Are you looking to make a lasting impression on potential investors? Crafting a thoughtful follow-up letter is essential to stand out and keep the conversation flowing. It's an opportunity to reiterate your vision, spark their interest, and provide any additional insights that might resonate with them. Read on to discover our comprehensive template that will help you connect effectively with your potential investor!

Personalization and Investor's Name

Personalized follow-up communication with potential investors can enhance relationships and foster interest. An effective message might reference the investor's name, such as "Mr. Smith," alongside mentioning relevant topics discussed, like "recent breakthroughs in renewable energy technologies." Including specifics such as investment milestones, market trends, or projected returns allows for a clearer context. Highlighting mutual connections or prior engagements, like "our conversation at the Green Energy Summit in July 2023," can create a more personalized touch. This tailored approach demonstrates genuine interest and reinforces shared goals, paving the way for ongoing dialogue about potential collaboration opportunities.

Summary of Previous Meeting or Discussion

A summary of the previous meeting with potential investors highlights essential feedback and insights gathered during the conversation. Key topics discussed included the investment proposal's financial projections, emphasizing a projected annual growth rate of 30% over the next five years. Critical questions regarding market saturation in the renewable energy sector, specifically solar power, raised concerns about competition and long-term sustainability. A summary of investor interests revealed a strong inclination towards eco-friendly technology and scalability potential. Action items included providing updated financial reports and a more detailed market analysis, with a follow-up scheduled for December 15, 2023, to address these areas and build a stronger rapport.

Highlight of Business Opportunity or Proposal

In the competitive landscape of online retail, the rise of eco-friendly products presents a significant business opportunity, projected to grow to a market size of $150 billion by 2025. Our venture, EcoGoods Inc., focuses on sustainable household items, utilizing biodegradable materials sourced from renewable resources. Based in San Francisco, California, we aim to capture the Millennial and Gen Z consumer segments who prioritize environmental responsibility, with over 70% indicating a willingness to pay more for sustainable options. Our innovative marketing strategy employs social media platforms, leveraging influencer partnerships to increase brand visibility. Furthermore, a recent collaboration with a leading recycling organization enhances our credibility and promotes circular economy practices. Investing in EcoGoods Inc. not only aligns with social responsibility goals but also positions stakeholders to benefit financially from a rapidly growing market.

Key Differentiators and Unique Selling Points

A well-prepared follow-up with potential investors highlights key differentiators and unique selling points that set the business apart. The innovative technology, such as proprietary algorithms or exclusive partnerships, showcases the distinct advantages of the product. Market analysis reports (Q3 2023) demonstrate significant trends indicating a projected 25% growth rate in the industry sector. The emphasis on sustainable practices, like eco-friendly materials sourced from certified suppliers, appeals to the environmentally-conscious consumer. Customer testimonials underline a 95% satisfaction rate, reinforcing brand loyalty while increasing revenue potential. Finally, strategic marketing initiatives, including social media engagement and targeted ad campaigns, position the company for success in a competitive landscape.

Clear Call-to-Action and Next Steps

Following up with a potential investor is crucial in maintaining momentum after initial discussions. A well-crafted email can demonstrate commitment and clarity regarding the next steps. Begin with a concise recap of previous discussions, highlighting key points such as the investor's interests, potential funding amounts, and relevant timelines. Include specific metrics or milestones that showcase growth potential, such as revenue figures or user engagement statistics. Clearly outline the desired action, whether it's scheduling a meeting for deeper discussions or inviting them to a product demonstration. Providing a defined timeframe for a response can help prompt action. Ensure to express enthusiasm about the collaboration and emphasize mutual benefits arising from the partnership, reinforcing the valuable insights the investor could bring to the table.

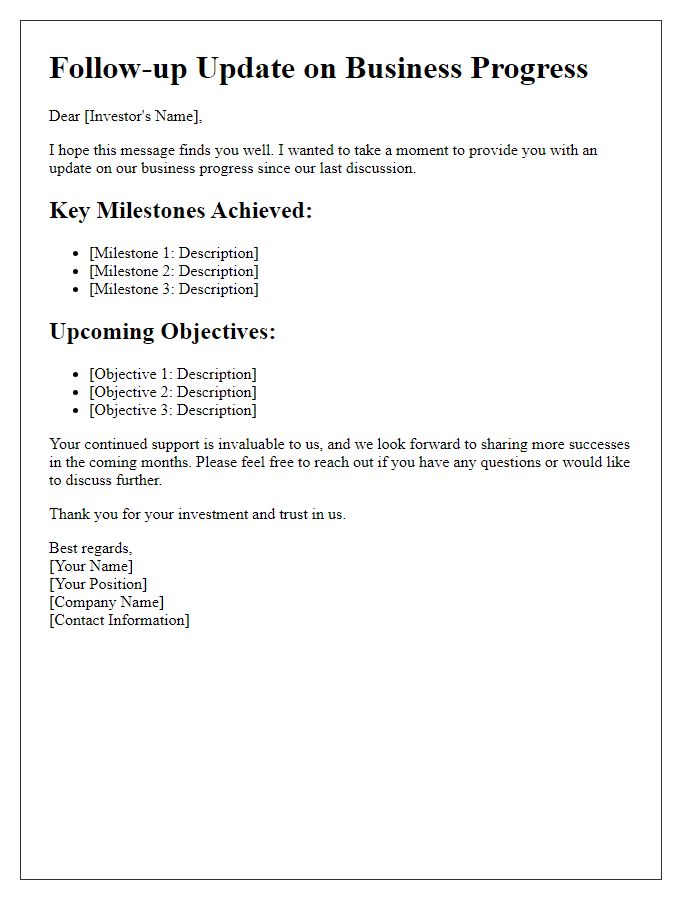

Letter Template For Follow-Up With Potential Investor Samples

Letter template of follow-up communication regarding investment proposal.

Letter template of follow-up message to reconnect with potential investor.

Letter template of follow-up request for feedback from potential investor.

Letter template of follow-up outreach for potential partnership investment.

Comments