If you've ever faced the frustration of an incorrect invoice, you know how important it is to address the issue promptly and professionally. In this article, we'll explore the essential elements of a letter template that you can use to request a correction on your invoice. From the appropriate greeting to the necessary details, we'll guide you through crafting a clear and effective request. Ready to make your invoicing process smoother? Let's dive in!

Clear Subject Line

A clear subject line, such as "Request for Invoice Correction - Invoice #12345," ensures immediate understanding of the email's purpose. Specific invoice number facilitates easy reference for accounting teams. Including dates relevant to transactions enhances clarity of the request. For instance, mentioning the invoice date (January 15, 2023) and the due date (February 15, 2023) provides context. Highlighting discrepancies, like incorrect billing amounts or missing line items, allows for prompt action. Providing your contact information also enables swift communication for resolution. Clear and concise language helps in maintaining professionalism throughout the correspondence.

Accurate Contact Information

Inaccurate contact information can lead to significant issues in business transactions, including communication delays and potential misunderstandings. For example, incorrect email addresses or phone numbers may prevent timely correspondence, causing invoice disputes. Accurate contact details, such as the correct recipient name and address, ensure invoices are delivered promptly to the intended person, whether at a corporate office in Manhattan or a regional branch in Austin. Proper contact information also aids in maintaining strong business relationships, as it reflects professionalism and attention to detail, which can ultimately affect payment timelines and financial efficiency.

Original Invoice Details

Original invoices play a crucial role in maintaining accurate financial records for businesses. The invoice number (typically a unique identifier like INV-1234) is essential for tracking transactions. Dates (e.g., issue date such as October 1, 2023) provide a timeline for when services were rendered or products sold. Item descriptions (e.g., electronic components such as resistors or capacitors) clarify what was provided and their associated costs. Quantities enable precise calculations of total amounts owed, while tax details (e.g., applicable VAT at 20%) reflect legal requirements in specific regions such as the European Union. An accurate billing address (e.g., 123 Business Lane, Commerce City, CA) ensures that generated documents reach the correct company for payment processing. Each of these elements contributes essential context to the overall financial documentation process.

Detailed Error Description

Example output: Invoice discrepancies can arise due to various reasons, such as incorrect billing amounts or misapplied discounts on documents issued by companies like Acme Corp. An error in the invoice number (e.g., INV-12345) can lead to confusion in tracking payments. Additionally, discrepancies in quantities of items listed (e.g., quantity of widgets ordered versus quantity billed) can distort financial records. Dates on invoices should align accurately with the service delivery date (e.g., service provided on March 10, 2023, versus invoice issued on March 15, 2023). Addressing these details in the request for invoice correction can help ensure accurate accounting and smooth financial transactions.

Corrected Invoice Request

An invoice correction request arises when inaccuracies are identified in previously issued invoices. This process typically involves providing updated financial documents that clarify correct product details, pricing, and billing information. For instance, discrepancies may occur with line items reflecting charges from a specific transaction dated December 15, 2022, in San Francisco, California. Addressing these inaccuracies promptly ensures compliance with internal accounting standards and maintains trust between businesses. Accurate invoices also support efficient record-keeping for tax purposes and financial audits, minimizing the risk of complications during year-end reviews.

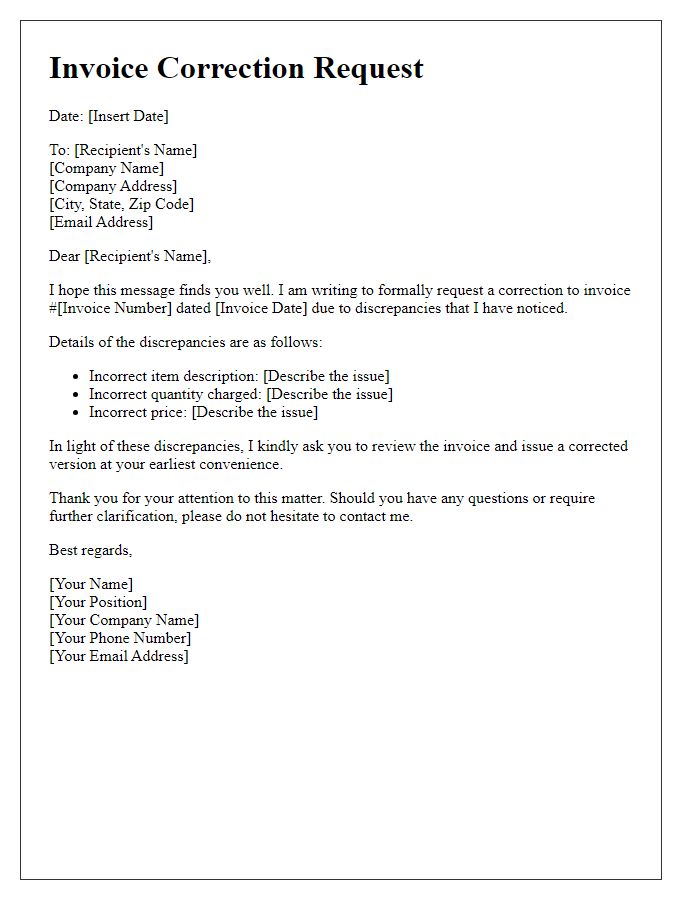

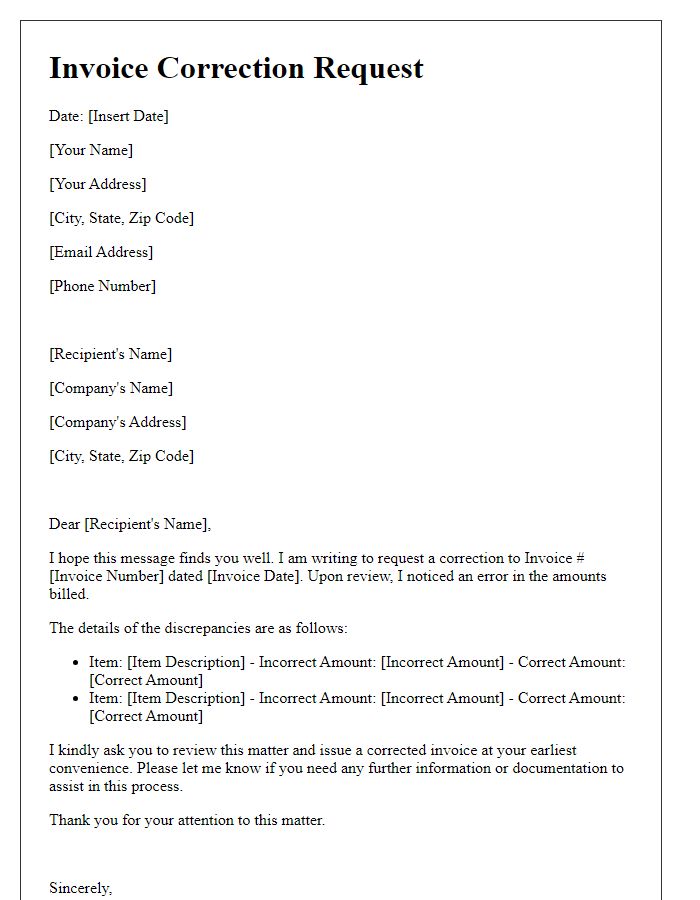

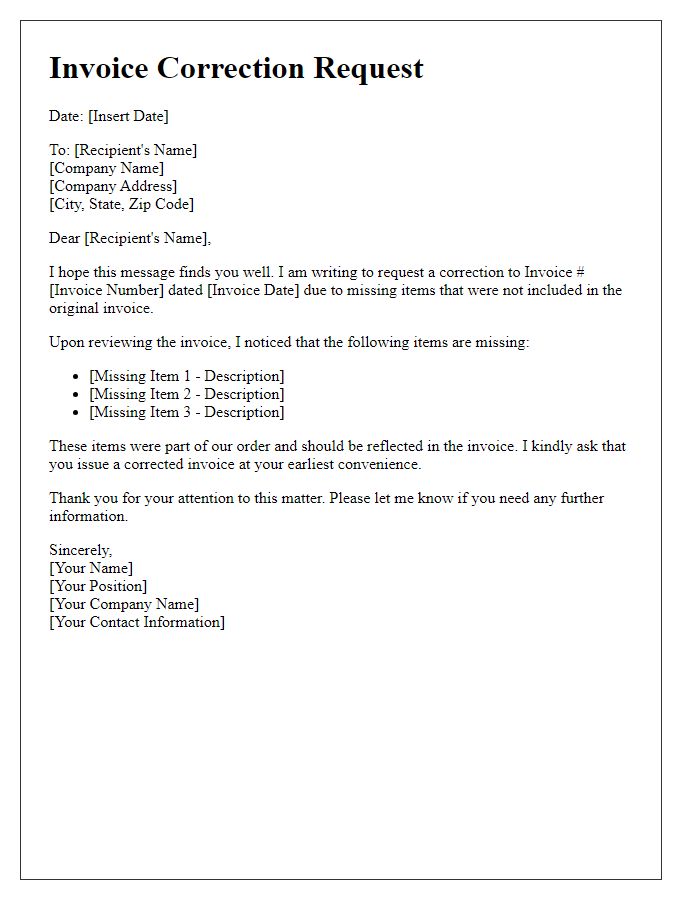

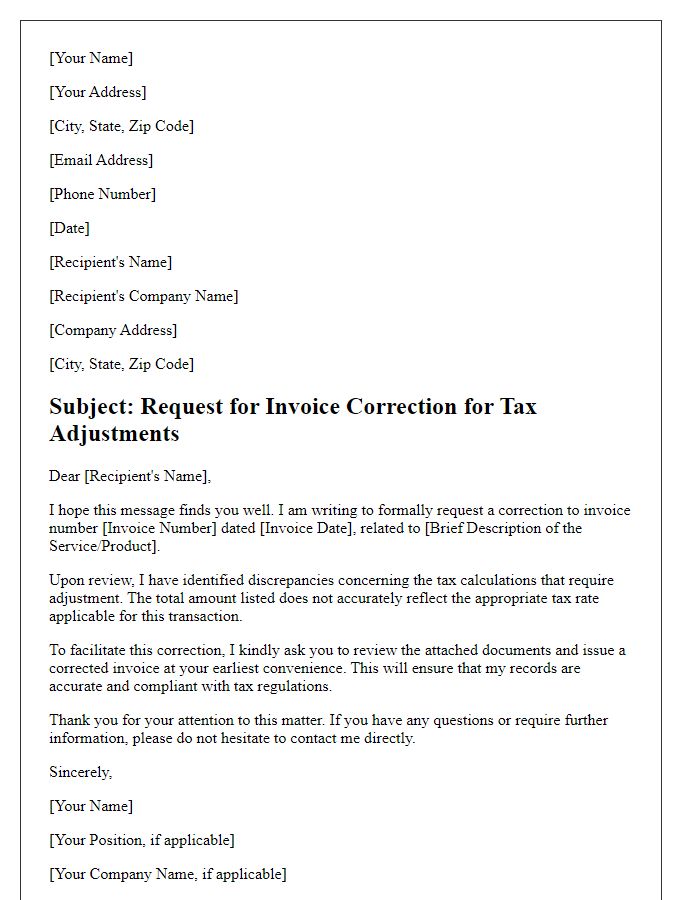

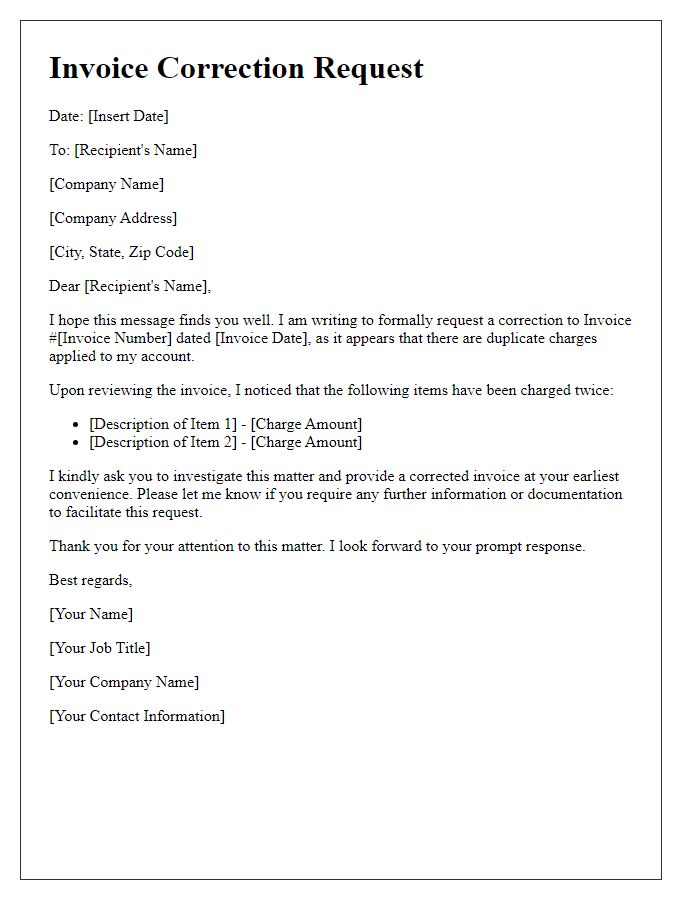

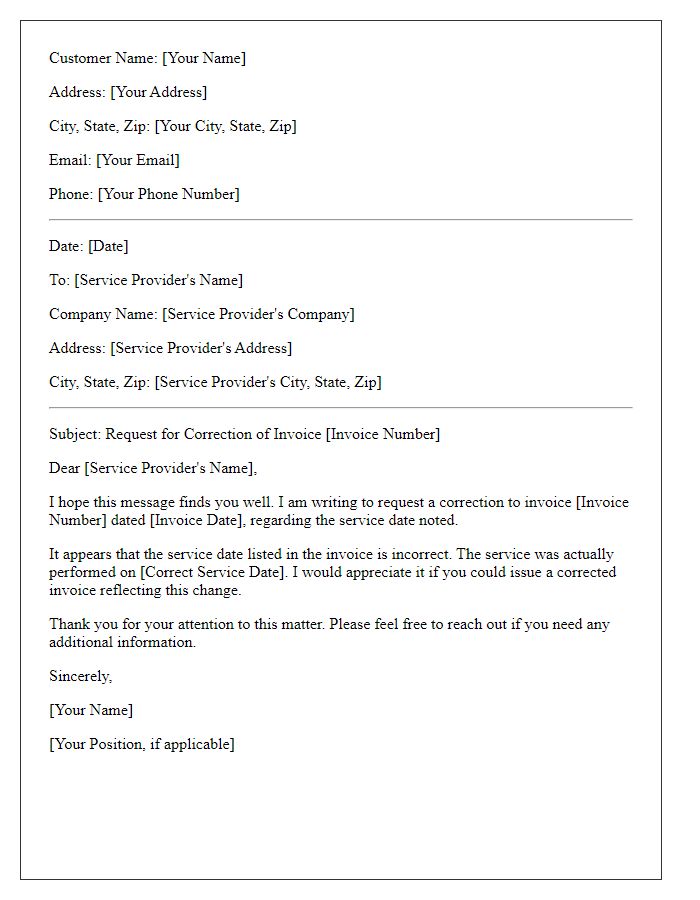

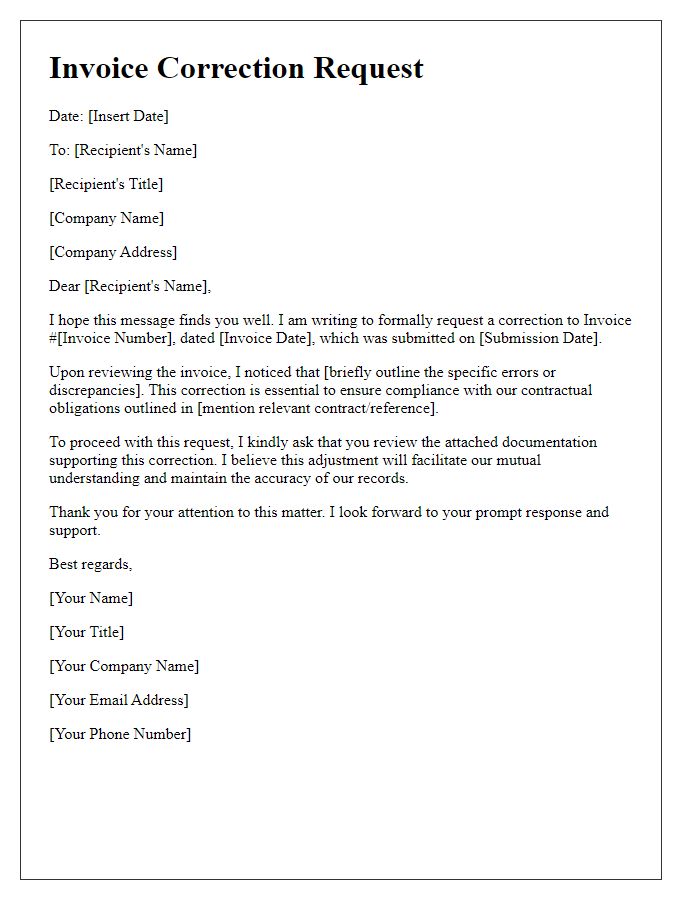

Letter Template For Invoice Correction Request Samples

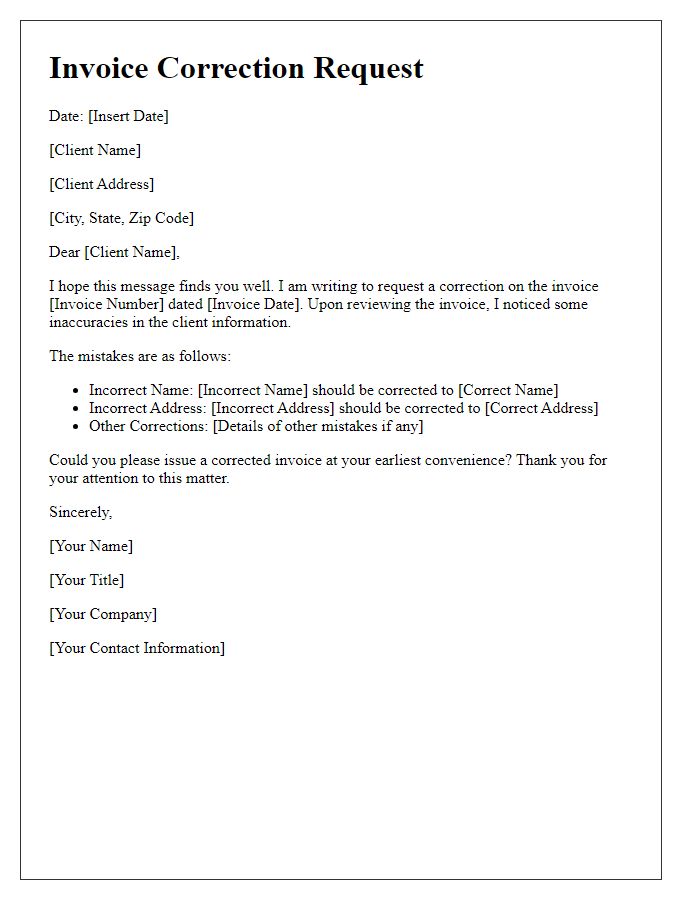

Letter template of invoice correction request for client information mistakes

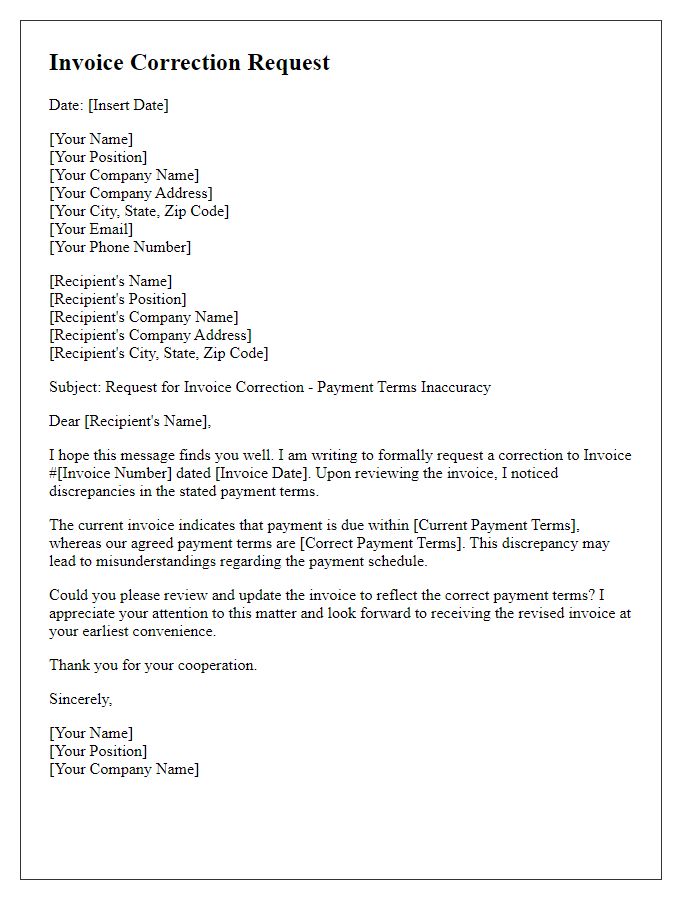

Letter template of invoice correction request for payment terms inaccuracies

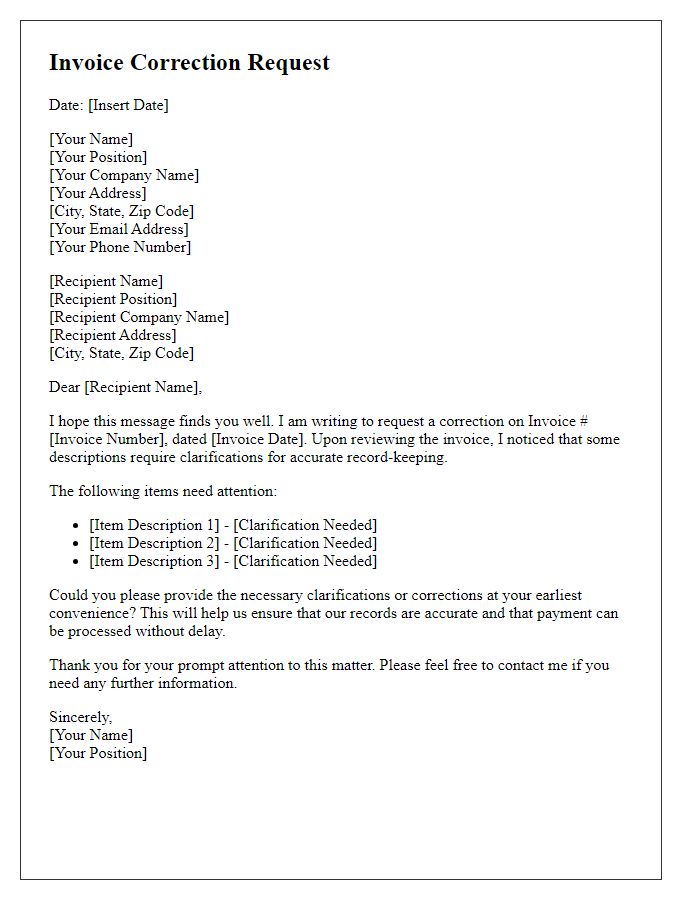

Letter template of invoice correction request for description clarifications

Comments