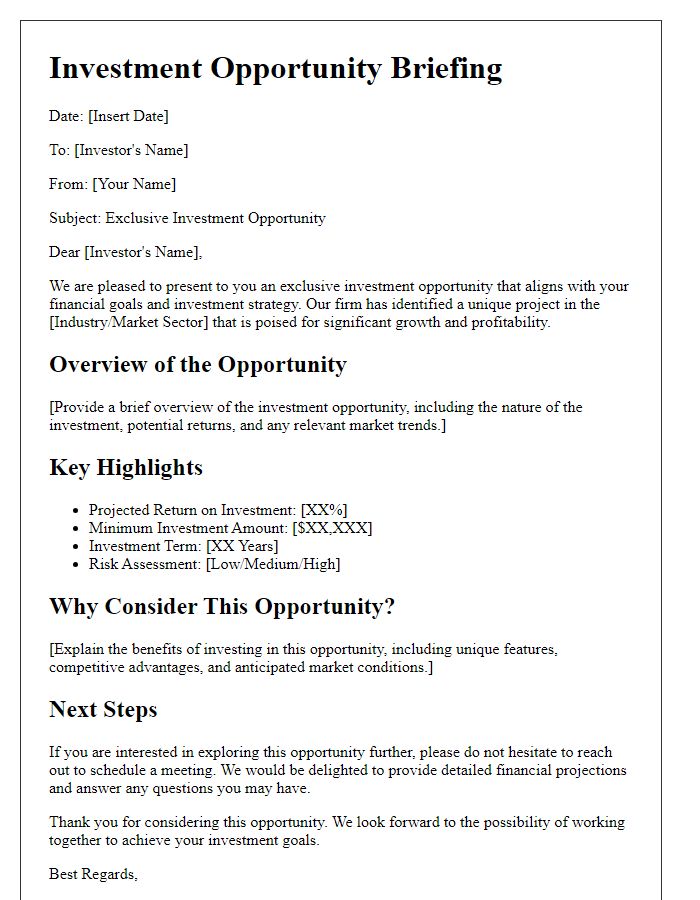

Are you looking to take your investment strategy to the next level? We understand that navigating the world of specialized investment products can be overwhelming, but we're here to help simplify that journey for you. This exclusive offer is designed to cater to your unique financial goals, providing tailored solutions that can enhance your portfolio. Curious to learn more about how these specialized products can work for you? Keep reading!

Target Audience Identification

Investment product offerings often appeal to specific groups, such as high net worth individuals or institutional investors. Identifying the target audience requires analyzing factors like income levels, investment experience, financial goals, or risk tolerance. For instance, accredited investors (those meeting SEC regulations, usually with an income exceeding $200,000 per year) are often suited for specialized products like hedge funds or private equity. Additionally, institutions such as pension funds and endowments aim for long-term growth, thus favoring alternative investments or portfolio diversification strategies. Understanding these demographics helps tailor investment products to match their specific financial needs and objectives, enhancing the likelihood of successful engagement and investment.

Personalized Messaging

Personalized messaging in investment products can enhance customer engagement and drive conversions. Utilizing customer data, such as investment preferences and risk tolerance, allows financial institutions to tailor offerings specifically for individuals. For example, a personalized investment portfolio could include a mix of stock options from technology firms like Apple and Microsoft, alongside sustainable energy funds such as NextEra Energy. Direct communication through emails or notifications can highlight potential returns based on historical performance, often showcasing annual growth rates that surpass standard market indices like the S&P 500. Further refining the approach, incorporating local market trends and economic indicators from regions like Silicon Valley can present a compelling case for clients seeking to maximize their investment potential.

Clear Value Proposition

This specialized investment product, the High Yield Green Bond Fund, provides investors with an opportunity to support sustainable projects while earning competitive returns. With an average yield of 5.5% annually, these bonds are focused on financing renewable energy, energy efficiency, and sustainable infrastructure, driving positive environmental impact. Investment in this fund allows contributions toward climate change initiatives globally, including solar energy projects in California and wind farms in Scotland. The bond's maturity period ranges from 5 to 10 years, offering investors flexibility and aligning with both short-term and long-term financial goals. Rigorous vetting processes ensure that each project meets Environmental, Social, and Governance (ESG) criteria, safeguarding investor interests.

Regulatory Compliance

Investment products, particularly specialized ones, must adhere to strict regulatory compliance measures established by bodies like the Securities and Exchange Commission (SEC) in the United States. These regulations ensure transparency and protect investors, requiring firms to disclose essential information, such as risks, investment strategies, and historical performance metrics. For example, the Alternative Investment Fund Managers Directive (AIFMD) in Europe imposes requirements on fund managers regarding capital reserves, reporting standards, and investor protections. Adherence to these regulations not only fosters trust but also enhances the credibility of investment offerings, showcasing a commitment to ethical practices in financial markets. Regular audits and compliance checks are essential in maintaining conformity with these legal standards, safeguarding both the firm and its clients from potential legal ramifications.

Call to Action

Specialized investment products, such as private equity funds, offer unique opportunities for wealth growth and portfolio diversification. Investors can benefit from higher potential returns compared to traditional stocks and bonds, often targeting an annualized return of 15% or more. Geographic focus on emerging markets, like Southeast Asia, presents additional growth potential due to expanding economies and increasing consumer demand. These products typically have structures such as Limited Partnerships, where capital is pooled from accredited investors to support private companies or infrastructure projects. Risks, including illiquidity and market volatility, necessitate careful evaluation before committing funds. Engaging with a financial advisor can ensure alignment with individual investment strategies and risk tolerance.

Comments