Are you considering closing your investment account but unsure of how to communicate your decision? Writing a closure notice can feel a bit daunting, but it's a straightforward process when you know what to include. In this article, we'll guide you through the essential elements of a closure letter, making it simple and stress-free. Keep reading to discover how to finalize your investment journey with clarity and professionalism!

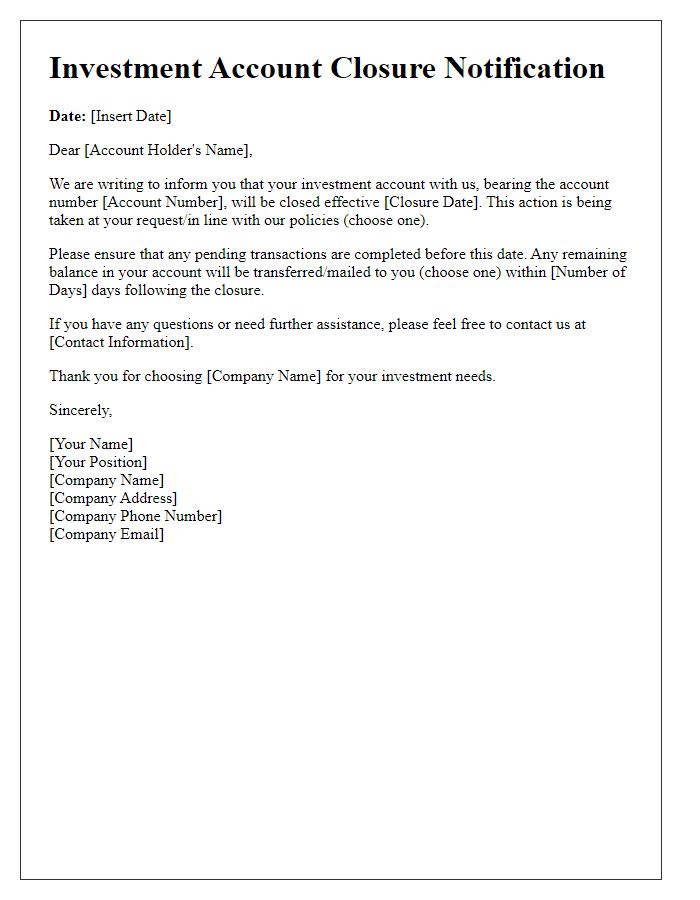

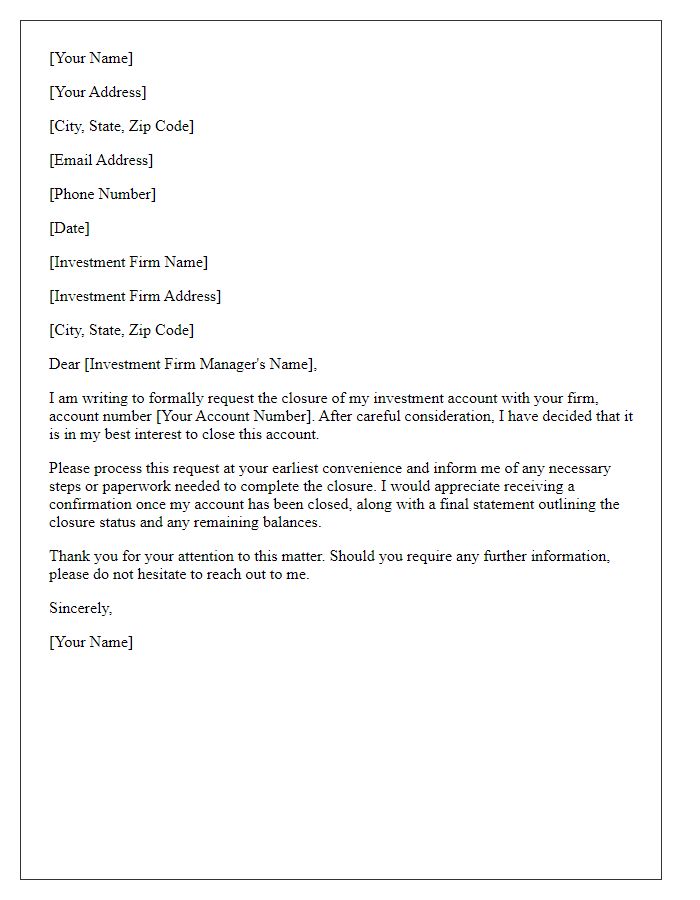

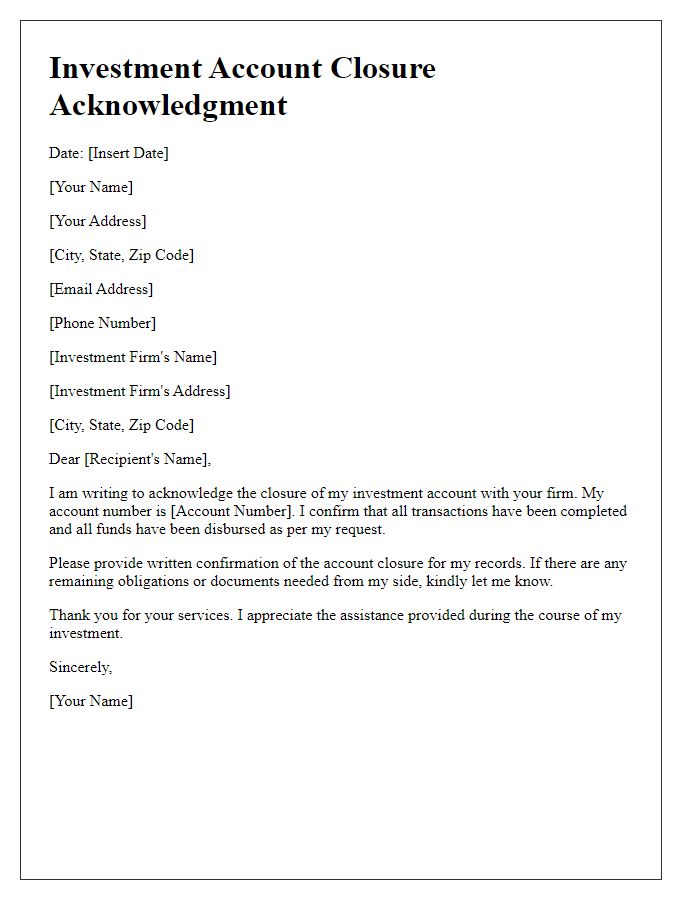

Account Holder Information

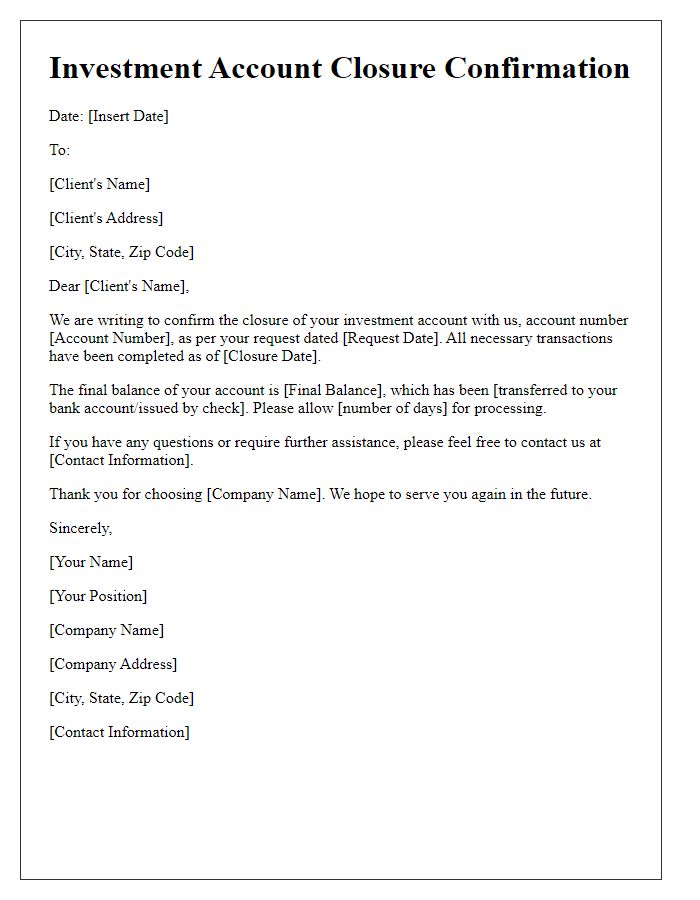

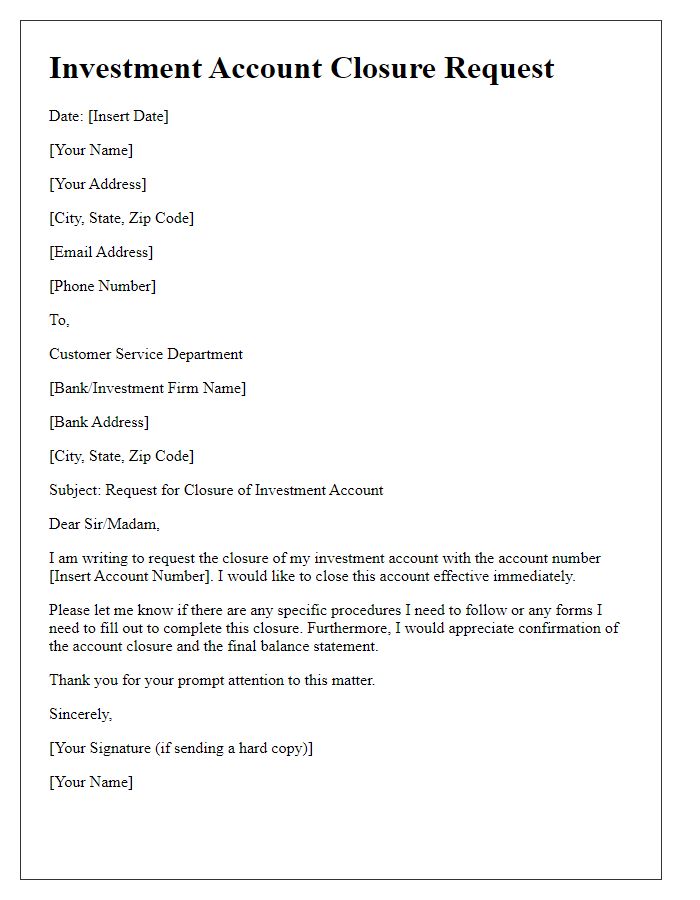

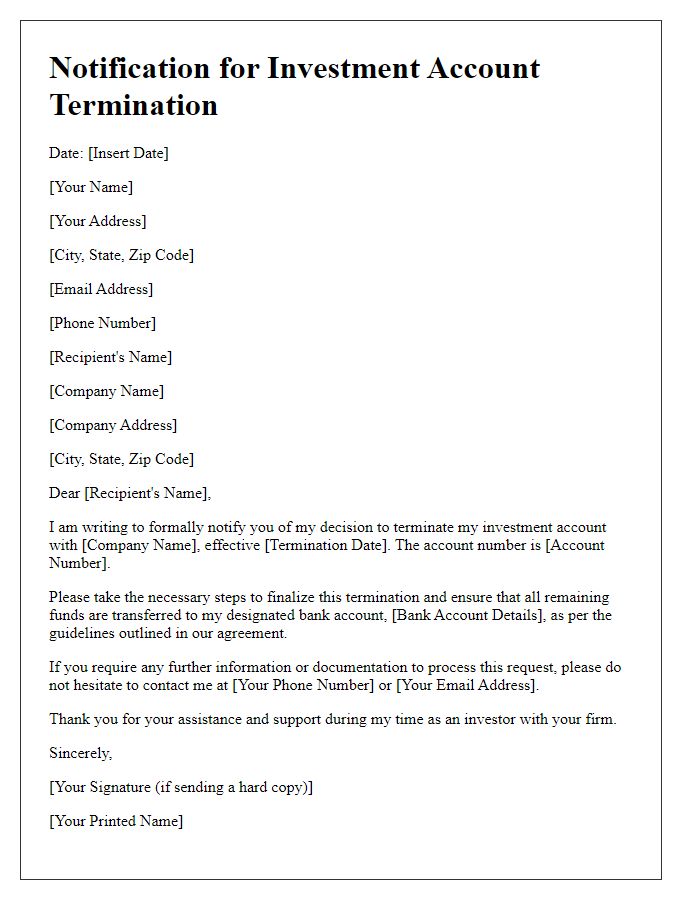

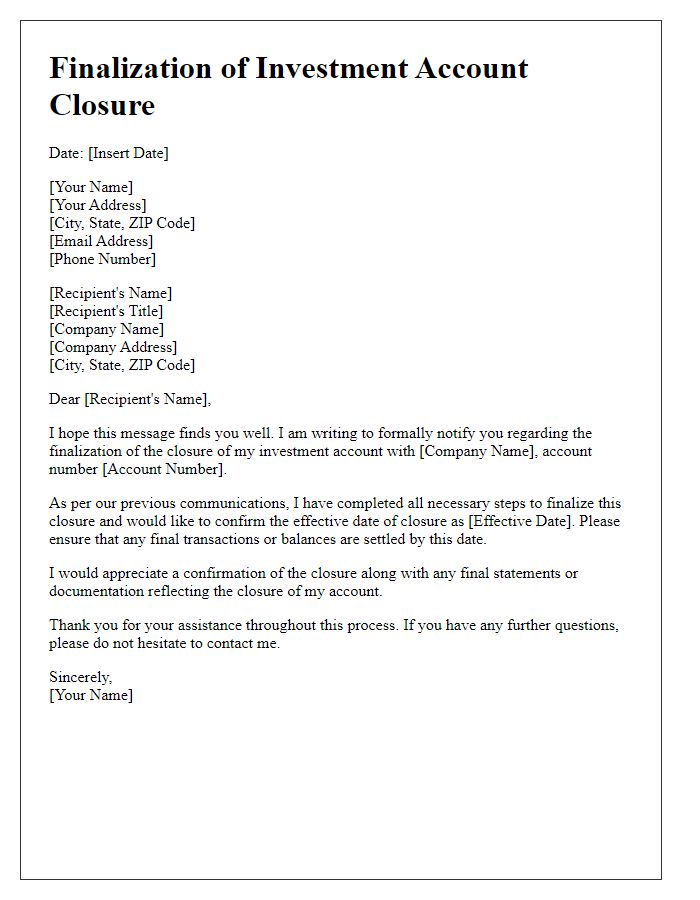

An investment account closure notice should include essential details like account holder information, account number, and specific instructions regarding remaining funds or assets. Account holder information typically comprises full name, address, contact number, and email address for verification. It is important to include the account number to ensure accurate processing. This document serves as an official request for the discontinuation of investment services associated with said account, indicating the desired closure date and any potential implications regarding pending transactions or fees. Proper documentation ensures a smooth transition, protecting the account holder's financial assets and ensuring compliance with applicable regulations.

Account Details

Investment account closure requires careful attention to details, including specifications about holdings, transaction history, and potential fees. Investors must note their account number for identification, which may include a combination of numbers and letters, providing a unique reference. The closure process can involve liquidating assets, such as stocks or bonds, at prevailing market prices determined by exchanges like the New York Stock Exchange. Investors should also account for any pending transactions or dividends that may influence their total balance before closure. Notifying the financial institution, typically via a written request, ensures an official record of the closure request and facilitates effective communication regarding the final steps, including disbursement of remaining funds.

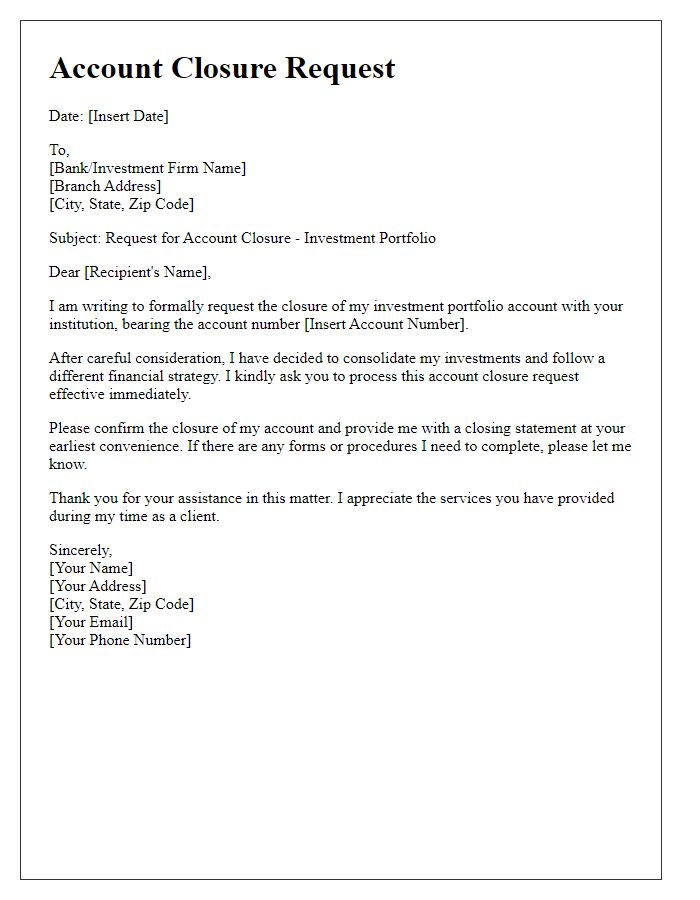

Closure Request Statement

Closing an investment account involves several important considerations and consequences for account holders. An investment account, whether held with companies like Fidelity Investments or Charles Schwab, often requires a formal closure request. Investors should understand that closure typically entails liquidating any assets, potentially incurring tax liabilities on capital gains, and facing possible fees depending on the account type. Account holders must provide identification information, such as Social Security numbers or account numbers, to verify their identity and facilitate the closure process. It's critical to review the remaining balance and ensure that all outstanding transactions are settled before submitting a closure request. Additionally, investors should consider alternatives, such as transferring assets to another account, to avoid potential financial setbacks.

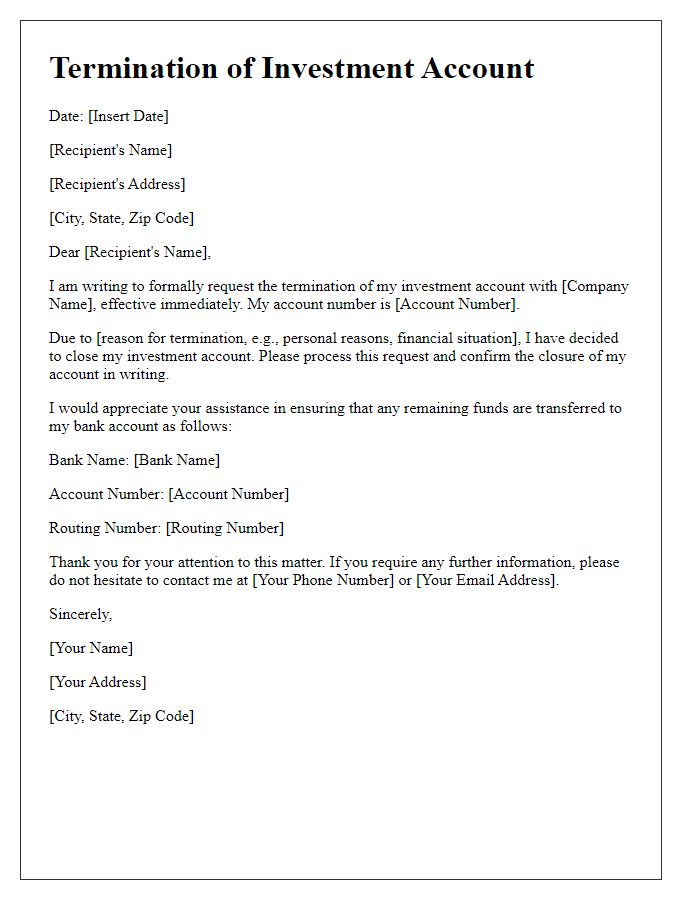

Reason for Closure

Investment account closure can occur for various reasons, such as financial changes, relocation, or a desire for account consolidation. An individual may choose to close an account due to excessive fees, dissatisfaction with service, or to simplify financial management by merging multiple accounts into one. For example, an investor may find that a particular brokerage, such as Charles Schwab or Fidelity, does not meet their specific investment goals or provides inadequate customer support. In some cases, personal circumstances, like job loss or relocation to another country, may necessitate the closure of an account. Furthermore, some investors might switch to a different asset class, requiring a reevaluation of their existing accounts. It's essential for investors to document the reason for closure, ensuring that all associated financial implications are understood.

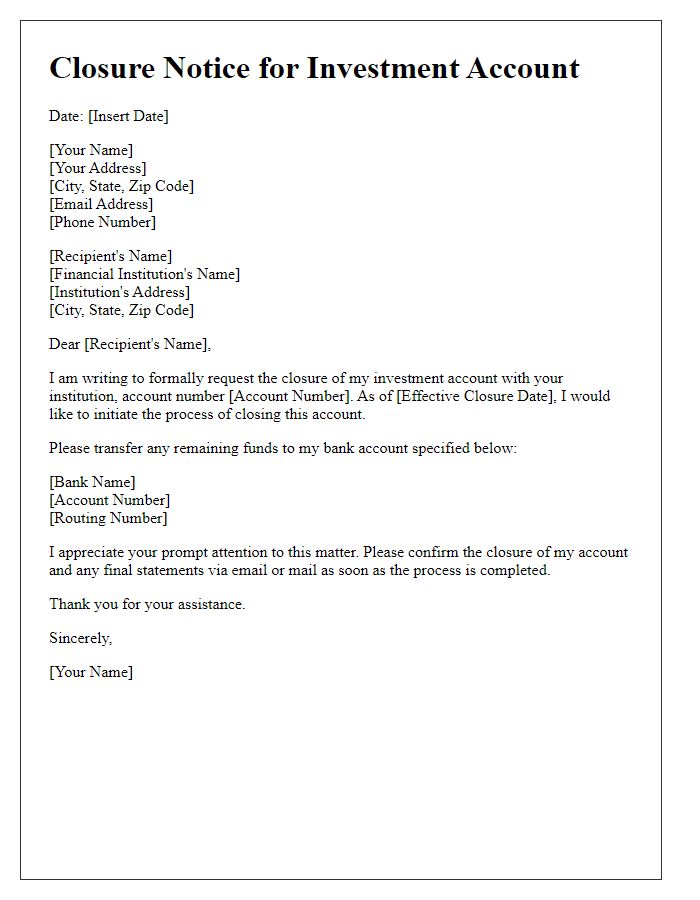

Instructions for Funds Transfer

The process of closing an investment account requires careful attention to detail to ensure a smooth transition of funds. Investors should review account summaries to ascertain total balances, which may include cash holdings and investments in various financial instruments like stocks and bonds. Prior to initiating closure, submitting a written closure request to the investment firm, detailing the account number, is essential. It is advisable to consult applicable fees related to closing accounts, as some firms may impose a final processing fee. Investors should specify the desired funds transfer method, such as direct deposit into a bank account or issuing a check, and provide necessary banking information, including routing numbers. Completing this process in accordance with the firm's timeline can take anywhere from several days to a couple of weeks, depending on the policies of the financial institution.

Comments