Are you curious about the exciting world of cryptocurrency and how it can enhance your investment portfolio? With the rapid growth and evolving landscape of digital assets, now is the perfect time to explore the potential benefits that cryptocurrency can offer. Imagine diversifying your investments while tapping into a market that's changing the financial landscape as we know it. Dive deeper into this fascinating opportunity and discover how you can start investing today!

Introduction and Investment Purpose

Cryptocurrency investment opportunities exist within dynamic digital markets, attracting attention from investors around the globe. Since the inception of Bitcoin in 2009, cryptocurrencies (digital or virtual currencies secured by cryptography) have evolved rapidly, introducing various alternatives like Ethereum, Ripple, and Litecoin. These decentralized currencies often operate on blockchain technology, a distributed ledger system that enhances transparency and security for transactions. The primary purpose of this investment is to capitalize on the burgeoning growth within the cryptocurrency sector, which has seen market capitalization soar past $2 trillion in 2021, signaling increased adoption and interest from institutional investors. Engaging in this investment could potentially yield significant returns as the demand for innovative financial solutions and decentralized finance (DeFi) platforms continues to surge.

Market Analysis and Trends

The cryptocurrency market, particularly Bitcoin and Ethereum (2023 data shows Bitcoin at approximately $27,000 and Ethereum around $1,700), exhibits significant volatility influenced by global economic events, regulatory changes, and technological advancements. Recent trends indicate increased institutional investment, with entities like Tesla and MicroStrategy integrating Bitcoin into their asset portfolios. Furthermore, advancements in blockchain technology, such as Ethereum's transition to a proof-of-stake model, enhance efficiency and sustainability, attracting environmentally-conscious investors. Geopolitical factors, such as inflation and currency devaluation in countries like Turkey (inflation rates soaring above 70%), also push individuals toward cryptocurrency as a hedge against traditional financial systems. Continued innovation in decentralized finance (DeFi) and non-fungible tokens (NFTs) demonstrates the sector's potential for growth, offering new avenues for profit. Monitoring these trends and market dynamics is crucial for maximizing investment opportunities in cryptocurrency.

Risk Assessment and Management

Cryptocurrency investment presents an opportunity for significant financial gains but also includes substantial risks, particularly in volatile markets. Price fluctuations can exceed 20% within a single day, as observed in cryptocurrencies like Bitcoin, which reached an all-time high of approximately $64,000 in April 2021 but dropped below $30,000 shortly after. Regulatory uncertainty continues to loom over the market as governments worldwide, including the United States and the European Union, explore regulations and compliance requirements, adding to investor caution. Furthermore, security threats such as hacking incidents, notably the $600 million hack of Poly Network in August 2021, highlight vulnerabilities associated with digital assets. Effective risk management strategies, including diversification across various cryptocurrencies and asset classes, will help mitigate potential losses while maximizing returns. Continuous monitoring of market trends and regulatory changes is essential for informed decision-making in the ever-evolving cryptocurrency landscape.

Security Measures and Compliance

Investing in cryptocurrency requires understanding security measures and compliance regulations to safeguard assets and ensure lawful operations. Robust cybersecurity protocols, such as encryption technologies, multi-factor authentication, and regular security audits, protect digital wallets and exchanges from hacking attempts, which have affected platforms like Mt. Gox in 2014. Compliance with regulations, such as the Financial Action Task Force (FATF) guidelines and the U.S. Securities and Exchange Commission (SEC) standards, fosters trust and credibility in the cryptocurrency market. Moreover, anti-money laundering (AML) policies and know-your-customer (KYC) processes enhance transparency, promoting a secure investment environment. By prioritizing these essential aspects, investors can navigate the complexities of the cryptocurrency landscape with confidence.

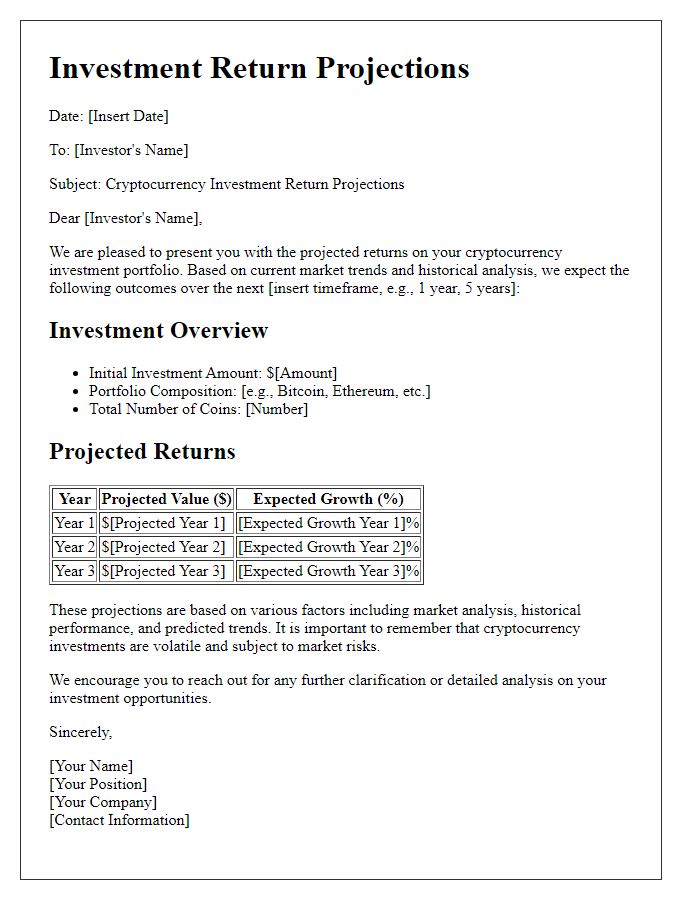

Potential Returns and Exit Strategy

Cryptocurrency investment presents substantial potential returns, influenced by market volatility and demand for digital currencies like Bitcoin and Ethereum. Historical data shows that Bitcoin achieved a staggering 9,000% increase in value over the past decade, demonstrating the lucrative nature of this asset class. An effective exit strategy is essential, often outlined in terms of target profit percentages, such as taking profits at 20% or 50% gains. Diversification across various cryptocurrencies can help mitigate risks associated with sudden market downturns, with exchanges like Coinbase and Binance facilitating seamless transactions. Monitoring market trends through resources like CoinMarketCap and utilizing stop-loss orders can further enhance the investment strategy. Understanding key aspects of liquidity and market capitalization is vital for making informed decisions that maximize returns while minimizing potential losses.

Letter Template For Cryptocurrency Investment Opportunity Samples

Letter template of introductory proposal for cryptocurrency investment opportunity

Letter template of risk assessment for cryptocurrency investment opportunity

Letter template of quarterly update on cryptocurrency investment performance

Comments