Are you struggling with how to craft the perfect payment due invoice notice? You're not aloneâmany find it challenging to strike the right balance between professionalism and urgency. In this article, we'll provide you with a helpful letter template that ensures your message is clear and effective, encouraging timely payments while maintaining positive relationships. Ready to take the next step in your invoicing game? Let's dive in!

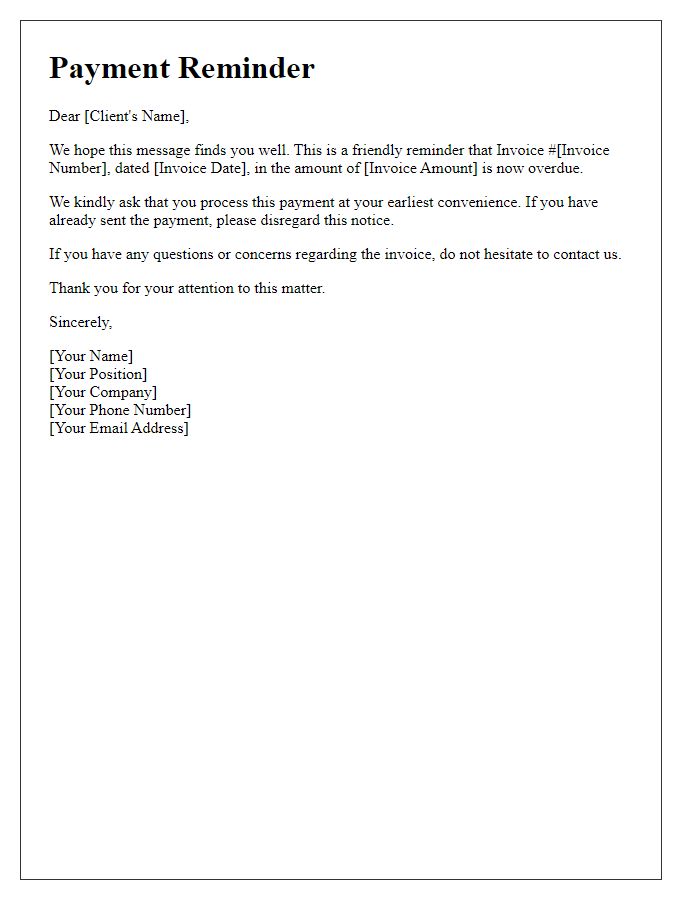

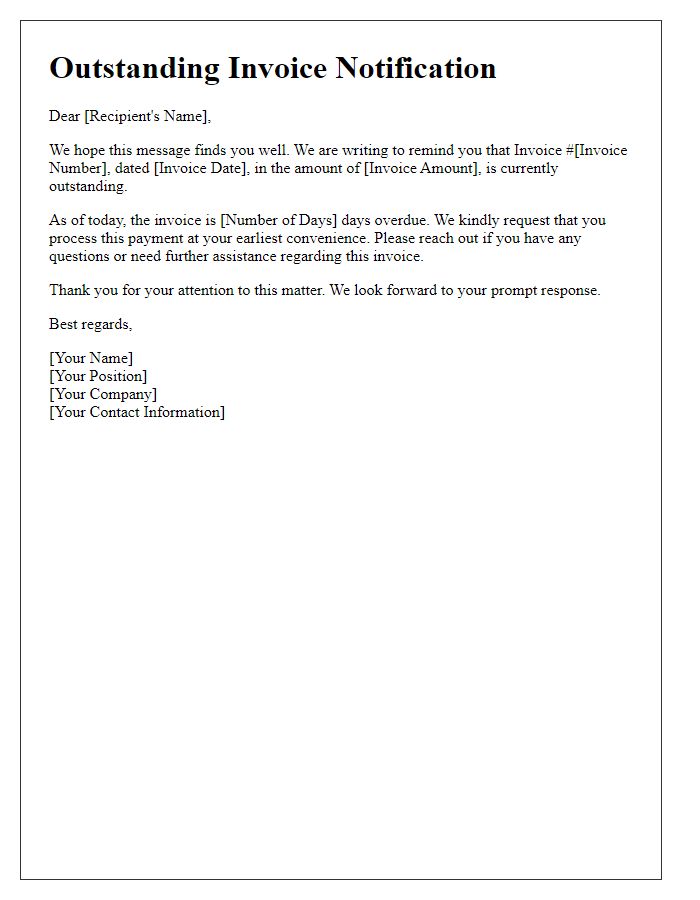

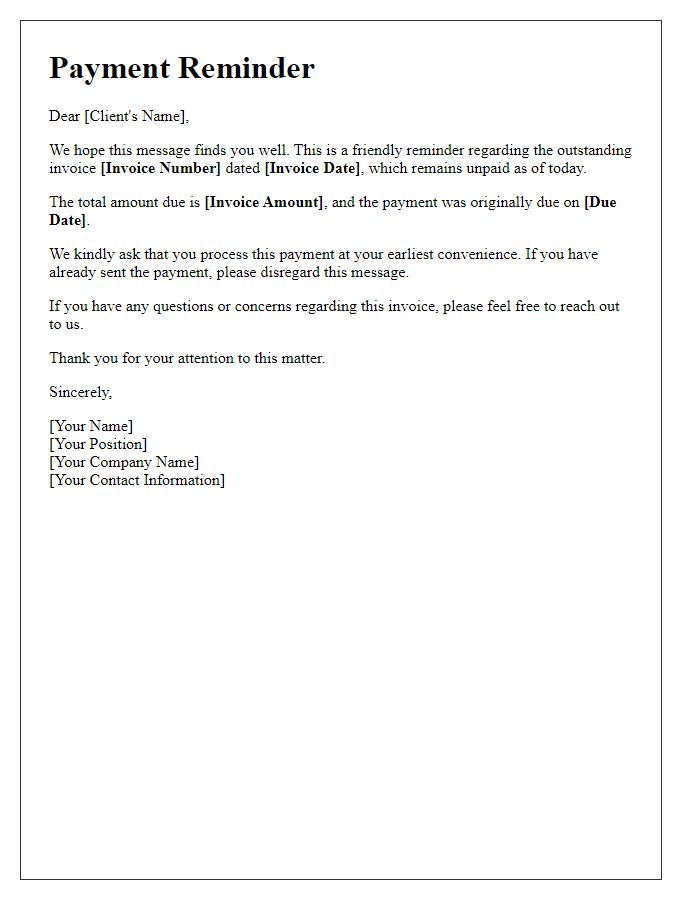

Clear and concise language

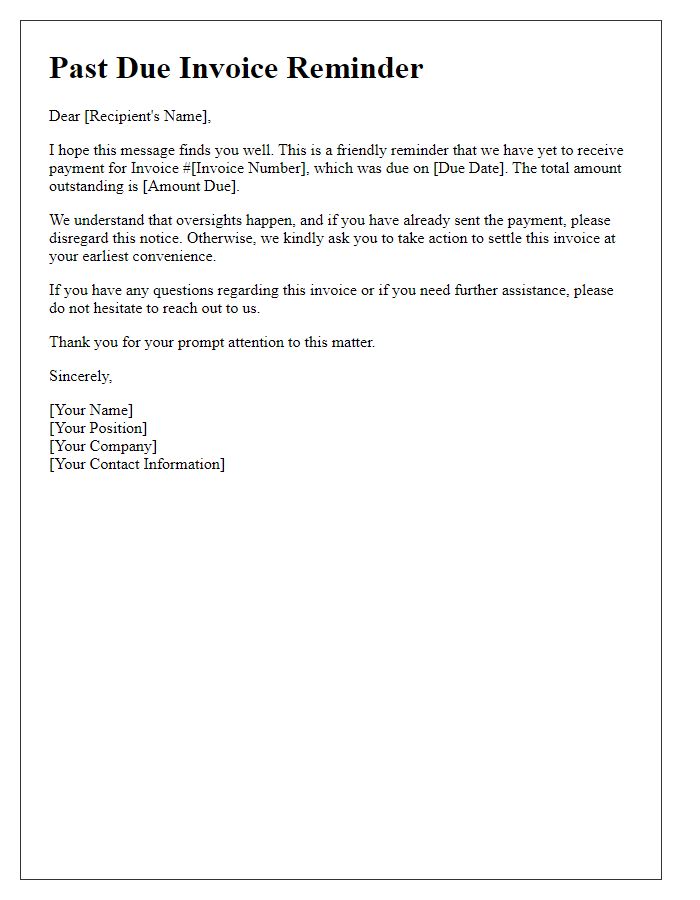

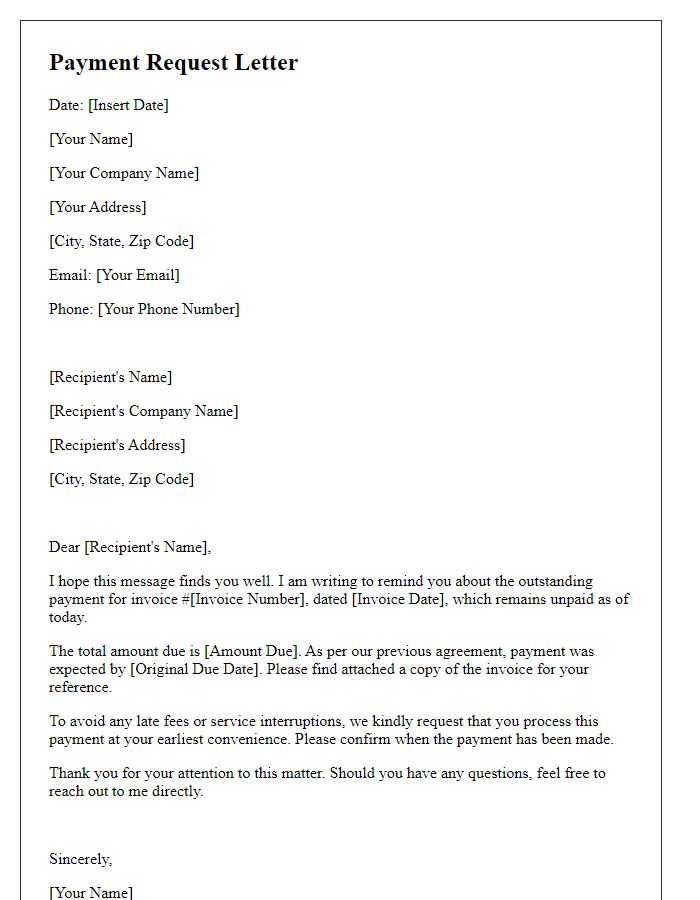

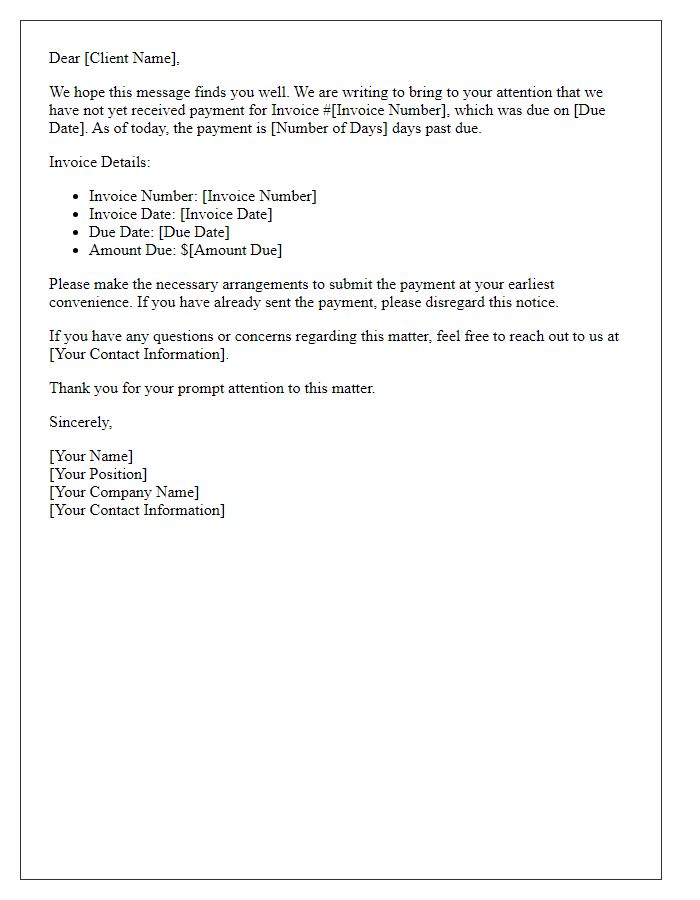

Outstanding invoices can create significant cash flow challenges for businesses, leading to friction in supplier relationships. Invoice reminders (sent typically 30 days past due) serve to motivate clients to fulfill payment obligations. Specific payment terms, like net 30 or net 60 days, vary among industries, with architecture firms or healthcare providers often adopting longer periods. Clear details in these notices, including invoice number, payment amount (for example, $1,250), and due date, help minimize confusion. Following up with an escalation policy can aid in addressing persistent delays, ultimately sustaining healthy financial operations. Key stakeholders (like accounts payable contacts) should be alerted through professional communication methods (emails or phone calls) to maintain business integrity and open lines of dialogue.

Invoice details (number, date, amount, due date)

The overdue invoice notification is a crucial reminder for businesses and individuals regarding outstanding payments. Invoice number 12345, dated September 15, 2023, reflects an amount of $1,500. The payment due date was October 15, 2023. Timely payment helps maintain positive cash flow, essential for the operational efficiency of organizations. Delayed payments can lead to additional late fees or penalties, impacting financial planning and budgeting. Prompt attention to this invoice encourages continued business relationships and upholds creditworthiness in financial agreements.

Payment instructions and options

Payment instructions and options for invoice due are crucial for facilitating timely transactions. Clear guidelines ensure customers understand how to settle their outstanding balances. Accepted methods typically include bank transfers, credit card payments, and online payment platforms such as PayPal or Stripe. For bank transfers, providing account details like account number and sort code enhances clarity. Credit card payments may require a secure link or portal for completion. Late fees may apply if payments are not received by the designated due date, often specified in terms of net 30 or net 60 days. Additionally, offering a payment plan option can alleviate customer burden, making it easier for them to manage their finances while ensuring prompt payment.

Contact information for questions

A payment due invoice notice is crucial for maintaining healthy cash flow in businesses. Invoice numbers, such as INV-12345, should be clearly referenced to avoid confusion. Clients often require specific contact information for queries related to invoices, which typically includes a company email, like billing@company.com, and a phone number, such as (555) 123-4567. Providing a physical address, for instance, 123 Main St, Cityville, State, ZIP 12345, can also enhance transparency. Timely communication about payment terms, including a due date of 30 days from the invoice date, assists in managing expectations and fostering prompt payments.

Call-to-action for payment urgency

Timely payment is crucial for maintaining smooth operations within businesses. Accounts receivable is the financial tracking system that monitors incoming payments towards outstanding invoices. Late payments can incur additional fees, typically around 1.5% per month, leading to further financial strain on organizations. The due date of an invoice is set to ensure cash flow aligns with business needs--delays can disrupt budget planning and affect vendor relationships. Prompt settlement of outstanding balances not only maintains positive cash flow but also supports continued access to necessary goods and services. Payment reminders, often sent via email or traditional mail, serve as important communication tools to encourage swift action. The urgency conveyed in such notices can enhance the likelihood of timely payment, ultimately sustaining operational efficiency and financial health.

Comments