Are you considering establishing an investment trust but unsure about how to get started? Navigating the complexities of investment trusts can be daunting, but a well-structured confirmation letter can set you on the right path. This vital document not only outlines the establishment details but also reinforces the trust's purpose and investment strategy. Curious to learn more about crafting the perfect investment trust confirmation letter?

Legal Compliance and Regulatory Requirements

Establishing an investment trust requires strict adherence to legal compliance and regulatory requirements as stipulated by financial regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States. Documentation must include the trust's formation documents, detailed investment policies, and a prospectus outlining fees, risks, and investment strategies. Compliance entails fulfilling necessary filings, such as Form N-1A for mutual funds, and ensuring transparent reporting to stakeholders. Regulations also mandate the establishment of a board of trustees tasked with fiduciary duties, oversight of fund performance, and adherence to the Investment Company Act of 1940. Meeting these standards ensures the trust operates within the legal framework and protects investor interests.

Trust Structure and Beneficiary Details

Investment trusts serve as vehicles for collective investment, pooling capital from multiple investors to buy a diversified portfolio of assets, while ensuring clear trust structures and beneficiary rights. Establishing an investment trust often involves defining a trustee, who oversees asset management, ensuring fiduciary duties are met, such as the protection of beneficiaries' interests. Beneficiary details, including individuals or institutions benefitting from income or capital gains generated, must be clearly outlined, allowing for transparency and accountability. Regular reporting and valuation, typically conducted on a quarterly basis, ensure beneficiaries are informed about investment performance, aligning with regulatory frameworks like the Financial Conduct Authority (FCA) guidelines in the UK. Additionally, compliance with tax regulations, such as those set forth in the Income Tax Act 2007, is crucial for the trust's financial operations and the protection of beneficiaries' interests.

Financial and Tax Implications

Establishing an investment trust involves careful consideration of financial and tax implications, particularly in the context of regulatory frameworks such as the Investment Company Act of 1940 in the United States. Investment trusts, often structured as closed-end mutual funds, may incur setup costs, including legal fees (ranging from $10,000 to $50,000), as well as annual management fees, typically around 1% to 2% of assets under management. Tax implications include potential capital gains taxes on profits realized from asset sales, with rates varying based on the taxpayer's income bracket. Investment trusts may also benefit from favorable tax treatment as they are generally not subject to federal income tax as long as they distribute at least 90% of their taxable income. Understanding these elements is crucial for effective financial planning and compliance with laws governing investment vehicles.

Trustee Roles and Responsibilities

The establishment of an investment trust involves the appointment of trustees who bear significant responsibilities to protect the interests of beneficiaries. Trustees of investment trusts, such as those established under the Investment Company Act of 1940 in the United States, are responsible for overseeing the management of funds, ensuring compliance with legal and regulatory requirements, and maintaining transparent communication with investors. Key duties include prudent investment management, conducting regular performance assessments, and fiduciary oversight to safeguard assets. Trustees must be well-versed in financial regulations and investment strategies, ensuring sound decision-making that aligns with the trust's objectives and beneficiaries' best interests. Engaging with financial advisors and conducting regular audits are also critical to maintaining trust integrity and performance.

Investment Strategy and Objectives

An investment trust, such as a Real Estate Investment Trust (REIT), can have specific investment strategies and objectives that aim to maximize shareholder value through targeted asset management. The trust may focus on acquiring commercial real estate properties in major metropolitan areas, such as New York City and San Francisco, known for high rental yields. Objectives often include achieving a minimum annual return of 8%, distributing at least 90% of taxable income to investors as dividends, and diversifying the investment portfolio across various sectors, like industrial, residential, and retail real estate. The strategic goal may also involve leveraging financing options, such as low-interest loans, to enhance capital for acquiring new properties, while maintaining a debt-to-equity ratio below 50% to ensure financial stability and risk management.

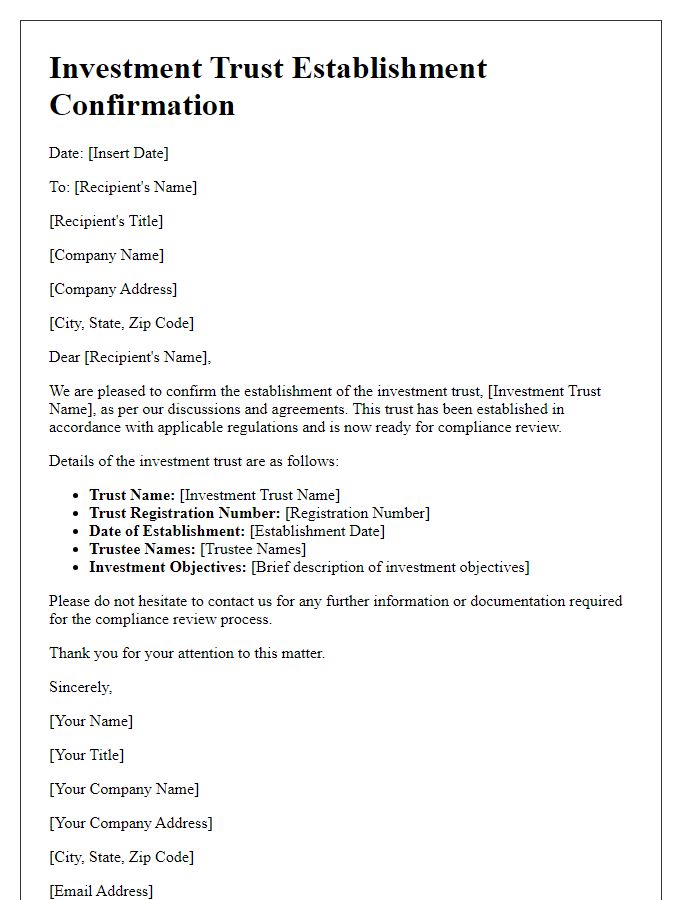

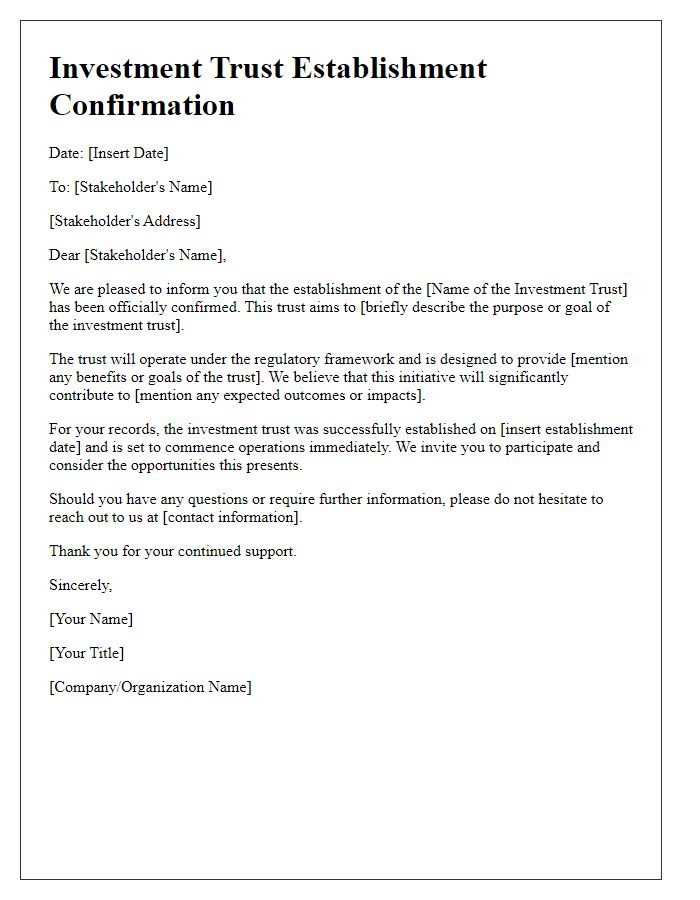

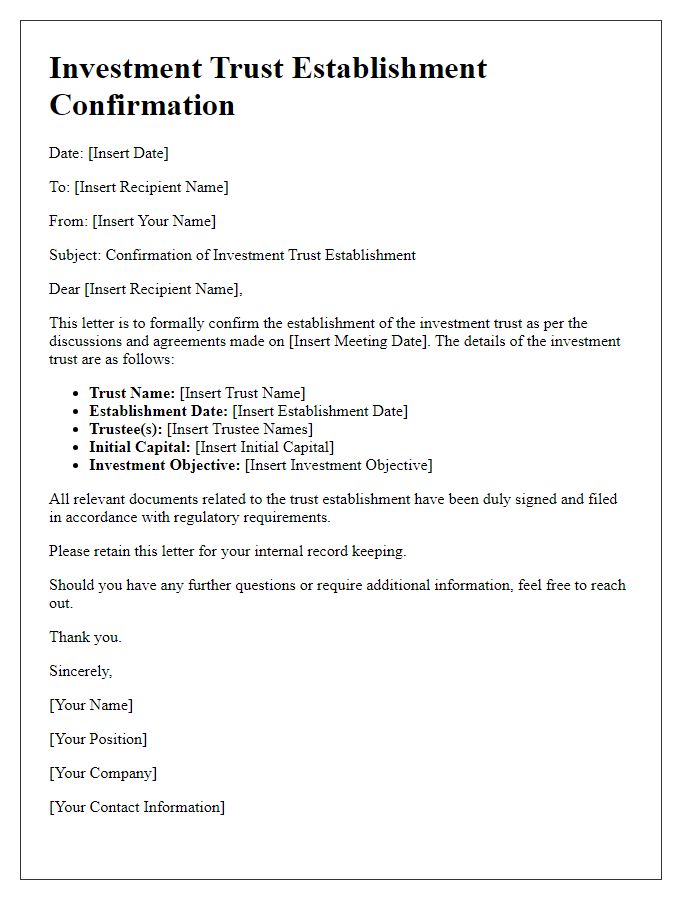

Letter Template For Investment Trust Establishment Confirmation Samples

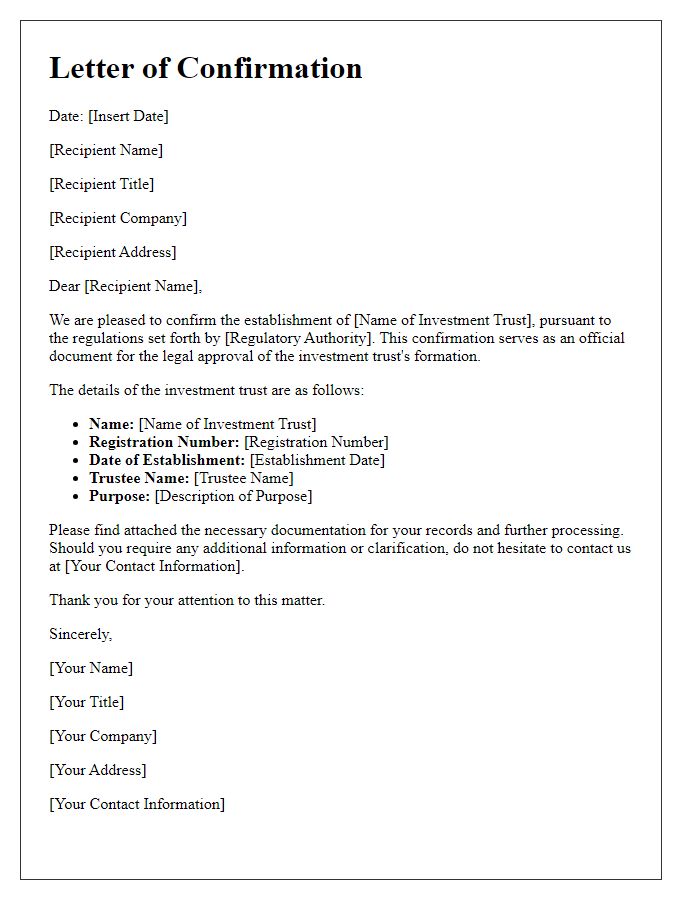

Letter template of investment trust establishment confirmation for compliance review.

Letter template of investment trust establishment confirmation for stakeholder notification.

Letter template of investment trust establishment confirmation for internal record keeping.

Letter template of investment trust establishment confirmation for legal approval.

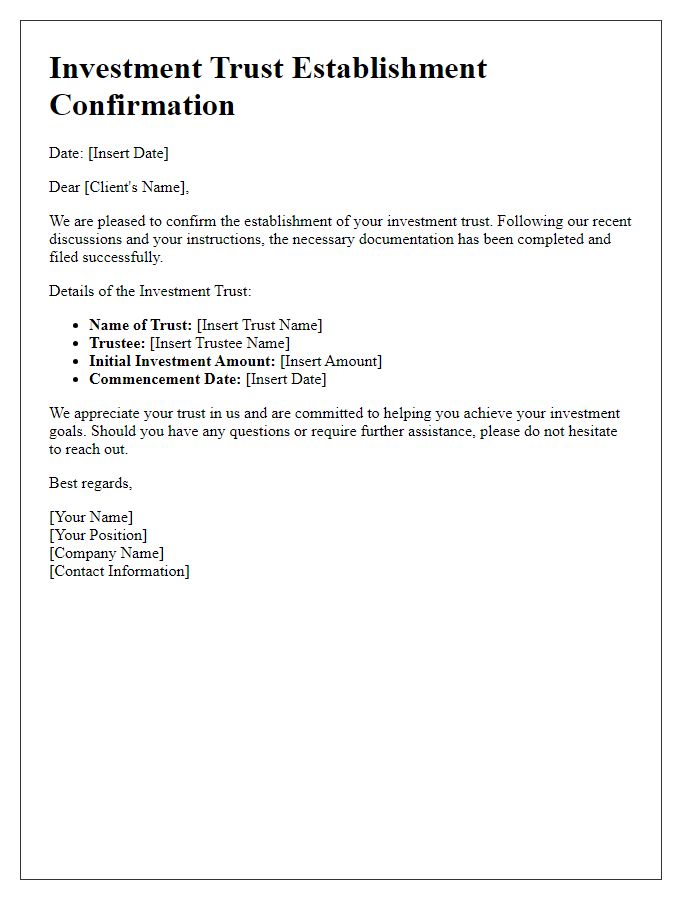

Letter template of investment trust establishment confirmation for client communication.

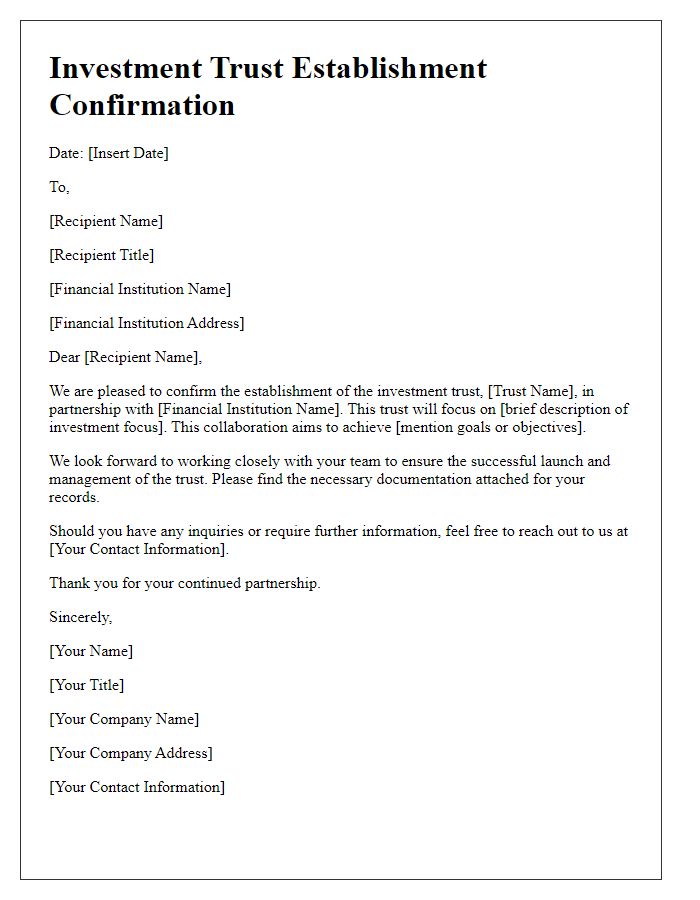

Letter template of investment trust establishment confirmation for financial institution partners.

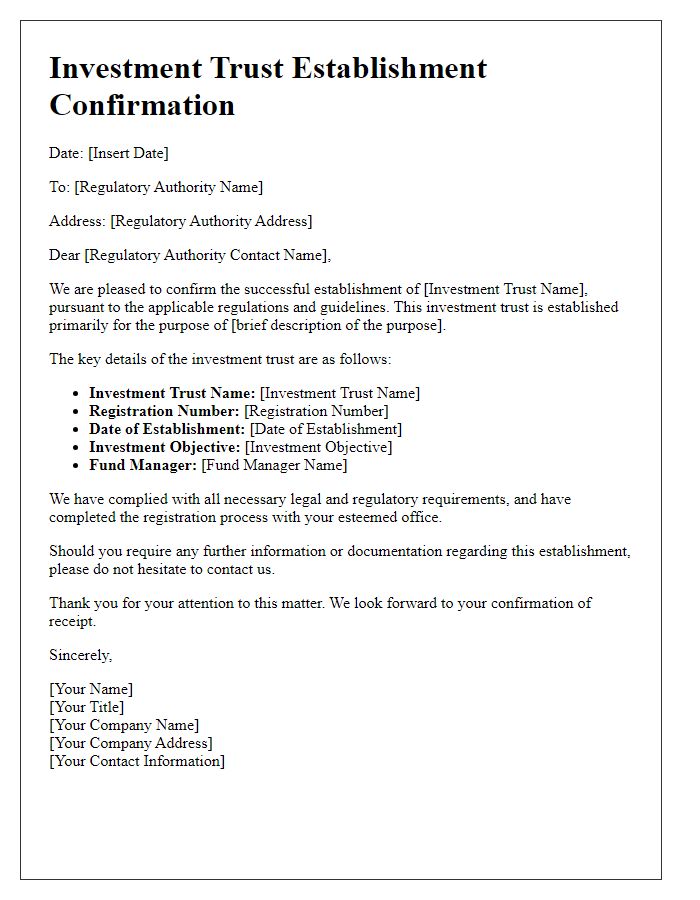

Letter template of investment trust establishment confirmation for regulatory submission.

Letter template of investment trust establishment confirmation for promotional material.

Letter template of investment trust establishment confirmation for due diligence purposes.

Comments