Have you ever found yourself in a situation where you just need to confirm a payment transaction but don't know where to start? In this article, we'll walk you through a simple yet effective letter template that will help you verify those transaction updates effortlessly. Whether you're dealing with business transactions or personal payments, having a clear and professional approach can make all the difference. So, let's dive in and explore how you can streamline your payment verification process!

Business Name and Contact Information

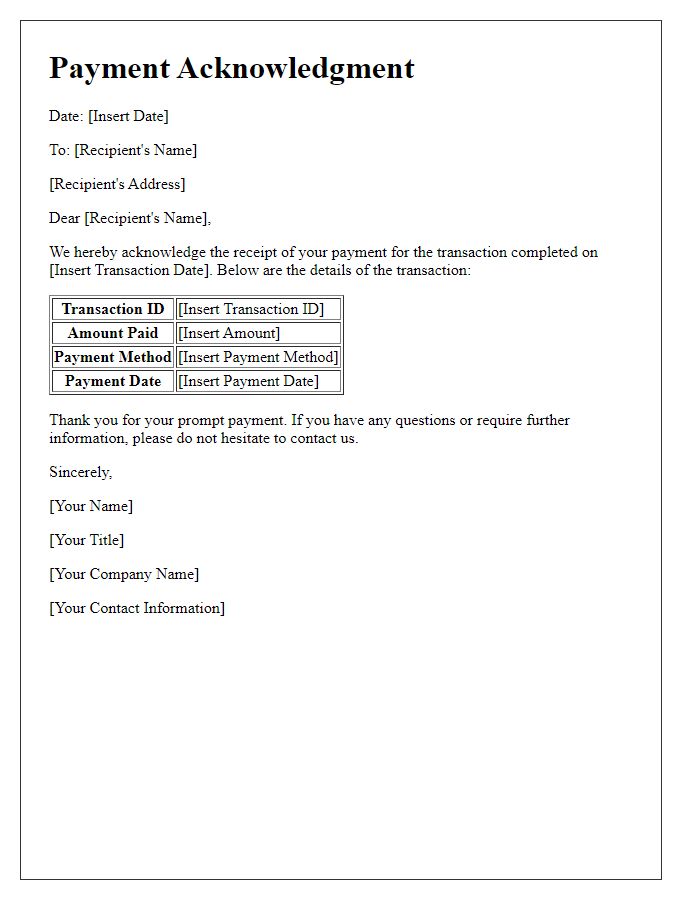

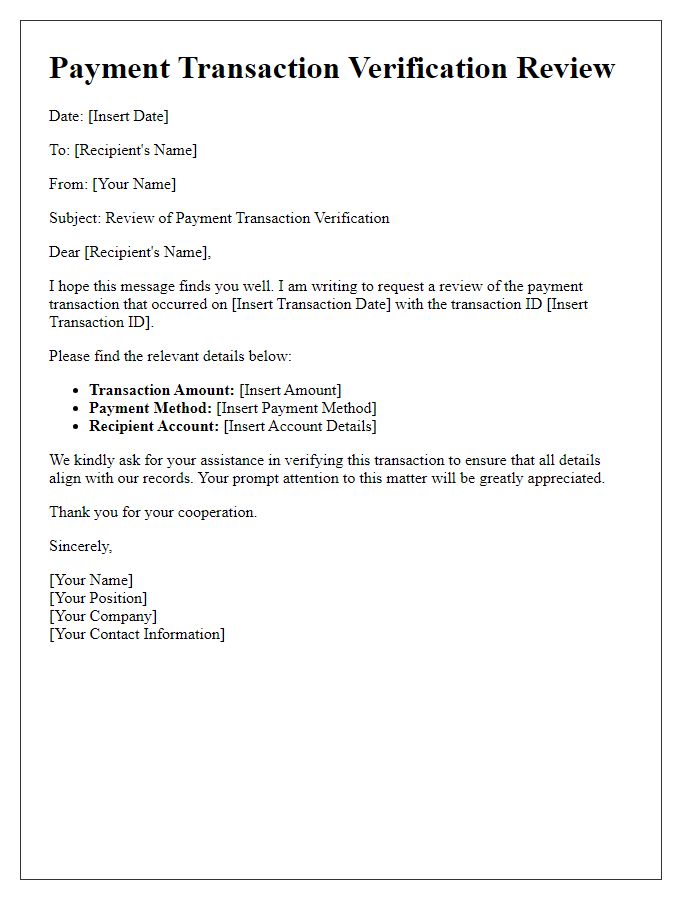

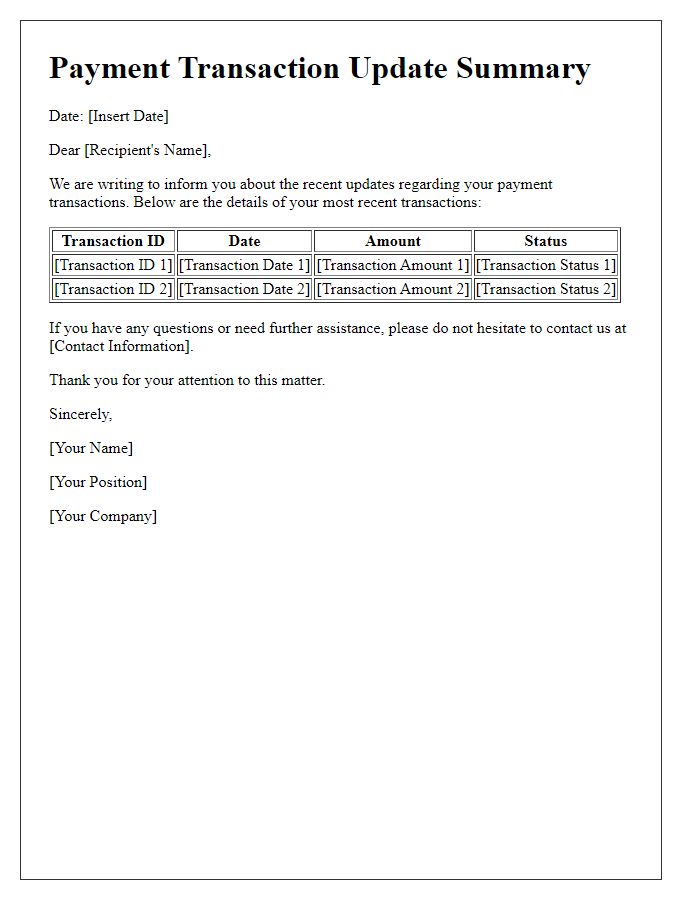

Payment transaction verification serves as a crucial step in ensuring accuracy and trust in financial dealings. A confirmation email typically includes critical components: business name (XYZ Corporation) alongside contact information (123 Business Road, City, State, ZIP, phone number, email). The transaction details consist of transaction ID (TRX-987654), amount ($500), date (October 20, 2023), and status (successful). The recorded payment method (credit card, ending in 1234) further enhances clarity. Additionally, any associated invoice number (INV-456789) provides a reference for further inquiries or auditing. Proper documentation fosters transparency and strengthens customer relationships, ensuring all parties have accurate records.

Customer's Name and Transaction ID

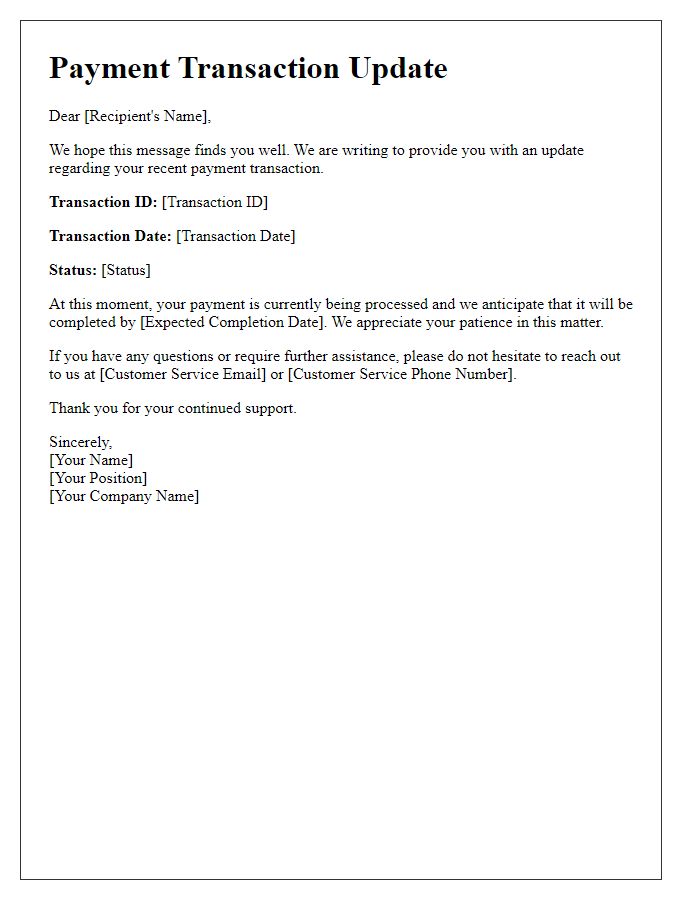

Businesses must implement a robust payment verification process to ensure secure transactions for customers. An essential element involves confirming the customer's name (for instance, John Doe) along with a unique transaction ID (like 123456789). Transaction IDs serve as a crucial reference that maintains accurate records of the payment status, facilitating clear communication with customers regarding their purchase updates. With data breaches on the rise, enhanced verification measures must incorporate secure channels, potentially leveraging encryption technologies to protect sensitive customer information during updates. This approach not only builds customer trust in the transaction process but also promotes a seamless experience in e-commerce platforms globally.

Confirmation of Payment Amount and Date

Confirmation of payment transactions is essential for maintaining transparent financial records. The total payment amount, which often varies depending on service agreements, needs precise documentation; for example, a recent transaction of $2,500 completed on July 15, 2023, for a software service subscription at Tech Solutions Inc. Verification of these details ensures that both parties (the payer and the receiver) have accurate records for auditing and reconciliation purposes. Furthermore, a timely confirmation helps in minimizing disputes related to payment discrepancies, thus fostering trust and integrity in business transactions.

Details of Payment Method and Reference Number

Verifying payment transaction updates involves several key details. Payment methods such as credit cards (Visa, MasterCard), bank transfers, and digital wallets (PayPal, Apple Pay) require accurate recording of information. Reference numbers, usually consisting of 10 to 20 alphanumeric characters, serve as unique identifiers for each transaction. Date and time of transaction provide additional context, often displayed in formats like MM/DD/YYYY or DD/MM/YYYY. Furthermore, transaction status (completed, pending, failed) gives insight into the completion stage. Amount paid, including currency type (USD, EUR), is also critical for verification. Keeping detailed records of these elements ensures efficient tracking and resolution of payment-related issues.

Instructions for Further Inquiries or Contact Information

Payment transaction verification processes are crucial for ensuring financial accuracy and accountability in business transactions. Each transaction typically involves a unique transaction ID, payment amount, date, and status update, reflecting whether the payment is processed, pending, or failed. Companies often provide dedicated customer service lines or email addresses for inquiries, such as (800) 555-0199 or support@company.com, allowing users to seek assistance. Timely communication is essential to address concerns related to payment discrepancies or unauthorized transactions, fostering trust and transparency between parties involved. Detailed records of these interactions can also assist in resolving issues efficiently, reducing potential financial losses.

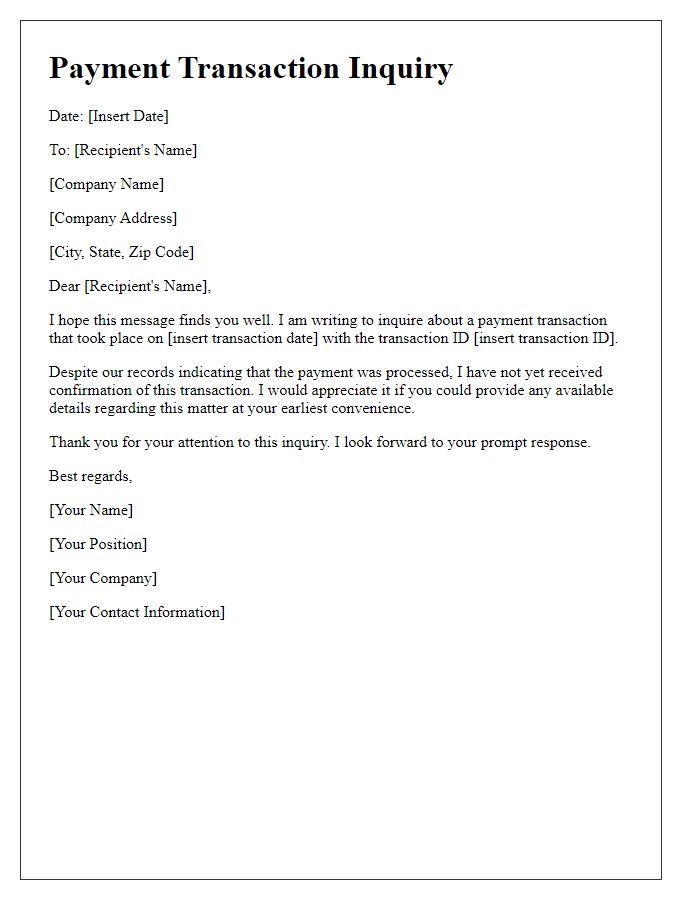

Letter Template For Verifying Payment Transaction Updates. Samples

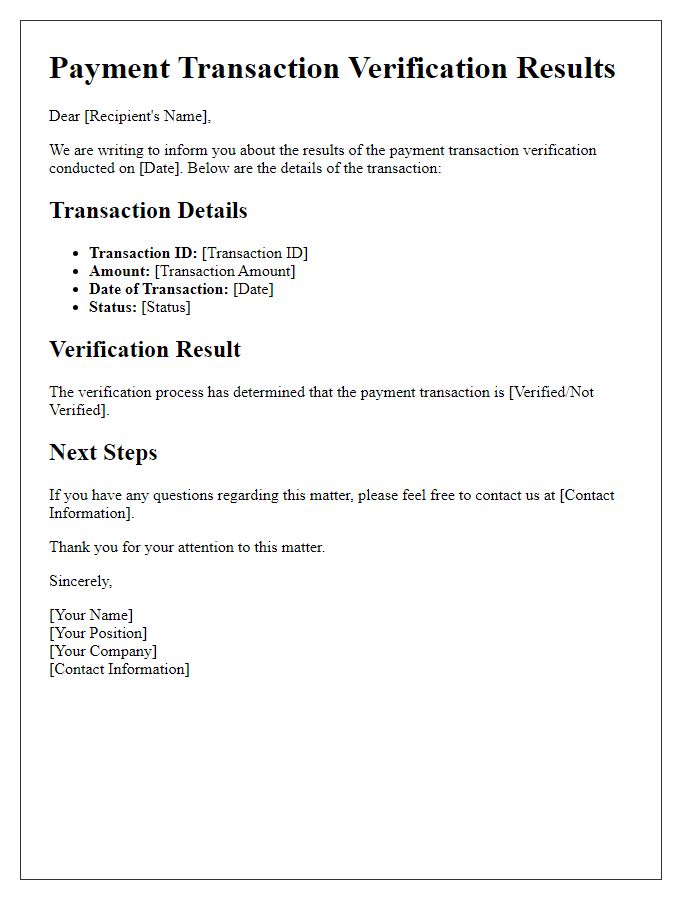

Letter template of confirmation for successful payment transaction verification.

Comments