Are you feeling overwhelmed by financial commitments? If so, you're not alone, and we're here to help! We're excited to introduce our flexible payment plan designed to ease your financial burden while making it easier to manage your expenses. Join us as we explore how this plan can benefit you and provide some much-needed relief!

Tailored Payment Schedule

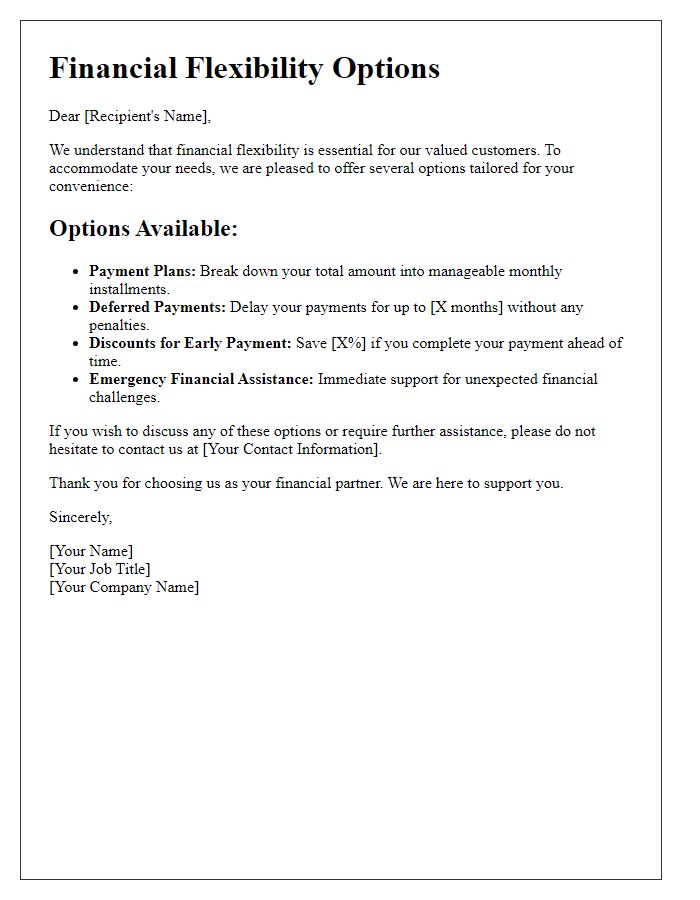

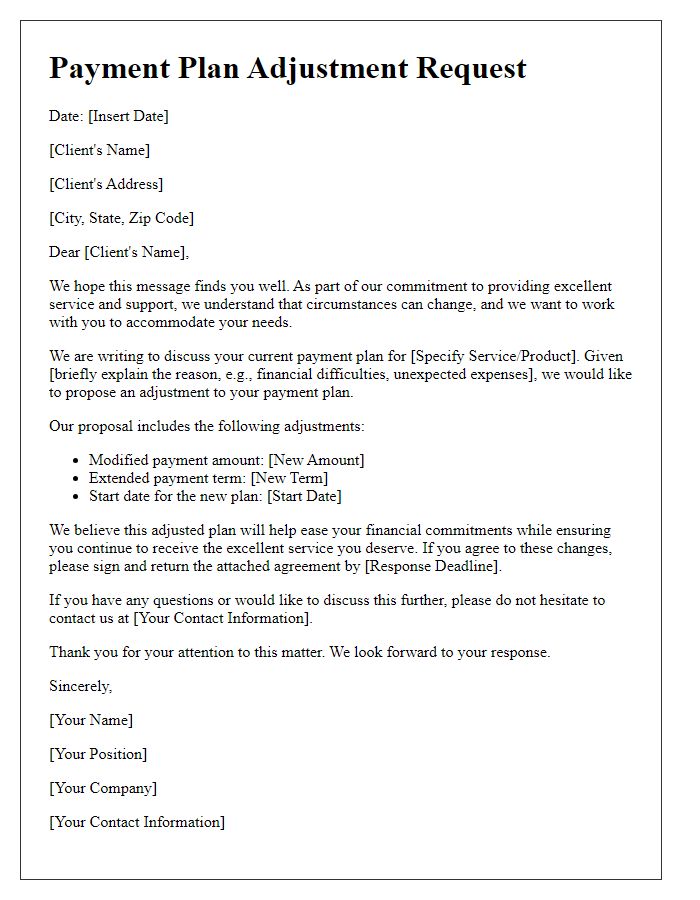

A tailored payment schedule presents a customized financial solution designed to accommodate individual cash flow needs. This arrangement often involves segmented payments over time, which can alleviate the immediate financial burden of lump-sum payments. Various plans can include monthly installments, bi-weekly options, or quarterly payments based on factors like total outstanding balance, interest rates, and personal income stability. By adjusting the payment timeline, entities such as businesses or service providers in sectors like healthcare or education enable consumers to manage their obligations more effectively while ensuring continued access to essential services or products without financial strain.

Clear Payment Terms

A flexible payment plan allows individuals to manage their financial commitments more effectively by spreading out payments over a designated period. Clear payment terms, such as monthly installments, interest rates, and due dates, are crucial in establishing transparency and preventing confusion. Typically, these plans can be structured over 6, 12, or even 24 months, depending on the total amount owed. For instance, a $1,200 purchase could be divided into 12 monthly payments of $100. Understanding the implications of late fees, which can average between $20 to $40, is essential for maintaining good standing. These terms apply to various sectors, including retail, healthcare, and educational institutions, fostering accessibility for customers and clients alike.

Interest and Fees Information

Flexible payment plans provide a structured approach to managing financial commitments while considering varying individual circumstances. These plans typically involve installment payments spread over a designated period, allowing for budget-friendly options. Interest rates associated with these plans can vary significantly, often ranging from 0% to as high as 29.99%, depending on factors such as creditworthiness and the lender's policies. Fees may also apply, including setup fees that can be approximately $50 or late payment fees which might be $15 to $30 for missed deadlines. Understanding these variables is crucial for effective financial planning, ensuring that consumers are aware of total costs associated with their flexible payment options.

Contact and Support Details

Flexible payment plans offer consumers the opportunity to manage their financial commitments more effectively through structured repayment options. Payment plans can be tailored to accommodate various financial situations, enabling individuals to spread the cost of a purchase over several months or even years. Common features of such plans include fixed monthly payments, interest rates ranging from 0% to 25%, and timelines extending from three months to five years. Companies often provide online support resources, including FAQ sections and customer service hotlines, ensuring assistance is available for inquiries related to payment schedules, account management, and eligibility criteria. Consumers may also find mobile apps useful for tracking payments and accessing account information with ease.

Assurance of Service Continuation

Flexible payment plans enhance accessibility for clients managing financial constraints. Organizations often offer tailored solutions, allowing customers to divide outstanding balances into smaller, manageable installments over specific periods, typically ranging from three to twelve months. Such arrangements promote continued service access without interruption, significantly benefiting small businesses and individuals in economic hardship. Assurance of service continuation remains crucial; clients can maintain essential services, such as internet or utilities, despite temporary financial setbacks, thus fostering trust in the organization's commitment to customer support during challenging times. Detailed terms, including interest rates and payment deadlines, must be clearly communicated to ensure mutual understanding and satisfaction.

Comments