Hey there! If you're curious about how your mutual fund investments are performing, you're in the right place. It's always exciting to see how market trends can impact your portfolio, and we're here to provide you with the latest insights. So, why not dive in and discover what's new and how you can make the most of your investments?

Introduction and reference to previous communication

In the recent communication dated October 1, 2023, regarding mutual fund investment strategies, we discussed the performance of various funds and their alignment with market trends. Our previous analysis highlighted the importance of diversification and risk assessment. Current updates will elaborate on portfolio adjustments and projections for the upcoming quarter, focusing on key funds such as the Vanguard Total Stock Market Index Fund and Fidelity Contrafund, which have shown considerable resilience in fluctuating markets.

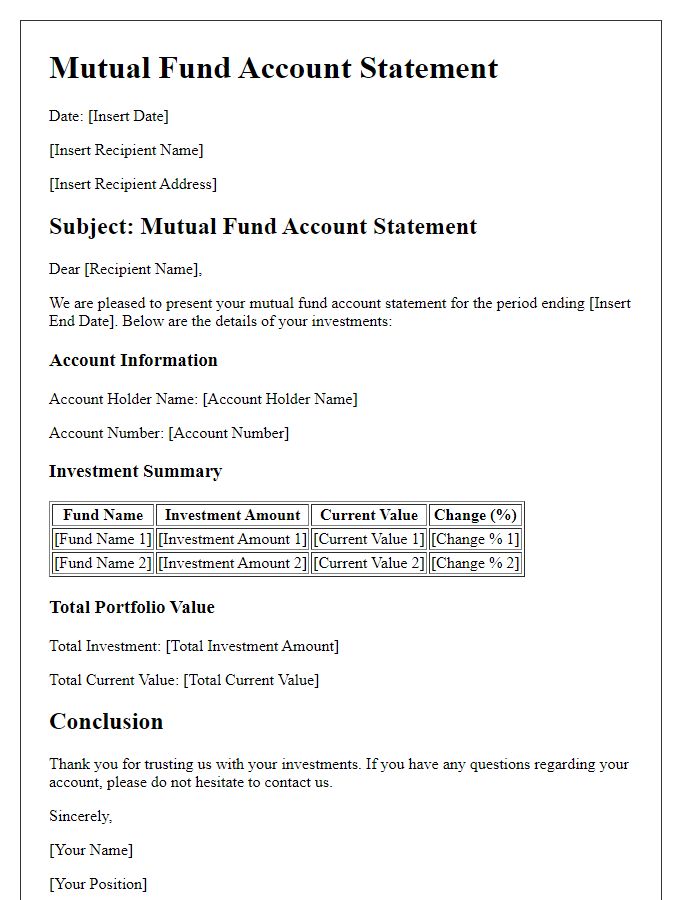

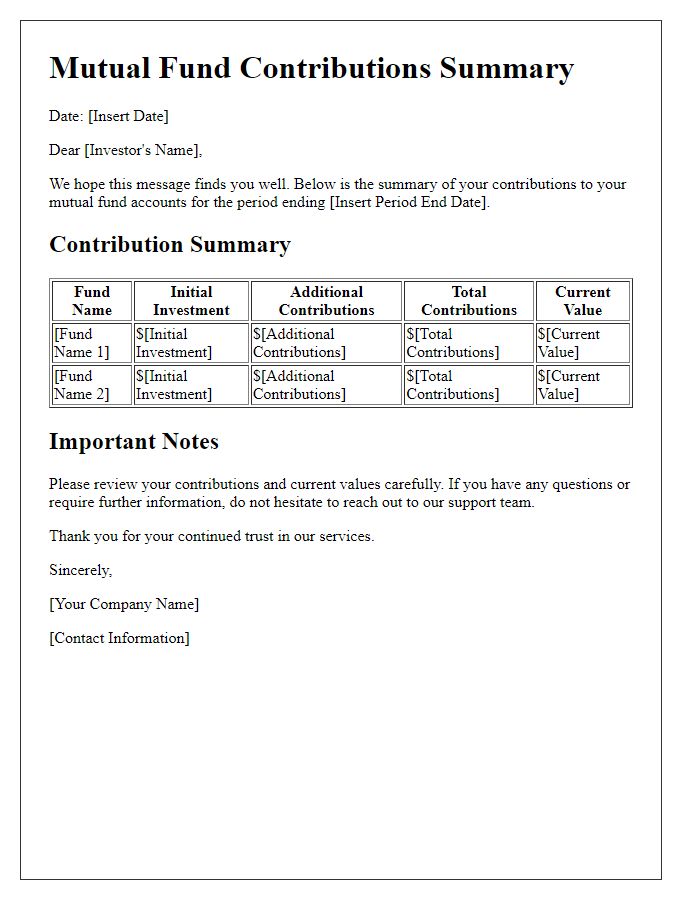

Performance summary and key statistics

The mutual fund investment performance summary reveals significant insights regarding fund growth and key statistics over the last quarter. The XYZ Mutual Fund, launched in April 2010, recorded an impressive annualized return of 12.5%, outperforming the benchmark index, the S&P 500, by 3% during this period. Total assets under management (AUM) reached $2 billion as of September 2023, indicating robust investor confidence. The fund's expense ratio remains competitively low at 0.75%, enhancing net returns for investors. Furthermore, the top five holdings, including leading companies like Apple Inc. (AAPL) and Microsoft Corp. (MSFT), collectively account for 35% of the portfolio, underscoring a targeted growth strategy. Overall, market volatility has been closely monitored, with risk-adjusted metrics such as the Sharpe ratio standing at 1.2, reflecting favorable performance despite fluctuations.

Detailed analysis of market trends

Mutual fund investments underwent significant fluctuations in response to evolving market trends throughout 2023. The S&P 500 Index, which serves as a benchmark for U.S. equities, experienced a volatility range of approximately 20%, reflecting investor sentiment driven by interest rate changes led by the Federal Reserve's policy adjustments. International markets, particularly emerging economies like India and Brazil, demonstrated resilience, with respective GDP growth rates projected at 6.5% and 4.5% for the year. The majority of sectors showed varied performance; technology stocks rallied, driven by advancements in artificial intelligence, while energy stocks faced challenges due to fluctuating crude oil prices, which fell below $70 per barrel. Environmental, social, and governance (ESG) funds continued to draw interest, accumulating nearly $50 billion in net inflows, highlighting an increasing preference among investors for sustainable investment options. Bond markets reacted to these trends, with a shift in yields affecting fixed-income mutual funds, prompting a re-evaluation of duration exposure. Overall, the shifting economic landscape necessitates continual analysis and adaptation within mutual fund strategies.

Future outlook and strategy adjustments

The current landscape of mutual fund investments reveals a dynamic market environment, characterized by fluctuating interest rates and evolving economic indicators. As of October 2023, investor sentiment is cautiously optimistic, driven by anticipated growth in sectors such as technology and renewable energy. Market analysts forecast an annual growth rate of 5-7% for the broader market indices, with mutual funds focused on Mid-cap stocks showing resilience. Strategic adjustments include reallocating assets to capitalize on emerging opportunities, integrating ESG (Environmental, Social, and Governance) factors into investment decisions, and increasing exposure to international markets, particularly in Asia, where forecasts predict higher GDP growth compared to developed nations. Ongoing monitoring of inflation rates, currently hovering around 3%, will guide tactical shifts in the portfolio to maximize long-term returns while mitigating risks.

Contact information for questions or further discussion

Investors in mutual funds often seek clear communication regarding updates and performance. Contact information remains essential for inquiries. Reach out via email at invest@mutualfundprovider.com or call the dedicated hotline at +1-800-555-0123 for immediate assistance. An investor relations team is available Monday through Friday, from 9 AM to 5 PM EST, to address any concerns or questions about fund performance, strategies, or market trends. Additional resources can be found on the official website, where comprehensive reports and educational materials are accessible.

Comments