Are you grappling with settling an invoice while maintaining a positive relationship with your client? Navigating the world of invoice negotiations can be tricky, but with the right approach, you can foster understanding and find a resolution that suits both parties. Setting the tone for a productive conversation is key, and a well-crafted letter can make all the difference. So, if you're ready to learn how to draft an effective invoice settlement negotiation letter, let's dive deeper into the details!

Clear Identification of Invoice Details

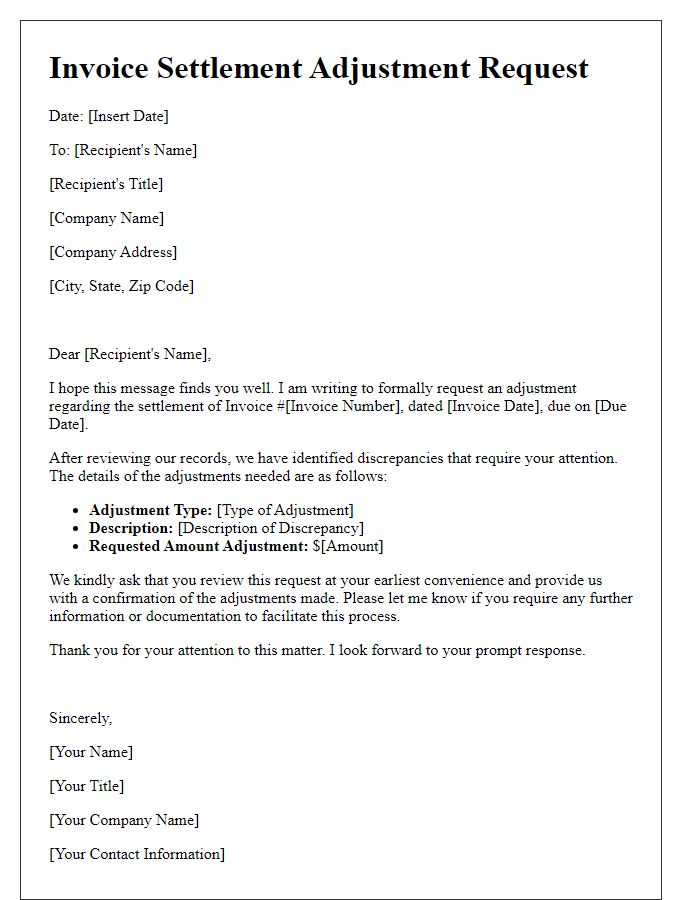

Clear identification of invoice details is crucial for efficient negotiation and resolution of outstanding payments in business transactions. Each invoice should include unique identifiers such as invoice number (e.g., 2023-001), date of issue (e.g., October 1, 2023), and due date (e.g., October 15, 2023). Essential information such as the company name (e.g., ABC Supplies Ltd), contact information (e.g., phone number, email address), and total amount due (e.g., $2,500) must be clearly stated for reference. Itemized descriptions (e.g., Quantity, description of goods/services, unit price) enhance clarity, while payment terms (e.g., net 30) stipulate conditions for settlement. Any previous communication regarding the invoice (e.g., emails, reminders) should also be documented to provide a complete context for negotiation.

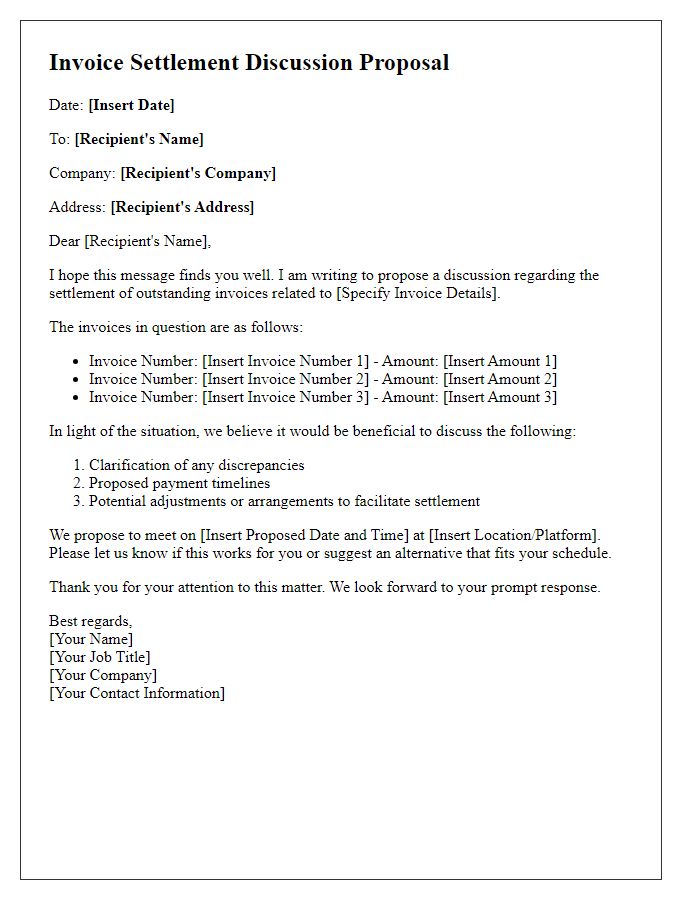

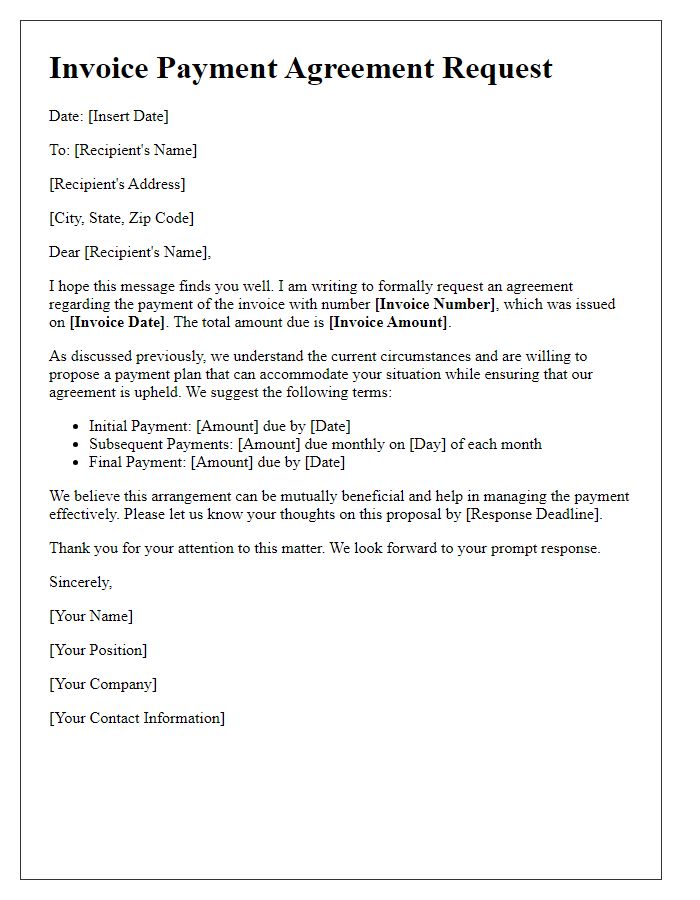

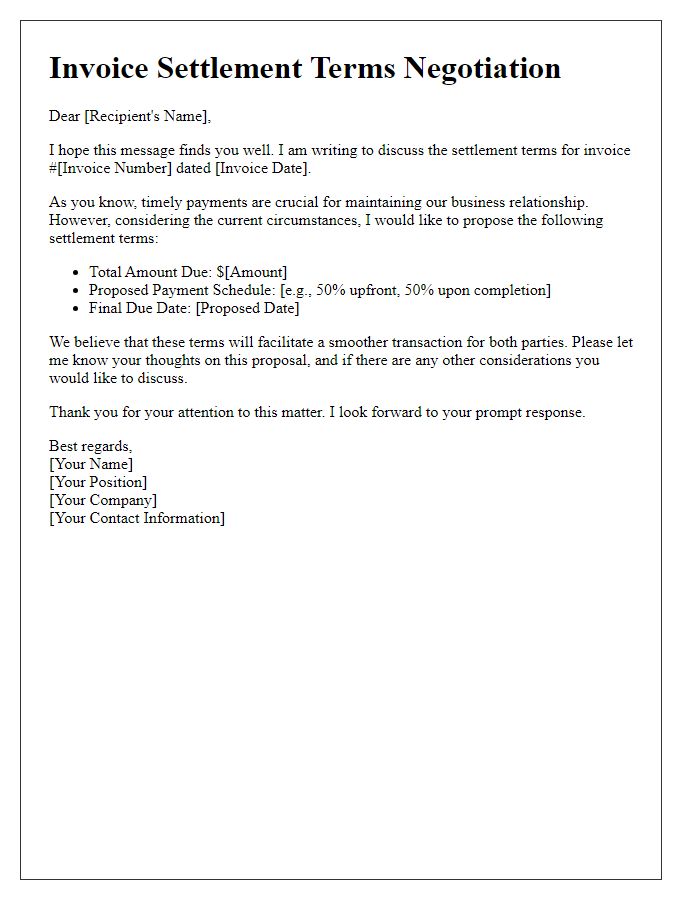

Proposed Settlement Terms

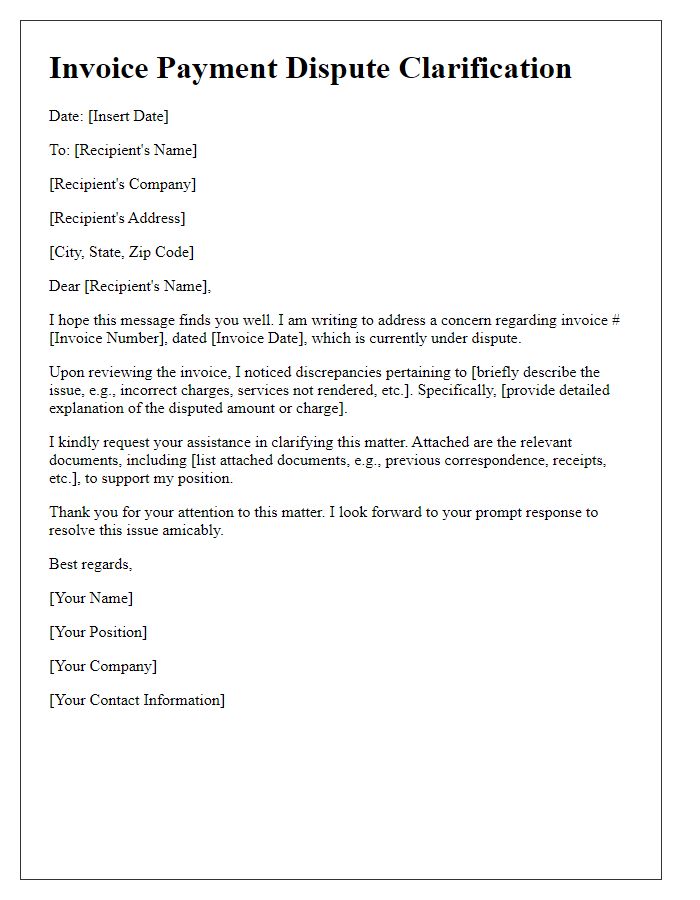

Negotiating a settlement for invoice discrepancies can involve various terms and conditions. Effective communication is essential for reaching an amicable agreement. When both parties propose their settlement terms, they outline key aspects such as payment amounts, timelines, and potential discounts. Invoice discrepancies often arise from product delivery issues, service errors, or billing inaccuracies, all of which can impact operational costs. Clear documentation of prior agreements, such as the original contract date and agreed payment methods, establishes a foundation for the negotiation. Additionally, including specific invoice numbers and amounts owed aids in clarifying the context and urgency of the discussion.

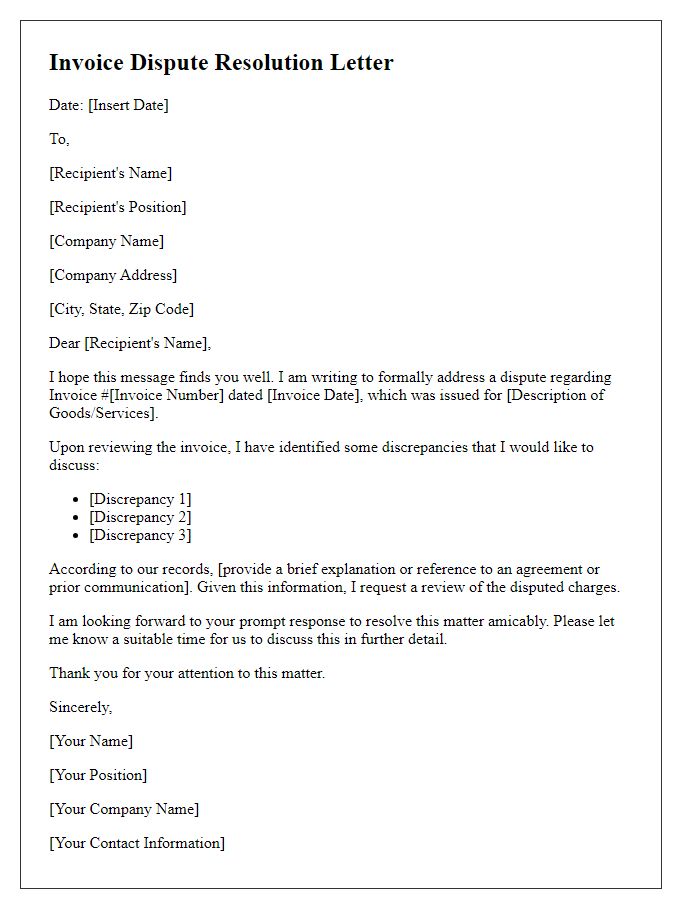

Justification for Negotiation

Effective invoice settlement negotiation can significantly impact cash flow and financial relationships. Disputes over charges (often exceeding 10% of total invoices) may arise due to discrepancies in service delivery, contract terms, or misunderstandings regarding payment timelines. Establishing clear communication channels and documentation (such as emails or contracts from the initial agreement) is essential for addressing these issues. Additionally, presenting data (like payment history or industry benchmarks) can support the case for negotiation, demonstrating a willingness to find a fair compromise. It is crucial for businesses to approach negotiations professionally, aiming for outcomes that maintain long-term partnerships while ensuring financial stability.

Request for Confirmation and Follow-up

In the bustling city of New York, business negotiations frequently involve invoice settlements that require timely communication. For instance, firms often seek to confirm rationale behind specific charges listed in invoices, especially when amounts exceed $10,000. In many cases, businesses might initiate follow-up discussions to clarify discrepancies or negotiate payment terms. Additionally, confirming receipt of the invoice-related communication plays a crucial role in maintaining clear records, especially in industries like finance or construction where documentation is vital for compliance purposes and ongoing projects worth millions. Prompt engagement in these discussions helps prevent delays in cash flow, crucial for maintaining operational stability in fast-paced environments.

Professional and Courteous Tone

Invoicing discrepancies can lead to financial strain on businesses and require careful negotiation tactics. Invoice details, providing clear breakdowns of costs, project names, and delivery timelines, are essential for achieving settlement resolutions. Company representatives should approach negotiations with clear figures, such as outstanding amounts and payment terms, to facilitate transparent discussions. Addressing concerns in a courteous and professional manner fosters positive relationships, enabling successful negotiations. Leveraging established communication channels, like emails or formal meetings, helps ensure clarity and prevent misunderstandings during such discussions. This strategic approach can lead to mutually beneficial outcomes, ensuring both parties feel valued and understood.

Comments