Have you ever found yourself waiting anxiously for a payment that's long overdue? It's a frustrating reality for many, but knowing how to approach the situation can make all the difference. In this article, we'll explore effective strategies for crafting a polite yet firm letter to request overdue payments, ensuring your message is clear and professional. Ready to take charge of your financial conversations? Let's dive in!

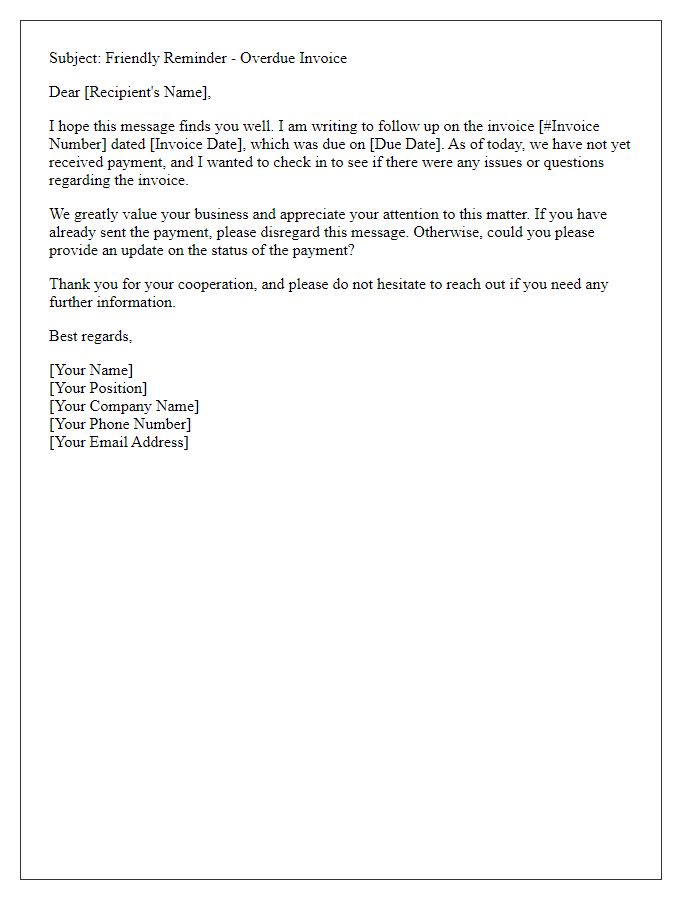

Clear subject line.

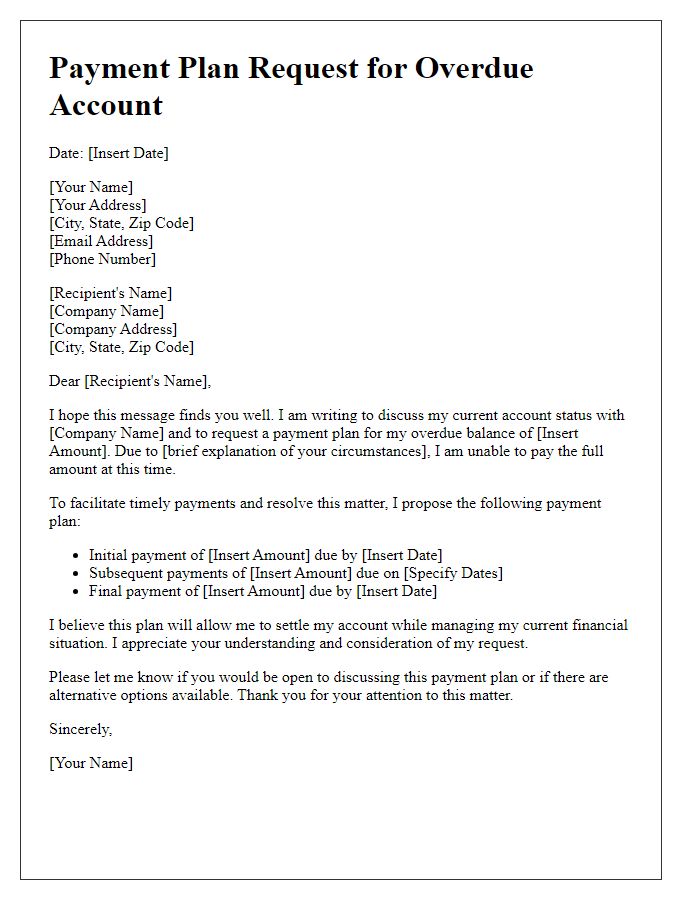

Delaying payment can lead to complications in cash flow management for small businesses. Outstanding invoices, typically due within 30 days, often result in a negative impact on the ability to pay bills or invest in new opportunities. For example, a $1,000 invoice overdue by 60 days can incur additional late fees, usually around 1.5% per month, increasing financial strain. In some cases, communication with clients regarding overdue payments can enhance the likelihood of prompt settlement, fostering stronger business relationships. It is essential to maintain professionalism while requesting payment, emphasizing the importance of timely transactions for ongoing services or products delivered.

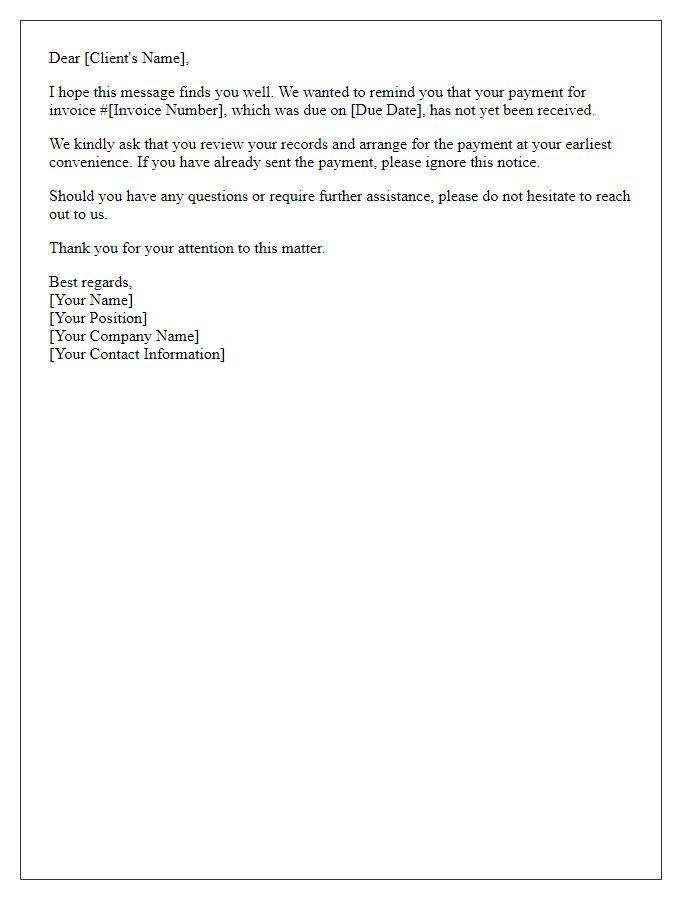

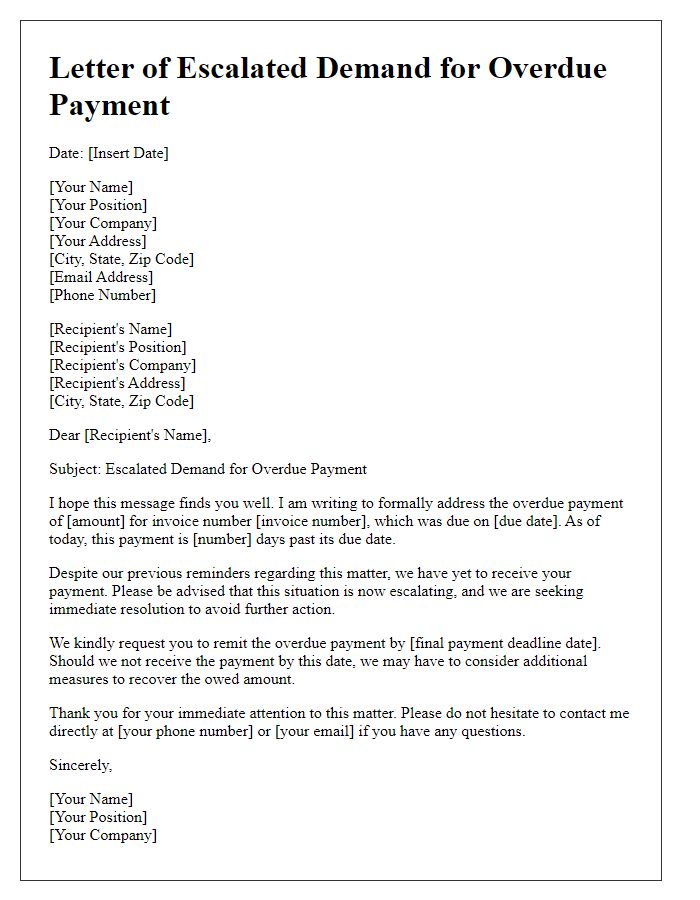

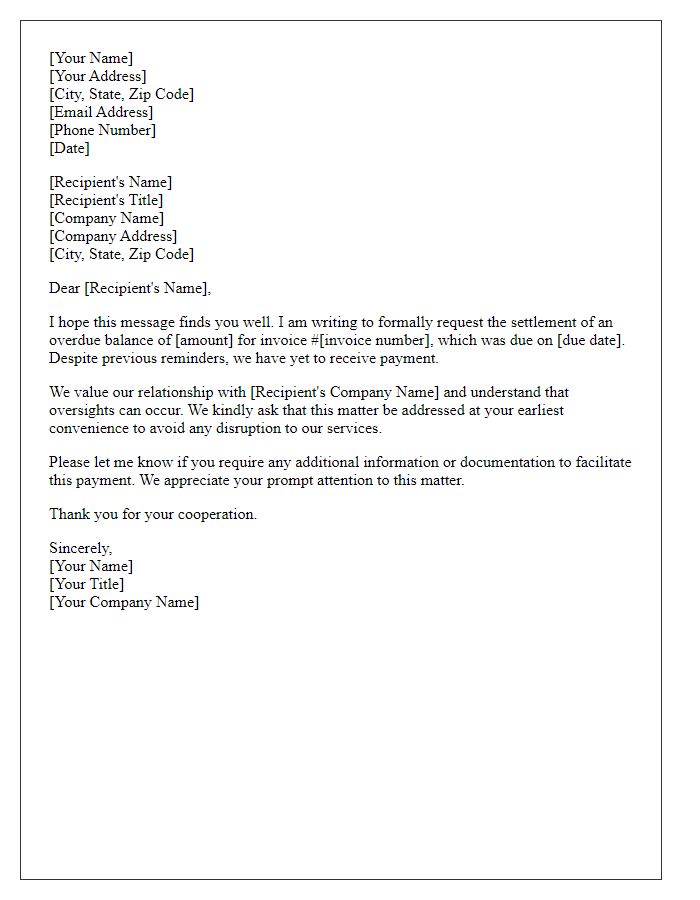

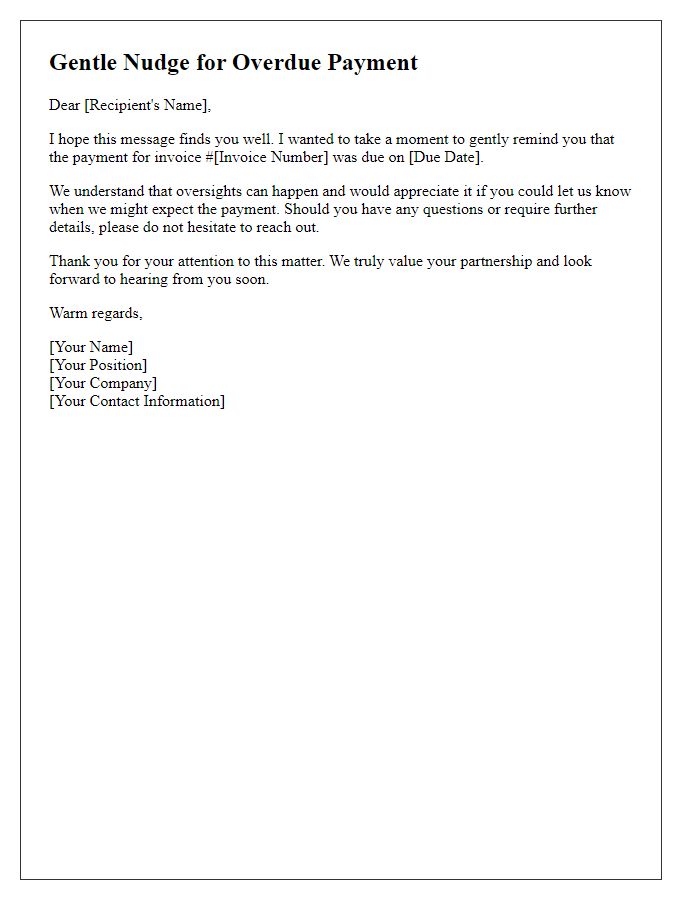

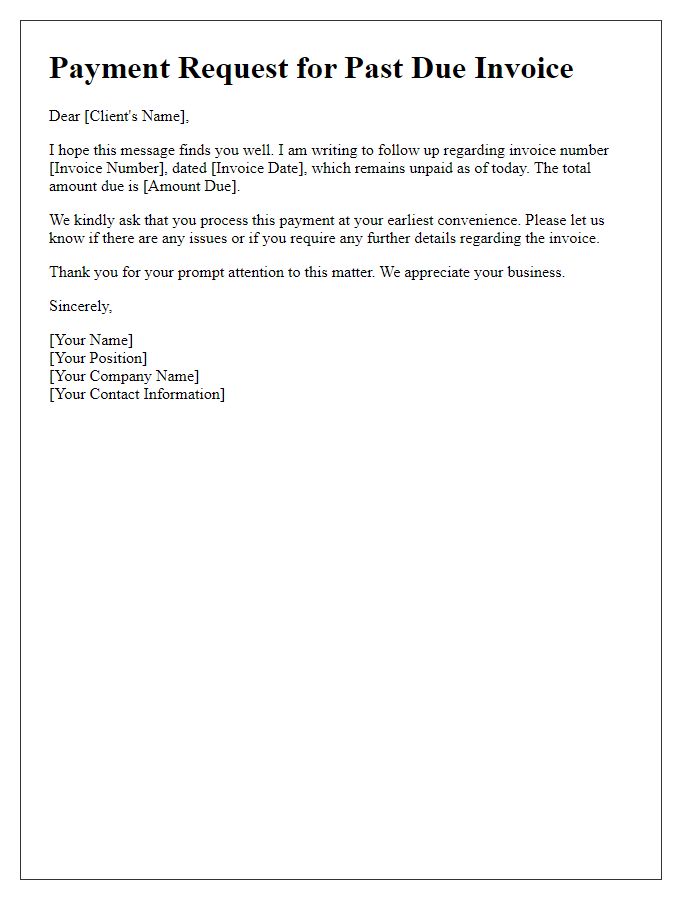

Polite yet firm language.

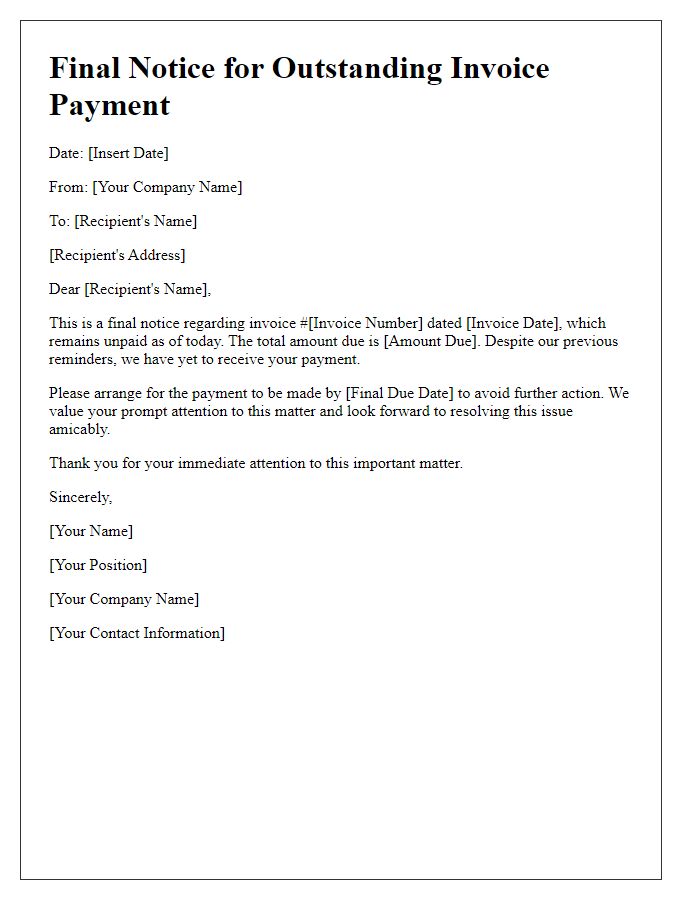

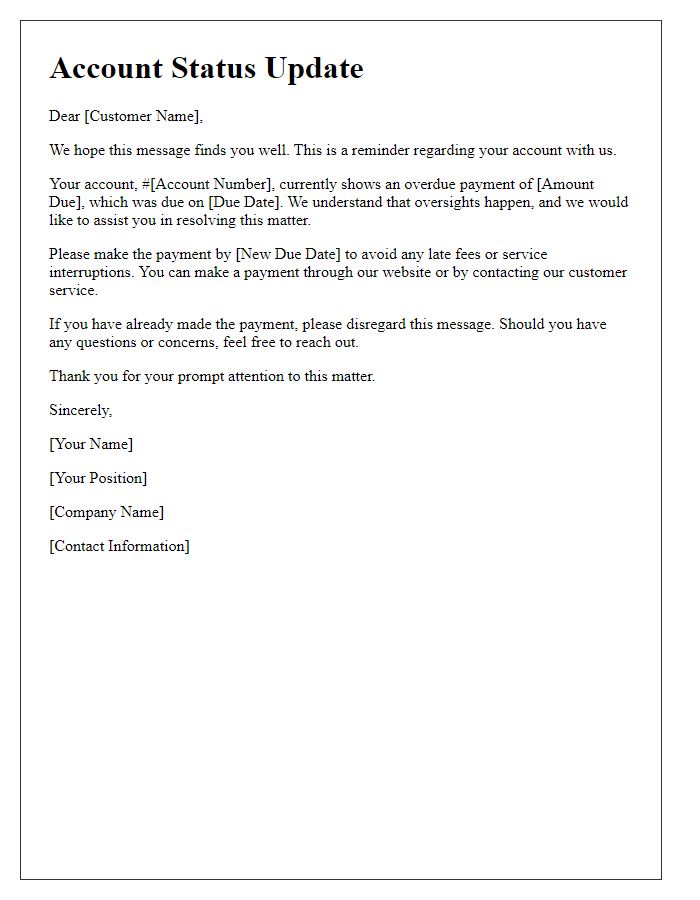

Overdue payments can significantly impact cash flow for businesses, particularly small and medium-sized enterprises. Invoices that remain unpaid beyond the agreed payment terms, typically 30 to 90 days, create challenges in maintaining operations. Correspondence best practices recommend sending reminders through email or letter, utilizing a tone that balances politeness with assertiveness. Key information should include the invoice number (for tracking), original due date, and the total amount due. Including a clear call to action, such as a request for immediate payment or a response confirming the payment timeline, helps in facilitating prompt responses. Adhering to these guidelines aids in maintaining professional relationships while ensuring financial obligations are met.

Invoice details (amount, date, invoice number).

In the realm of business transactions, overdue payments pose significant challenges to cash flow management. The outstanding invoice, numbered 12345, dated March 1, 2023, reflects an amount of $2,500 due for services rendered. Such delays often lead to financial strain on operations, requiring immediate attention to rectify the account status. Timely payment ensures ongoing business relationships remain intact and fosters a positive working environment. It's essential to adhere to agreed-upon payment terms, which are typically stipulated within the service agreement or purchase order. Addressing overdue invoices promptly not only mitigates financial discrepancies but also reinforces professional accountability among parties involved.

Payment terms and deadlines.

A clear overdue payment notification is crucial for maintaining healthy cash flow in business transactions. Payment terms typically specify the timeline for payment, often ranging from 30 to 90 days post-invoice date. Specific deadlines can vary depending on agreements made between parties; for example, a 30-day payment term covers payments due by the end of the month following the invoice date. Agencies and suppliers in sectors such as construction or freelance services might enforce stricter timelines due to project schedules. Follow-up communications should detail amounts owed, previous payment dates, and any additional late fees or interest that may apply if payments remain outstanding. Utilizing professional invoicing software can enhance tracking of these payments and automate reminders to clients.

Contact information for follow-up.

Overdue payments can significantly impact small businesses and financial stability, often leading to cash flow issues. For example, invoices older than 30 days may require immediate attention, with an average small business losing 5.2% of revenue due to late payments. Effective follow-up strategies, such as sending reminders via email or phone calls, can enhance recovery rates. Clear contact information, like a dedicated accounts receivable number or email address, can facilitate communication, ensuring prompt action on overdue balances. Implementing structured follow-up processes is essential for maintaining healthy financial operations in competitive marketplaces.

Comments