Hello valued client! It's essential to take a step back and assess your financial well-being regularly, much like a health checkup for your body. In our upcoming article, we'll explore simple steps you can take to better understand your financial situation and identify areas for improvement. We invite you to read more to discover actionable tips and strategies that can empower you to enhance your financial health!

Personalized Client Greeting

A personalized client greeting sets the tone for a thorough financial health checkup, emphasizing the importance of tailored financial strategies. Serving clients in diverse regions such as New York and California, understanding unique financial landscapes is crucial. Each greeting should include the client's name, express appreciation for their trust, and highlight key financial milestones. References to specific investments, like their portfolio's performance or recent market trends, illustrate attentiveness. Mentioning upcoming fiscal deadlines, such as tax season, ensures relevance, while a warm, inviting tone fosters a collaborative atmosphere for discussing financial goals.

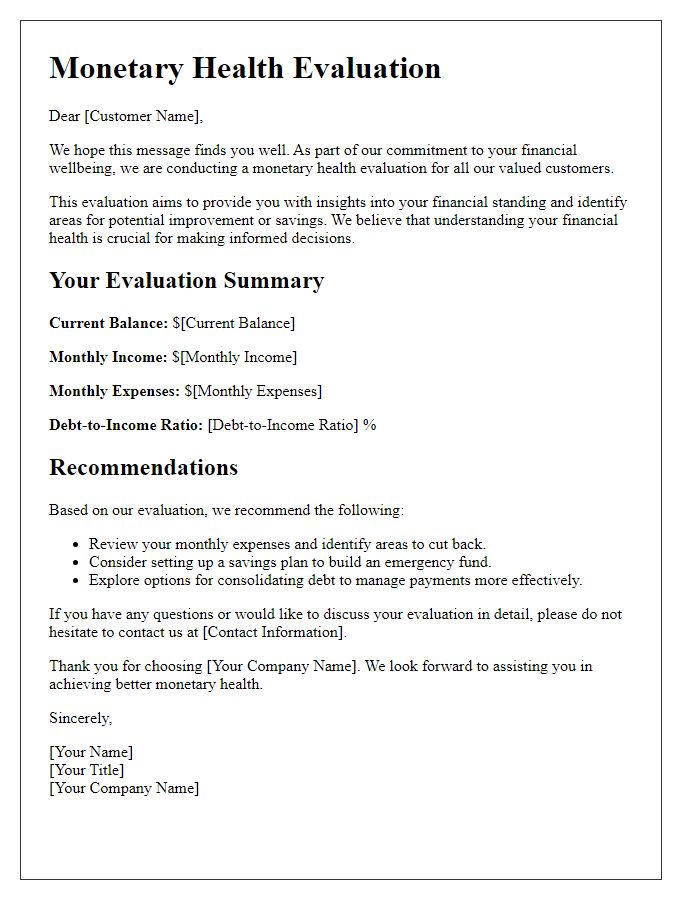

Current Financial Overview

A current financial overview provides insights into an individual's or organization's fiscal status. Key metrics include total assets, which represent valuable properties and investments, and total liabilities, such as outstanding loans and credit card debts, essential for determining net worth. Cash flow statements highlight income and expenditure trends, identifying positive or negative cash flow situations. Essential ratios like debt-to-income ratios help assess borrowing capacity, providing a clearer picture of financial health. Additionally, analyzing retirement accounts such as 401(k) plans or IRAs emphasizes preparedness for future needs. Reviewing credit scores, which range from 300 to 850, aids in evaluating creditworthiness and potential lending terms. Overall, these components offer a comprehensive snapshot of financial stability, guiding future decisions for better management and growth.

Key Performance Indicators

A comprehensive client financial health checkup should focus on key performance indicators (KPIs) that assess financial stability and growth. Metrics like the debt-to-income ratio, which is the percentage of monthly income that goes towards debt, typically recommended to stay below 36 percent, provide insight into overall financial health. The emergency fund ratio, generally advised to cover three to six months of living expenses, evaluates savings readiness for unforeseen expenses. Additionally, investment performance can be measured through annualized return on investment (ROI), which illustrates the profitability of portfolios over time, while diversification ratios help to understand the risk exposure across asset classes. Monitoring these KPIs enables clients to align their financial objectives with their current performance, ensuring informed decision-making and sustainable growth.

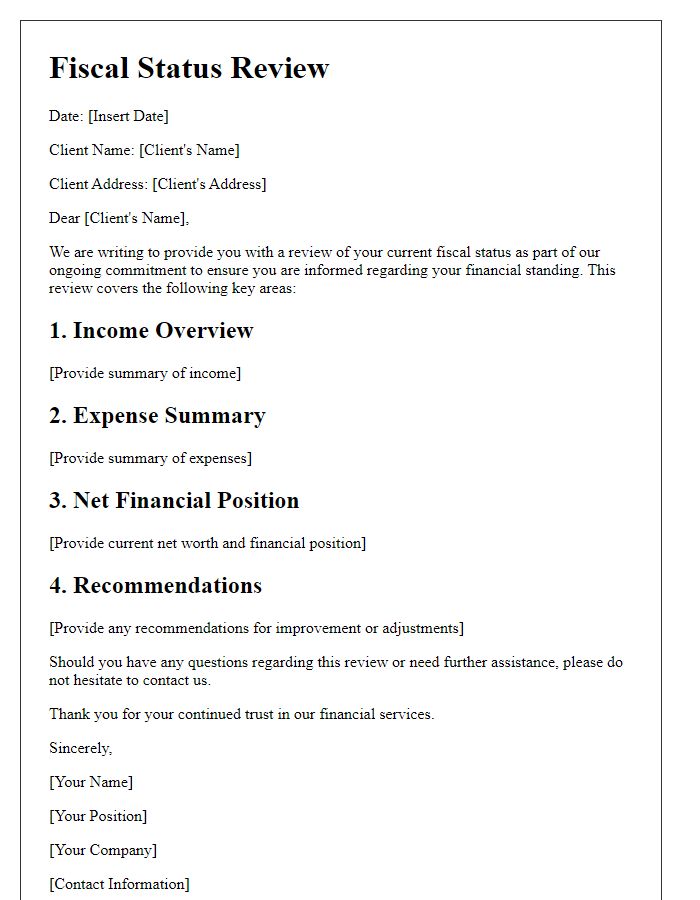

Recommendations for Improvement

During a financial health checkup, various indicators reveal the overall financial stability of clients, including budgeting habits, debt levels, and investment performance. Analyzing cash flow statements can highlight discrepancies, suggesting a focus on increasing savings rates by 10% or more, particularly in emergency funds set at 3-6 months of living expenses. Evaluating credit scores, often influenced by payment history and credit utilization ratios, can provide recommendations to reduce debt-to-income ratios below 36%. Clients may need guidance in diversifying investment portfolios, targeting a mix of equities and bonds that aligns with risk tolerance and long-term goals. Moreover, retirement planning should emphasize increasing contributions to retirement accounts, aiming for the maximum allowable limits, currently up to $22,500 in 401(k) plans, to ensure financial security in later years.

Future Financial Goals

Future financial goals play a crucial role in shaping an individual's overall financial health. Specific targets, such as saving for retirement at age 65 with a desired corpus of $1 million, or purchasing a home valued at $300,000 within five years, are critical milestones. Educational funding for children, for example, setting aside $50,000 for college expenses, is another significant goal. Individuals may also aim to establish an emergency fund containing three to six months' worth of living expenses, typically around $15,000 to $30,000. Additionally, debt reduction strategies, like eliminating $10,000 in credit card debt within two years, contribute to long-term financial stability. A comprehensive financial health check should assess progress towards these goals, ensuring alignment with personal values and lifestyle aspirations. Tracking income sources, investment portfolios, and expenses provides clarity and guides adjustments to help achieve future financial objectives.

Comments