Hey there! We understand that payment inquiries can sometimes be a bit confusing, and we're here to help clarify any questions you may have. Whether it's about processing times, payment methods, or the status of your transaction, we're committed to providing you with all the information you need. So, grab a cup of coffee and join us as we delve deeper into how to navigate these queries with ease!

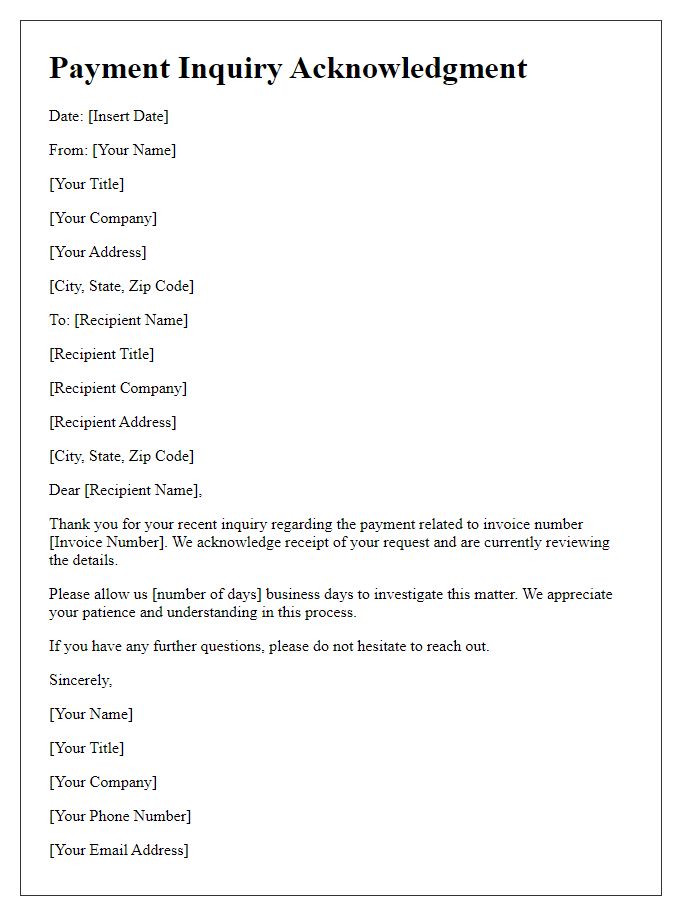

Contact Information

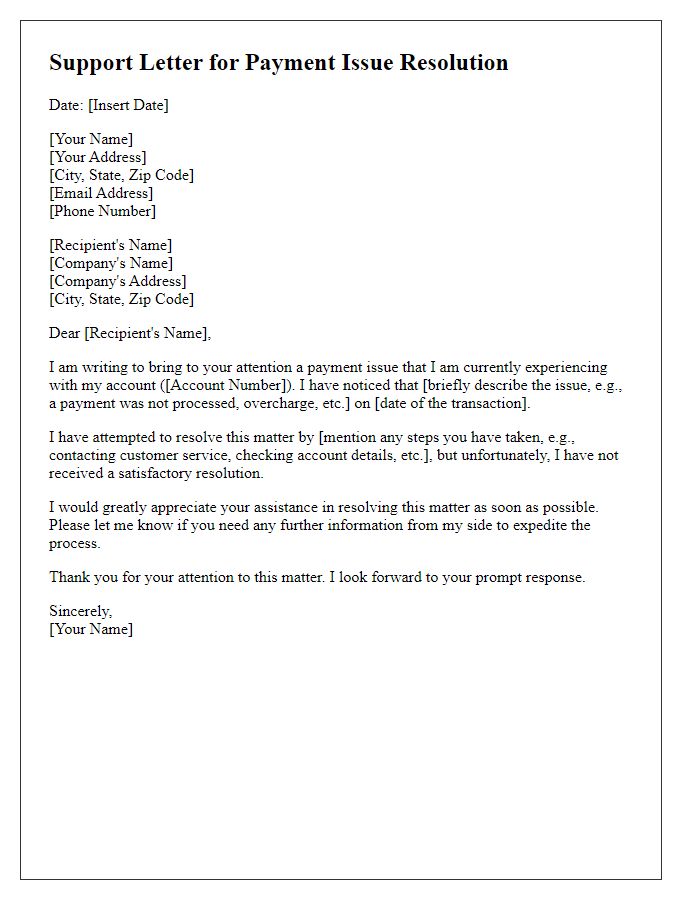

Payment inquiries often arise in business transactions, involving requests for clarification regarding transactions involving amounts, dates, or service agreements. Accurate contact information is crucial for addressing these inquiries efficiently, ensuring responses reach stakeholders such as clients, financial departments, and treasurers. Key details to include are name, phone number (often a direct line to the accounting team), email address (preferably a designated accounts department email), and a physical company address. Payment processing times usually range from 3 to 7 business days, depending on the payment method, such as credit card, wire transfer, or check. Providing precise information can facilitate quicker resolutions and maintain professional relationships.

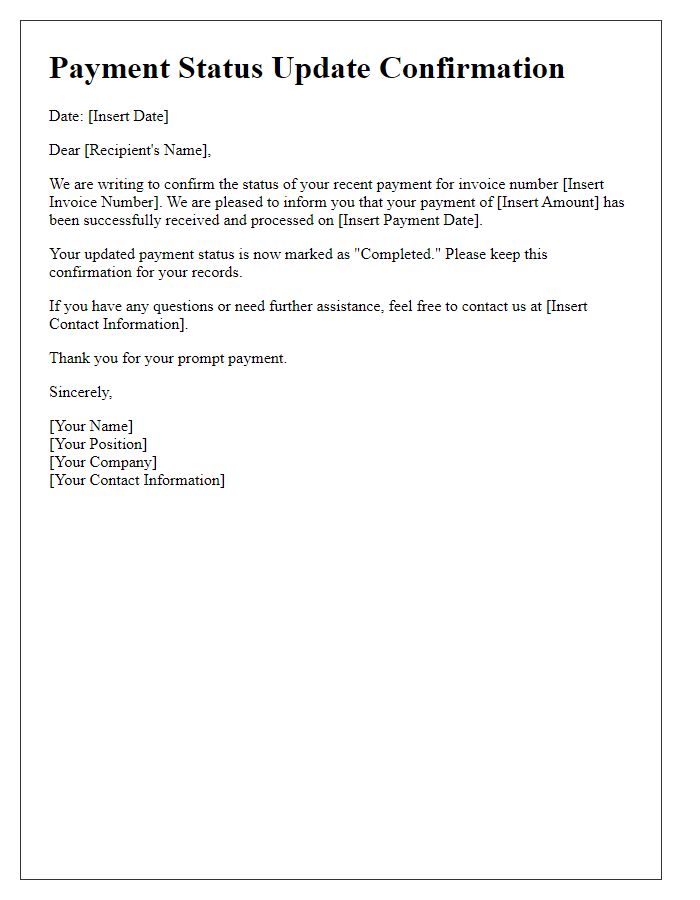

Payment Details

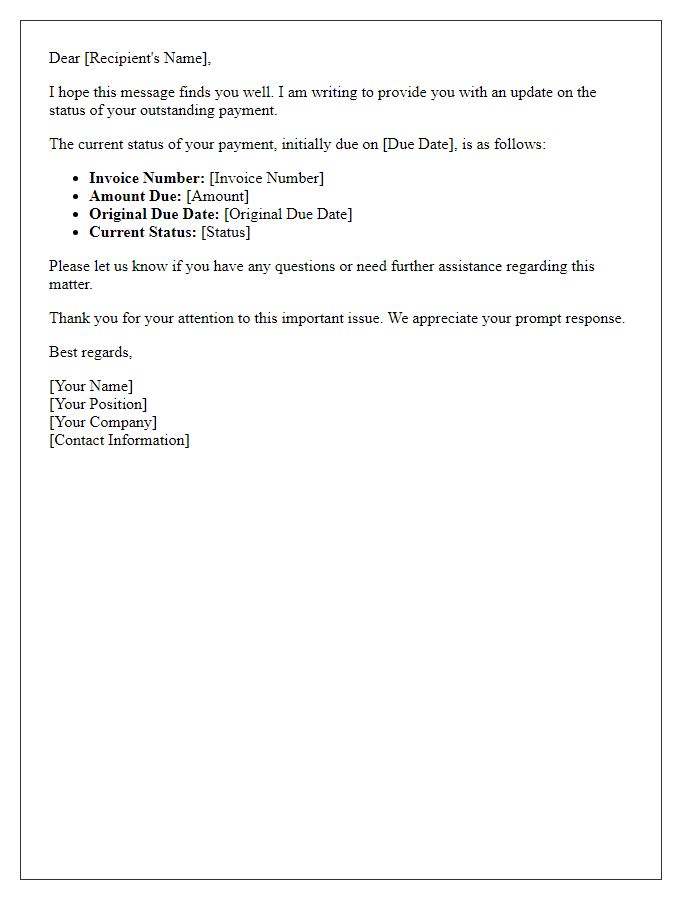

Payment details, including transaction IDs, payment methods, and amounts, are crucial for maintaining clear financial records. Accurate documentation ensures that both parties, the sender and recipient, can track the status of payments. For instance, in e-commerce platforms, confirming payment via credit card or PayPal transactions helps in minimizing disputes. Including relevant dates, such as the payment initiation date and the expected clearance date, is essential for transparency. Furthermore, informing clients about any applicable fees or delays associated with processing can enhance communication and trust in business relationships.

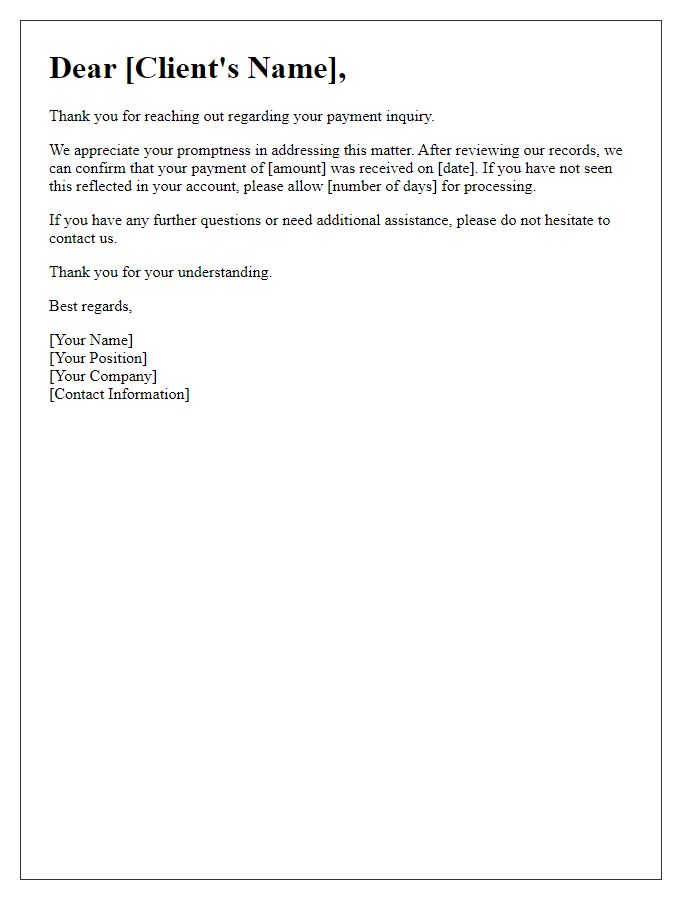

Response Timeliness

In payment inquiry scenarios, timely responses significantly affect customer satisfaction and trust in service providers. For instance, financial institutions generally aim to reply to such inquiries within 24 to 48 hours to maintain client relationships. A delay of over three business days can create frustration among customers, especially when large transactions or due dates are involved, potentially impacting their financial planning. Leaders in customer service often implement automated systems to ensure that acknowledgment of inquiries occurs immediately, followed by personalized responses shortly thereafter, thereby improving the overall response efficacy and customer experience.

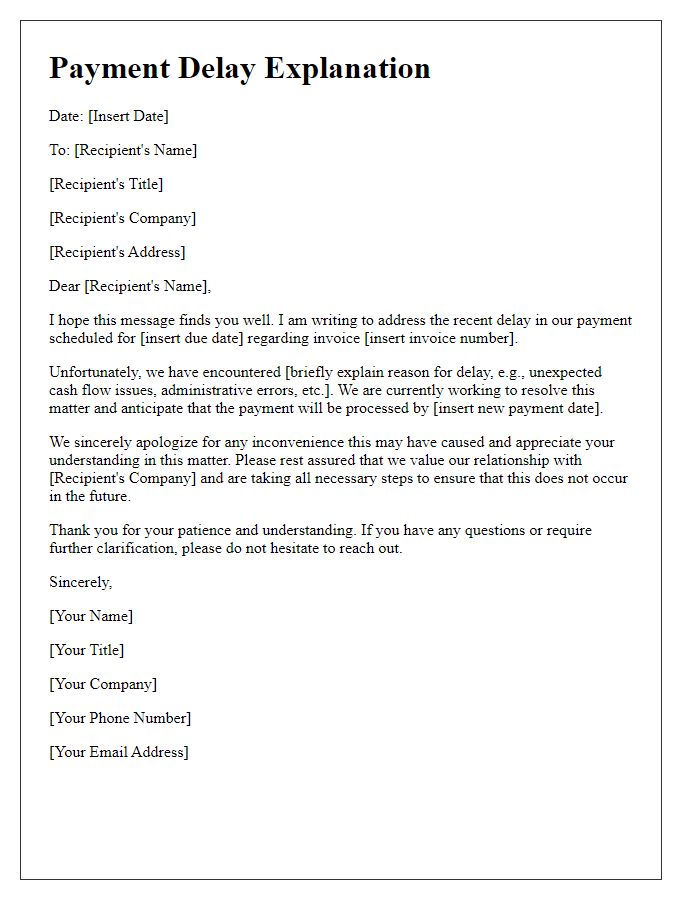

Clarity and Precision

Prompt payment inquiries require a clear response outlining the status of the account balance. Invoices, dated specifically within a grace period (typically 30 days), should be referenced to provide a detailed timeline of payments received. Account numbers associated with the client's file can enhance identification. Payment methods accepted, such as credit cards or bank transfers, need to be specified to simplify future transactions. Frequent communication channels, including email and phone numbers, aid in maintaining transparency and resolve any potential discrepancies quickly, ensuring a smooth customer experience.

Professional Tone

A payment inquiry regarding outstanding invoices can create misunderstandings between businesses. Timely responses convey professionalism and commitment. In the financial sector, clarity is essential. Common concerns often relate to overdue payments, discrepancies in amounts, or missing invoices. Businesses, such as small enterprises or large corporations, may use accounting software like QuickBooks or Xero to manage their finances efficiently. Timely communication, often within 48 hours, is standard practice in maintaining client relationships and ensuring cash flow stability. Clear identification of the invoice number and payment due date are crucial components for effective resolution. Regular follow-up patterns are often beneficial in remediating potential payment delays, helping to maintain a steady and positive business cycle.

Comments