Hey there! We know that your feedback is invaluable when it comes to enhancing our investment strategies and service offerings. That's why we're reaching out to hear your thoughts on your recent experiences with us. Your insights could help shape the future of our services and lead to even greater success for you as our client. So, if you're curious to learn more about how we can grow together, keep reading!

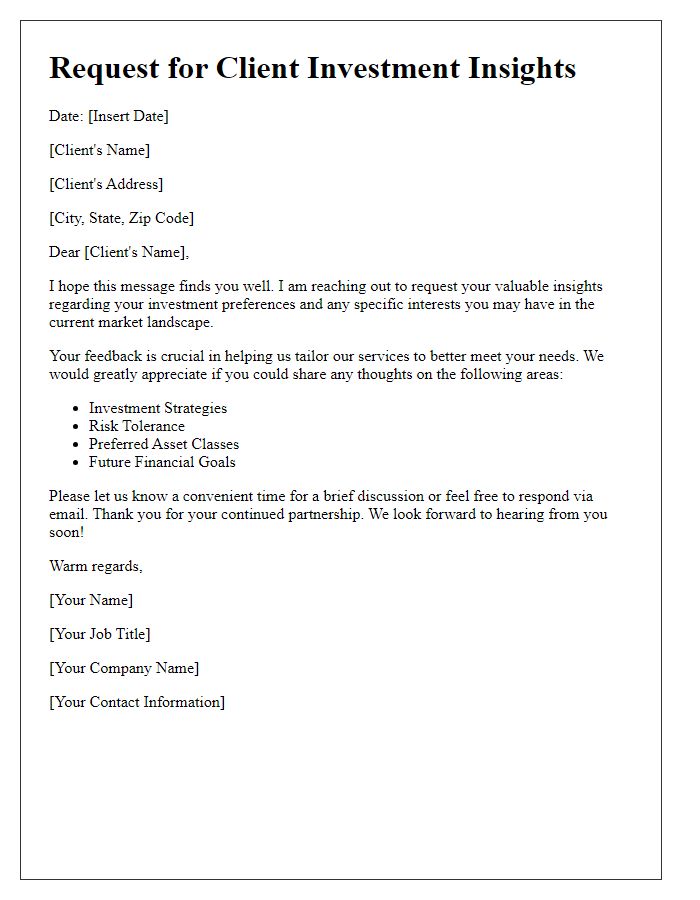

Clear subject line

Investment feedback is crucial for improving client relations and optimizing portfolio performance. Clients are often targeted through emails or surveys, aiming for concise subject lines that reflect the purpose. Effective subject lines can include phrases like "Your Investment Insights Matter" or "We Value Your Feedback on Your Portfolio." By emphasizing importance (client engagement) and urgency (limited time), these subject lines capture attention. Additionally, personalizing the subject line with the client's name can enhance open rates and responses, fostering a more engaging communication experience.

Personalized greeting

Understanding client investment feedback is essential for refining financial strategies and enhancing service quality. Investment portfolios, such as real estate, stocks, or mutual funds, require regular assessments to optimize financial performance. Collecting insights from clients, especially after major events like annual reviews or significant market fluctuations, can provide invaluable perspectives on their satisfaction and future expectations. Utilizing surveys and direct communications during quarterly reviews will help in tailoring investment approaches, ensuring alignment with clients' evolving financial goals and risk tolerances. This feedback mechanism is crucial for building long-term relationships and fostering trust in financial advisory services.

Specific questions

Building strong client relationships involves soliciting feedback effectively. Conducting surveys can provide valuable insights. For instance, specific questions can focus on investment performance. Inquire about satisfaction levels with current portfolios, noting asset classes like equities or fixed income. Ask clients to rate communication frequency on a scale, assessing optimal touchpoints--monthly or quarterly updates. Explore their willingness to recommend services to peers; a Net Promoter Score (NPS) can be insightful. Gauge interest in education on market trends, offering webinars or newsletters as solutions. Collecting this feedback through structured questionnaires can enhance service offerings and foster loyalty.

Encouragement for detailed feedback

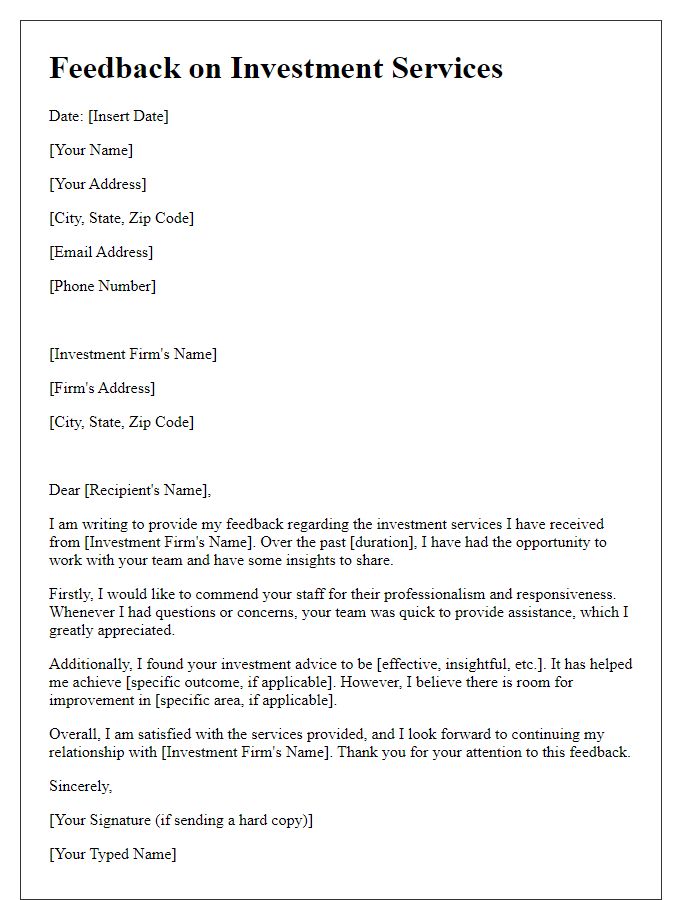

Client investment feedback plays a crucial role in refining our financial services. Constructive insights regarding your investment experience with portfolios, risk management strategies, and customer service interactions can significantly enhance our offerings. Specific areas for feedback may include satisfaction with investment returns, clarity of communication, or effectiveness of our financial advice. Your opinion is invaluable; we welcome detailed comments that can help us understand your unique investment journey. Engaging with our team to share your thoughts can foster a stronger partnership and optimize future investments.

Easy response options

Seeking client investment feedback is crucial for enhancing service quality. Providing easy response options can increase participation rates significantly. Incorporating methods such as online surveys or quick polls can streamline the feedback process. For instance, using tools like Google Forms allows clients to answer questions regarding their satisfaction levels, investment performance, and service experiences effortlessly. Additionally, offering multiple choice answers enhances clarity and convenience. A simple rating scale from 1 to 5 can capture valuable insights on various aspects such as communication, portfolio management, and overall satisfaction. Utilizing these strategies fosters an open line of communication, encouraging clients to contribute their thoughts without feeling overwhelmed.

Comments