Are you navigating the complex world of disability insurance? Understanding your rights and options can be challenging, but it's essential for ensuring financial security in case of unforeseen circumstances. This article will guide you through the ins and outs of securing the coverage you need while also providing key letter templates to help you effectively communicate with your insurance provider. So, let's dive in and explore how you can empower yourself with the right information!

Personal Information

Navigating disability insurance coverage requires clear communication regarding personal information essential for evaluation. Key details include full name, addressing information, and date of birth for accurate identification. Additionally, providing Social Security number ensures proper processing of claims. Employment details are crucial, such as job title, employer name, and the duration of employment. Medical information, including any diagnosed conditions, treatment history, and healthcare provider contacts, supports the claim's validity. Ensuring all personal identifiers are current and complete facilitates smoother interactions with insurance representatives, ultimately enhancing the likelihood of claim approval.

Policy Details

Disability insurance coverage refers to the financial protection provided to individuals unable to work due to disabling conditions. A letter template for disability insurance coverage must include policy details such as the coverage amount, which denotes the maximum benefit received during a claim. The elimination period specifies the waiting time before benefits commence, crucial for financial planning. Policy limits outline the duration benefits are payable, typically ranging from a few months to several years. Furthermore, it's important to note any exclusions that may apply, delineating instances where coverage is not granted. Clear identification of the policyholder is vital, ensuring accurate communication and claims processing.

Reason for Application

The letter template for disability insurance coverage serves as a formal document used to request benefits based on an individual's inability to work due to a medical condition or injury. This template typically includes essential elements such as the applicant's personal details, the specific nature of the disability, and medical documentation supporting the claim. The reason for application section outlines the precise circumstances leading to the inability to perform job-related tasks, emphasizing how the condition affects daily functioning and financial stability. Clear articulation of these aspects enhances the likelihood of approval, making the letter a crucial tool in navigating the complexities of disability claims.

Medical Documentation

Disability insurance coverage often requires comprehensive medical documentation to substantiate claims and ensure that individuals receive the benefits they are entitled to. This documentation typically includes detailed medical reports from healthcare providers, which outline diagnoses, treatment plans, and the impact of the disability on the individual's daily functioning. Common disabilities may encompass physical impairments, such as those resulting from advanced arthritis or severe back injuries, as well as mental health conditions like major depressive disorder or anxiety disorders. Specific medical terms, treatment dates, and physician signatures are essential components to validate the claims process. Moreover, clear evidence of how these disabilities restrict activities, such as work performance or personal care, aids insurance companies in processing claims efficiently. Understanding insurance policy terms and submitting all necessary medical documents promptly can significantly enhance the likelihood of approval for disability benefits.

Contact Information

A letter template for disability insurance coverage typically includes essential contact information, which acts as the foundation for effective communication. The sender's name, address, phone number, and email address ensure that the insurance provider can easily reach the individual in need of assistance. Additionally, including the policy number serves as a crucial identifier, linking the correspondence to specific coverage details. On the recipient's side, a clear designation of the insurance company with its official address and relevant department ensures the letter reaches the appropriate party responsible for processing claims. Accurate contact information facilitates prompt responses and enhances the overall efficiency of the insurance claims process.

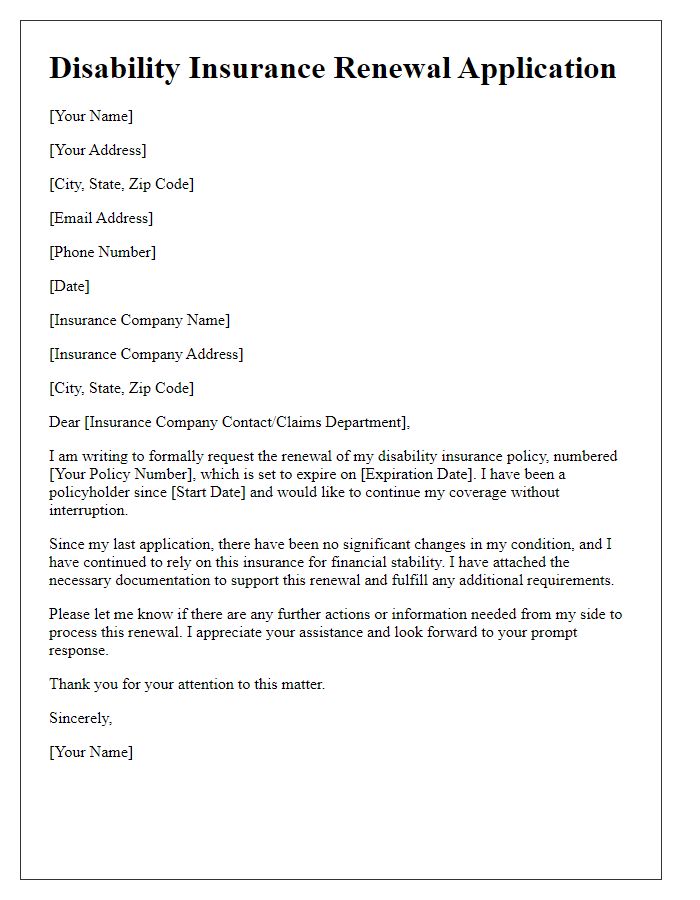

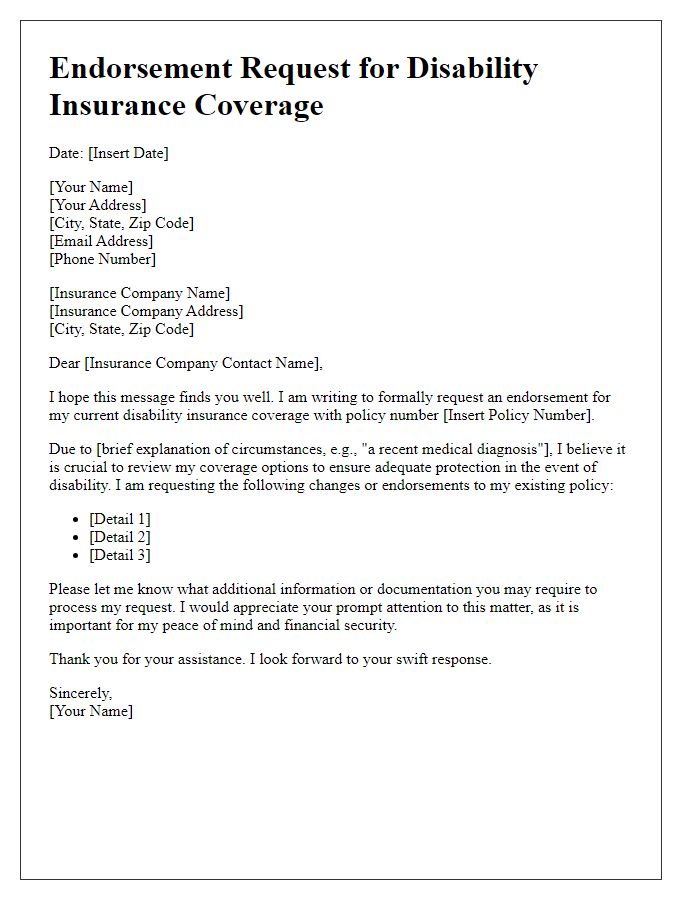

Letter Template For Disability Insurance Coverage Samples

Letter template of notification for change in disability insurance status

Letter template of inquiry regarding disability insurance policy details

Comments