Are you exploring the world of family office investment services and eager to safeguard and grow your wealth? You're not alone! Many families are seeking tailored investment strategies that align with their unique values and long-term goals. Join us as we delve into the essentials of family office investment servicesâyour comprehensive guide awaits!

Personalization

Family offices often prioritize personalized investment services to cater to unique financial goals. Tailored strategies include asset allocation specifically designed to meet the risk tolerance and investment horizon of each family member. For instance, if a family wishes to focus on sustainable investing, a family office may allocate funds towards renewable energy sectors, such as solar or wind power, which have seen a significant rise, with a projected market growth rate of 20% annually through 2025. Furthermore, specific geographic diversification can be employed, such as investing in emerging markets like Brazil, which offers unique opportunities due to its vast natural resources and growing consumer base. The integration of wealth management with philanthropic goals also highlights the personalization aspect, allowing families to fund charitable initiatives in alignment with their values.

Client Objectives

Family offices play a crucial role in managing wealth, investment strategies, and financial planning for high-net-worth individuals and families. Client objectives often vary, with priorities such as capital preservation, wealth growth, tax optimization, and philanthropic ventures being paramount. Focus on tailoring investment portfolios that align with specific objectives, including real estate investments, private equity opportunities, and alternative assets. In addition, understanding risk tolerance is vital for effective asset allocation and diversification strategies. The integration of family values and mission in investment decisions enhances the legacy-building aspect of family office services. Regular performance reviews and adjustments in the investment approach ensure alignment with changing market conditions and family goals. Effective communication is essential to nurture relationships and facilitate informed decision-making.

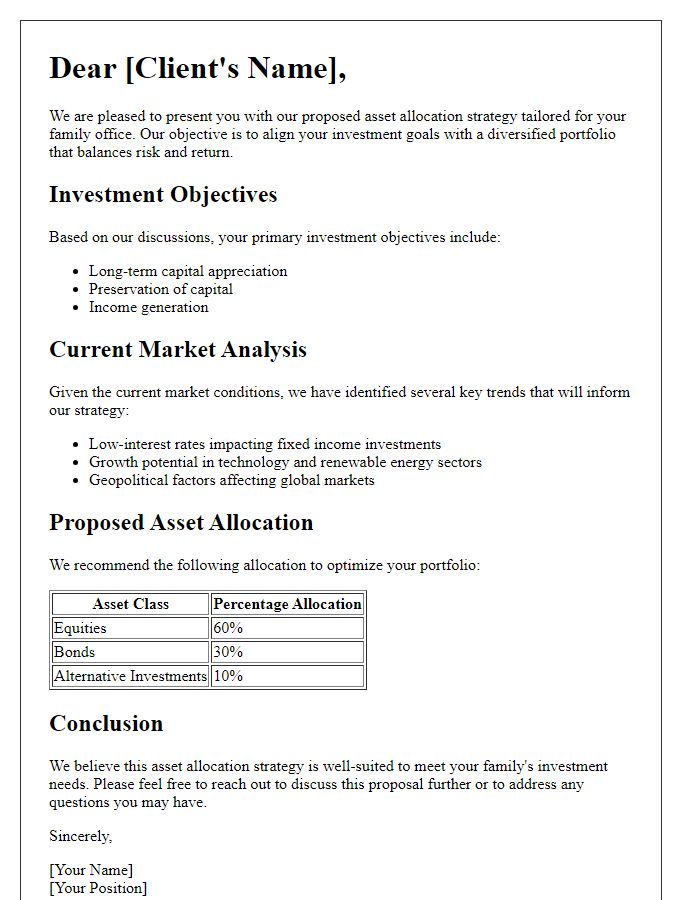

Investment Strategy

Investment strategies typically focus on diversifying asset allocation across various sectors, including public equities, private equity, real estate, and alternative investments. A family office often emphasizes long-term wealth preservation with goals such as capital growth, income generation, and risk management. Key performance indicators (KPIs) include annual return targets (e.g., 8-10% CAGR) and volatility metrics (e.g., max drawdown limits). Each investment decision should align with the family's risk tolerance and liquidity needs, typically assessed during regular reviews (quarterly or annually). Utilizing advanced investment vehicles, such as hedge funds or venture capital, provides opportunities to tap into unique market segments or innovative startups. This structured approach fosters a balanced portfolio geared for sustainable returns in fluctuating economic conditions.

Risk Management

Family offices play a crucial role in managing investments, with a strong emphasis on risk management strategies. Effective risk management identifies potential financial vulnerabilities, protecting wealth across various asset classes such as equities, real estate, and fixed income. Robust frameworks evaluate market volatility, geopolitical influences, and macroeconomic indicators that can impact investment performance. Utilizing advanced analytics and modeling, family offices craft tailored portfolios aligned with long-term objectives, ensuring preservation of capital while seeking optimal returns. Regular stress testing scenarios simulate adverse market conditions, enabling proactive adjustments to mitigate potential losses while capitalizing on emerging opportunities. Comprehensive reporting provides transparent insights into risk exposures, fostering informed decision-making for family stakeholders.

Performance Metrics

Performance metrics in family office investment services encompass a variety of critical indicators that reflect portfolio efficiency. The internal rate of return (IRR) quantifies the profitability of investments, typically expressed on an annualized basis. Standard deviation measures risk by assessing return volatility, allowing families to understand potential fluctuations in their wealth. The Sharpe ratio evaluates risk-adjusted performance, comparing excess returns to portfolio volatility, providing insight into investment decisions. Total assets under management (AUM), a key indicator of operational scale, reflects the firm's market position, with larger AUM signifying trust and expertise. Additionally, benchmarking against indices like the S&P 500 or MSCI World offers contextual performance insights, while the time-weighted rate of return (TWRR) ensures fair comparison across varied cash flows. Effective performance reviews are essential for strategic adjustments and optimizing future investment approaches.

Comments