Are you feeling uncertain about your current policy coverage? It's not uncommon to seek peace of mind, especially when life evolves and new challenges arise. If you're considering extending your policy coverage, you'll want a clear and compelling letter to communicate your needs effectively. Keep reading to discover a helpful template that simplifies the process and ensures your request is well-received!

Clear Identification of Policyholder

A policyholder's request for policy coverage extension necessitates clear identification to ensure accurate processing and verification. Relevant details include the full name of the policyholder, such as John Doe, and the policy number, which could be an alphanumeric string like A123456789. Additionally, the effective date of the original policy, typically noted as January 1, 2023, is necessary for reference. The policyholder's contact information, including a current address, such as 123 Main Street, Anytown, USA, and a phone number like (555) 123-4567, allows for any follow-up inquiries. Having a clear record of previous communications or claim events may also support the request, ensuring a seamless extension process.

Specific Policy Details

A policy coverage extension request often involves specific details regarding the insurance policy in question, such as the policy number, the coverage limits currently in place, and the types of coverage being requested for expansion. For instance, the policy number (e.g., P12345678) uniquely identifies the agreement between the insurer and the policyholder. It is essential to mention the existing coverage limit amounts, such as liability coverage capped at $1 million and property damage coverage at $500,000. Additionally, the types of coverage that are commonly sought for extension include comprehensive coverage, collision coverage, or personal injury protection, tailored to the unique risk profile of the insured party. Furthermore, it may be beneficial to specify reasons driving the request for extension, such as recent changes in business operations, expansion to new locations like California or Texas, or increased asset values needing additional protection against unforeseen events.

Reason for Coverage Extension

A request for a policy coverage extension typically arises from specific circumstances that require additional protection or support. For instance, individuals may seek an extension due to significant life changes, such as the purchase of a new home valued at over $500,000, or the need for coverage for new family members, like newborns or adopted children, which may create additional insurance needs. Businesses might request a coverage extension when expanding operations, for instance, opening a new location or increasing inventory to more than $1 million. Furthermore, unforeseen events such as natural disasters, with damages recorded over $100,000, can prompt a coverage review to ensure adequate protection against covered risks. In such cases, providing comprehensive reasons reinforces the necessity for an extension.

Desired Extension Period

A policy coverage extension request typically involves seeking an extension for a specific duration to ensure ongoing protection. This process is crucial for individuals or businesses who require additional coverage to mitigate risks, particularly in areas such as property insurance, liability coverage, or health benefits. An extension period might range from a few months to an entire year, depending on the nature of the policy and the specific needs of the insured. This request often must be submitted before the current policy expiration date to avoid any lapses in coverage, which can lead to potential financial losses or legal liabilities. The precise details of the desired extension period should be clearly stated to facilitate a smooth approval process.

Contact Information for Follow-up

A policy coverage extension request requires precise information to facilitate effective communication. It is essential to provide clear contact information, including a primary phone number (including area code for accurate dialing), an email address for immediate correspondence, and a physical mailing address for official notifications. Ensuring availability during business hours can expedite the response process. Including a secondary contact person with their phone number and email can offer an alternative communication route, especially in urgency. Finally, specifying the preferred method of contact can enhance the efficiency of follow-up actions.

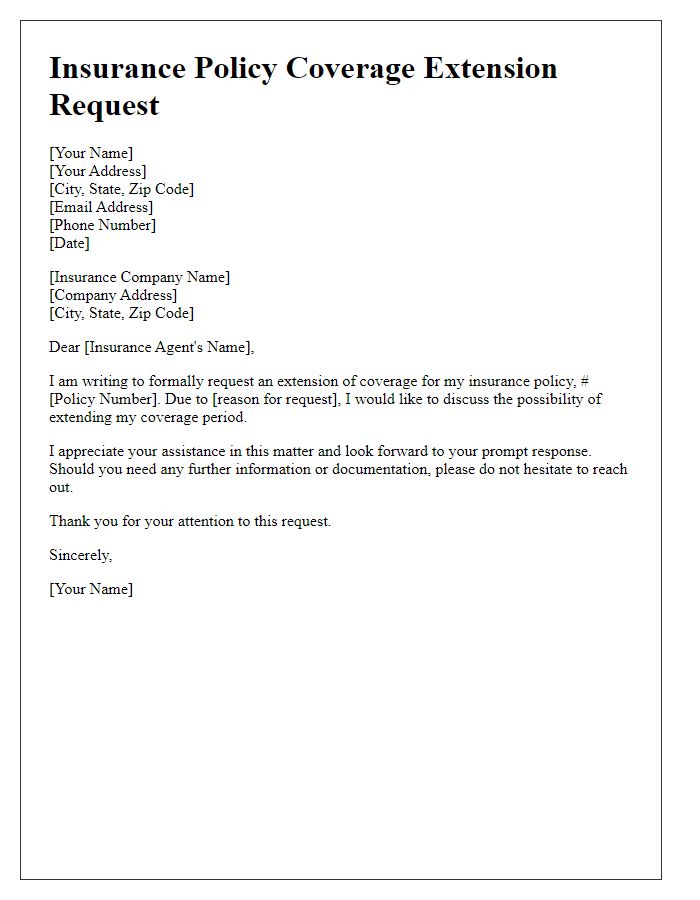

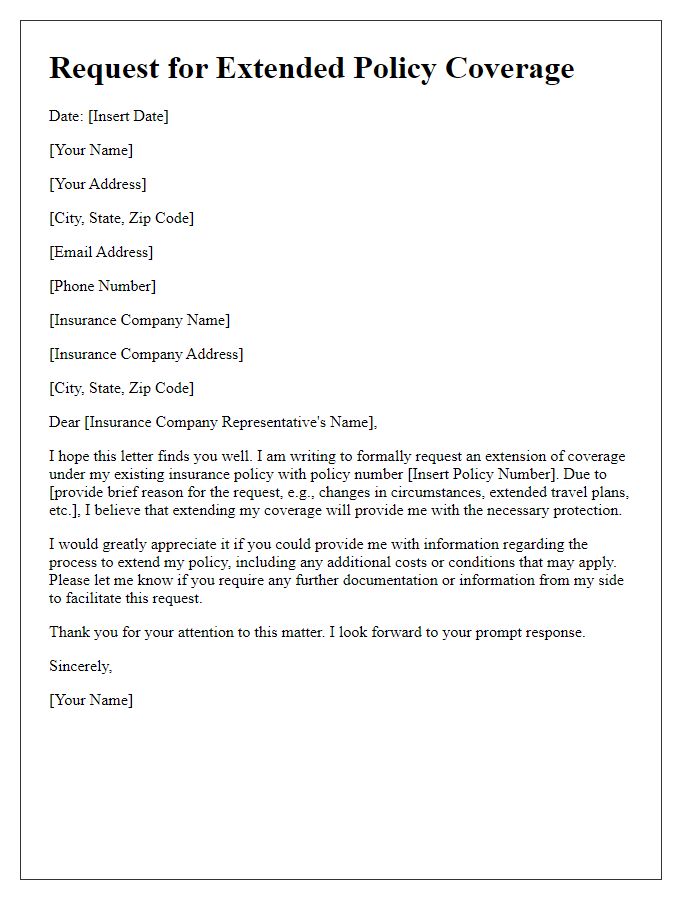

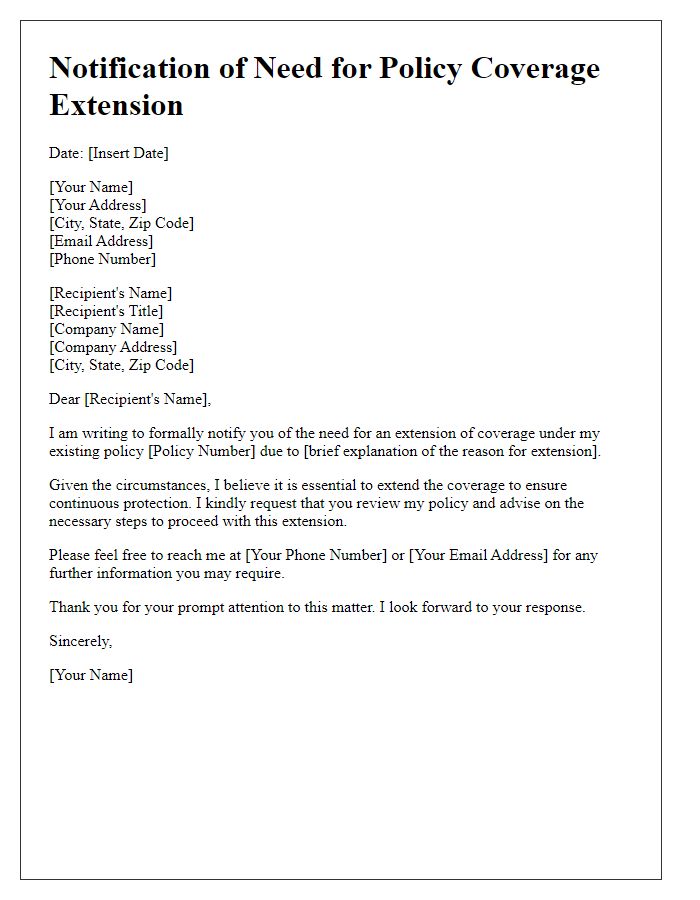

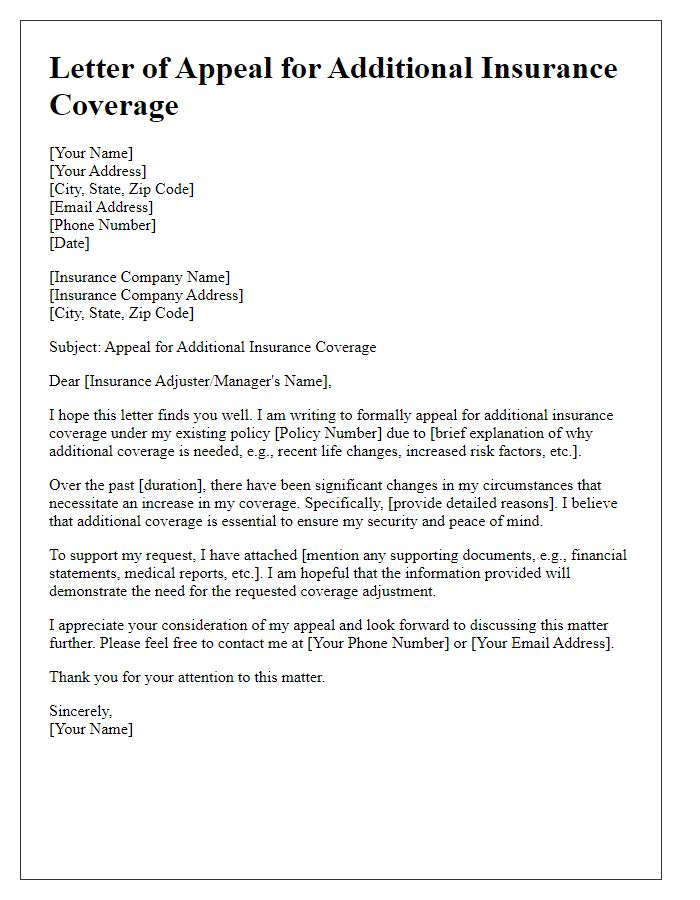

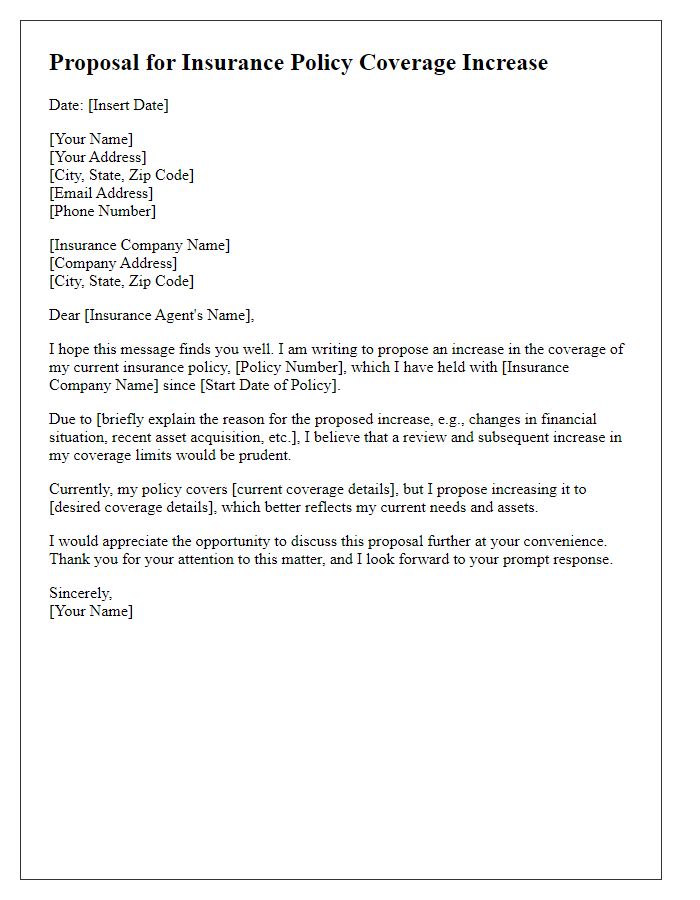

Letter Template For Policy Coverage Extension Request Samples

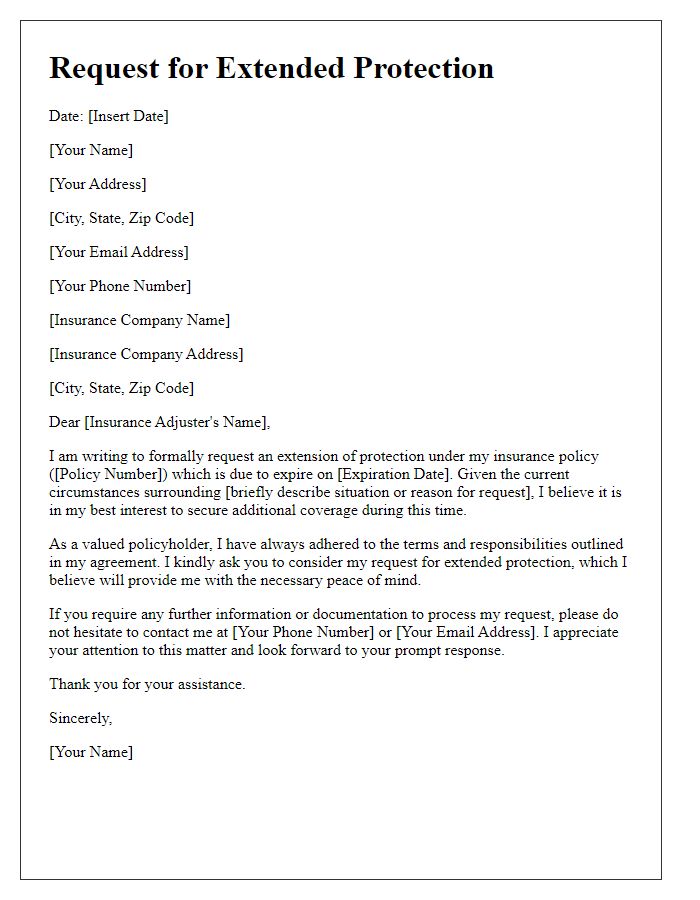

Letter template of request for extended protection under insurance policy

Comments