Are you navigating the often complex world of critical illness policy claims? It can feel overwhelming, but understanding how to articulate your situation clearly can make a significant difference. In this article, we'll guide you through a simple letter template designed to streamline your claim process and ensure you have all the essential elements covered. Ready to simplify your claim experience? Let's dive in!

Policyholder Information

The critical illness policy claim process begins with the essential policyholder information, which includes the policy number, full name, and date of birth of the insured individual. Additionally, it is crucial to provide the policyholder's contact details, including phone number and email address, along with the mailing address for correspondence related to the claim. Details about the policy commencement date and coverage specifics, including the listed critical illnesses, must be outlined to ensure the claim aligns with the defined criteria. Documentation may also require information about the treating physician or hospital involved, including their name, contact information, and any relevant medical report, such as diagnosis dates to support the claim.

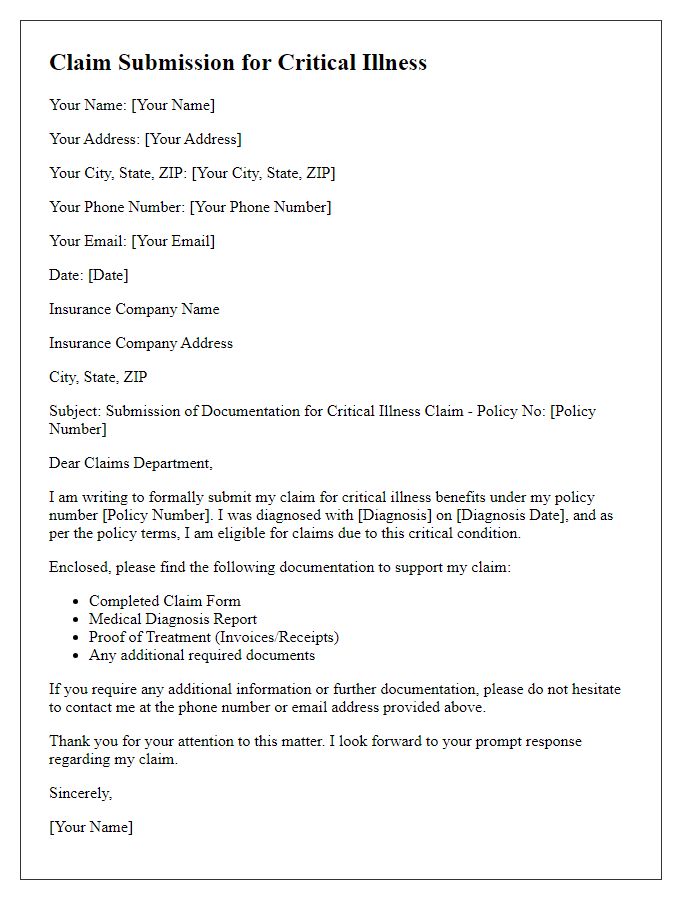

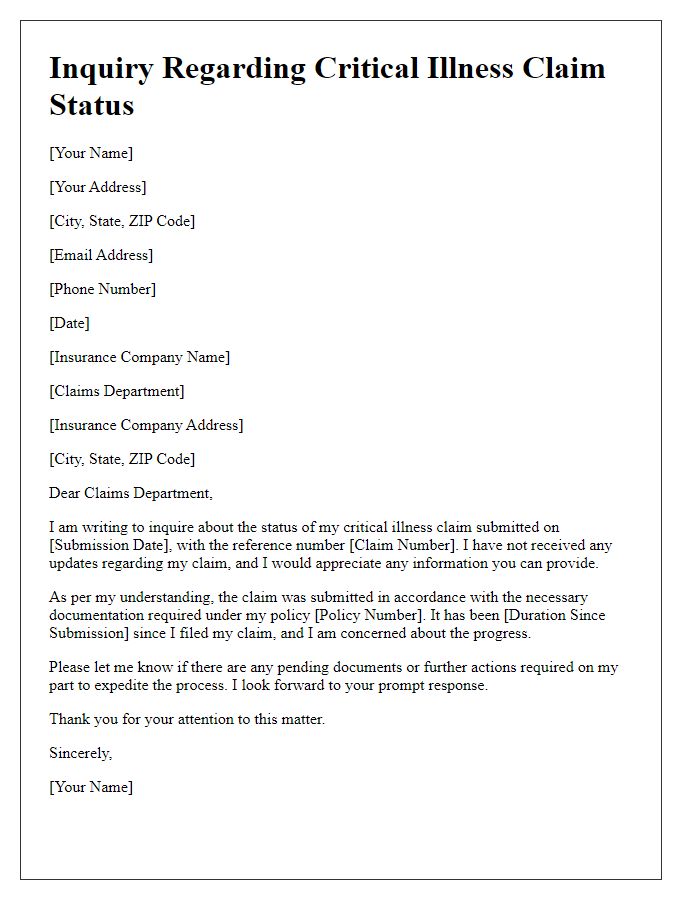

Policy Details and Claim Number

Critical illness policies provide financial support for individuals diagnosed with severe medical conditions, such as cancer or heart disease. Policy details include essential information such as the policyholder's name, the insurer's name, and specific coverage terms. Claims often require a claim number, a unique identifier assigned to track the process. Medical documentation is vital, ensuring doctors' diagnoses match the covered conditions. Timely submission of the claim is crucial, with most insurers requiring it within a specified period after diagnosis. Understanding these elements can significantly impact the efficacy of the claim process.

Description of Critical Illness

Critical illness refers to severe health conditions that significantly impact a person's lifestyle and require substantial medical intervention. Common examples include heart attacks, strokes, and cancer diagnoses, each categorized based on severity and potential mortality risks. Statistics indicate that approximately 1 in 2 men and 1 in 3 women will face a critical illness in their lifetime (Cancer Research UK). Treatment for such conditions often involves extensive medical procedures, long-term therapy, and rehabilitation. Diagnosing a critical illness typically requires advanced medical imaging and tests, such as MRIs or CT scans, performed at specialized healthcare facilities. These illnesses not only affect physical health but can also lead to emotional and financial strain, emphasizing the importance of having adequate critical illness insurance coverage for support during recovery and treatment.

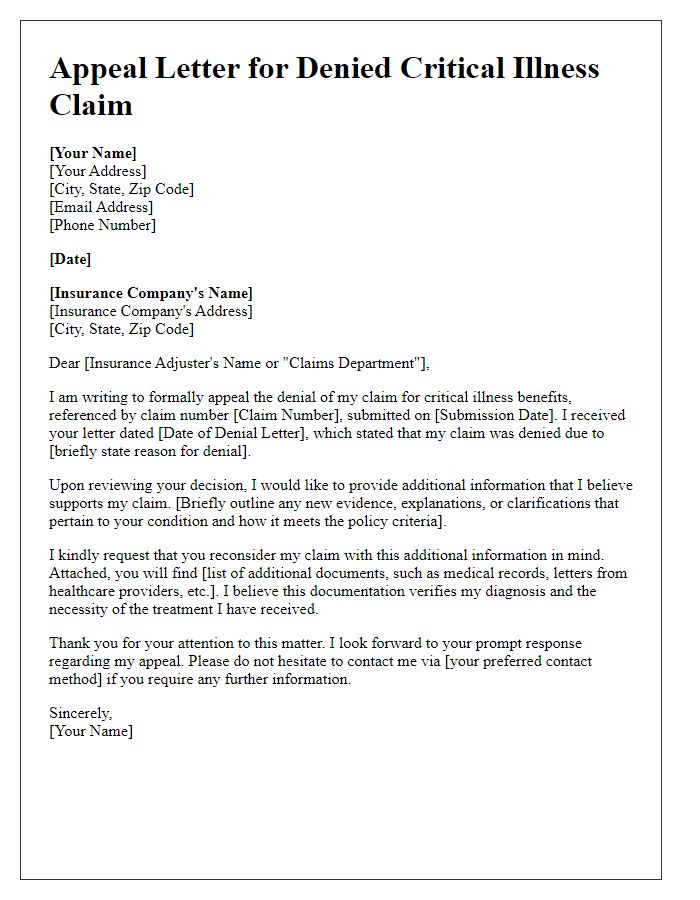

Medical Documentation and Evidence

Critical illness policy claims require thorough medical documentation and compelling evidence to facilitate approval. Essential documents include a verified diagnosis from a licensed healthcare professional, such as an oncologist for cancer-related claims or a cardiologist for heart disease claims. Medical records must encompass hospital reports, treatment summaries, and test results, with dates clearly outlined to establish the timeline of the illness. Additionally, claims may benefit from letters of support from healthcare providers detailing the severity and impact of the condition on the claimant's life. Collecting and submitting these materials promptly can significantly enhance the likelihood of a successful claim, helping policyholders navigate the financial hardships associated with critical illnesses.

Authorized Contact Information

The authorized contact information for a critical illness policy claim typically includes essential details that ensure effective communication and processing of the claim. The policyholder's full name must match the documents on file, providing clarity. The address, including street number, city, state, and ZIP code, allows for accurate correspondence. A reliable phone number, preferably a mobile contact (with the area code) ensures quick updates regarding the claim status. An email address, often preferred for prompt electronic communication, is also crucial. Finally, the relationship to the policyholder, such as spouse or dependent, should be noted for clarity in case any additional verification is needed during the claims process. Providing complete and precise information ensures a smoother claim experience.

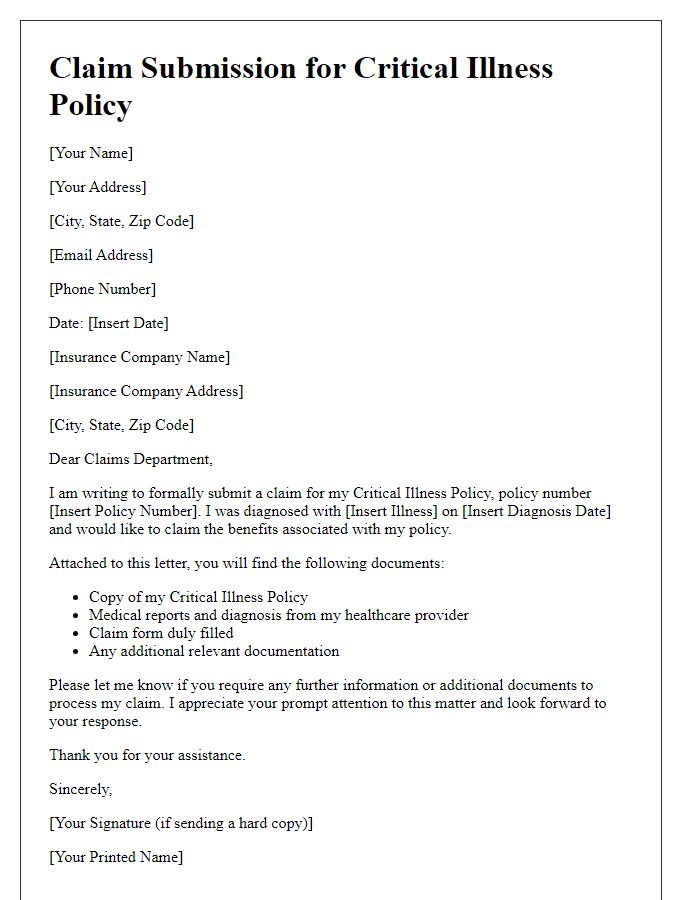

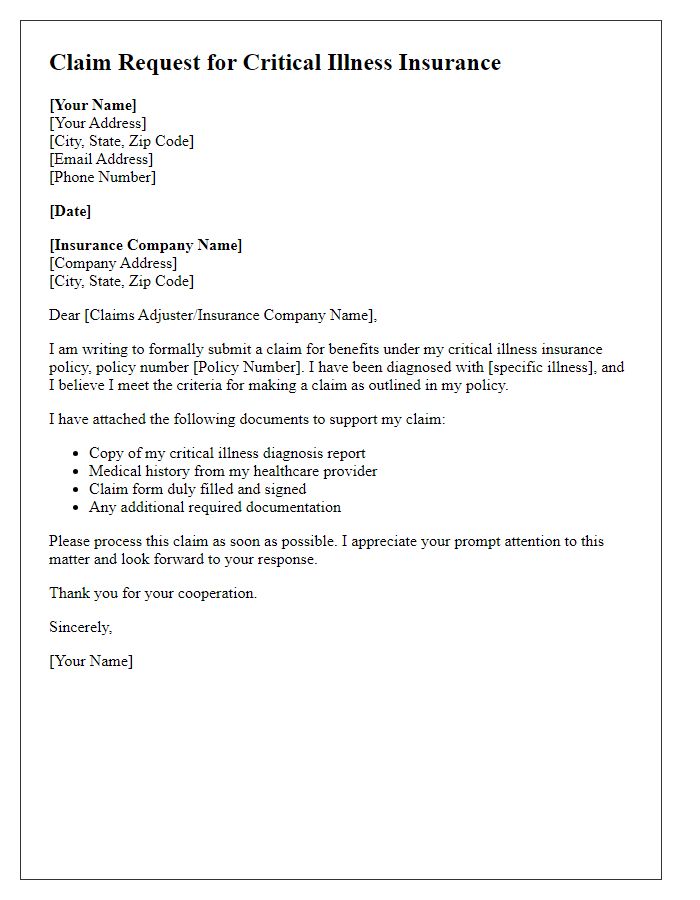

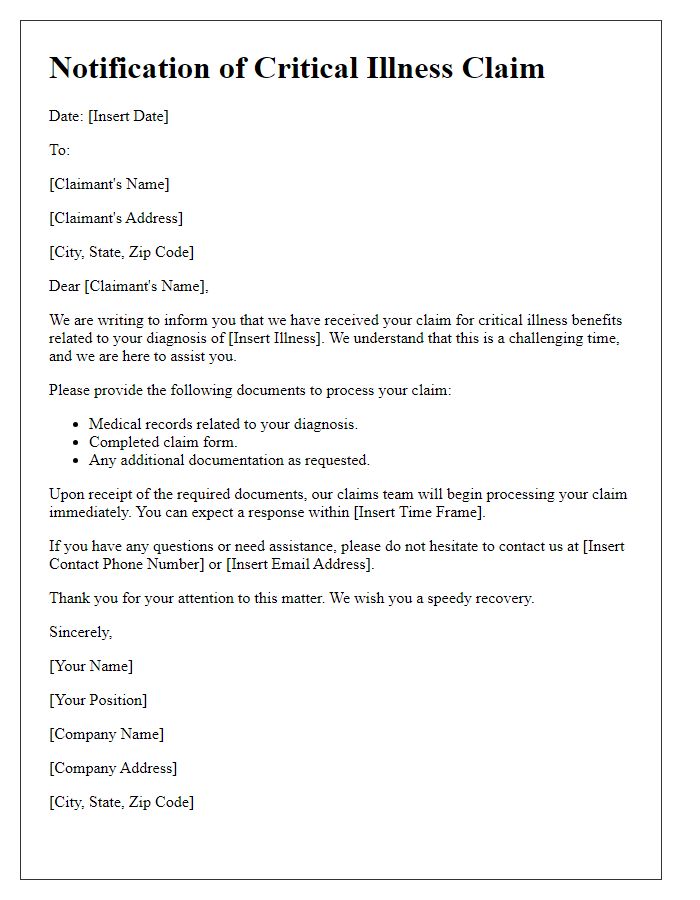

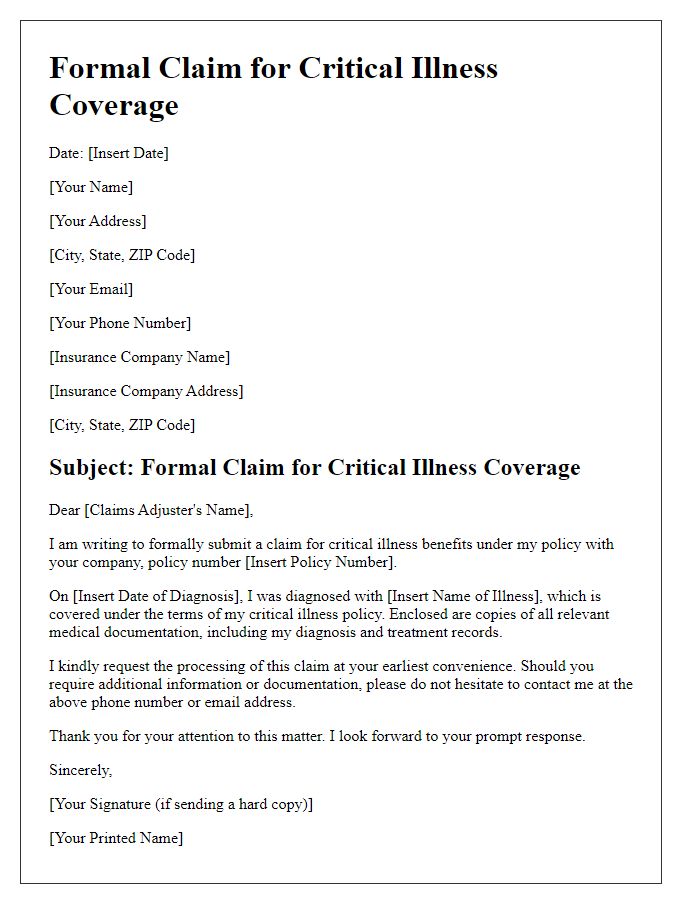

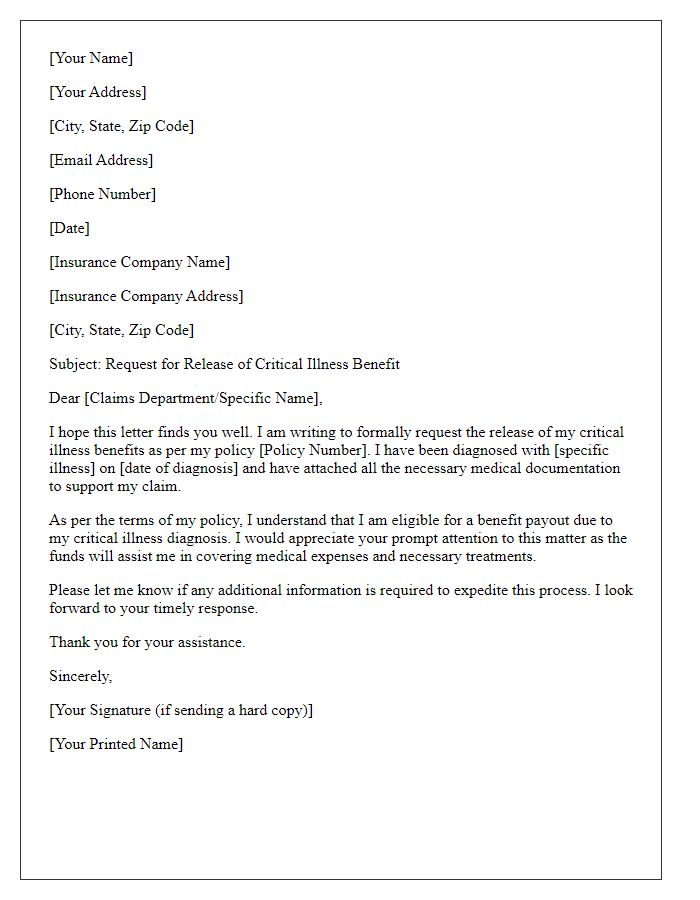

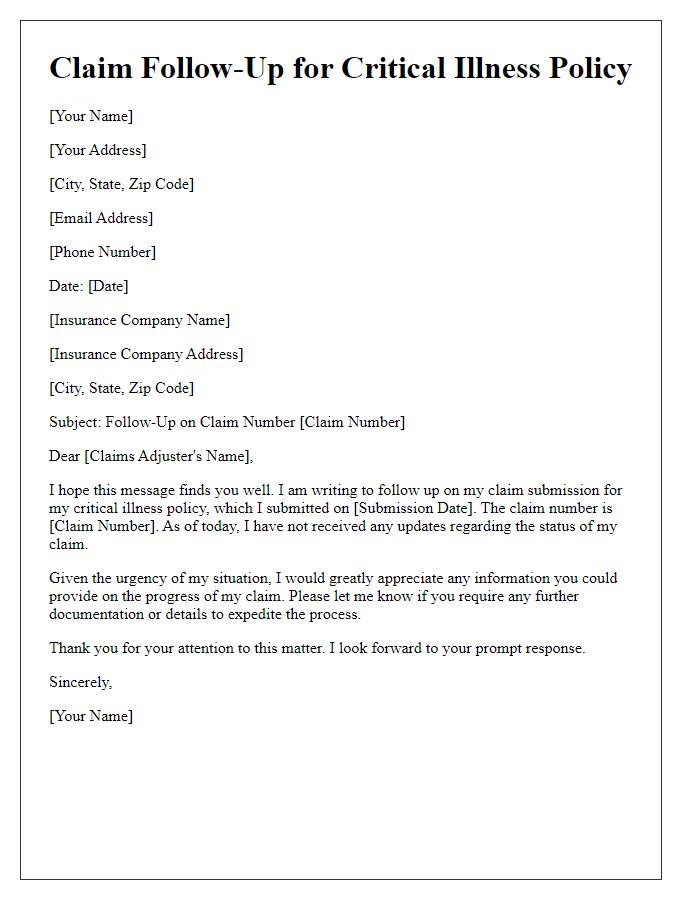

Letter Template For Critical Illness Policy Claim Samples

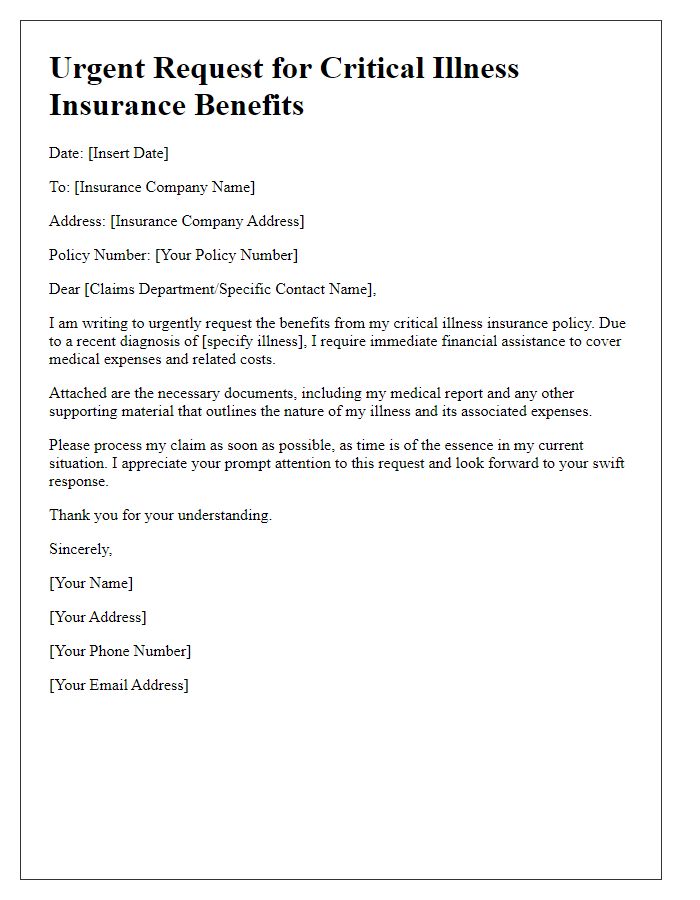

Letter template of urgent request for critical illness insurance benefits

Comments