Are you looking for the best way to communicate a bridging payment with clarity and professionalism? It's essential to ensure that all parties are on the same page regarding the specifics, timelines, and amounts involved. In this article, we'll provide you with a comprehensive letter template to streamline your communication and keep everything organized. So, let's dive in and discover how you can simplify your bridging payment communication!

Clear and concise subject line.

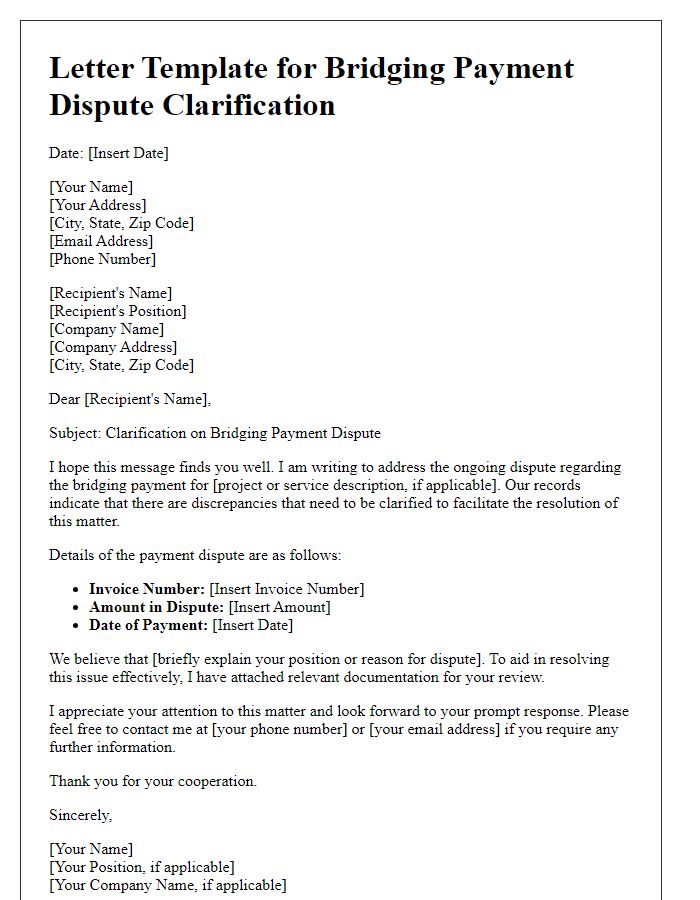

Bridging payments play a crucial role in financial transactions, particularly in real estate deals involving loans and escrow services. Timely bridging payments (typically due upon agreement or deposit) facilitate smooth transitions between purchase agreements, ensuring all financial obligations are met. Delays in this payment can affect timelines, leading to potential penalties or even jeopardizing agreements. Specifics such as transaction amounts, payment due dates, and contact information for financial institutions must be clearly communicated to prevent misunderstandings. Stakeholders, including sellers, buyers, and legal entities, must stay informed and engaged throughout the process for a successful transaction outcome.

Personalized greeting.

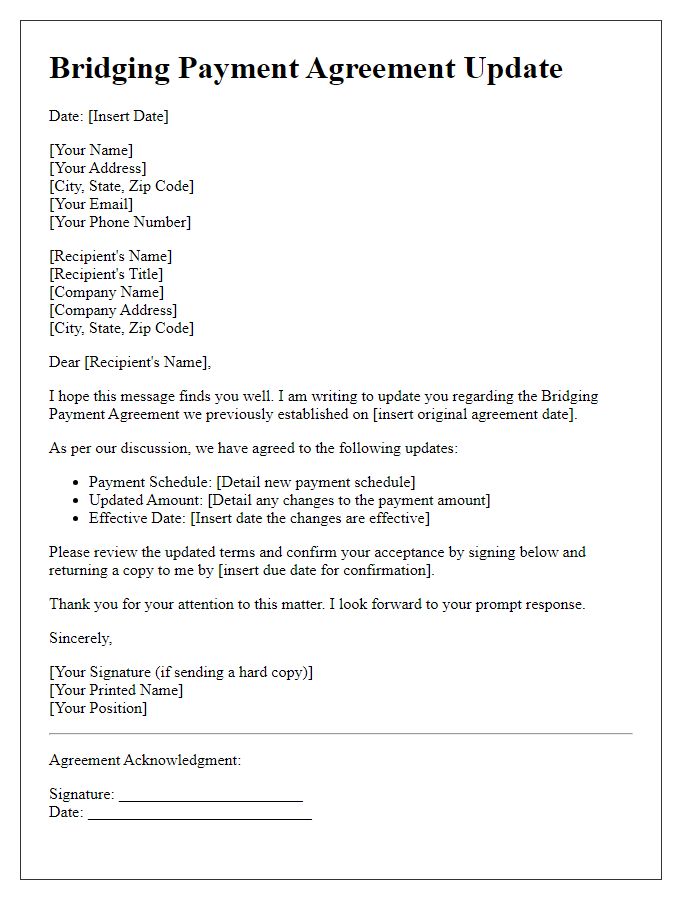

Bridging payment agreements are essential for managing finances efficiently, especially in real estate transactions. Parties involved in the agreement must coordinate funding timelines to ensure smooth transitions between financial obligations. For example, a seller may require a bridging payment of $50,000 within 30 days to cover interim costs. The recipient, such as a real estate developer, must provide confirmation due to regulatory requirements, ensuring compliance with financial regulations in various jurisdictions like the U.S. or U.K., where laws may differ. A clear communication channel must be established, often through email or formal letters, to outline the terms of payment, including deadlines and potential penalties for late payments.

Explanation of payment details and purpose.

Bridging payments are temporary financial arrangements used to cover short-term funding needs, often associated with real estate transactions or project financing. These payments can provide necessary liquidity during transitional phases, such as waiting for long-term financing approval or the completion of payment processing by lending institutions. Typically, bridging payments involve interest rates higher than conventional loans, reflecting the urgency of the funding; this can range from 0.5% to 3% monthly. Detailed documentation is crucial, outlining the purpose of the payment, which might include covering renovation costs or securing purchase options for property located in areas like Manhattan or San Francisco. Moreover, understanding the repayment timeline, which may span from a few weeks to several months, is essential for proper cash flow management.

Payment method and instructions.

The bridging payment process involves ensuring that transactions are efficiently completed between parties. Utilizing bank transfers is a common method for bridging payments, with procedures varying by institution. For seamless transactions, confirm necessary details such as account numbers, routing information, and payment references. Payment platforms like PayPal or Stripe offer alternative methods, providing instant transfer capabilities with applicable fees. Additionally, mobile wallets such as Venmo facilitate quick peer-to-peer transactions. When completing bridging payments, users should verify transaction limits and potential international fees if dealing with cross-border transfers.

Contact information for queries.

Bridging payment is a vital process in financial transactions, often used in real estate deals or substantial contractual agreements. Delays in bridging payments can occur due to various reasons, such as insufficient documentation or compliance issues. Frequent communication with stakeholders, including real estate agents or financial advisors, is crucial to ensuring smooth transactions. Contact information is essential for addressing queries efficiently; stakeholders typically prefer response times under 24 hours. Utilizing structured methods such as phone calls, emails, or dedicated customer service portals can facilitate timely resolution of issues related to bridging payments. Proper channels ensure transparency and maintain trust in the transaction process.

Comments