Have you ever received an invoice that left you scratching your head, wondering exactly what you're being charged for? It's a common scenario, and understanding the components of an invoice can save you both time and confusion. In this article, we'll break down the key elements of a typical invoice and explain how each part contributes to the total amount due. So, let's dive in and clarify those invoice mysteries together!

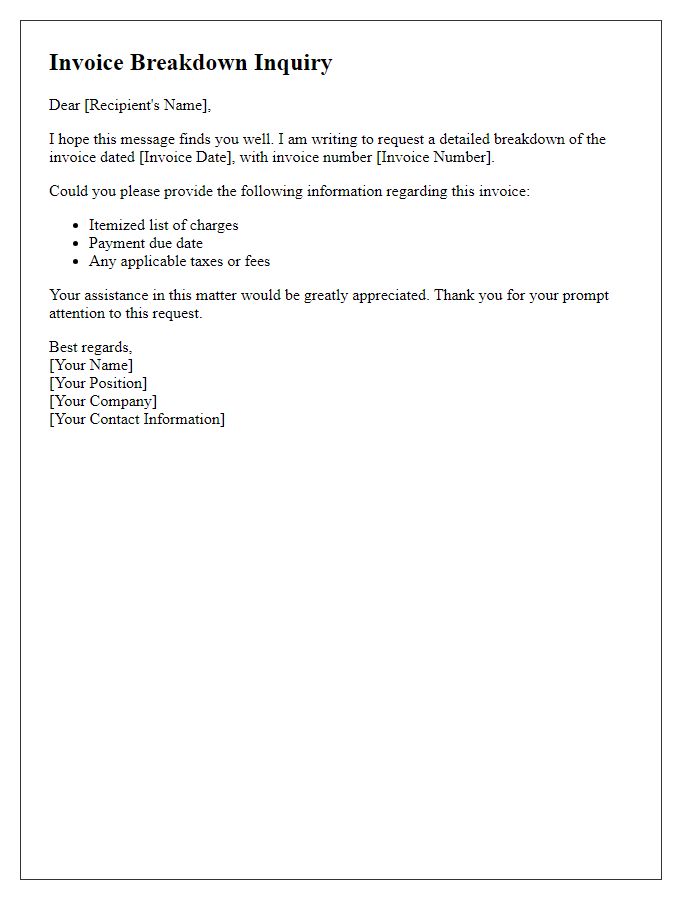

Invoice Number and Date

Invoices often contain crucial components that require clarification to ensure proper understanding and processing. An invoice number serves as a unique identifier for each billing document, facilitating easy tracking and reference during financial transactions. The invoice date indicates when the billing statement was issued, essential for establishing payment timelines and terms. Clear comprehension of these elements prevents discrepancies and enhances communication between buyers and sellers in the financial exchanges. It ensures accuracy in record-keeping and financial planning across businesses and organizations globally.

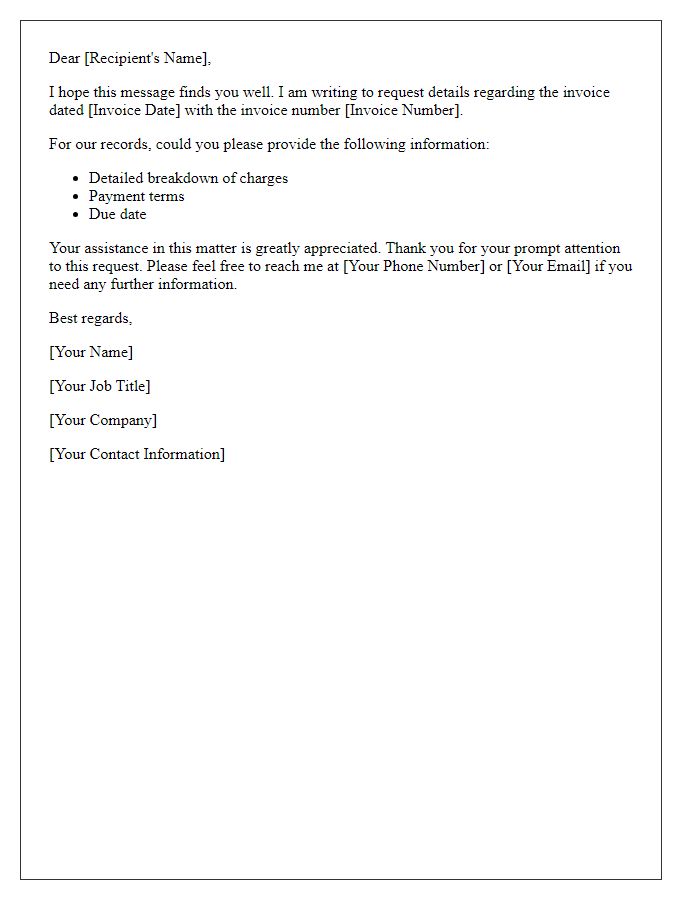

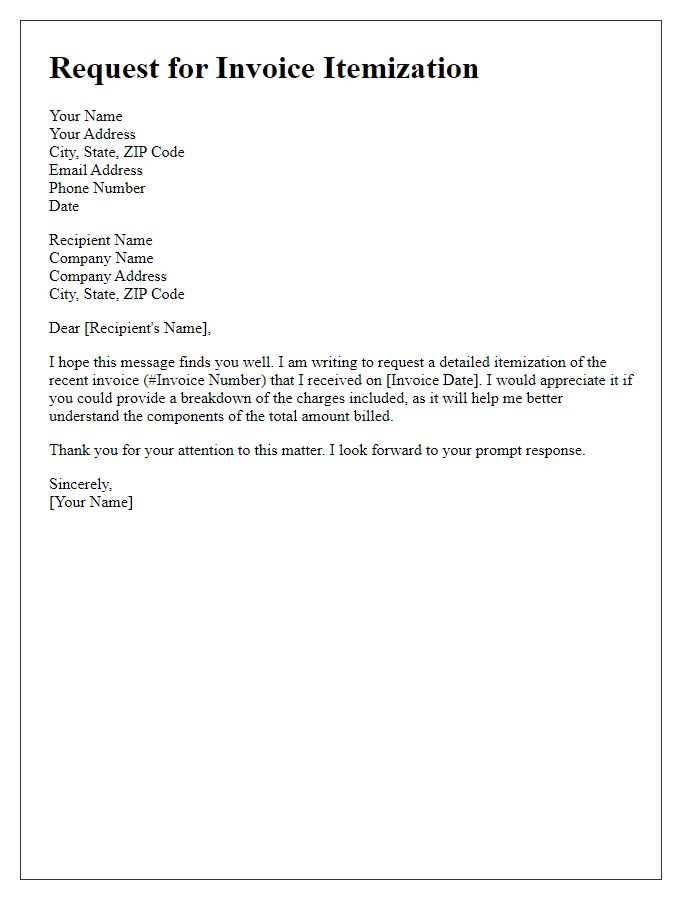

Detailed Description of Services/Products

A comprehensive invoice breakdown clarifies each service and product component, ensuring transparency in billing. For instance, graphic design services (number of hours worked, hourly rate) may align with branding projects (logo design, social media graphics), detailing specific tasks to justify costs. Likewise, software development (number of features, testing phases) can include crucial elements like coding or user interface design, emphasizing complexity. Additionally, physical products, such as electronics (model, quantity, individual price), contribute to an overall understanding of material costs. Clear delineation of taxes (state sales tax rate, total amount) enhances financial accuracy, providing customers with a succinct overview of all charges.

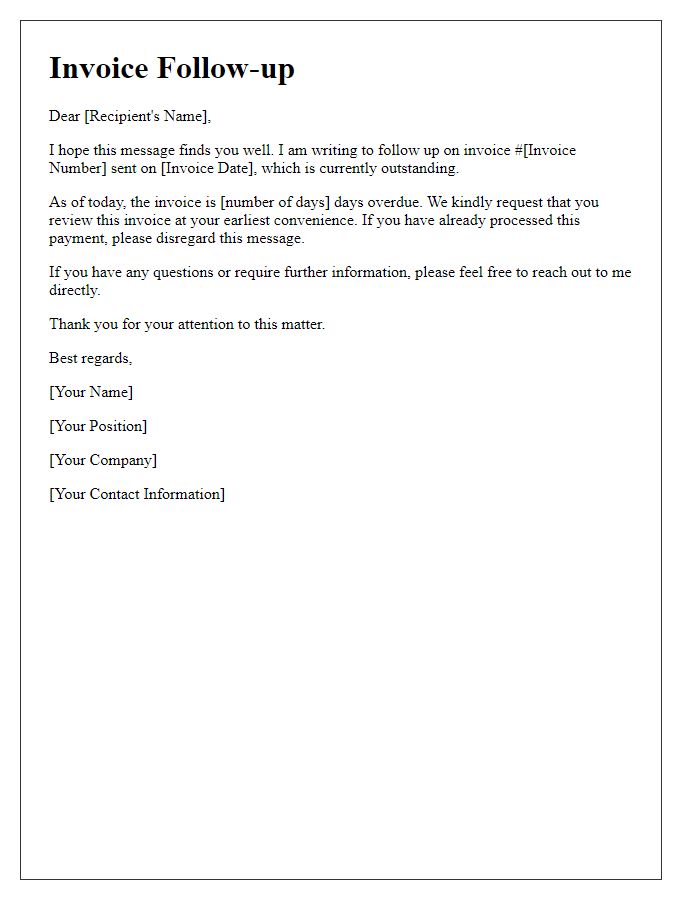

Amount Due and Payment Terms

Billing statements often include distinct components that require clarification for proper financial management. The "Amount Due" signifies the total sum payable, which encompasses the principal charges along with any applicable taxes or fees. Commonly, this value can be found prominently on the invoice, usually highlighted for emphasis. "Payment Terms" outline the agreed-upon conditions for the transaction, specifying the timeframe for payment completion, generally noted as Net 30, Net 15, or similar terms that stipulate the number of days from the invoice date until full payment is required. Adherence to these terms is crucial for maintaining good financial standing and avoiding late fees or interest charges. Understanding these components ensures clarity for both the payer and the recipient, facilitating a smooth financial interaction.

Contact Information for Queries

When managing invoice components, clarity ensures seamless transactions. Key components include the invoice number, which uniquely identifies each transaction for record-keeping. The billing address details the recipient's location, pivotal for accurate delivery. Itemized lists signify each product or service, showcasing descriptions, quantities, and individual prices. Subtotals eliminate confusion by summarizing costs before taxes. Taxes, often a percentage based on regional laws, detail additional charges applied to the subtotal, emphasizing their importance in total amounts. Payment terms outline deadlines for payment, typically conveying a net 30-day policy. Contact information for inquiries must be prominent, including a customer service number, email address, and designated contact person. Such contact details enable swift resolutions to any invoice-related queries, fostering trust and professionalism in business dealings.

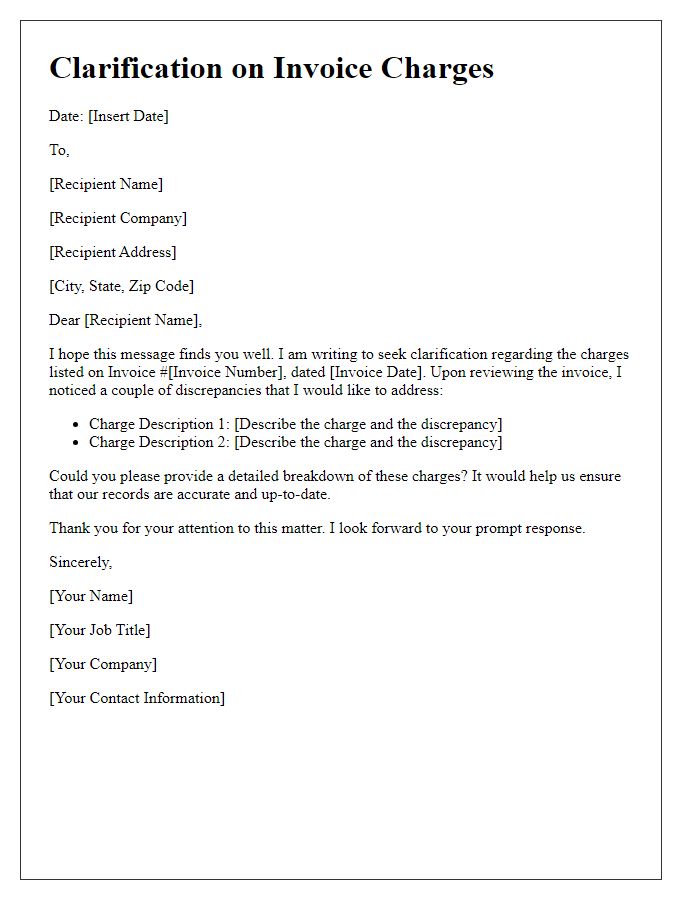

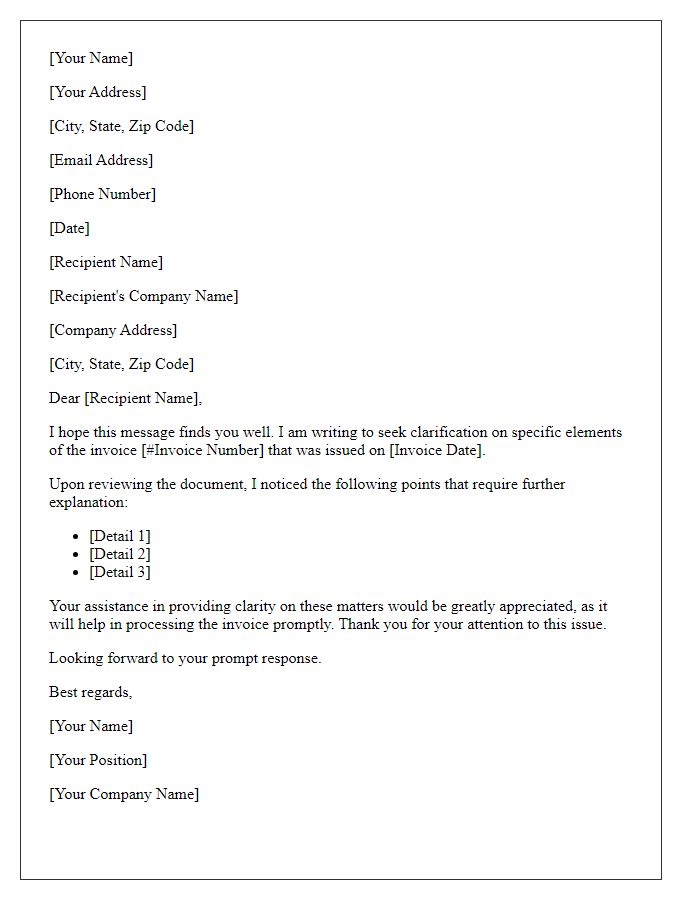

Clarification Request Context and Purpose

Clarification of invoice components is essential for ensuring transparency in financial transactions. Detailed breakdown of line items, such as product descriptions, quantities, unit prices, and total amounts, is necessary for accurate accounting. Various taxes, including state sales tax (which might range from 0% to 10% depending on jurisdiction), need to be explicitly stated. Payment terms, such as full payment due within 30 days, should be clearly defined alongside applicable late fees. Additionally, unique invoice numbers, issued by the accounting software (like QuickBooks or FreshBooks), assist in tracking and referencing. Accurate billing representation aids in maintaining positive relationships between businesses and clients.

Comments