When it comes to ensuring swift payments for your invoices, having the right approach can make all the difference. Many businesses face delays that can hinder cash flow, but there's a simple remedy: crafting an effective letter that promotes expedited processing. In this article, we'll guide you through essential tips and a template to help you convey your request clearly and professionally. Read on to discover how a well-structured letter can get your invoices paid faster than ever!

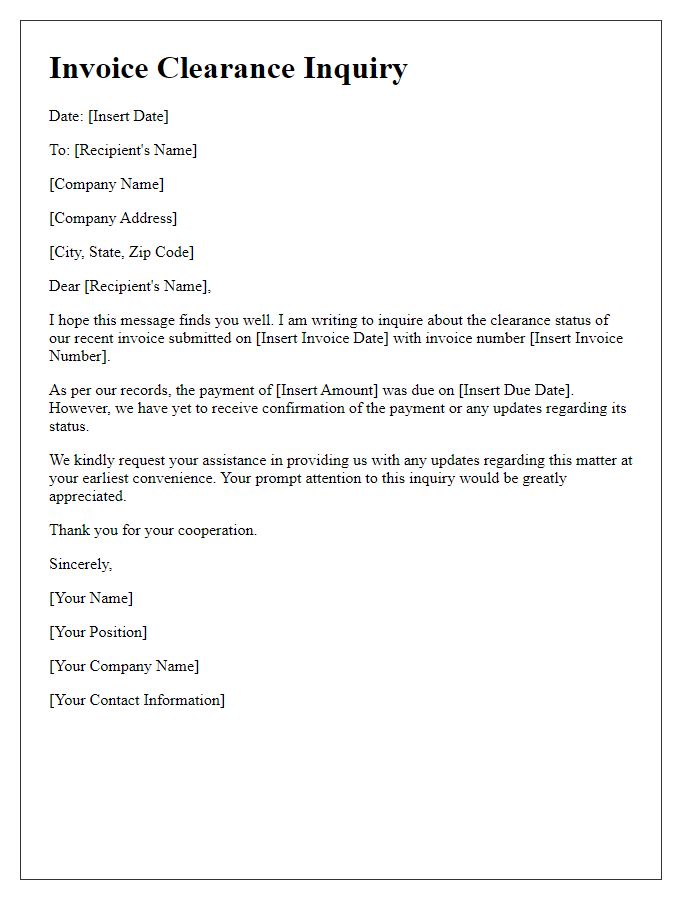

Clear Invoice Details

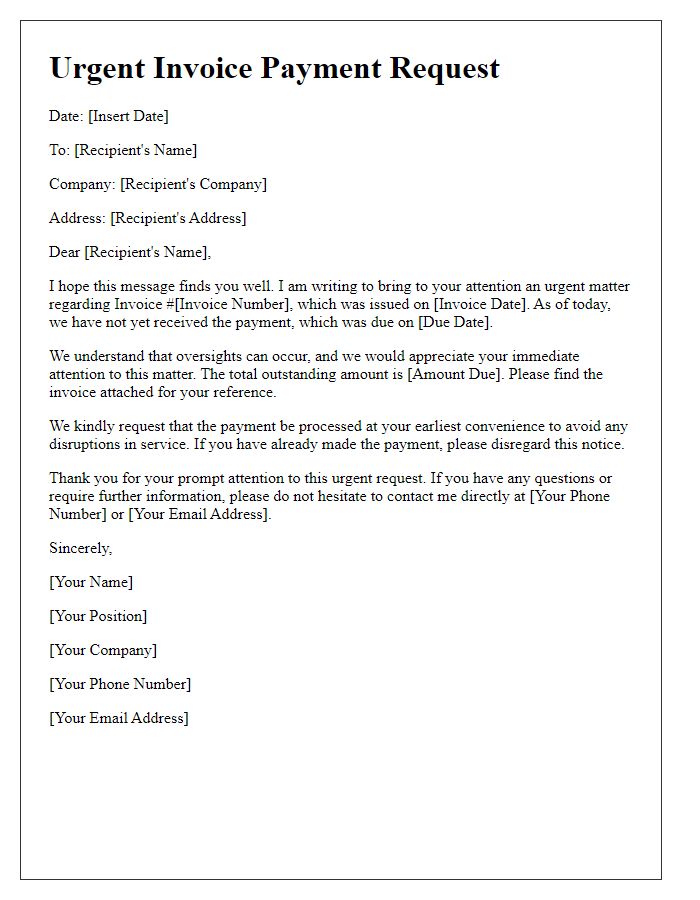

Expedited invoice payment processing requires clear invoice details to ensure swift resolution and accurate financial transactions. The invoice should include essential information such as the invoice number (unique identifier for tracking), due date (often set 30 days post-issue), total amount due (including taxes and any applicable fees), and itemized list of products or services rendered (detailing quantity, unit price, and description per line item). Additionally, payment terms (such as net 15 or net 30) and accepted payment methods (like bank transfer, credit card, or PayPal) are crucial. Clear contact information (email and phone number) facilitates communication regarding any discrepancies or questions. Accurate data reduces processing delays, ensuring timely payment and a smooth financial workflow.

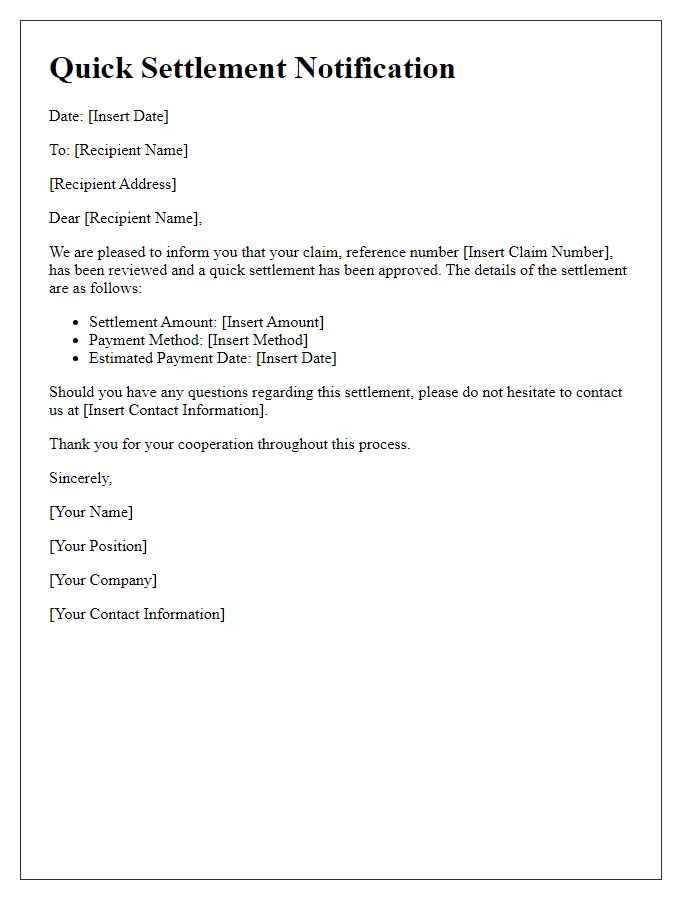

Payment Terms Clarification

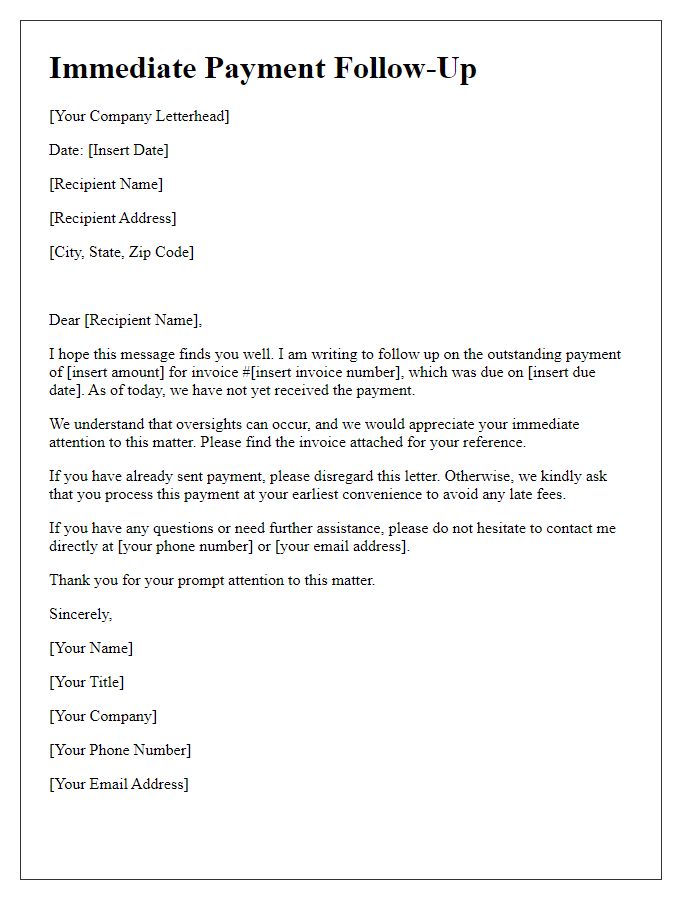

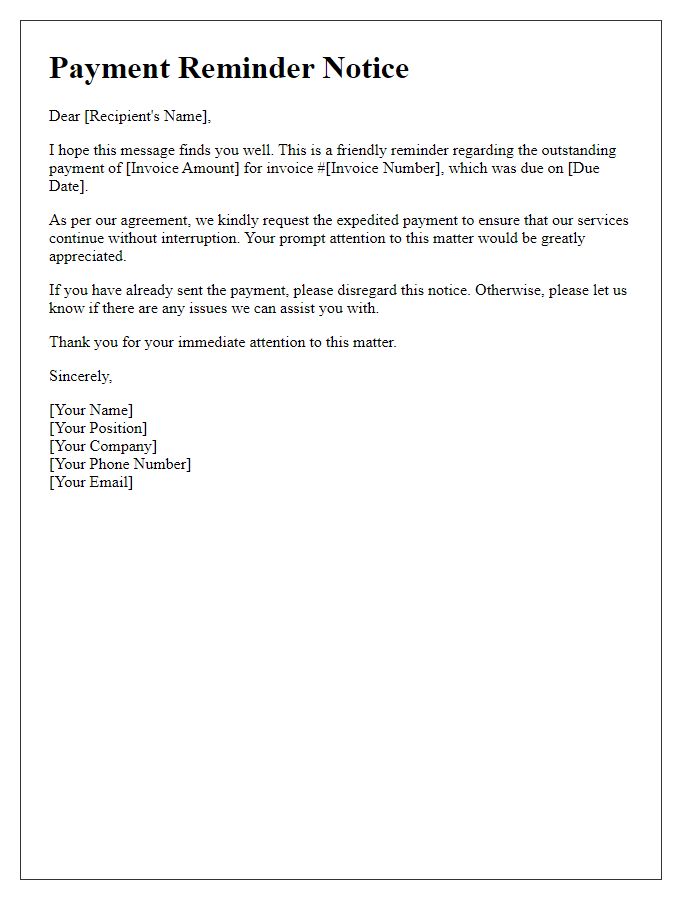

Expedited invoice payment processing can enhance cash flow management for businesses engaged in frequent transactions. Clear payment terms, typically outlined in agreements, establish expectations regarding deadlines and accepted methods. For instance, Net 30 or Net 60 terms specify payment due dates following the invoice date, providing a structured timeline for financial planning. Utilizing electronic invoicing platforms can accelerate payment cycles by enabling quicker processing and tracking. Additionally, offering discounts for early payments (e.g., 2% discount if paid within ten days) incentivizes timely settlements and fosters better client relationships. Establishing regular communication about outstanding invoices can also aid in preventing delays in payment.

Incentives for Early Payment

Companies often implement incentives for early payment of invoices to improve cash flow and maintain healthy supplier relationships. By offering discounts (commonly ranging from 1% to 5%) for payments made within specified periods (such as 10 or 15 days), organizations encourage prompt settlement. Incentives can significantly reduce accounts receivable days (the time taken to collect payments), leading to increased operational efficiency. Furthermore, timely payments can enhance credit ratings (a score reflecting creditworthiness), ensuring better financing terms in future transactions. Businesses like suppliers of raw materials or service providers in sectors like manufacturing or logistics benefit from this strategy, helping them stabilize their financial health in competitive markets.

Contact Information

Contact information plays a crucial role in facilitating expedited invoice payment processing for businesses. Vital elements typically include the business name (often reflecting the registered entity), a complete physical address (to ensure accurate delivery of correspondence), a professional email address (for swift electronic communication), and a dedicated phone number (to resolve inquiries promptly). Additionally, key individuals within the organization, such as the accounts payable manager or financial officer, should be identified with their direct contact details, enhancing efficiency. Clear presentation of this information is essential to streamline transactional processes and minimize delays in payment.

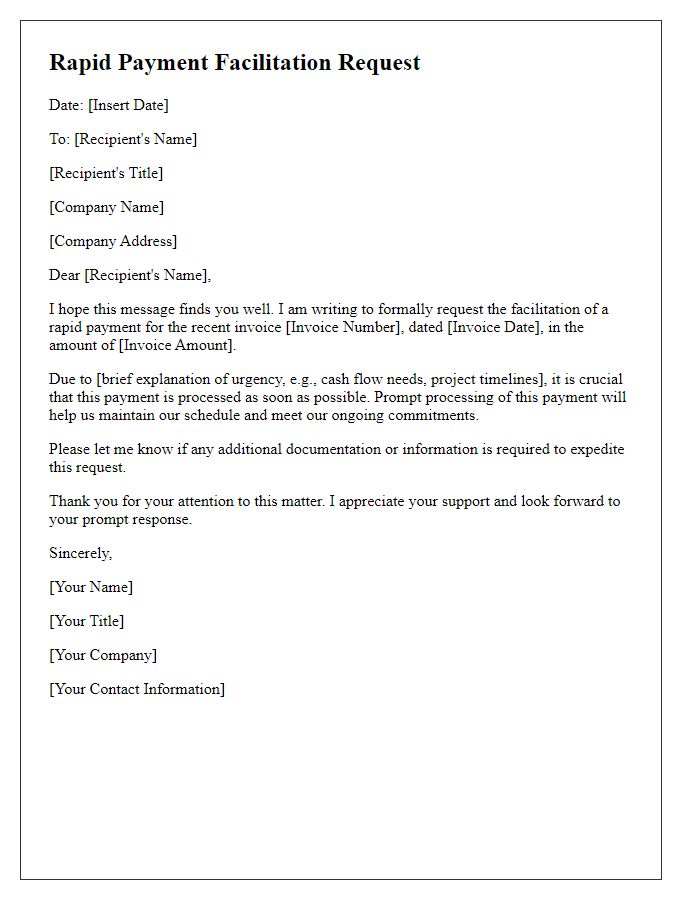

Urgency Emphasis

Expedited invoice payment processing ensures timely financial transactions for businesses, particularly in high-stakes environments. With invoices often ranging from thousands to millions of dollars, swift processing can significantly impact cash flow and operational continuity. Companies, such as those in the construction industry or technology sector, routinely rely on prompt payments to maintain project timelines and operational efficiency. Adopting methods like electronic invoicing and automated payment systems can reduce processing times from weeks to just days. In instances like government contracts or large-scale events, maintaining urgency in payment processing fosters better supplier relationships and supports ongoing projects.

Comments