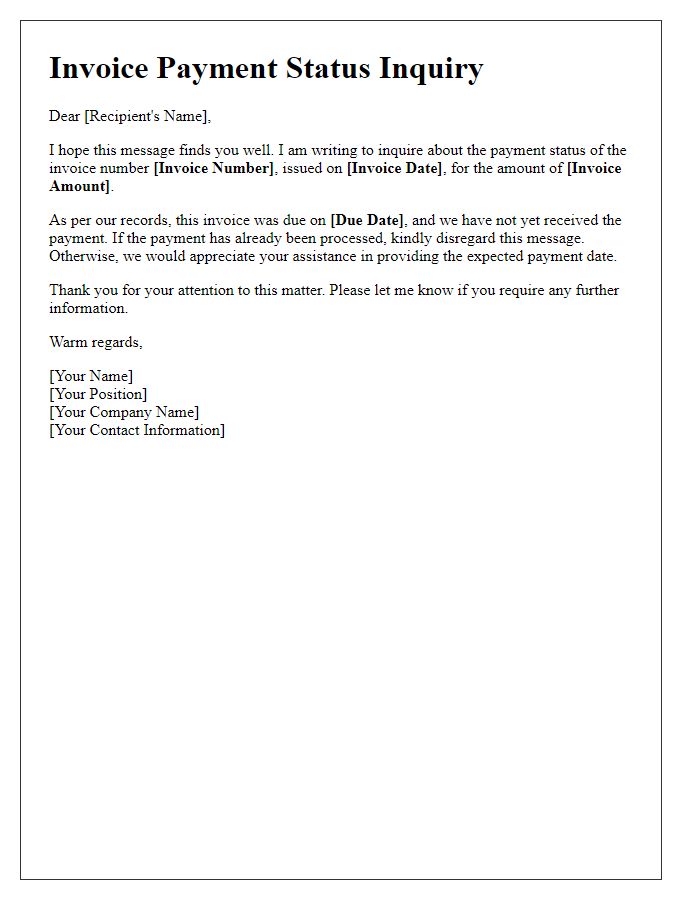

In today's fast-paced business world, keeping track of invoice payments can often feel like a daunting task. It's essential to maintain open communication with clients regarding their payment statuses, ensuring that both parties stay informed and aligned. A well-structured letter can facilitate this process, making it easier to follow up without coming across as pushy. Curious about how to craft the perfect invoice payment status update letter? Read on for some helpful tips!

Invoice number and date

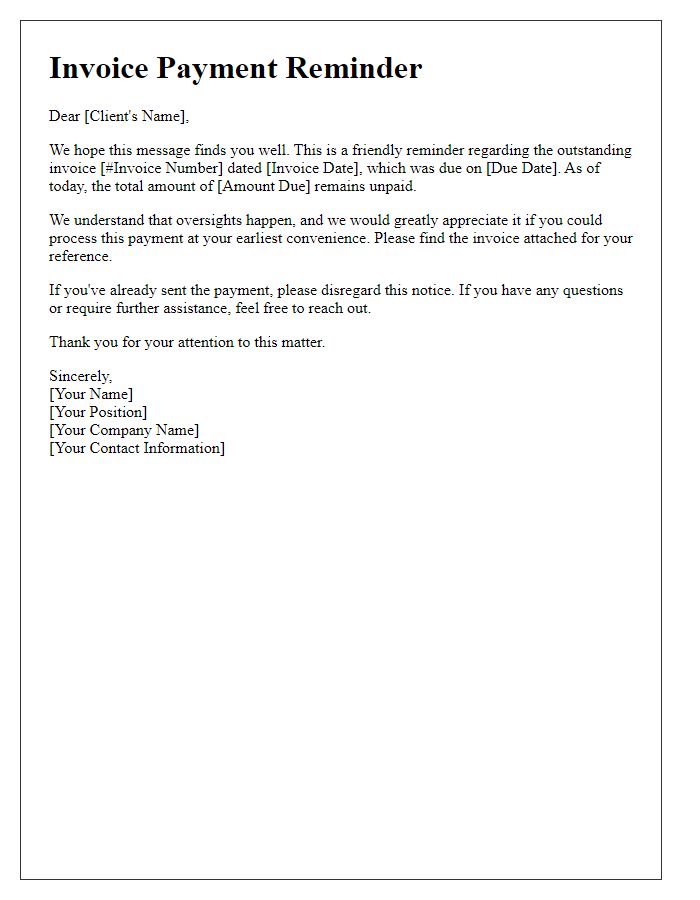

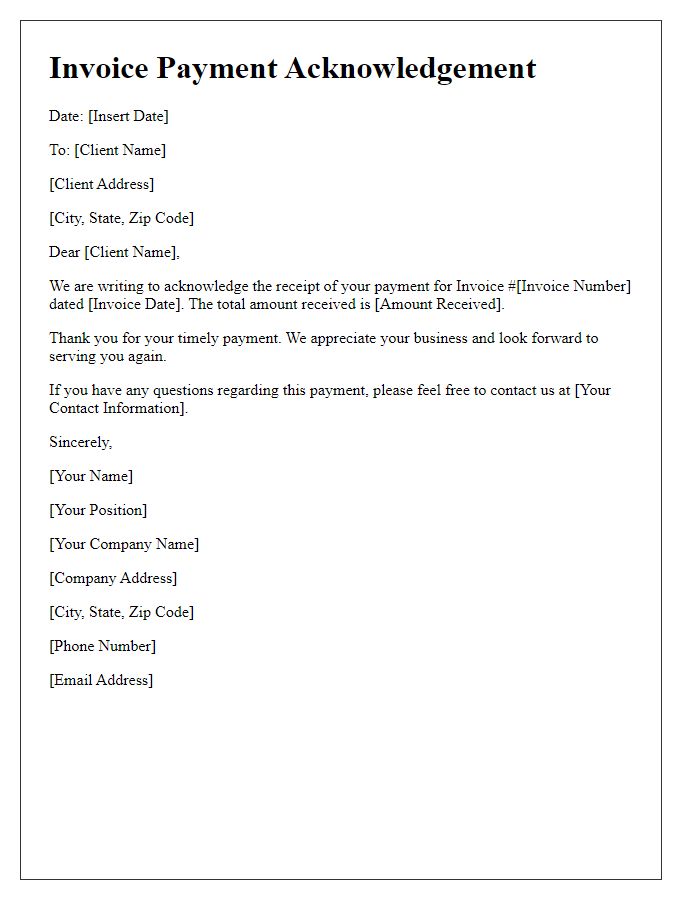

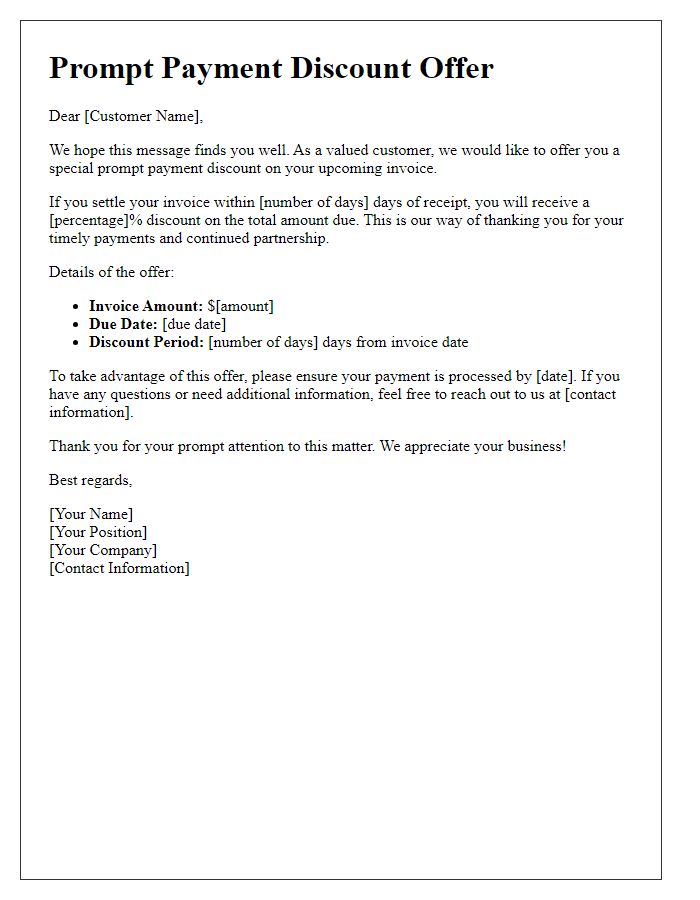

An invoice payment status update provides crucial information regarding outstanding amounts. For instance, an invoice with number 12345, dated January 15, 2023, reflects a total due of $1,500. Companies often utilize invoice tracking systems to monitor payment timelines and outstanding balances. Delayed payments may incur late fees or interest depending on agreed terms, such as a 2% fee for every month past due. Regular communication about the payment status not only enhances cash flow but also maintains good client relationships and ensures project continuity.

Payment due date

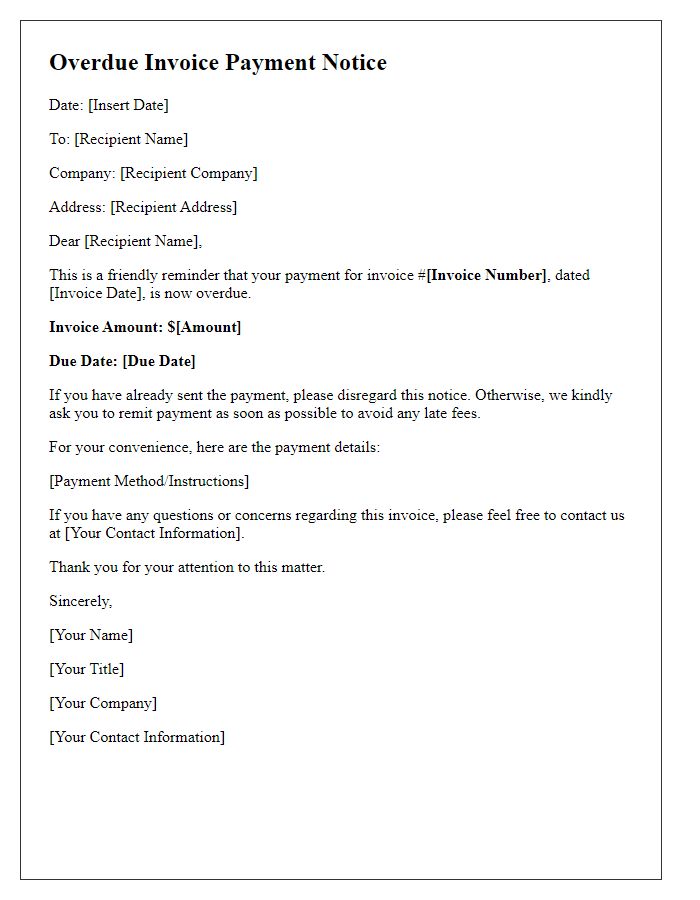

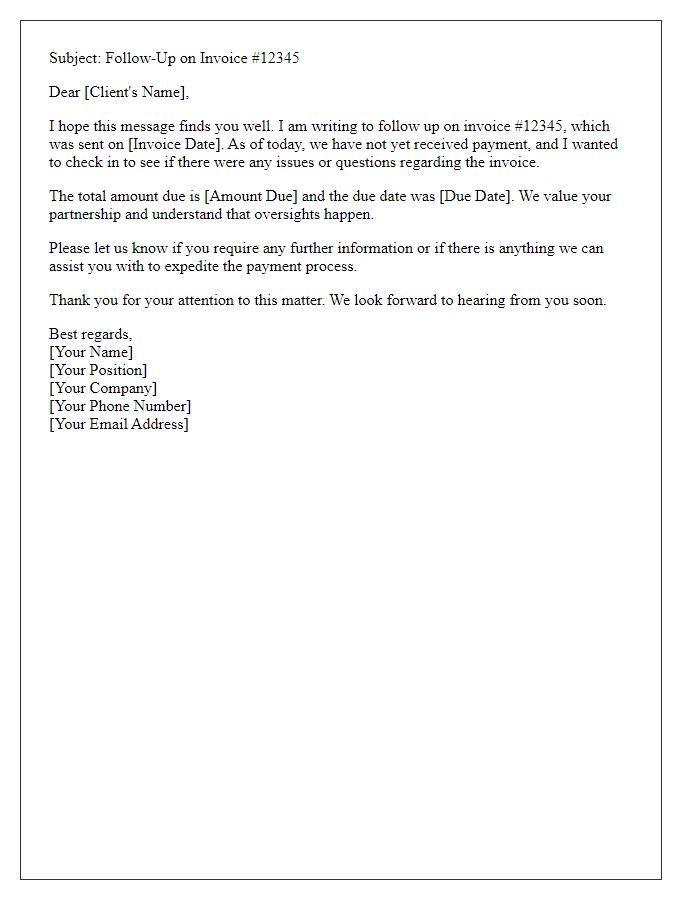

An invoice payment status update indicates the urgency for businesses to ensure timely payment. Payments typically have a due date, often set 30 days from the invoice date, reflecting standard business practices. This period allows clients ample time to process their invoices, but it also establishes a firm deadline for maintaining healthy cash flow. Missing the payment due date may incur late fees, which can be calculated as a percentage of the outstanding amount. In many industries, recurring late payments can jeopardize supplier relationships and result in loss of services or goods. Clarity in the payment status helps both parties manage their financial obligations effectively, ensuring transparency and trust.

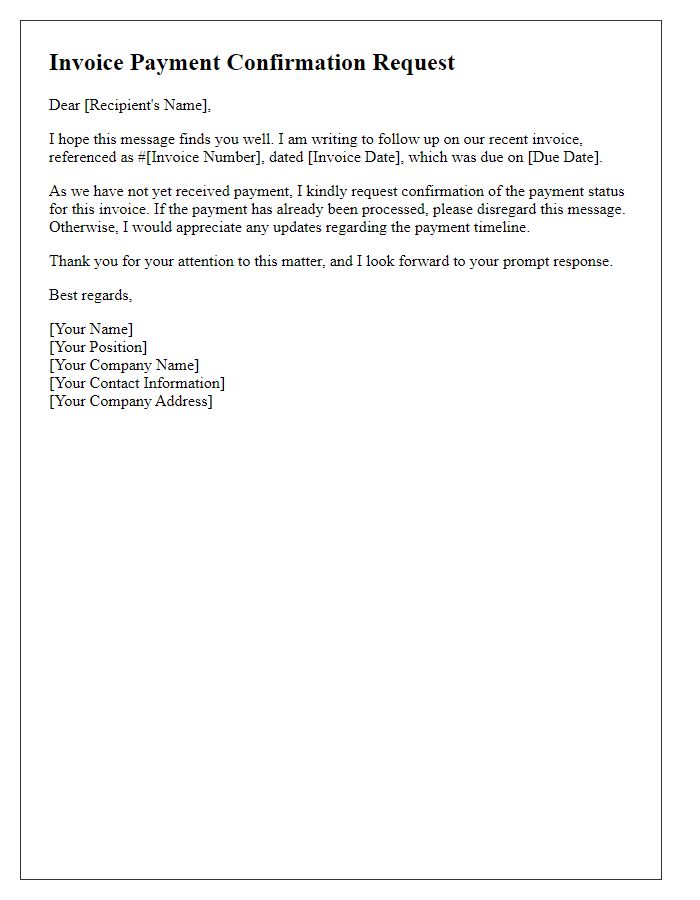

Current payment status

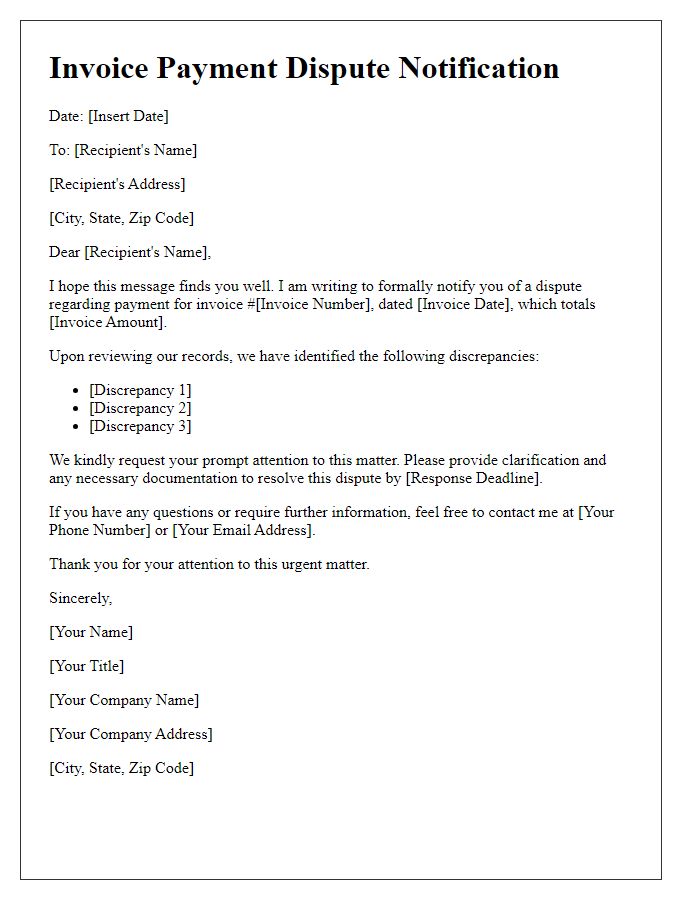

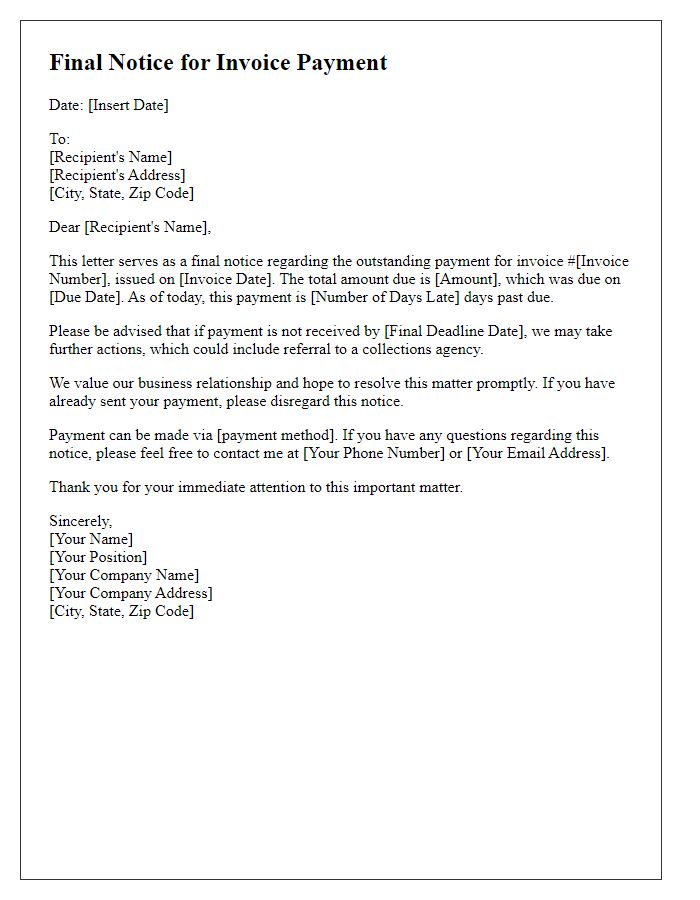

Current payment status indicates outstanding amounts due for Invoice #12345, issued on September 15, 2023, totaling $1,250. The payment was initially due on October 15, 2023. As of today, October 25, 2023, the payment is 10 days overdue, prompting the need for follow-up communication. Late fees may apply according to the terms outlined in our service agreement, which specifies a 5% penalty for payments received after the due date. It is essential to review your accounts payable records and ensure settlement to maintain a positive business relationship with our company.

Outstanding amount

An outstanding payment status can significantly impact business operations. The total outstanding amount may vary, for example, \(2,500\) USD, which remains overdue by \(30\) days beyond the original due date. Late payments can incur additional fees (typically around \(1.5\%\) per month) as stipulated in service agreements. Tracking and updating the status of unpaid invoices through accounting software helps maintain financial health, ensuring that cash flow remains stable for ongoing projects or expenditures. Regular follow-up communications with clients may enhance recovery rates, fostering positive relationships while addressing outstanding balances effectively.

Contact information for queries

Invoicing systems require clear status updates to ensure smooth transactions between businesses. Invoice payments can be tracked efficiently through effective communication with clients. Providing contact information is essential for queries related to invoice payments. Use designated agents, such as finance department representatives or accounts receivable managers, for inquiries. Include phone numbers (e.g., +1-555-123-4567), email addresses (e.g., finance@company.com), and office hours (e.g., Monday to Friday, 9 AM to 5 PM EST) to facilitate prompt responses. This practice enhances transparency and fosters trust in financial dealings.

Comments