Updating your policyholder information is essential for seamless communication and ensuring you receive the benefits you deserve. Whether you've moved, changed your contact number, or updated your beneficiaries, it's crucial to keep your records current. A well-crafted letter can make this process straightforward and efficient, ensuring your insurance provider has all the necessary details at their fingertips. Ready to dive into the details of crafting the perfect letter for your policyholder update? Read on!

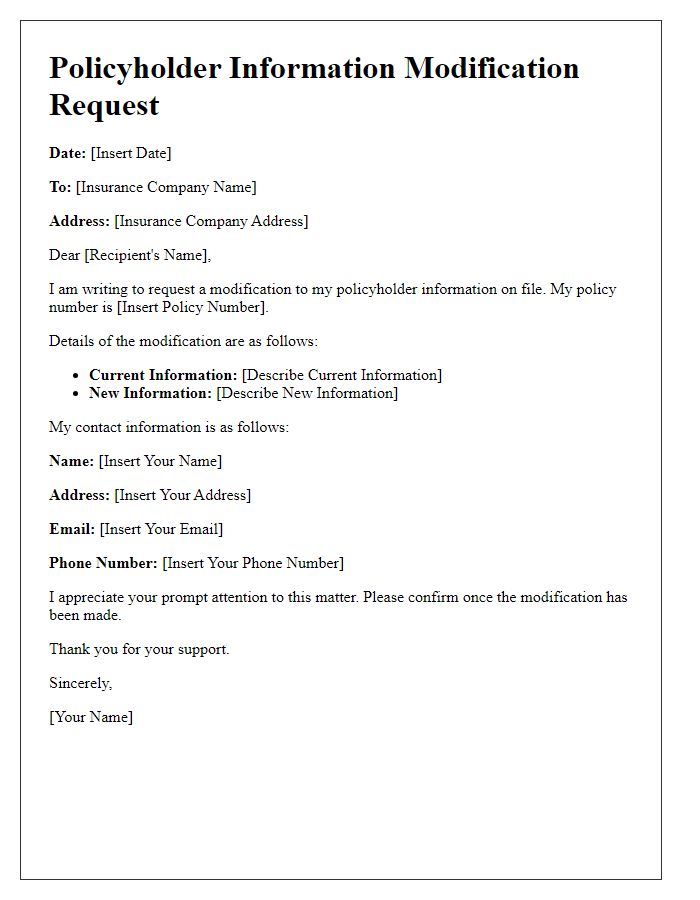

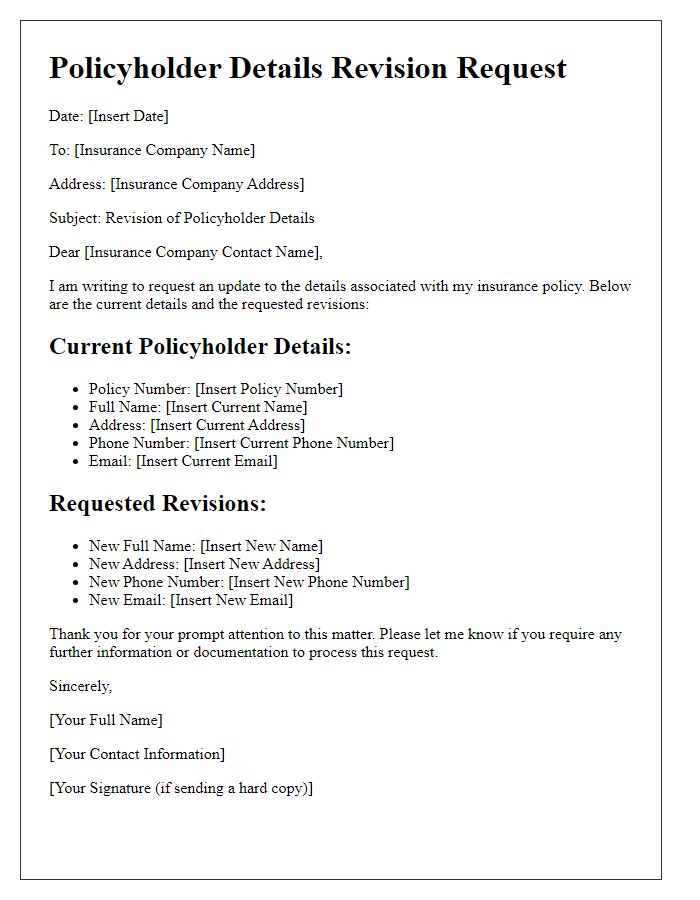

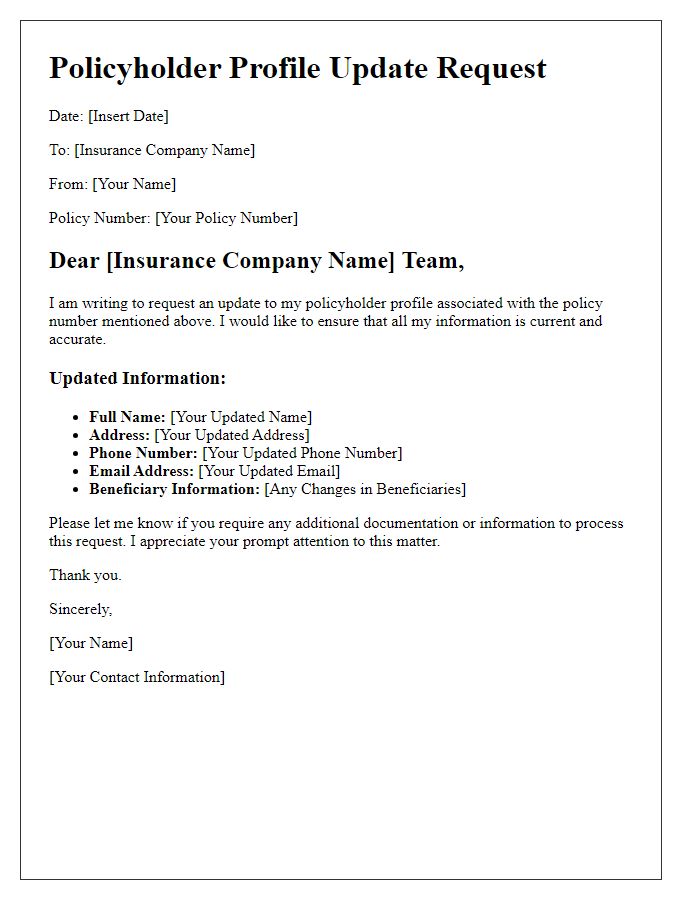

Clear Identification of Policyholder

Policyholder identification plays a crucial role in streamlining communication and ensuring accuracy in insurance records. Specific elements including the policyholder's full name, unique identification number (policy number), and contact information (phone number and email address) are essential. This information must be confirmed for verification against existing records, assisting representatives in accessing pertinent data swiftly. Updates can include changes in personal status, such as marriage or relocation to a new address. Ensuring accurate records is vital for claim processing, premium billing, and legal documentation. Maintaining updated contact methods enhances responsiveness and service quality from insurance providers.

Updated Contact Information Section

Policyholders must ensure their contact information remains current to facilitate seamless communication with the insurance provider. Key details include phone numbers (mobile and landline), email addresses, and residence addresses, all of which can significantly impact claim processing and policy updates. Inaccurate information can lead to missed notifications regarding policy changes, renewal deadlines, or emergencies. Therefore, policyholders are encouraged to review and update their contact details promptly, ensuring that correspondence from the insurance company reaches them without delay. This proactive approach enhances the overall service experience and ensures that important information is always accessible.

Verification of Existing Details

Policyholders must ensure that personal information remains current for effective communication and claims processing. Essential details include full name, address, phone number, and email address. For instance, a recent change in address (like a move from New York City to Los Angeles) should be promptly reported. Accurate information helps maintain coverage and avoid delays during critical events. Additionally, policyholders may be required to submit supporting documents, such as utility bills or identification, to verify changes. Regularly updating this information enhances trust and efficiency in the insurance relationship.

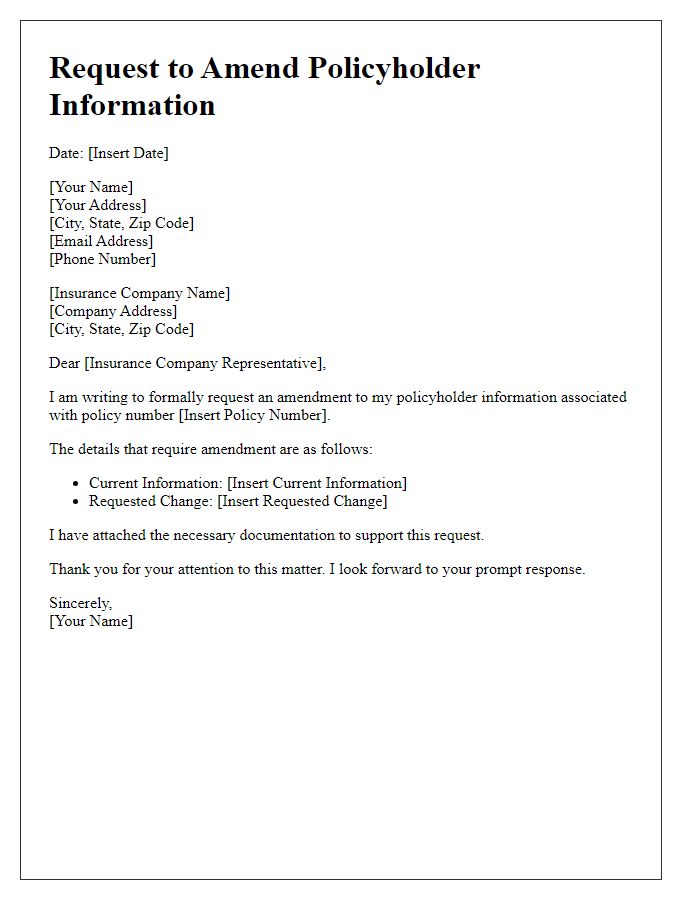

Instructions for Submission Process

Policyholders must submit updates to their personal information through the designated online portal provided by the insurance company. This secure platform requires valid credentials, including the policyholder's unique policy number and date of birth for verification. Gather required documents, such as proof of identity (government-issued ID) and any relevant supporting documents (marriage certificate, adoption papers) depending on the nature of the update (name change, beneficiary modification). Ensure all information is accurate, reflecting the current status. Once completed, submit the form electronically, and a confirmation email will be received for tracking the status of the request, typically processed within 10 to 15 business days.

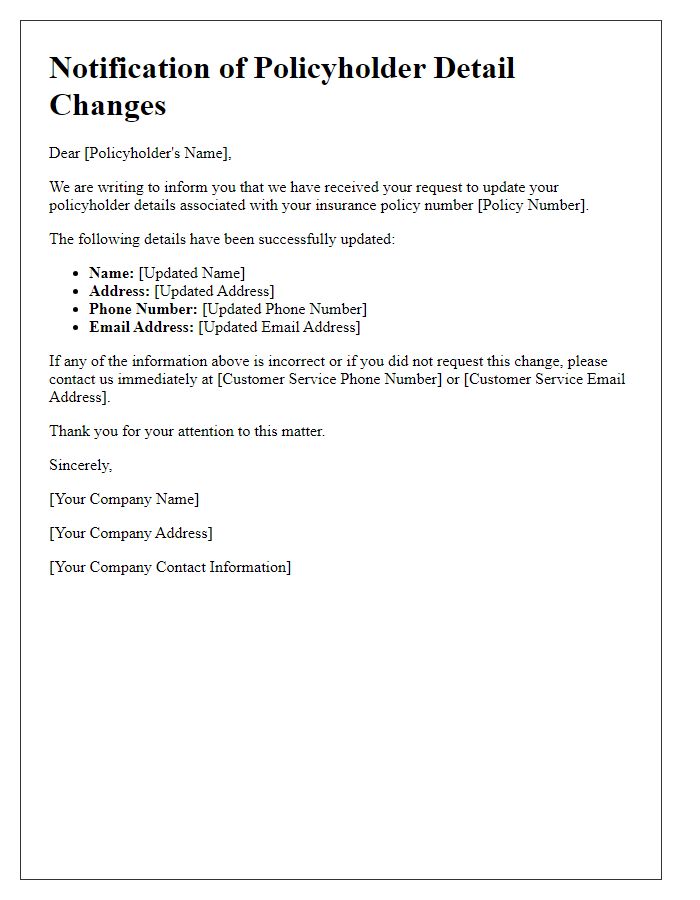

Privacy and Data Protection Assurance

Policyholder information updates are critical for maintaining accurate records within financial institutions, such as insurance companies, to ensure compliance with regulations like GDPR (General Data Protection Regulation). These updates involve personal data, including names, addresses, phone numbers, and policy details, requiring strict adherence to data protection protocols. Organizations must assure policyholders that their information will remain confidential and will only be used for transactional purposes, adhering to data minimization principles. Regular audits and secure storage solutions, such as encrypted databases, play an essential role in protecting sensitive data from breaches or unauthorized access, fostering trust between the policyholder and the company.

Comments