Are you feeling uncertain about your investment strategy? Understanding your risk tolerance is crucial for navigating the financial landscape, especially when it comes to making informed decisions. In this article, we'll break down the key elements of assessing your investment risk tolerance, highlighting how it affects your portfolio and long-term goals. So, let's dive in and discover the best approach to tailoring your investment planâread on to explore more!

Investor's financial goals and objectives.

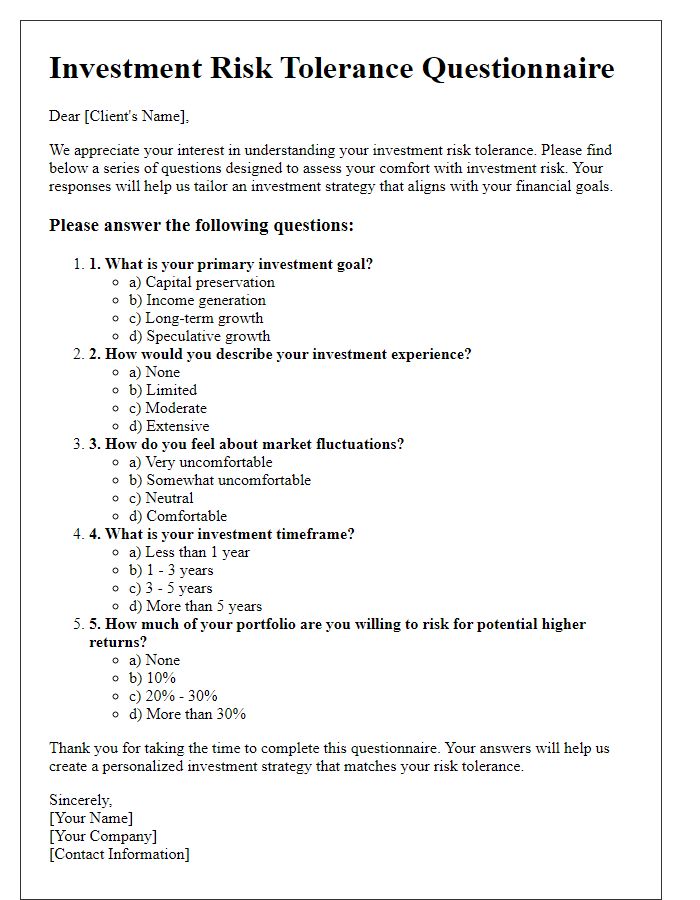

Investment risk tolerance assessment plays a crucial role in achieving investors' financial goals and objectives, such as retirement planning, wealth accumulation, and funding education. Specific numbers help to quantify these goals, like a target retirement fund of $1 million by age 65 or saving $50,000 for college tuition. Objective milestones, including a timeline for achieving these financial targets, inform investment strategies. Understanding individual circumstances, such as current income, expenses, and assets, lays the foundation for risk assessment. Additionally, factors like market volatility and historical returns of various asset classes accentuate the potential risks associated with different investment options, ensuring informed decision-making tailored to the investor's unique situation.

Time horizon for investments.

Investment time horizon defines the duration an investor plans to hold an investment before needing to access the funds. For example, individuals saving for retirement may adopt a long-term horizon of 30 years, allowing for growth strategies that capitalize on market fluctuations. Conversely, a person saving for a home purchase within five years has a short-term horizon, necessitating much more conservative investment strategies, typically favoring stable assets like bonds or cash equivalents. Understanding this timeframe helps assess risk tolerance; investors with longer horizons may endure volatility for higher returns, whereas those with shorter horizons seek to minimize risk to preserve capital.

Current financial situation and net worth.

Assessing an individual's investment risk tolerance is crucial in determining appropriate financial strategies. The current financial situation encompasses total assets, including cash, investments, real estate, and personal property, while subtracting total liabilities such as mortgages, loans, and credit debt. Net worth calculation, reflecting the difference between assets and liabilities, serves as an essential indicator of financial health. Additionally, income sources including salary, dividends, and interest, alongside monthly expenses, provide context for assessing potential risk exposure. Factors like age, investment experience, and financial goals also contribute to understanding an individual's comfort level with market fluctuations and potential losses, ultimately guiding investment decisions tailored to personal circumstances.

Risk appetite and comfort level with potential losses.

Evaluating investment risk tolerance is crucial for determining an individual's risk appetite and comfort level with potential financial losses. Factors influencing risk tolerance include age (younger investors typically adopt a high-risk approach), investment goals (short-term versus long-term), financial situation (income level and savings), and personal experiences (past market volatility or significant loss exposure). In a diverse investment landscape, understanding one's psychological comfort threshold plays a vital role in portfolio construction and asset allocation. Regular assessments of risk tolerance can enhance investment strategies, aligning them with changing market conditions and individual life circumstances.

Past investment experience and knowledge.

An investment risk tolerance assessment evaluates an individual's past investment experience and knowledge to determine their comfort level with potential financial losses. Investors with extensive experience in volatile markets, such as the 2008 financial crisis, may demonstrate a higher risk tolerance, while novices may prefer safer assets. Understanding investment vehicles, such as stocks, bonds, or mutual funds, impacts risk perception; knowledge gained from participating in seminars or utilizing resources like online courses enhances confidence. Additionally, the familiarity with economic indicators, such as interest rates (current rate around 5.25% in 2023) and market trends, plays a crucial role in shaping an individual's investment strategy. Collectively, these factors contribute to a comprehensive evaluation of risk tolerance essential for tailored investment planning.

Comments