Are you looking to streamline your invoicing process and ensure clients understand your billing policies? A well-crafted letter outlining your invoice billing policies is essential for maintaining transparent communication and avoiding misunderstandings. By clearly stating your terms, due dates, and payment options, you set the foundation for a smooth transaction and foster positive client relationships. Join us as we explore effective templates and tips for crafting your own invoice policy letter!

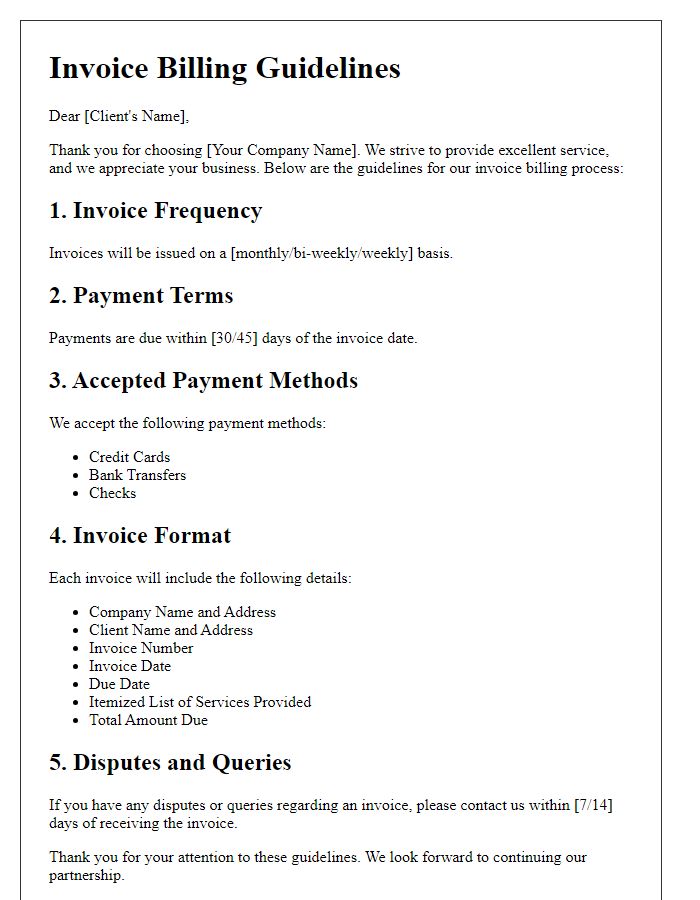

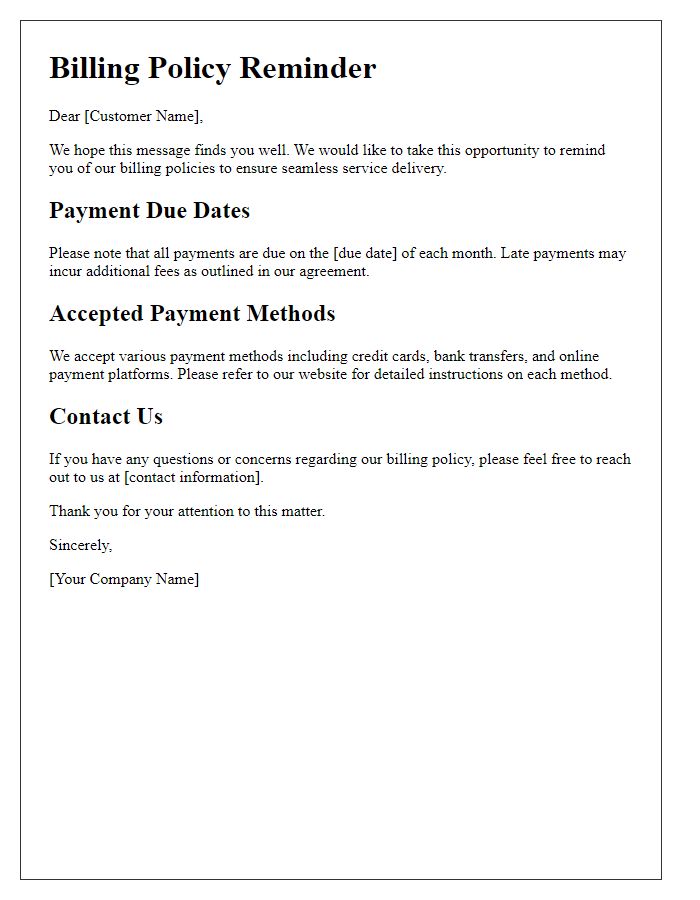

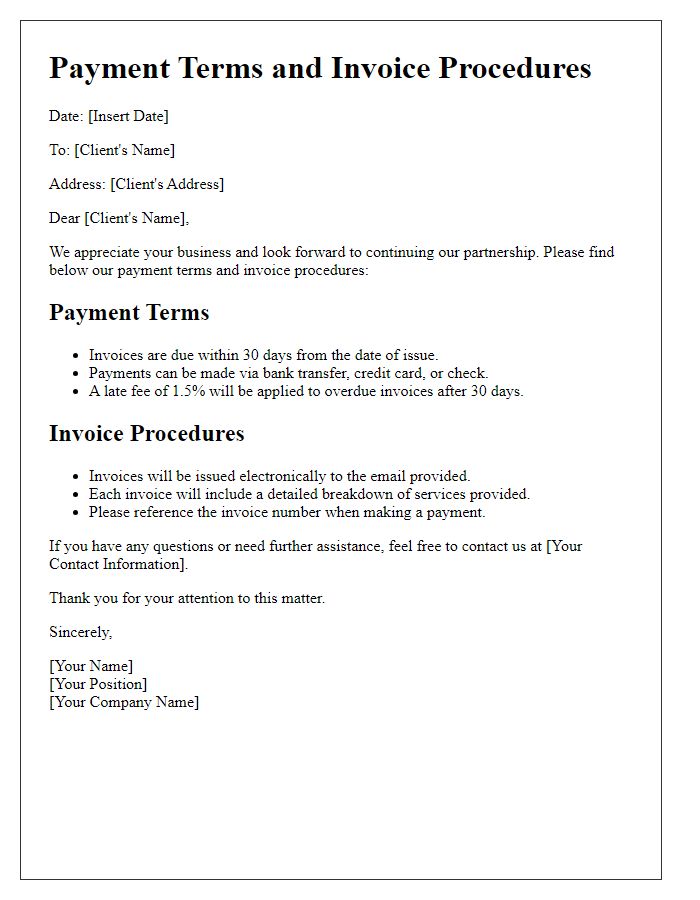

Payment Terms

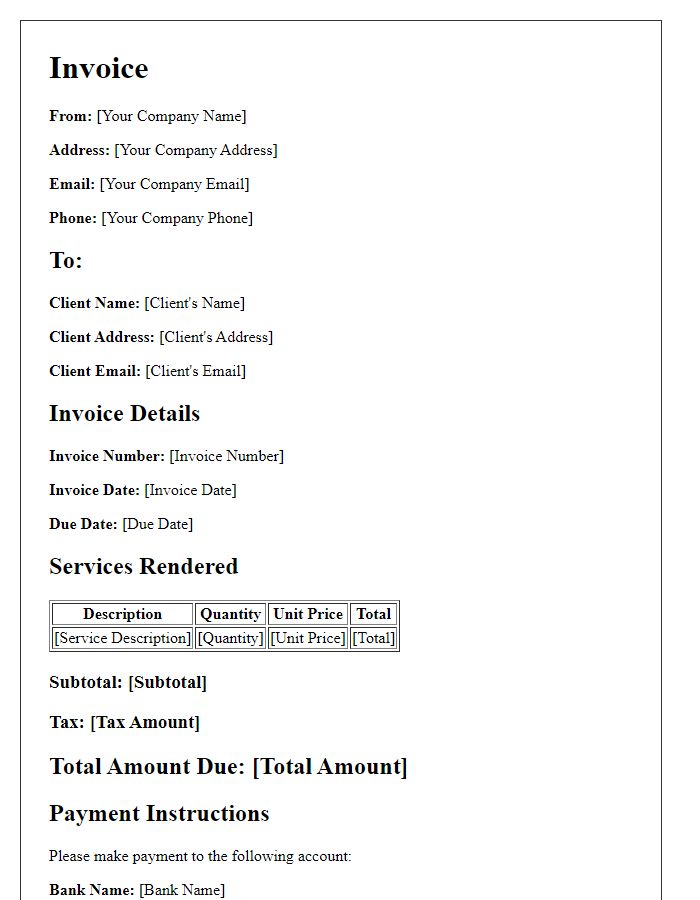

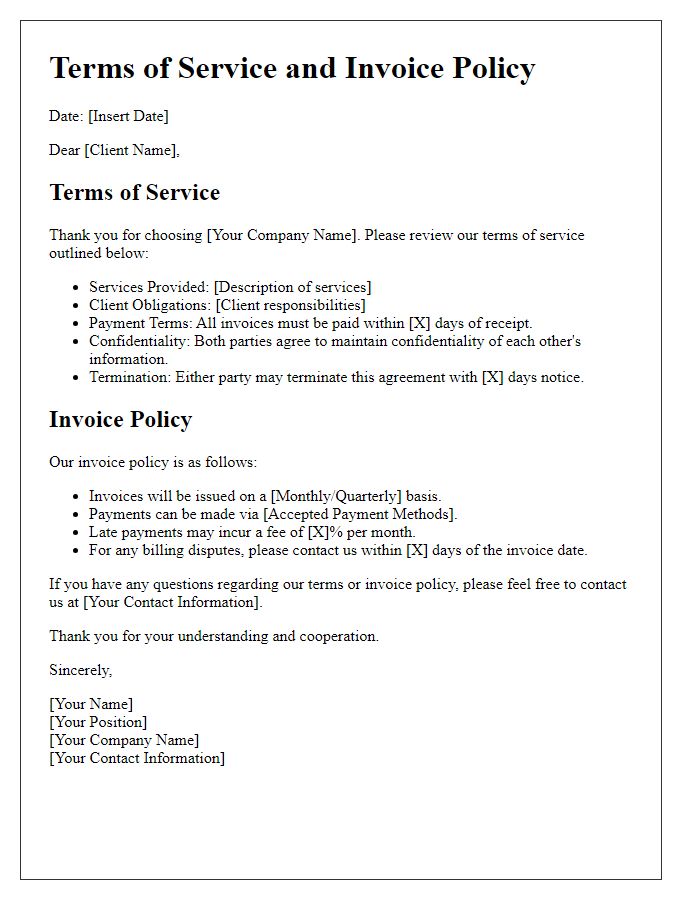

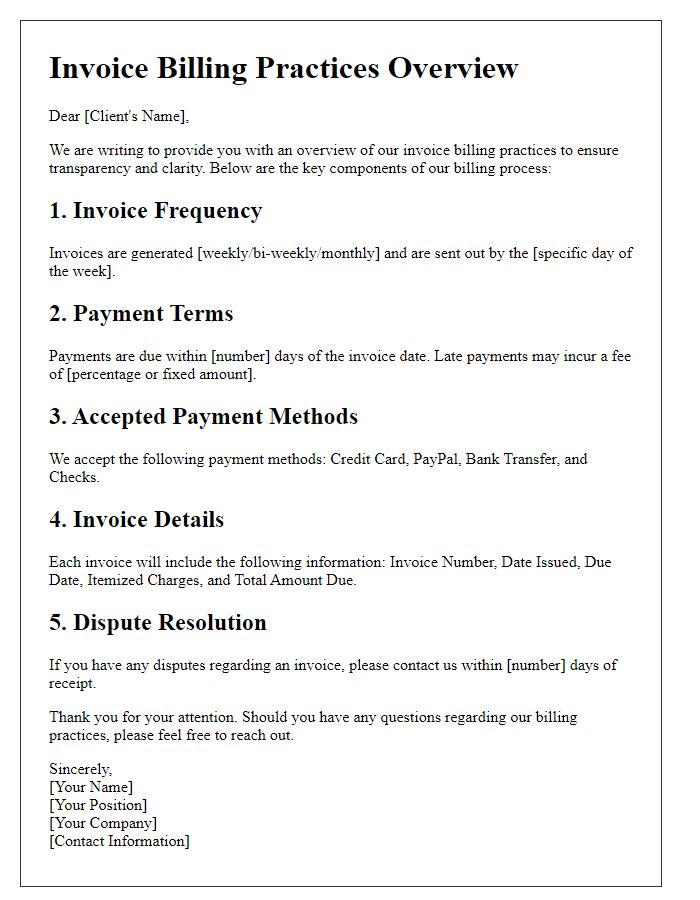

Invoice billing policies are crucial for maintaining clear financial communication between businesses and clients. Payment terms stipulate the timeframe within which clients must settle their invoices, typically ranging from 15 to 60 days. Delayed payments can incur late fees, often calculated as a percentage of the total amount due, such as 1.5% per month. It is important to outline acceptable payment methods including credit cards, bank transfers, and electronic payment platforms such as PayPal to provide clients with options. Additionally, early payment discounts, generally around 2% if paid within 10 days, can incentivize timely payments, enhancing cash flow for the business. Clear communication of these policies fosters transparency and builds trust with clients over time.

Due Date

Clear due dates are crucial for maintaining efficient billing processes. Typically, invoices should specify a payment due date, often set between 30 to 60 days post-invoice date, depending on contractual agreements or business practices. For instance, a due date of December 15 allows clients time to process invoice submissions received on November 15. Timely payment adherence ensures consistent cash flow for service providers, such as freelancers or small businesses, minimizing delays in project funding. It is vital to communicate any late fees or penalties associated with overdue payments, which may range from 1% to 5% of the total invoice amount per month, to encourage timely settlement and avoid misunderstandings.

Late Fees

Late payment penalties constitute a significant aspect of invoice billing policies, ensuring timely transactions in business environments. For instance, a standard late fee may apply after a grace period of 30 days post the invoice date, typically amounting to 1.5% of the unpaid balance per month. This translates into a potential 18% annual percentage rate, which is legally permissible in various jurisdictions. Additionally, frequent late payments can lead to stricter credit terms or suspension of services, emphasizing the importance of adhering to payment deadlines. Clear communication of these policies can help businesses maintain cash flow and minimize financial disruptions.

Accepted Payment Methods

Businesses typically outline their invoicing and billing policies to ensure clarity and accountability in financial transactions. Accepted payment methods may include credit cards, such as Visa and Mastercard, bank transfers, PayPal, and checks. For credit card transactions, companies often specify processing fees, commonly around 2.9% plus a fixed fee per transaction. Bank transfers may require customers to reference invoice numbers for seamless reconciliation. PayPal transactions might also incur fees, typically 2.9% plus 30 cents per transaction, emphasizing the importance of understanding cost implications. Clear guidelines for payment timelines, typically within 30 days after invoice issuance, reduce late payments and streamline cash flow management.

Contact Information for Billing Inquiries

For any inquiries related to billing, please reach out to our dedicated billing department at [Billing Department Email] or call us at [Billing Department Phone Number]. Our office is located at [Office Address], operating Monday through Friday from 9:00 AM to 5:00 PM (UTC-5). Our team is prepared to assist you with questions regarding invoices, payment options, or any discrepancies you may encounter. Please have your account number or invoice number handy for efficient assistance.

Comments