Hey there! We all know that sometimes invoices can slip through the cracks, and that's totally okay. In this article, we'll explore an effective letter template for following up on overdue invoice payments, ensuring your tone remains friendly yet firm. If you're looking to improve your communication about payment reminders, keep reading for some helpful tips and a sample letter you can easily customize!

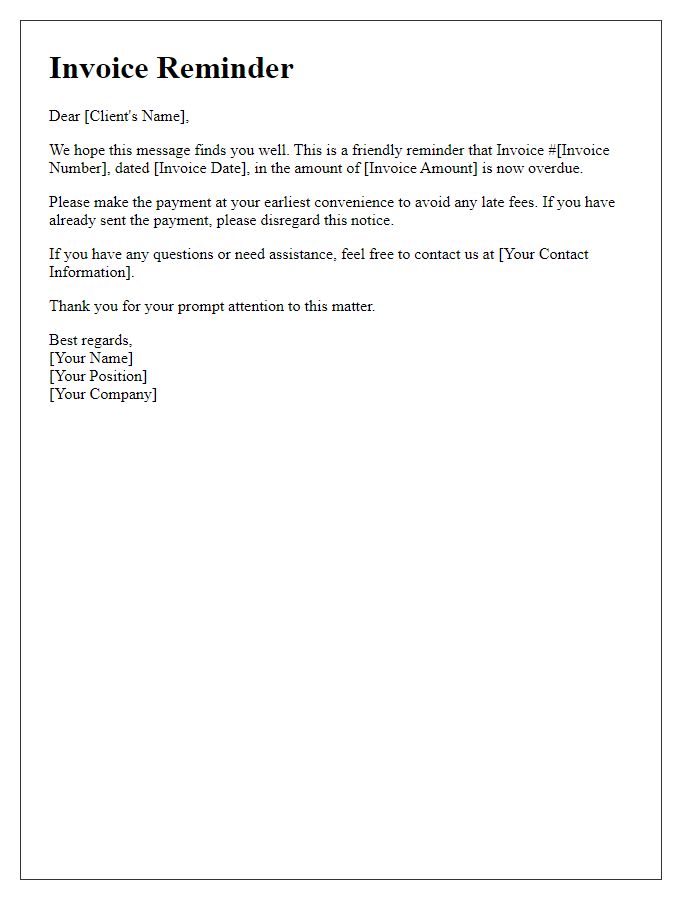

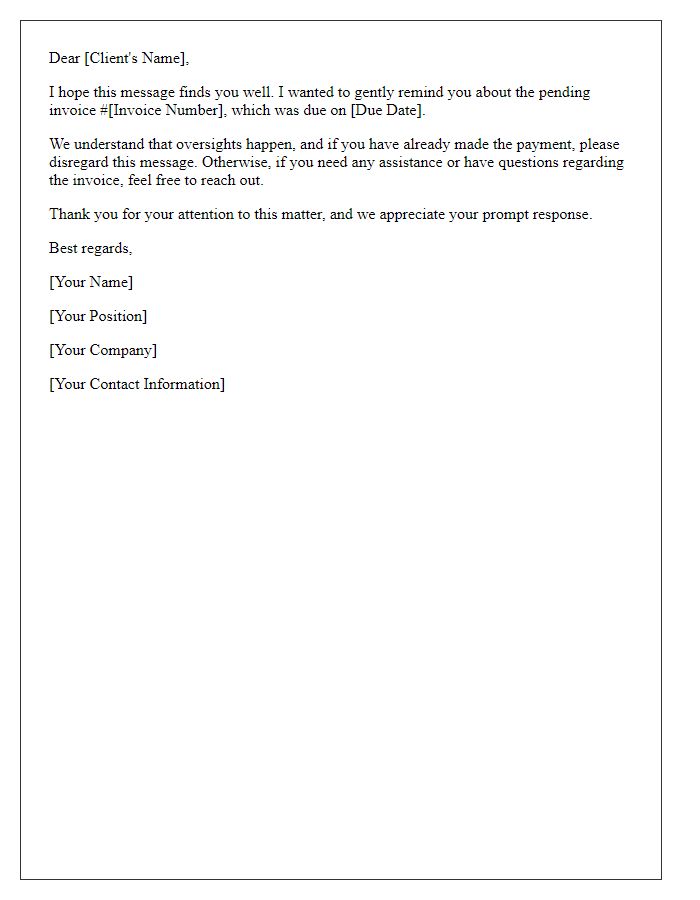

Polite Reminder

An effective follow-up on unpaid invoices is essential for maintaining healthy cash flow. A well-crafted reminder can gently nudge clients while preserving positive relations. Use clear subject lines, include invoice numbers for easy reference, and specify due dates to avoid confusion. In this reminder, mention payment methods accepted, the original amount due, and any late fees (which may kick in after a grace period) to emphasize urgency. Finally, express appreciation for their business and encourage open communication regarding any issues they might be facing. This approach, utilized across various industries, can enhance accountability and prompt timely payments.

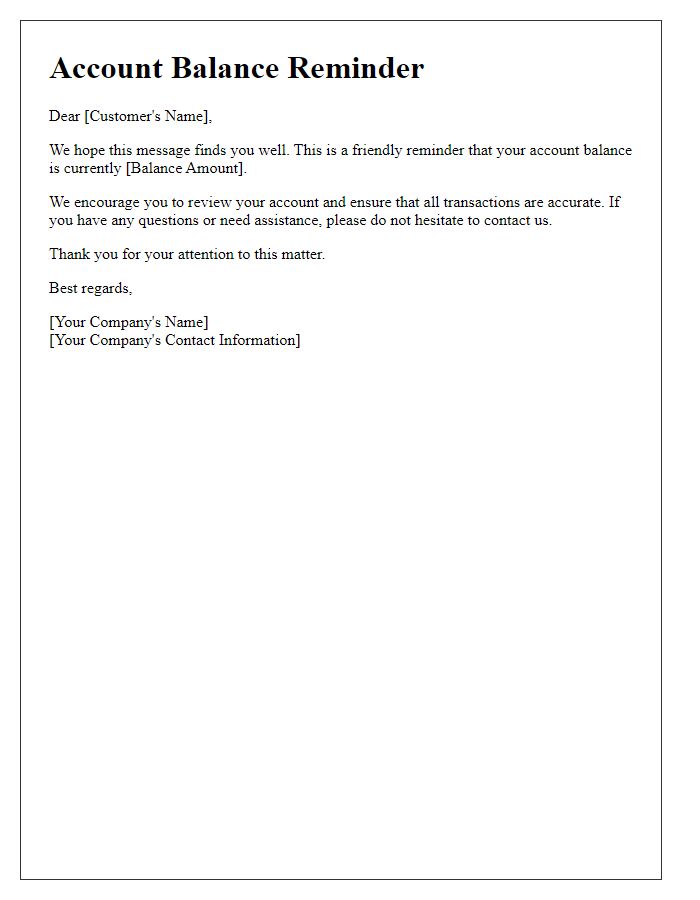

Invoice Details

Invoice follow-ups are essential for maintaining healthy cash flow in businesses. A typical invoice might include details such as invoice number (e.g., 12345), issue date (e.g., October 1, 2023), due date (e.g., October 15, 2023), items billed (e.g., creative consulting services, total amount due $2,500), and payment terms (e.g., net 30 days). Delayed payments can impact operational budgets, leading to constraints on resources. Additionally, consistent follow-ups contribute to stronger client relationships while ensuring timely compensation for services rendered. Companies often use tools such as automated accounting software to track outstanding payments effectively.

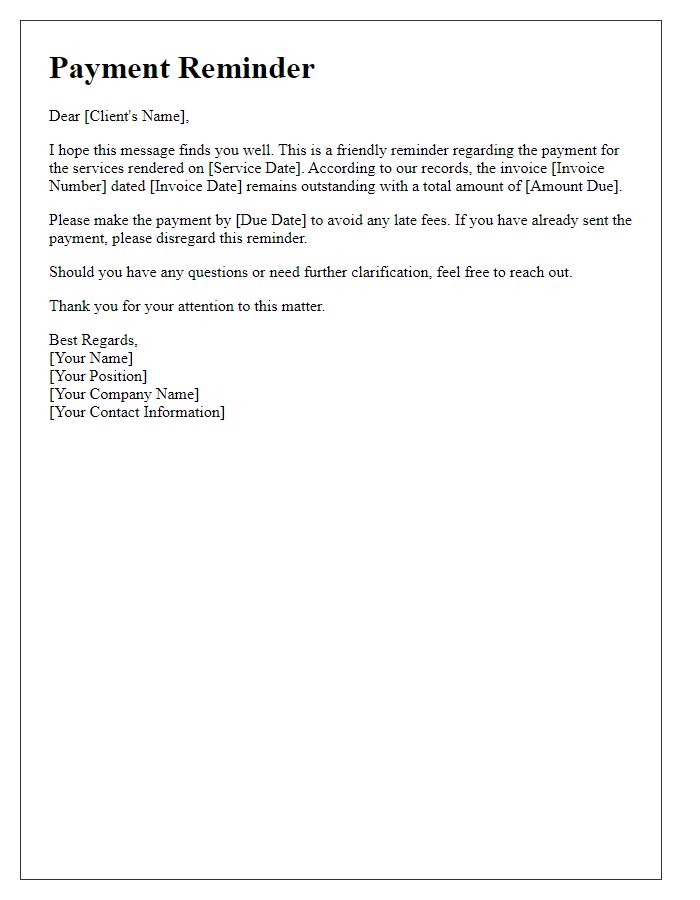

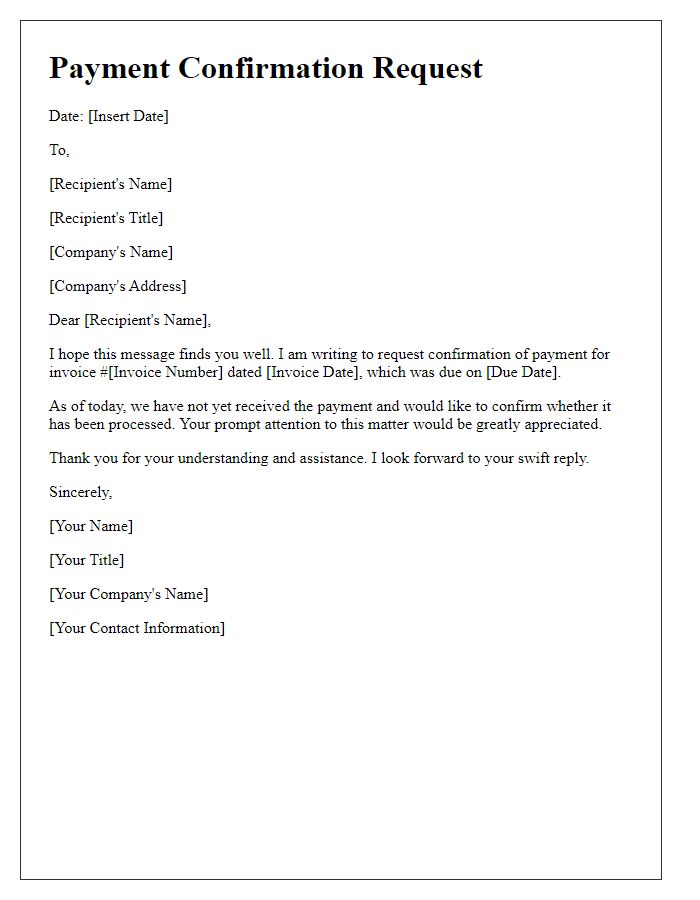

Payment Instructions

Invoicing plays a crucial role in business transactions, ensuring that services rendered are compensated in a timely manner. Clear payment instructions are vital for clarity, highlighting accepted payment methods such as bank transfers, credit cards, or online payment platforms like PayPal. Payment terms typically specify the due date, often 30 days post-invoice issuance, enabling efficient cash flow management. The invoice should also indicate late fees or interest rates applicable after the due date, fostering accountability. Including relevant details like invoice number, amount due, and recipient banking information is essential for smooth transactions, enhancing both visibility and traceability.

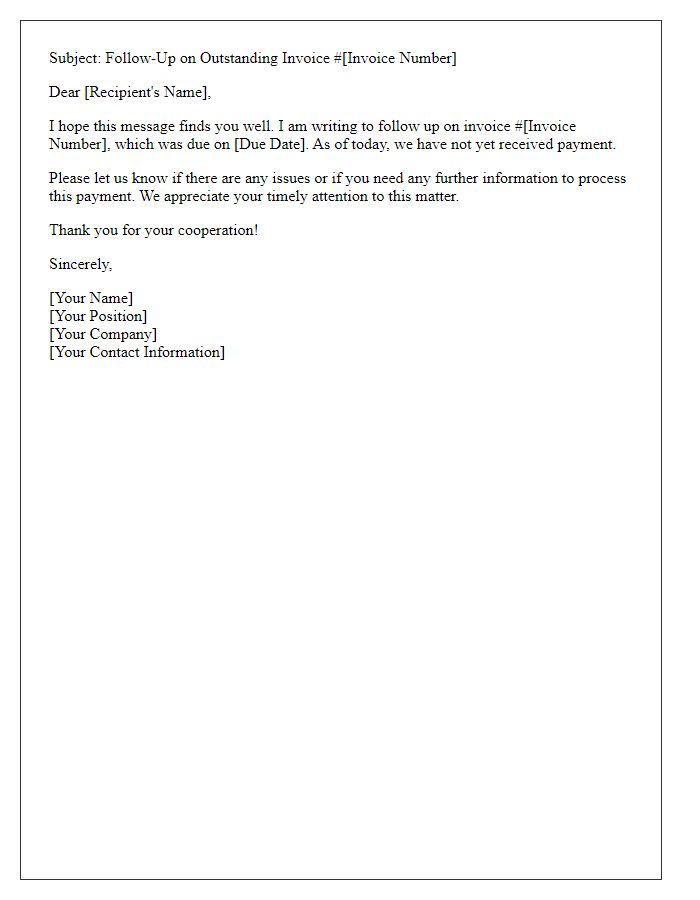

Contact Information

Remaining unpaid invoices can impact cash flow for businesses. Timely follow-ups on outstanding payments can significantly improve collection rates. Using a clear and concise approach ensures the client understands the payment instructions. Including contact information such as phone numbers, email addresses, and business hours increases the likelihood of a prompt response. Courteous language fosters a positive company-image and encourages cooperation. Documenting previous communications, such as the invoice date and payment terms, provides context for the follow-up and reinforces the need for action.

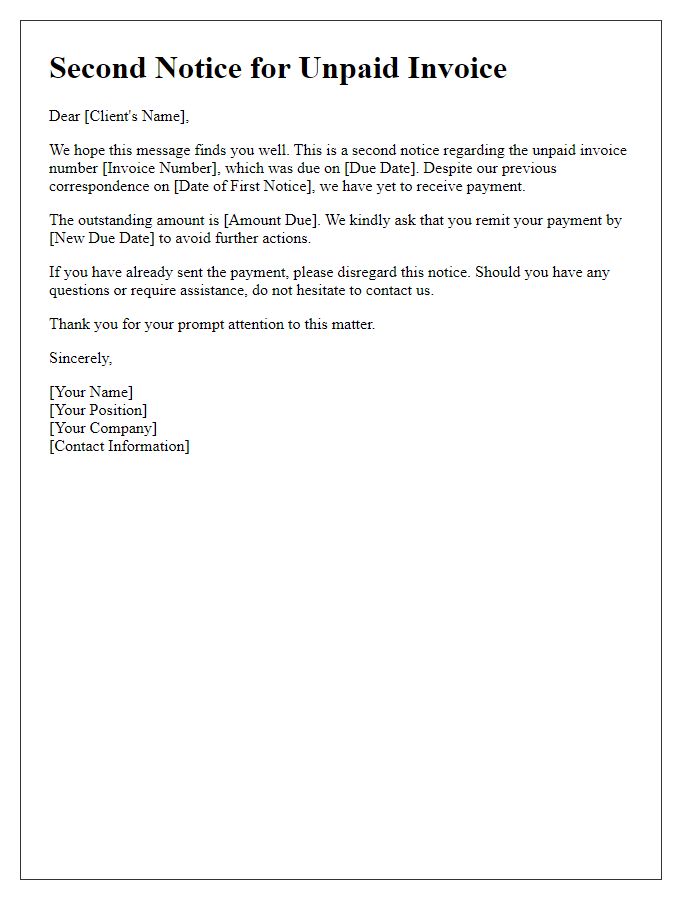

Deadline/Consequences

Outstanding invoices can disrupt cash flow in small businesses, particularly for service providers. Typically, payment deadlines are set within 30 days of invoice issuance. Failing to meet these deadlines can result in additional charges (such as late fees up to 5% of the invoice total per month) and negatively impact customer relationships. Businesses located in metropolitan areas such as New York City may experience increased competition, making timely payments essential for maintaining operational efficiency. Subsequently, consistent follow-up on overdue payments is vital, as it can lead to improved cash flow stability and ensure that services remain uninterrupted.

Comments