Are you ready to make sense of your capital gains investments? Understanding your returns can help you strategize better for the future. In this article, we'll break down the key elements of a capital gains investment report, ensuring you grasp every detail. Stick around as we delve deeper into maximizing your investment potential!

Introduction to Investment Performance

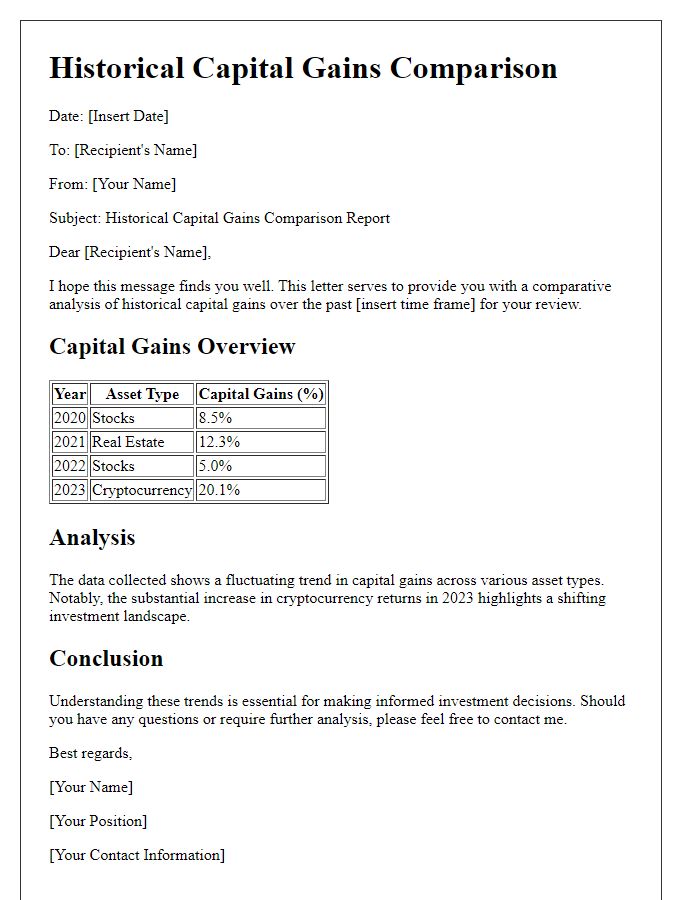

Investment performance analysis reveals essential insights into capital gains trends, highlighting the financial returns of various asset classes. The S&P 500 index, a crucial benchmark representing 500 leading U.S. publicly traded companies, has shown an average annual return of approximately 10% over the past century. High-performing sectors, such as technology, have outpaced others, with significant contributors like Apple and Microsoft buoying growth rates. Meanwhile, real estate investments have enjoyed substantial appreciation, with properties in cities like Austin or Seattle witnessing up to 20% annual increases in value during market booms. Understanding these dynamics aids in strategic decision-making and optimizing investment portfolios for future gains.

Detailed Analysis of Capital Gains

Capital gains refer to the profits earned from the sale of assets such as stocks, real estate, or collectibles. An analysis of these gains reveals significant trends and tax implications for investors. The capital gains tax rate varies based on income level and the duration for which the asset was held; for instance, long-term capital gains (for assets held beyond one year) can be taxed at lower rates, typically 0%, 15%, or 20% in the United States, depending on the individual's taxable income. Investment performance can be influenced by market fluctuations, with major stock market indices such as the S&P 500 experiencing an average annual return of around 10% historically. Additionally, certain investments, like Qualified Opportunity Funds, offer tax incentives to investors when capital gains are reinvested into economically distressed areas, prompting investors to strategize their portfolios effectively while remaining compliant with IRS regulations to maximize returns.

Tax Implications and Strategies

Capital gains investment reports detail the financial outcomes of various investment strategies, crucial for informed decision-making. Short-term capital gains, generated from assets held for one year or less, face higher tax rates, ranging from 10% to 37% in the United States, based on taxable income brackets. Long-term capital gains, from assets held over one year, enjoy lower tax rates of 0%, 15%, or 20%. Effective tax strategies include tax-loss harvesting, where losses offset gains to reduce overall taxable income, and utilizing tax-advantaged accounts like IRAs or 401(k)s, deferring taxes until withdrawal. Understanding the implications of the Tax Cuts and Jobs Act (2017) is essential for building a robust investment portfolio. Detailed records of purchase dates, sale dates, and values enhance compliance with Internal Revenue Service (IRS) regulations.

Future Market Projections

Future market projections for capital gains investments indicate substantial growth potential through the next decade. Analysts predict that technology sectors, particularly Artificial Intelligence (AI) and renewable energy, will lead the charge, with expected annual growth rates exceeding 20% in the AI market by 2025, valued at approximately $190 billion. Real estate markets in urban areas like San Francisco and New York City show resilience, with forecasts suggesting appreciation rates of 4% annually as demand continues to rise against limited supply. Global economic recovery post-pandemic is anticipated to boost consumer spending, contributing to a strong performance in retail and service sectors as they adapt to e-commerce trends. Investors should monitor key indicators such as Federal Reserve interest rate decisions and geopolitical developments, as these factors can influence market volatility and capital gains potential.

Summary and Recommendations

Capital gains investments, particularly in the context of financial markets, represent profits generated from the sale of assets such as stocks, real estate, or collectibles. Historically, investors can benefit from long-term capital gains tax rates, typically lower than ordinary income tax rates for assets held over a year. Key considerations include monitoring significant events, such as market volatility and economic indicators like the Consumer Price Index (CPI) and unemployment rates, which can influence asset prices. Notable places, such as Wall Street in New York City, serve as global financial hubs where investment trends can shift rapidly. Recommendations for optimizing capital gains involve diversification across sectors, frequently reevaluating the portfolio in response to market changes, and strategically timing sales to maximize after-tax returns.

Comments