Are you often left puzzled by the complexities of invoices? You're not alone! Many individuals and businesses find themselves grappling with line items, fees, and totals that can make their heads spin. In this article, we'll break down the common components of invoices and provide a clear, detailed explanation to help you understand exactly what you're paying forâso read on to demystify the world of invoicing!

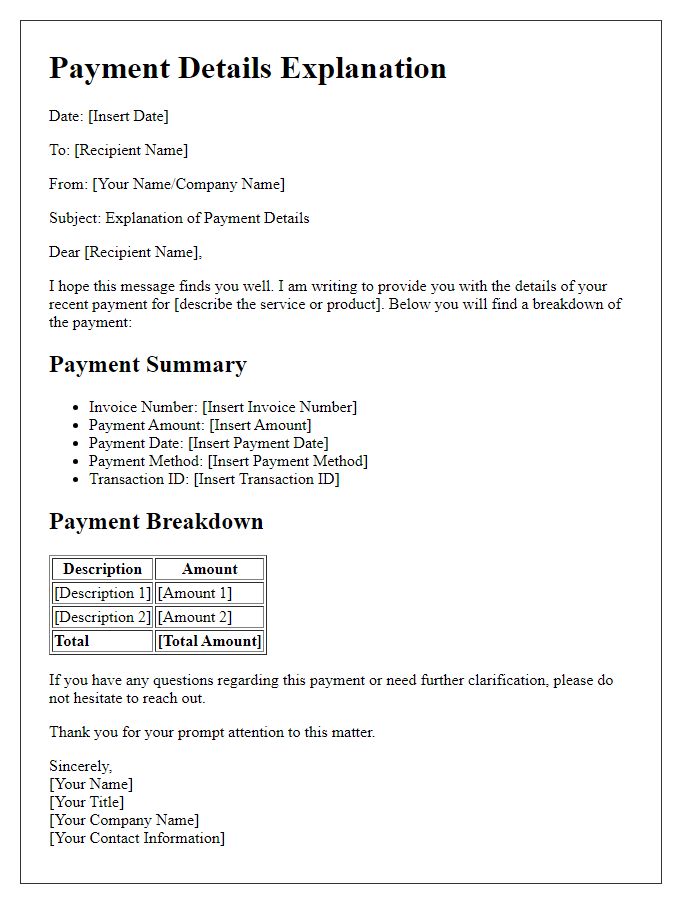

Clear and Concise Language

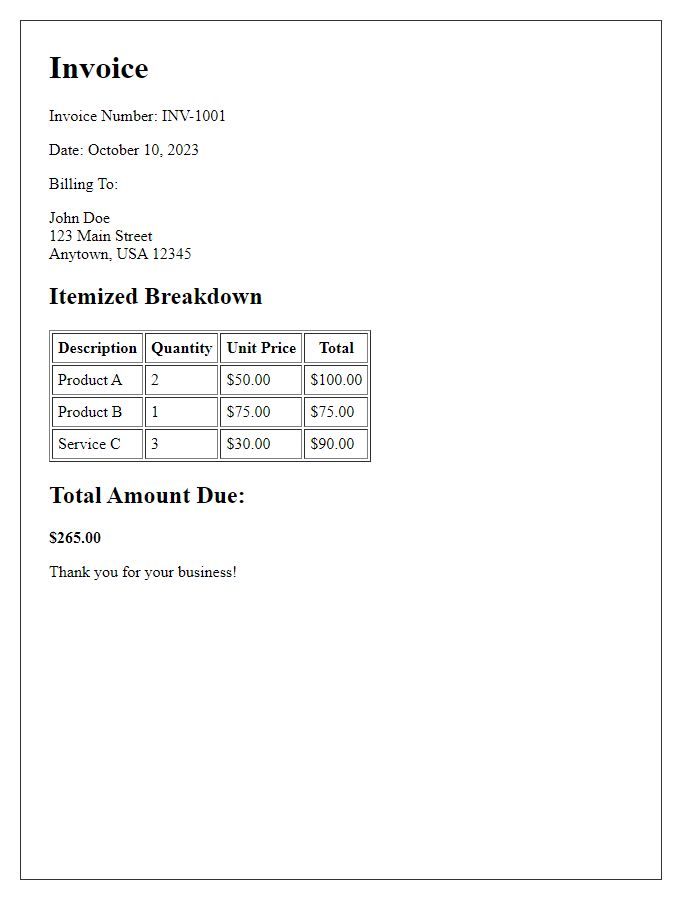

An invoice is a crucial financial document, detailing the transaction between a buyer and a seller. It typically includes key elements such as invoice number (unique identifier), date of issuance (when the invoice is generated), and payment terms (conditions for payment). Line items display products or services provided, along with quantities and individual prices, leading to a subtotal. Tax rates (local regulations, typically around 5% to 15%) may also apply, impacting the final total amount due. Additionally, payment methods (such as credit card, bank transfer, or PayPal) should be specified for clarity. Ensuring that all information is presented in a clear and structured format aids in preventing disputes and facilitates timely payments.

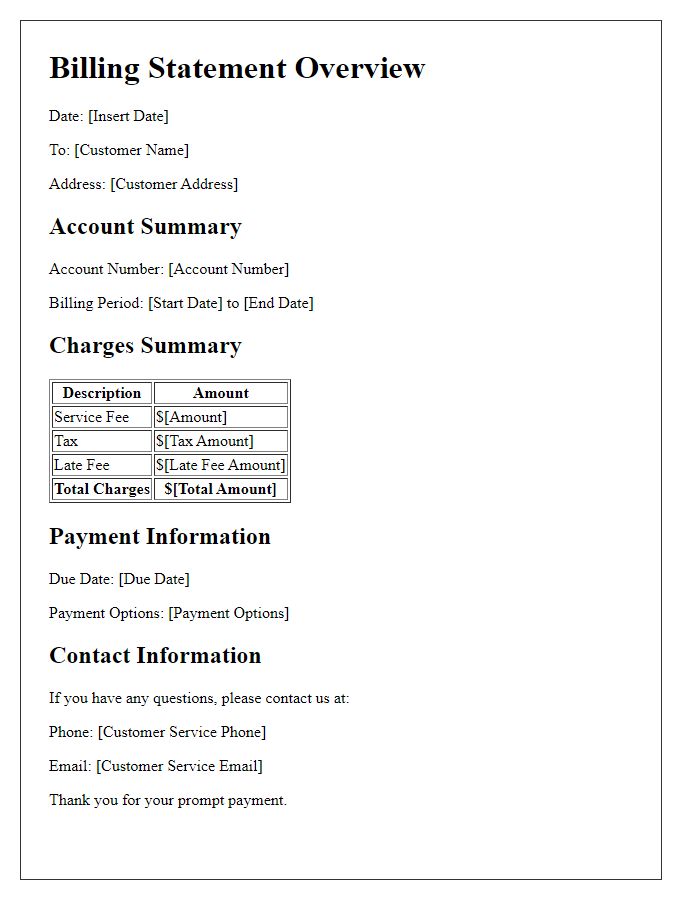

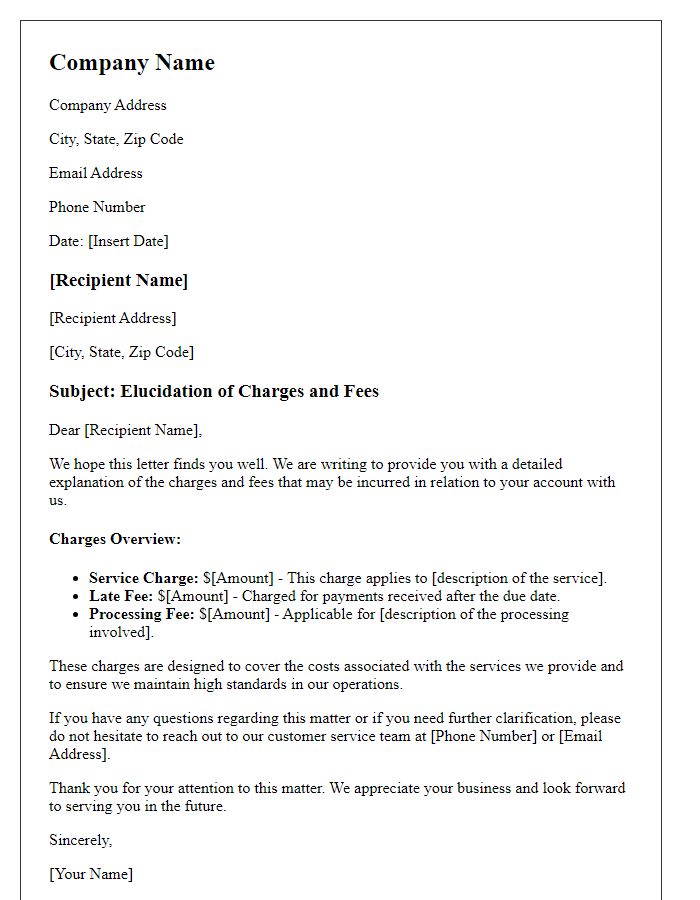

Detailed Breakdown of Charges

A detailed invoice explanation can clarify the charges incurred during a transaction, ensuring transparency. Each line item should specify the service or product provided, accompanied by a precise quantity, unit price, and total cost. For instance, a plumbing service might include the labor charge (e.g., $100 per hour for four hours), the cost of materials (e.g., $50 for PVC pipes), and any additional fees (e.g., a $20 travel charge for distance over 20 miles from the shop in Springfield, Illinois). Each charge should be itemized clearly to allow clients to understand how the final total was derived. For example, if an invoice totals $500, it could break down into $400 for labor, $70 for materials, and $30 for a service fee, providing clients with a comprehensive look at their expenditure. This transparency fosters trust and facilitates prompt payments.

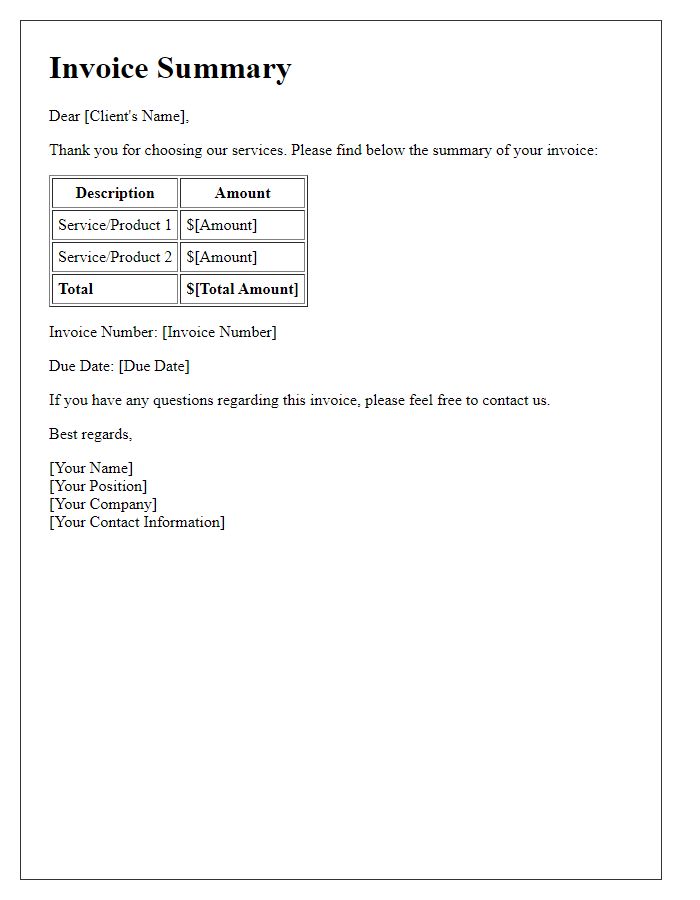

Customer Specific Information

In detailed invoices, specific customer information is crucial for clarity and accuracy. Names, such as John Doe Enterprises, identify the recipient clearly. Address details, including 1234 Elm Street, Springfield, IL 62704, ensure proper delivery and communication. Invoice numbers (e.g., INV-2023-00123) uniquely track transactions and aid in organizing records. Dates (e.g., Invoice Date: October 1, 2023) indicate when services or products were rendered and head towards payment timelines. Payment terms (e.g., Due by October 15, 2023) clarify expectations regarding settlement. Itemized lists describe products or services (e.g., Consulting Services, 5 hours at $100/hour) alongside quantities and unit prices, reflecting specifics of the transaction. Tax details (e.g., 7% sales tax) illustrate applicable government levies, enhancing transparency. Total amounts (e.g., $500.00) encapsulate the final cost, simplifying the payment process for clients.

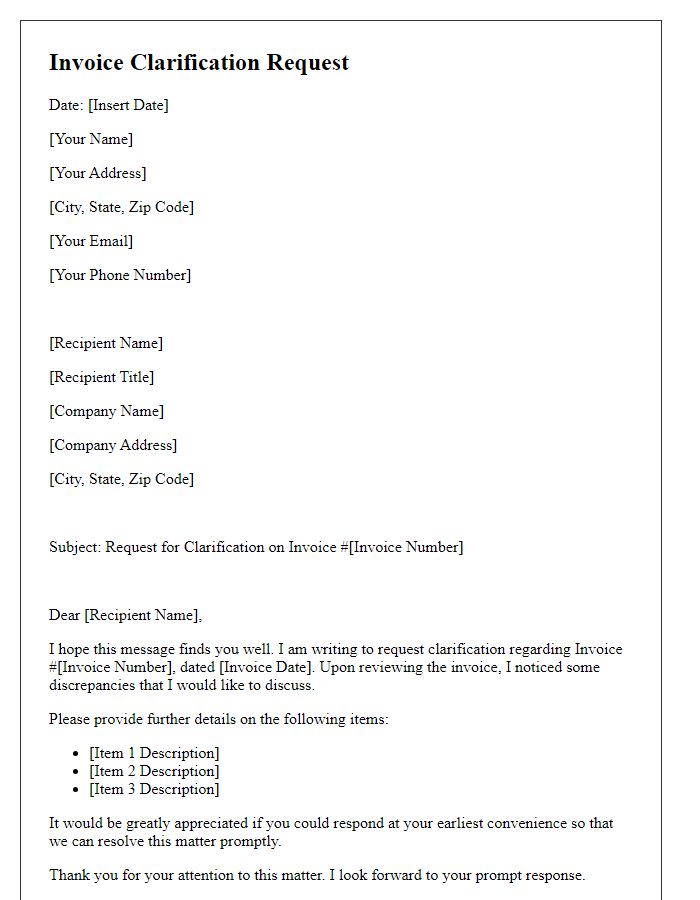

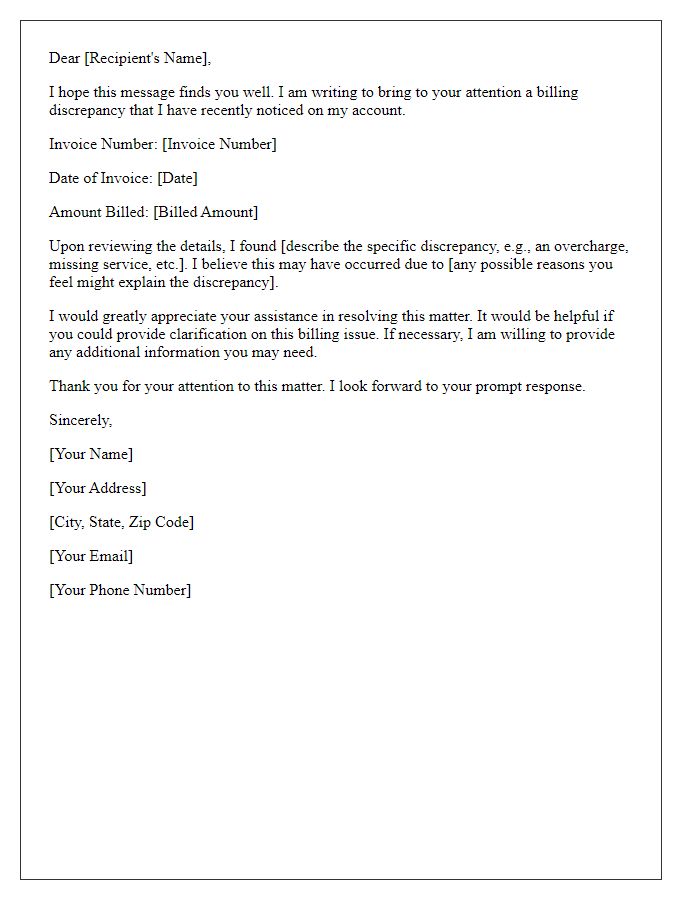

Contact Information for Inquiries

Contact information for inquiries regarding detailed invoices must be clear and accessible. The company's billing department in New York, ZIP 10001, typically handles all invoice-related questions. A dedicated email address, such as billing@companyname.com, is essential for efficient communication. Phone support, available at +1 (555) 123-4567 from 9 AM to 5 PM EST, provides immediate assistance. Including a website link, www.companyname.com/contact, can facilitate further inquiries and streamline the process for clients seeking clarification on charges, payment methods, or discrepancies found on their invoices.

Professional and Polite Tone

A detailed invoice explanation highlights essential components and ensures transparency for clients. An invoice typically includes an itemized list of services or products rendered, each with a corresponding cost, such as labor charges for services performed by skilled technicians, and material costs for high-quality raw supplies. The invoice may also specify the total amount due, including any applicable taxes like sales tax (up to 10% in certain jurisdictions), payment terms (such as net 30 days), and methods accepted like credit cards or bank transfers. A breakdown of discounts provided, if applicable, should also be included to emphasize fair pricing practices and customer appreciation. Moreover, including the invoice date and a unique invoice number aids in accurate record-keeping and facilitates easy reference for both clients and businesses.

Comments