Hey there! If you've ever had to deal with an invoice that needed a little tweaking, you're not alone. Amendments happen more often than you'd think, and knowing how to communicate those changes effectively can save you time and eliminate confusion. So, let's dive into the essentials of crafting the perfect letter to notify clients of an invoice amendmentâyou won't want to miss it!

Header Information

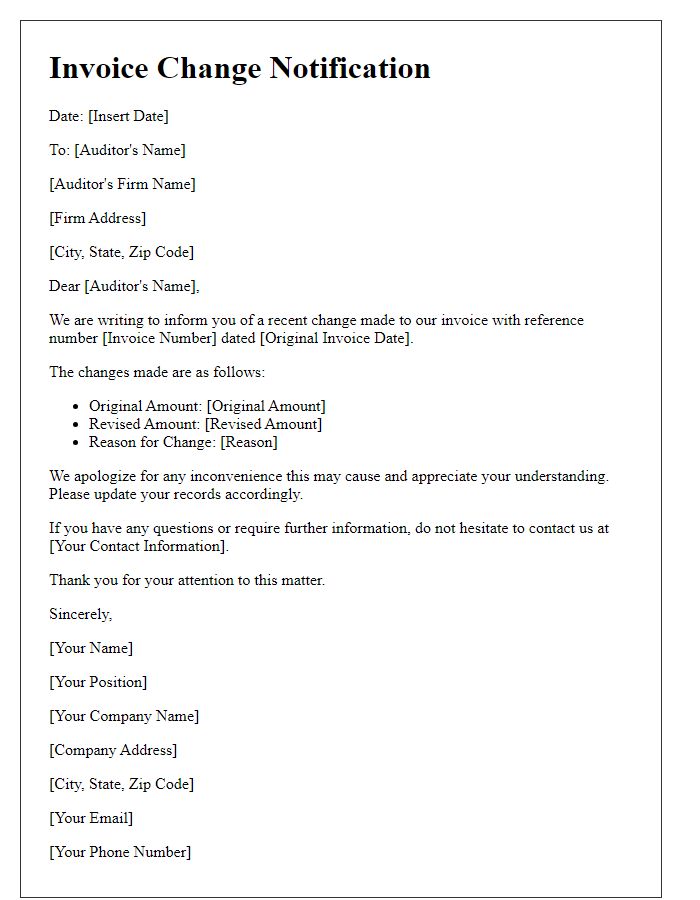

An invoice amendment notification consists of critical header information that ensures all parties are informed clearly. The notification should include the company name (ABC Services, Inc.), address (123 Business Lane, Suite 202, Cityville, ST, 12345), phone number (123-456-7890), and email address (contact@abcservices.com). The invoice number (INV-001234) associated with the original transaction must be prominently displayed, along with the amendment date (October 10, 2023). Additionally, a reference to the client's name (John Doe Enterprises) and their address (456 Client Ave, Townsville, ST, 67890) establishes the relationship. It's vital to indicate the reason for amendment (error correction, additional charges) to promote transparency in the transaction.

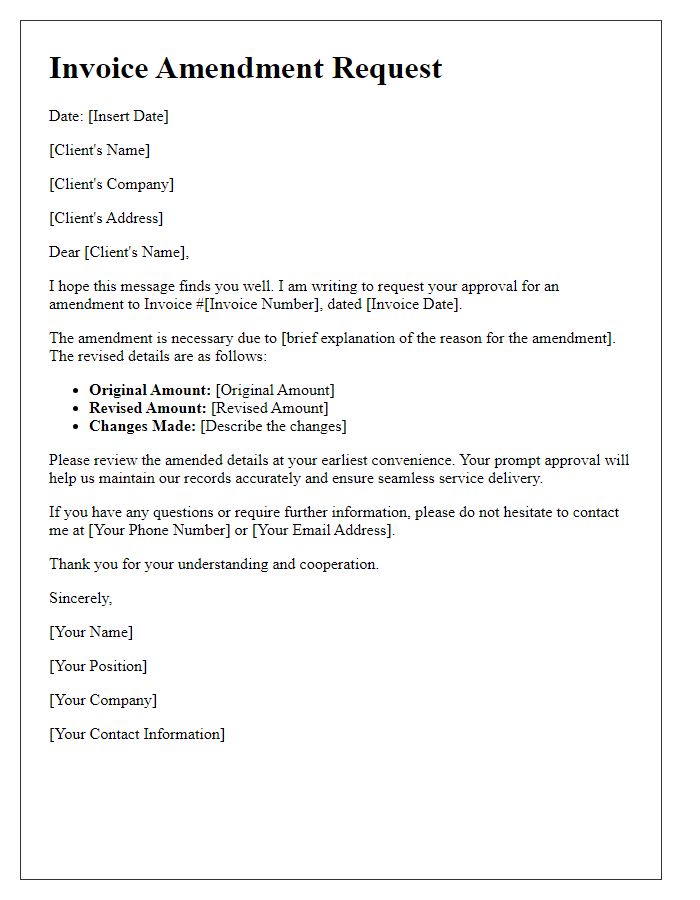

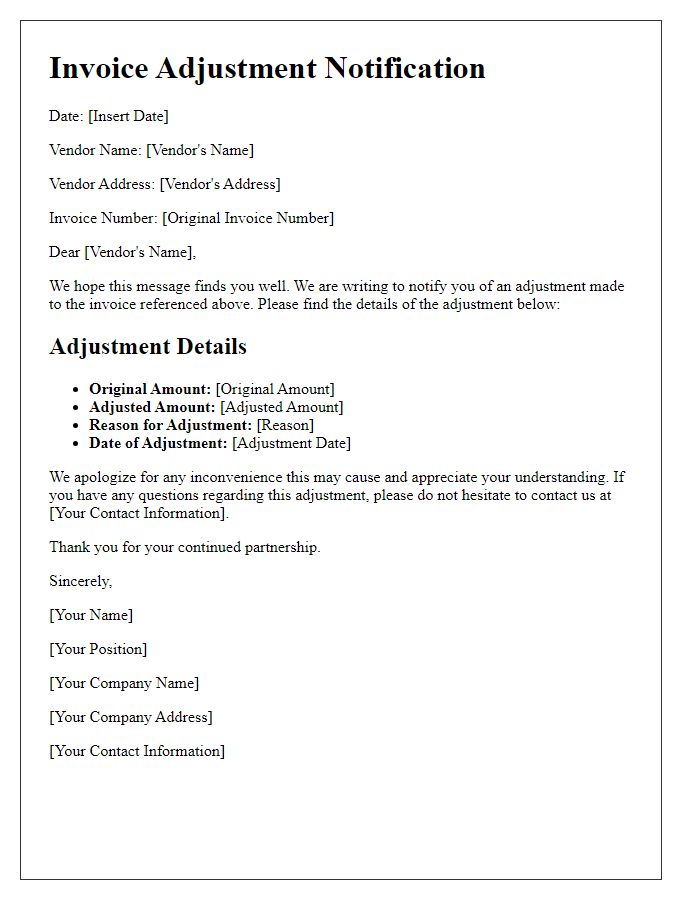

Recipient Details

Amending an invoice requires clear communication regarding recipient details to ensure accuracy. The recipient's name, typically a business or individual, must be prominently displayed, including their full name or company name. The physical or mailing address should be included, featuring street number, street name, city, state, and postal code to guarantee proper delivery of correspondence. Important contact information, such as a telephone number and email address, facilitates quick resolution of any discrepancies or queries related to the amended invoice. This attention to detail helps maintain professionalism and fosters trust with the recipient.

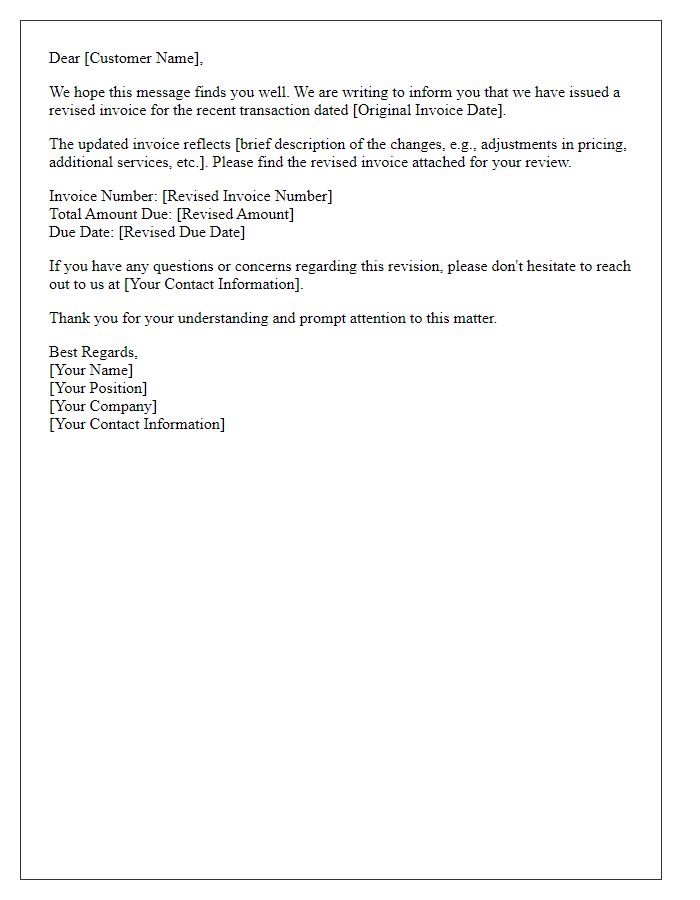

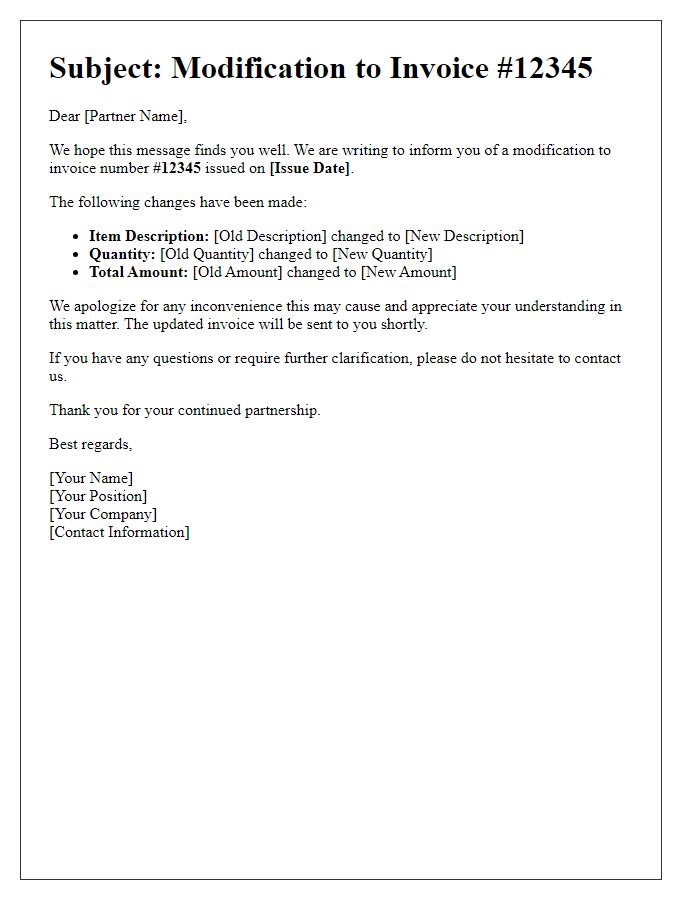

Clear Subject Line

The notification regarding an invoice amendment requires clarity and precision, ensuring that all relevant parties understand the changes made. An example of a clear subject line for such a notification could be "Invoice Amendment Notification: Invoice #12345 Updated." This subject line specifies the nature of the notification (amendment) and references the specific invoice number for easy identification. It is essential to include key details such as the date of the original invoice, the reason for the amendment, and the new total amount due. Clear communication helps prevent confusion and ensures that all parties are aligned on the updated terms presented in the revised invoice document.

Reason for Amendment

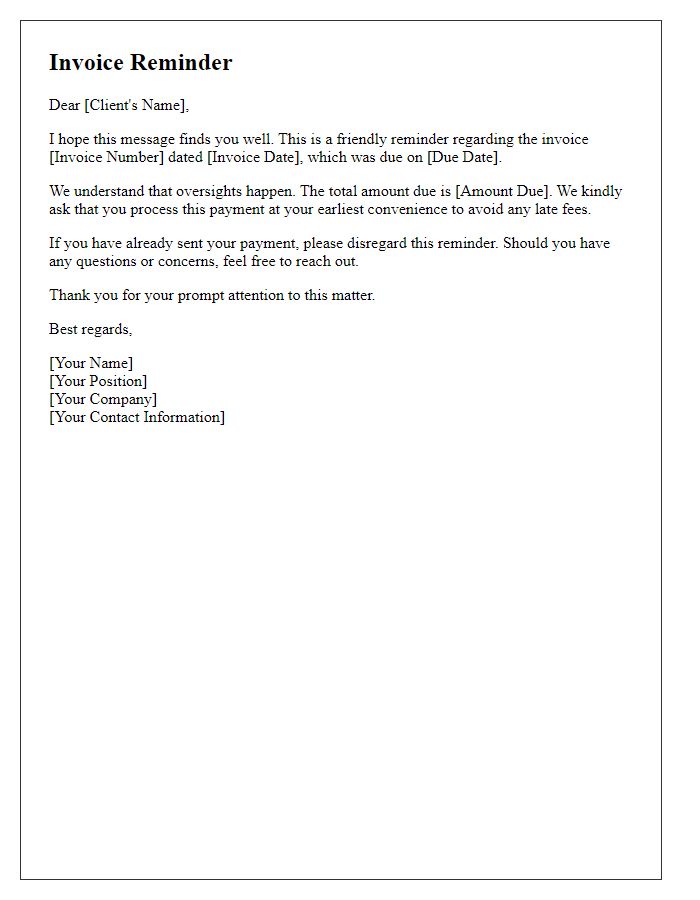

Invoice amendments often occur due to discrepancies such as billing errors, changes in service rendered, or updated pricing structures. Common reasons for amendment include incorrect item descriptions, adjustments in quantities ordered (for example, a correction from five units to four), tax recalculations, or changes in payment terms from net 30 to net 15 days. Addressing these amendments promptly ensures accurate financial records and maintains trust between parties involved, especially for businesses operating in fast-paced environments like e-commerce or freelance services. Ensuring clarity in communication regarding the amendment avoids confusion and potential disputes in future transactions.

Revised Invoice Details

In the world of financial transactions, an amended invoice can significantly impact billing accuracy and customer relations. When notifying clients about revised invoices, precise information is paramount. For instance, include the invoice number (reference to document), the original amount (before amendments), and the revised amount (after adjustments). Specify the reason for the amendment, such as corrections, additional services rendered, or discounts applied. Emphasize the new due date, especially if it has changed, to ensure timely payment. Clear communication about these details fosters transparency and can strengthen business relationships.

Comments